Bitcoin bifurcation for two years: Why do you want to fork in the year?

Yesterday was just the second anniversary of BCH's successful fork. Whether you like BCH or not, whether you earn money or not, whether you have experienced this or not, in short, this must be recorded in the history of Bitcoin. One thing.

Regarding the cause and effect of the fork and the beginning and end of the struggle, the Ming Dynasty board and the conspiracy behind it, many articles have already said a lot of very clear, I have not been to Hong Kong to open a meeting and did not go to New York to open the meeting of small leeks, Don't talk about those gossip, let's talk about the root cause of the fork (on the face): Bitcoin congestion and high fees.

It happened that a few days ago, BTC supporters and BCH supporters disputed because of the bitter network congestion and high fees that they liked. I didn’t comment on the content and opinions of the specific disputes. Everyone is interested in going to Weibo. Eat melon, here will not put the original, so as not to be suspected of standing / washing the ground.

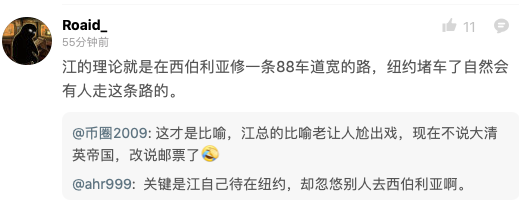

But one of the comments I think is very interesting:

- Bitcoin's IPO to the US is coming soon, raising more than $1 billion: core financial data exposure

- Interview with Babbitt | Matrixport, Trading, Lending and Hosting, How to build a bank in the digital currency world?

- Which platform is strong for the platform? Babbitt strips twitching and finds the truth for you

Netizens have felt that this metaphor is really brilliant, and I feel very good, haha.

In fact, many people have been arguing about BTC congestion, especially the congestion and high commissions in the big market, because this seems to be the biggest flaw in Bitcoin's current "separate retail." So, I’m going to talk about it today.

First, bitcoin blocked?

This seems to be a nonsense. For those who have just transferred from the world of legal currency, they are used to the WeChat payment and Alipay. Even if the bitcoin is completely unobstructed, it will take about ten minutes to complete the transfer. Of course, it is blocked.

But in reality, this is "slow", not blocked. After all, Bitcoin is a decentralized system. Naturally, it can't be as fast as a centralized service. If you compare Bitcoin to a transnational transfer, you can complete the transfer from the world to the other side of the world in ten minutes. I don't know how fast it is.

So when will Bitcoin block? In short, when there is a market, whether it is a skyrocketing or a plunging (mainly or skyrocketing), it will bring a lot of transfer of Bitcoin. If the analogy is analogous, I think the analogy is the ok at the peak of urban traffic, most of the time. They are all "normal", and the "early peaks and peaks" take a relatively short time.

In fact, the bitcoin network can not be blocked. It can be compared to the traffic in Beijing. The bear market is like the traffic in the middle of the night. I don’t want to go anywhere, but there is not much time in the middle of the night. Non-bullish non-bear market (we are now) is like the daytime, most of the time it is ok, normal driving, and occasionally blocked.

And the bull market is like a morning and evening peak, especially blocked, where to block.

The situation is such a situation, blocking is not blocked? The bear market is occasionally blocked, and the bull market is frequently blocked.

Second, blocking such a problem is big?

Unlike city traffic, you can't afford to open a special expressway for yourself. Bitcoin can be “arranged” for your own transactions as long as you are willing to spend money. This is why Bitcoin is congested. The fee will rise sharply, even to the exaggeration of hundreds of thousands of pieces.

So is the problem of such a blockage big? Of course it is big.

This means that, as the price of Bitcoin goes up one step further, the “use value” of Bitcoin is very small for ordinary people, and more is the value of stored value.

Obviously, for the word "cash" mentioned by Nakamoto in the white paper, we should also understand that the original intention of Bitcoin was not only hope that Bitcoin can help people resist the bad monetary policy of sovereign currency. Infinite inflation, and hope that Bitcoin can become a currency that everyone can use, rather than an asset that everyone is not willing to spend.

Third, what should I do?

This is actually a question that all the supporters and contributors of Bitcoin have been thinking about: How to accommodate as many transactions as possible while ensuring the stability of the main network?

The current solution for Bitcoin is to isolate the witness + slowly expand the block (now average 1.4M) and to accommodate as many transactions as possible. More solutions are still being tried and discussed, such as the Schnorr signature that is currently most promising for implementation in the near future. But obviously, this is the same as the continuous improvement of traffic management.

Of course, because of this flaw in Bitcoin, almost all new coins will come up with new solutions.

But unfortunately, several attempts at other currencies are currently not successful.

For example, Ethereum, when shouting a block for a few seconds, faster trading experience than Bitcoin, more suitable as a blockchain transfer tool and so on.

The results of it? Whenever there is a game or application based on ETH, what does ETH block up, everyone should be very impressed?

For example, BCH, LTC, and BSV are improved on the basis of Bitcoin. In fact, you can refer to Ethereum. Now it is not blocked and the fee is low. It is because no one is using it. Once they are given, they can put Bitcoin and Ether. The volume of traffic that is blocked by the square is also blocked, isn't it?

What is it completely blocked? EOS, BNB and TRX, which are PoS mechanisms, will basically not be blocked. But how many people can rest assured that the PoS mechanism currency is the ancestral treasure of their own family?

Just like the beginning of the paragraph, Beijing is blocked, but most people will not go to work in Siberia because of Beijing blocking? Moreover, if Siberia really developed into Beijing, it would not be blocked.

Fourth, not saved?

Looking at it this way, is Bitcoin unstoppable?

In fact, this must be a long-term problem with Bitcoin, especially in the upcoming bull market, which will block every day, and this problem will be amplified by non-BTC supporters.

But in fact, the seriousness of this problem has been magnified, and it is blunt – it is not impossible to use.

Bitcoin congestion fees are high, people can switch to other currencies in the secondary market, if it is a daily application, such as buying a coffee, buying a ticket, living in a hotel and other applications, must also pass the stable currency Come on, not other cryptocurrencies.

Those who really need to use Bitcoin on the main online direct transaction are often higher-value and more important transactions. They don't care about this handling fee. Bitcoin can fully meet their usage needs.

This problem will exist and exist for a long time. There is no need to enlarge it, and there is no need to worry about it, because you are worried that it is useless.

(In addition, I certainly support a faster and more stable currency than the Bitcoin transfer to get a higher consensus and market value, but before I do, I boast that I am better than the Bitcoin transfer, and I’m bragging about it. Gold bars are bigger and have no meaning.)

Conclusion: I am not saying that bitcoin congestion is not a problem, but you have no easy way to deal with it. Just as the big city is blocked at the peak, will you not go out? Certainly not.

The only reason that Bitcoin will be blocked and the fees are high is that the value of Bitcoin is getting higher and higher.

The person who asked the question will also say this: So, will the poor be ineligible to use Bitcoin in the future?

So do you think the poor are not qualified to have a house?

The same question, I believe you have your own answer.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Brazilian citizens will report encrypted transactions to the IRS

- The small BM slipped faster than the BM, and the ENU founder “killed” the project and called for the 砸

- The blockchain business of the fire coin and the OK port company began to take shape, and the forward holding group involved in the debt lending business.

- DeFi transaction: A large number of CDPs appear on MakerDAO, but the amount of collateral is close to 0

- Bitcoin fork 2 anniversary: fork is very annoying, but this is fatal

- Bitcoin futures for physical delivery have been officially launched, and Bakkt has gotten up early in the morning.

- Digital currency "national team": big countries have to control, the third world wants to overtake