Bitcoin halving: price impact and historical correlation

The crypto community has faced a huge bear market in the past 18 months. Major digital assets such as Bitcoin and Ethereum have suffered a 70-80% decline, while other "altcoin" markets are even worse. Fortunately, with Bitcoin and Ethereum growing by + 55.45% and + 48.69% respectively in the past three months, 2019 is a year showing greater hope for digital assets. As the outlook becomes more optimistic, the community is looking forward to a major event next year-Bitcoin halving.

Release schedule

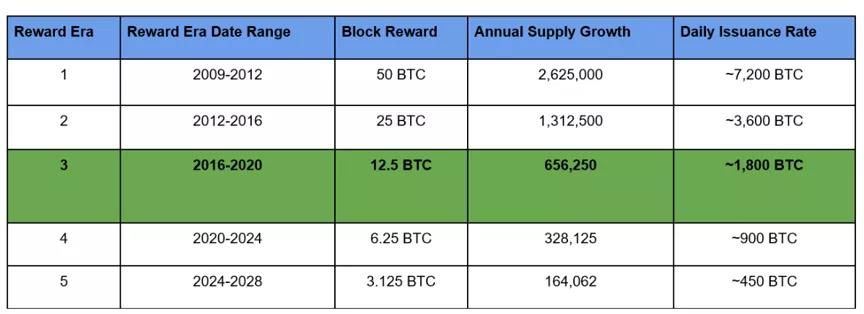

The release schedule states that the block reward for each 210,000 blocks will continue to decrease by 50%, effectively reducing the issuance of bitcoin to zero over time.

Bitcoin starts with a block reward of 50 BTC each. Given that the network is still in its infancy, as the computing power in the network increases and decreases, the time associated with creating new blocks has gradually changed. In general, historical data indicates that a new block is created approximately every 10 minutes. With this assumption in mind, we can assume that the overall reward is halved approximately every 4 years. The mathematical formula is as follows:

- A shares should not be too optimistic, BTC medium-term or expected

- Jiangzhuoer mine was shut down forcibly. Is the epidemic good or bad for BTC?

- "The Secret History of Bitcoin" (1): Historical Background When Bitcoin Was Born

210,000 blocks x 10 minutes per block / 60 minutes per hour / 24 hours per day / 365 days per year.

Take a look at the past:

One of the biggest benefits of Bitcoin is its transparency and algorithmic monetary policy, which is a feature lacking in the current financial system. Currently, about 1,800 new bitcoins enter circulation every day. After the third halving event in 2020, the daily circulation will drop to about 900 BTC per day, resulting in the annual interest rate of Bitcoin falling from 3.70% to 1.79%. This is an interesting development because the circulation of Bitcoin will now be lower than the inflation rate in most developed countries. In comparison, the U.S. inflation rate was 1.9% in the 12 months to March 2019. The biggest difference is that Bitcoin is a non-sovereign fixed supply asset, while the US dollar has no supply cap and is completely dependent on the US government.

Historical impact of halving on prices

For those of us who see digital assets as investment vehicles, to say the least, the historical price movement of Bitcoin in response to halving events is very interesting. Although past performance does not represent future results, we would like to analyze some past indicators obtained from the previous half to understand what may happen in the future.

Halved

The first official halving (reducing the block reward to 25 BTC per block) took place on November 28, 2012. Historical data show that after a large flow of traffic in June 2011, an upward trend began in November 2011, halving by about November 2011.

This "halving" upward trend has caused the price of Bitcoin to rise by + 341.90%, with an average transaction price of $ 12.31 per BTC, the first halving in November 2012.

The first halving reduced the daily issuance rate of Bitcoin from approximately 7,200 BTC per day to approximately 3,600 BTC per day. Almost immediately, Bitcoin has soared by nearly 8,000% over the past year, reaching around $ 1,000 in late November 2013, and has subsequently made historic gains. (Depending on exchange data).

Unfortunately, not all entertainment and games. In December 2013, Bitcoin started a multi-year bear market (largely thanks to the infamous Mt. Gox hacker) as the asset fell by more than 80%, and two years later in October 2015, Investors saw a reversal.

Halved twice

The second official halving (reducing the block reward to 12.5 BTC per block) took place on July 9, 2016. It is important to note that the time between the first halving and the second halving is actually 1316 days, or 3.6 years. Based on this, the data shows that about nine months before the halving, an upward trend began in October 2015.

The "halving" uptrend has caused Bitcoin to rise by 112.0% in nine months. The average transaction price when halving in July 2016 was $ 650 per BTC (52 times the last halving price). The second halving event reduced the daily issuance rate of Bitcoin from about 3600 BTC to the current daily 1800 BTC. This eventually pushed BTC into the latest bull market of 2017, with the asset growing by + 2,800% over the next 18 months. The peak eventually hit in mid-December 2017 and the price was slightly below 20,000 BTC (depending on exchange data).

Similar to the previous bear market in the 2013 bull market, Bitcoin has fallen by almost 80% over a 12-month period, and we assume it fell to a bottom of about $ 3,200 in December 2018.

Third half

A third formal halving is planned in approximately 57,455 blocks (reducing the block reward to 6.25 BTC per block) (based on block height 572545 as of April 20, 2019). Based on the 10-minute assumption of each block, the expected halving date is set from late May to early June 2020 (approximately 400 days from now).

If historical data is a good indication of previous success (which is not traditionally the case), then we will let Fitzner Blockchain Consulting predict that BTC will perform well this year, based on the event that will be halved in mid-2020.

More specifically, we should expect double-digit or lower triple-digit percentage growth by the end of 2019. If our historical analysis is correct, we expect Bitcoin to be trading at about half the current peak price (about $ 10,000). / BTC) and set a new ATH within 12 to 18 months after the halving event in May 2020.

Future incentives

As block rewards continue to decrease, as the cost of “producing” a BTC is halved, the fixed supply of Bitcoin should increase in value, which may be one of the driving factors behind the Bitcoin cycle. As future block rewards continue to decrease to zero, future miners will have to rely on other incentives within the system to protect the network.

It is estimated that the final bitcoin will be mined around 2140, when the block reward will be reduced to less than 1 Satoshi. Although the possibility that Bitcoin will still exist in a hundred years is inconclusive, it is very interesting to speculate how the incentive mechanism will work after the last block reward.

Miners are now paying for a combination of large rewards and transaction fees. The overall reward is the basic incentive for the miner to contribute computing power, while the transaction cost incentivizes the miner to verify the order of the transactions.

in conclusion

For those who are new to digital assets, we hope this article can provide some confidence so that they remain hopeful for the future of these markets. It's not accidental that the similarities between these cycles have appeared since the establishment to look at different market trends.

Article source: https://medium.com/fitzner-blockchain-consulting/bitcoin-halving-price-effects-and-historical-relevance-b63458216d97

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Peter Schiff loses Bitcoin, says holding cryptocurrency is "bad idea"

- Bitcoin difficulty adjustment and soaring BSV prices

- Analysis: Bitcoin's Value Logic and Its Prospects

- Science | This technology escorts two-thirds of Bitcoin transactions

- The turbulent situation in the United States and Iran and the rise in Bitcoin price, how strong is the risk aversion property of Bitcoin?

- Inventory of Bitcoin's technology development in 2019 (1)

- Weekly data report on BTC chain: The currency exchange strategy of the head exchange triggers the illusion of active promotion on the chain