Bitcoin has been hit hard for 14 hours and has fallen by 14%.

Overnight, Bitcoin continued to expand its short-term downtrend. The price accelerated downward after breaking down the support of the 9000 integer mark. Huobi market showed that the bitcoin's intraday low fell to the level of 8622 USDT, which was a new low in the past month and completely returned. Spit out all the gains achieved in the first half of this month. Although Bitcoin made a short-term rebound in the early hours of the morning, it retreated short-term gains in the early trading, fell again below the 8700 integer line in the post period, and is now entangled near 8680.

In the first three trading days of this week, Bitcoin has experienced a sharp decline of 14%, and the previous rally has stopped abruptly.

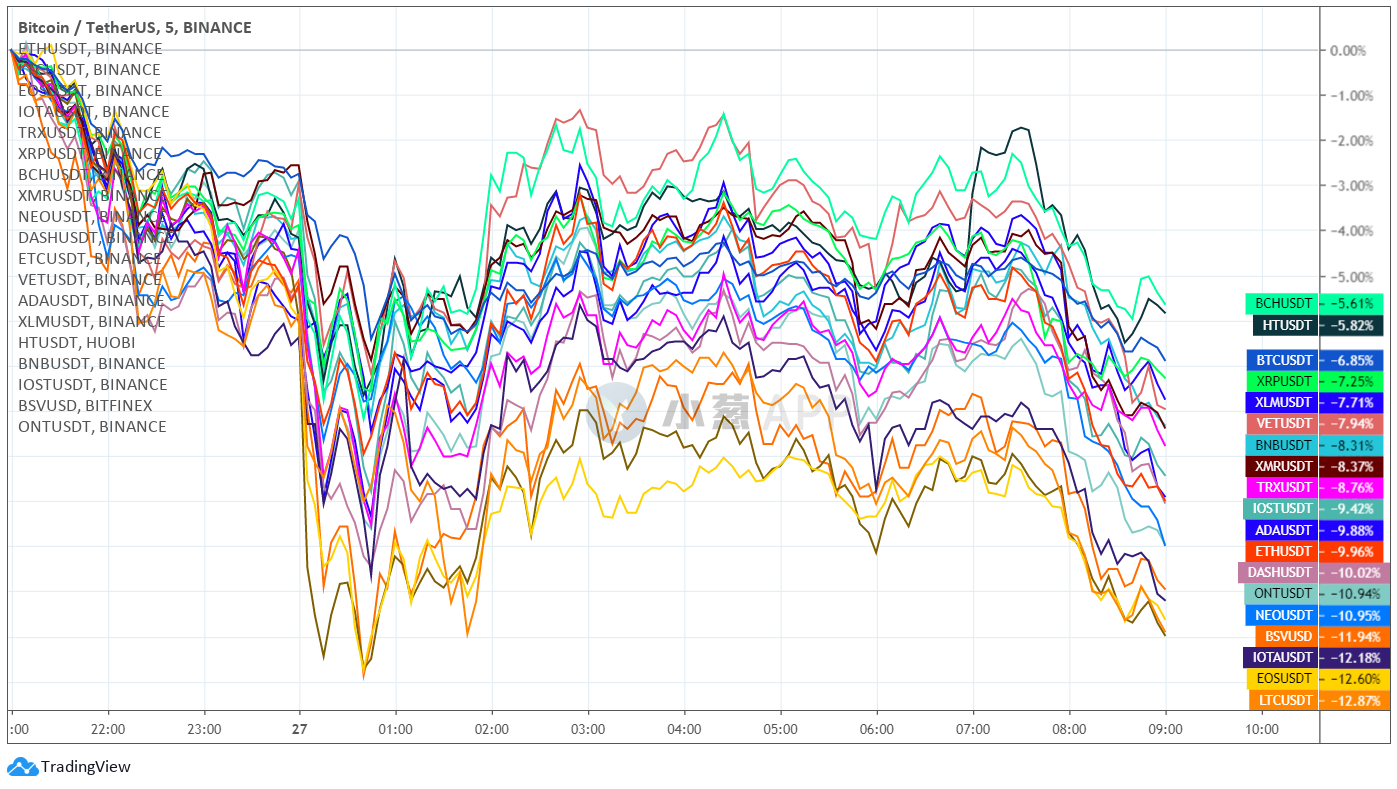

Driven by the sharp drop of Bitcoin, the overnight market value was lowered across the frontier currencies across the board. The top 20 currencies in the past 12 hours saw an average decline of nearly 10%. EOS and LTC currencies, which led the stage, fell more than 12% at night.

- Analyst observations | What is the correlation between Bitcoin and other assets?

- Bitcoin ETF rejected, "crypto mom" accuses SEC of "switching standards"

- Interview with Crypto Mom SEC Commissioner Hester Peirce: Analysis of Safe Harbor Proposal

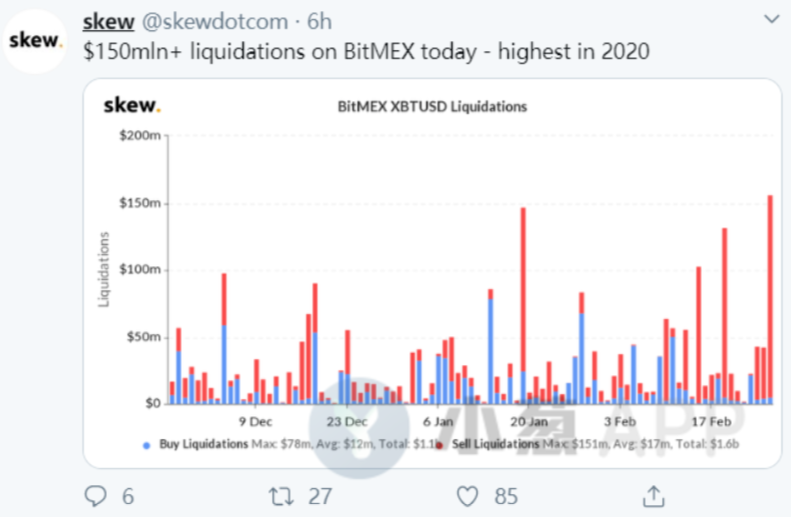

Skew's official data shows that on February 26, bitcoin positions worth more than $ 150 million were liquidated on BitMex, a record high in 2020.

In addition, according to the market statistics report of the contract emperor (heyuedi.com): the past 24 hours in the contract market, the entire network has exploded a total of 804 million US dollars, 35,370 positions. Among them, Huobi had a short position of 106 million US dollars, OKEx had a short position of 142 million US dollars, Binance had a short position of 350 million US dollars, and BitMEX had a short position of 204 million US dollars. The top three currencies for liquidation were BTC 486 million, ETH 120 million and BCH 52.17 million.

Why did the market trend suddenly reverse?

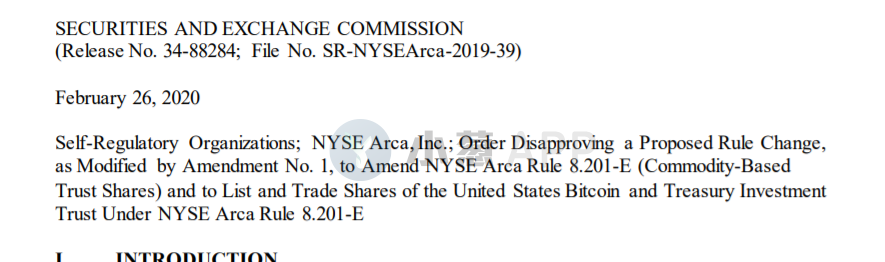

In an official document released on Wednesday local time, the U.S. Securities and Exchange Commission (SEC) has rejected Wilshire Phoenix's application to launch a Bitcoin ETF in NYSE Arca. The SEC states that Wilshire has yet to prove that the Bitcoin market is sufficiently resistant to market manipulation. To date, the SEC has rejected all Bitcoin ETF proposals submitted by multiple companies.

Bloomberg commented on the SEC's decision, saying that it shattered the hope of digital currency enthusiasts that a Bitcoin ETF will be approved this year. The article states that the SEC has long urged issuers to address a variety of risks and concerns related to cryptocurrency funds, including market manipulation, liquidity and custody issues. This has obviously become a direct incentive for short-term Bitcoin diving.

The delay in Telegram and the SEC ’s ruling on whether the Gram sale is illegal has also delayed the Cryptocurrency world. Although the original ruling deadline was February 19, the magistrate did not announce the result. However, the SEC stated in its statement that the way Telegram sells products to qualified investors does not meet the Reg D standard, which is the key to the company's previous denial of sales violations. Therefore, the poor progress of the incident has caused significant pressure on the market in the past few trading days, and has also laid the groundwork for this short-term accelerated decline.

In addition, on Monday, Boerse Stuttgart, Germany's second largest stock exchange, officially launched a reverse bitcoin ETP called 21Shares Short Bitcoin ETP, allowing traders on this exchange to short bitcoin, as the exchange is the ninth in Europe. On the big stock exchange, the turnover in the exchange in 2019 is as high as 68.5 billion euros, so the launch of this new bitcoin short product will undoubtedly provide a very large “potential selling” for the bitcoin market. After the launch of the product, Bitcoin did very "tacitly" walk out of the recent round of rapid callbacks. The negative impact caused by this news cannot be ignored.

In addition, as the analysis of the previous article by Onion, in the context of global public health security issues causing panic outbreaks in the market, gold and U.S. Treasuries have been popular in the market, but were once regarded as emerging hedges. Bitcoin in assets has been left out of the market. In this special environment, Bitcoin has not stepped out of the so-called safe-haven market, which has caused a certain degree of gap in investor psychology, and the image of a "safe-haven asset" previously shaped has almost been damaged. With the recent negative correlation between gold and bitcoin, and the fact that gold has continuously refreshed the highest point in the past seven years, it is not surprising that bitcoin's steadily decline.

How do analysts look at the market outlook?

Market analyst Filb Filb pointed out that although the market has experienced a very large drop in the short term, it has actually come to an area with dense technical support. The 200-day moving average, 20-week moving average, and 50-week moving average are at 8500-8700. There is a dense overlap in the region, so the rising trend laid out by the rapid rise since the beginning of this year has not actually been reversed. If the market can complete the stop-stabilization near the support of the above several major moving averages, then the current price can be around Think of it as an ideal multiple entry opportunity with a "risk-reward ratio".

Market analyst Michaëlvan de Poppe pointed out that the current pullback is actually just a regular technical pullback after the big rally at the beginning of the year. Considering that Bitcoin has achieved an amazing increase of nearly 50% in the first two months of this year, the recent pullback It should not be interpreted excessively as a trend reversal. After Bitcoin has broken the 9100 integer support, the market has gradually become a new small-level descending channel. If the market cannot complete the rapid recovery of the previous key support of 9400 in a short period of time, then the bottom is strong The support needs to look directly down to 7460 where the mid-term trend line support is located. However, this trend line support does not break the upward momentum that has been maintained since the beginning of the year.

Market analysts have simplified the currency market and pointed out that the key line-level support of 8680 has been broken in a wave of second-time diving in early trading today. At present, the "air defense alarm" over the bitcoin market has completely sounded. This position serves as a strong semi-quantile support for the pullback of this round of rising market prices since the beginning of this year. If the market is broken by more than 4 hours of confirmation during the test of this wave, then the step of further opening down the space will actually be Just stepped out, after the support was confirmed to break, the market may quickly fall to around 7650, and the rise of the previous two months will be ended. Only by sticking to the 8680 line in the past two trading days can the bulls have the hope of quickly picking up the rally. Therefore, Bitcoin has now reached a "fortune in the fortune" that may determine the future weeks and months.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DeFi is about to welcome zk-SNARK privacy technology without trust: what is Supersonic's solution?

- Bitcoin fell below $ 8,600 overnight, and the entire network exceeded $ 879 million

- "True Incense Law" is inevitable, Compound, the DeFi agreement, announced the issuance of governance token COMP to achieve a decentralized governance process

- Ethereum community members launch petition against ProgPoW, questioning its validity

- Detailed explanation of the new blue ocean of crypto asset derivatives: options trading

- Central bank digital currency industry chain carding: more than 20 companies participated, most of them have been listed

- Hackers demand bitcoin ransom in Johannesburg. When is Bitcoin Ransom?