Bitcoin Investment God: How to quickly filter out 1% of valuable tokens

Author: Hash school – Adeline

Source: Hash

Article words: 1800 words or so

Reading time: about 3 minutes

- The road to the Internet, the blockchain is back

- In just 21 days, 18 provincial and municipal leaders voiced the blockchain, and entrepreneurs may welcome the biggest policy dividend!

- Meng Yan: A paper on the nine major problems of the digital economy

Since 2019, bitcoin prices have increased by more than 130%. Compared with Bitcoin, most of the altcoins are “not moving” and do not even rise and fall. This seems to be contrary to our previous impression that “Bitcoin has risen and other altcoins have risen in linkage”. According to the data from coinmarketcap, the market value of Bitcoin has reached 70% of the encryption market this year. For a time, even the voice of "the altcoin has been abandoned by the market" appeared in the media.

In fact, this is also the performance of the market returning to rationality after the market's cruel education of rapid bull-bear conversion. Nor does it mean that all the altcoins will die, but in such a market, truly valuable tokens can survive.

In a recent tweet by well-known Bitcoin investor and partner partner Willy Woo of Adaptive Capital, some interesting opinions were published. The article said: Most of the price charts of the altcoin are like "radioactive decay", only a very small number of altcoins There are different trends, and these very few altcoins are worthwhile and worth investing.

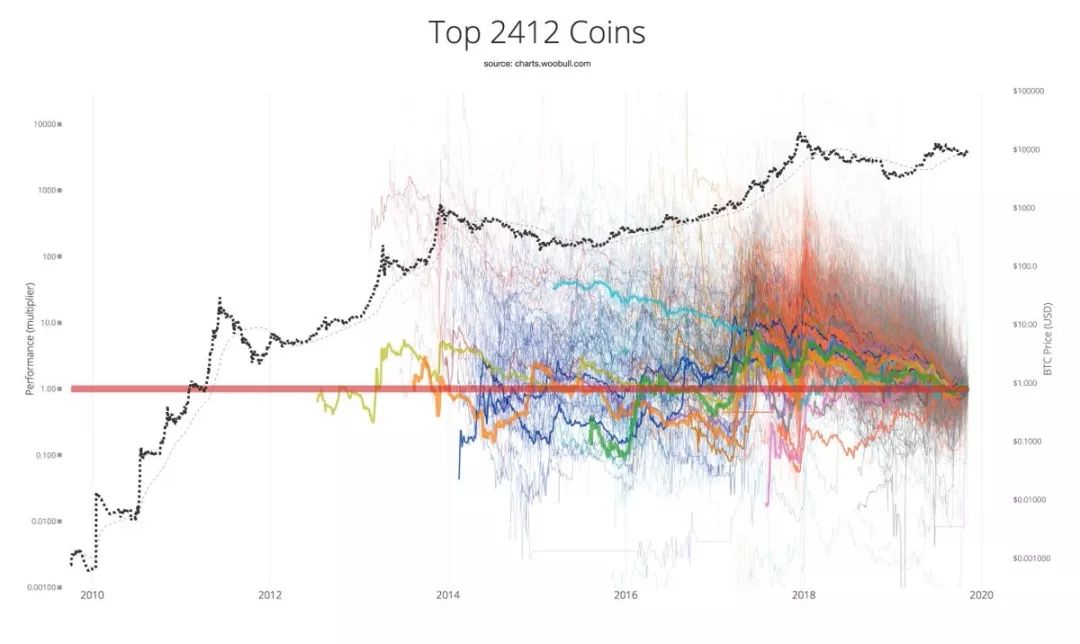

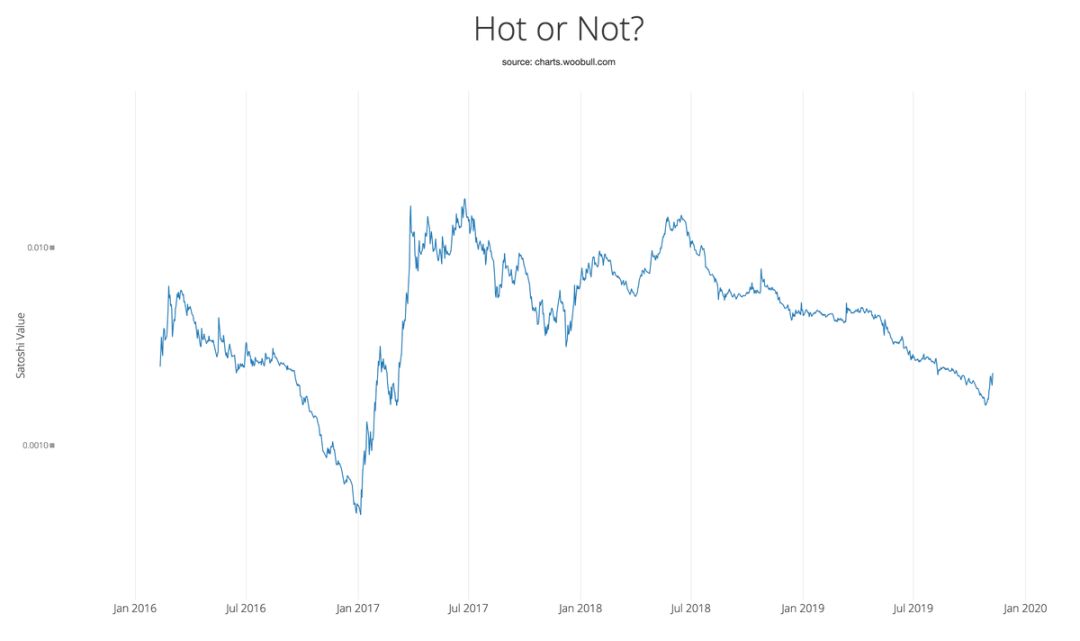

Below is a graph of the price changes of cryptocurrency drawn by Willy Woo in bitcoin. The chart tracks the price movements of Bitcoin from 2010 to the present and more than 2,000 other cryptocurrencies. We can see that the price of most altcoins against bitcoin continues to fall. This trend is particularly evident after 2018, with only a few altcoins fluctuating up and down a certain level.

※ Note: It should be noted that the token price curve used by Willy Woo in the text is all denominated in bitcoin. In this regard, cryptographer Yassine Elmandjra has expressed similar views. He believes: “The dollar-denominated token is very Misleading. Pricing in BTC is another picture. When denominated in bitcoin, most of the exchange rate of Bitcoin has fallen sharply. " (The picture shows the price change of the first 2412 tokens; :Willy Woo Tweets)

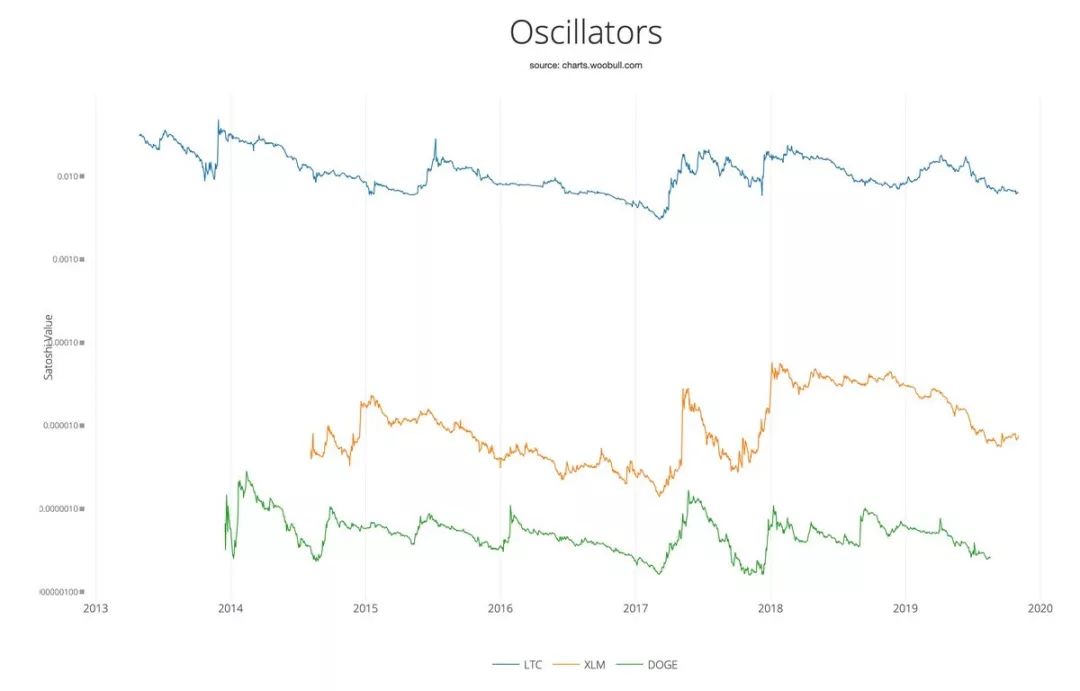

Based on these two different price trends, Willy Woo divides the altcoin into "Oscillators Oscillator" and "Degenerators Degraded".

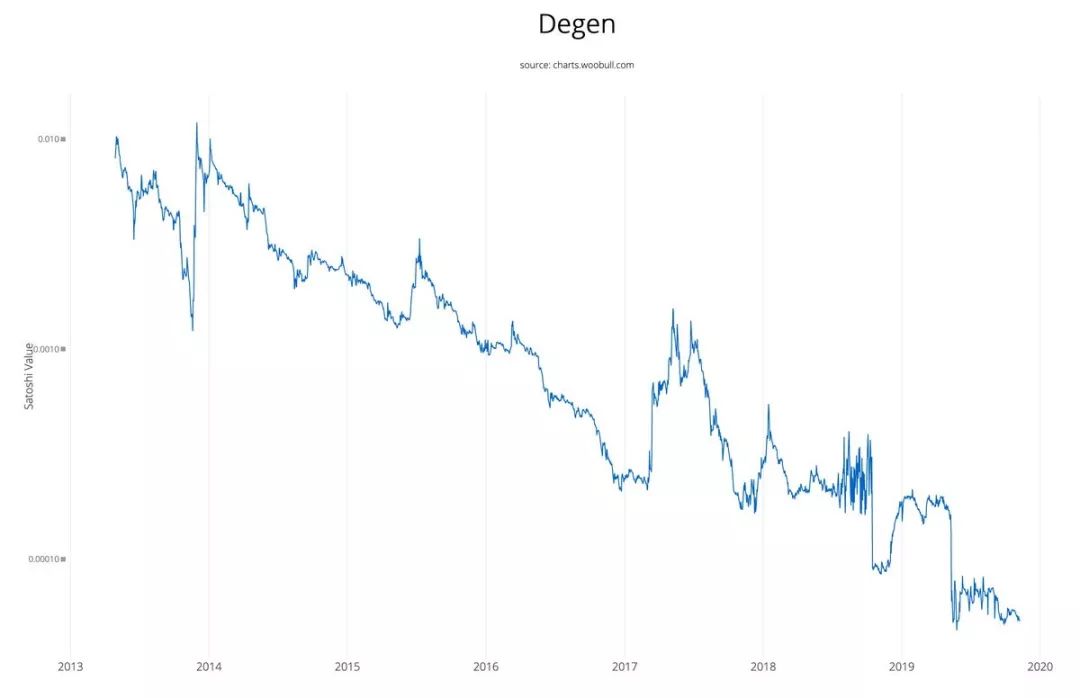

He believes that the vast majority of altcoins are degraded, the exchange rate of degraded tokens against bitcoin continues to fall , and their price curves have a predictable "half-life". In other words, the prices of these altcoins will look like The nucleus of the radioactive element decays like that.

In the figure below, taking the price curve of the domain name currency NMCBTC as an example, it can be clearly seen that its price has been declining from 2013 to 2019. According to Willy Woo's tweet, in addition to the NMCBTC, there are also more than 2,000 altcoins that have similar "decays", and their prices have plummeted for a while.

Domain Name Currency NMCBTC Price Change Curve Source: Willy Woo Tweet

Only a handful of altcoins are oscillating. As can be seen from the above figure, these BTC-priced oscillating altcoin price curves oscillate at a certain level , converge with bitcoin price changes, and have a complete bull-bear market cycle (about 4 years) . Therefore, like Bitcoin, this type of cryptocurrency is value-storing (SoV), and this potentially valuable asset is more attractive to investors.

Price curve with LTCBTC, XLMBTC and DOGEBTC as examples

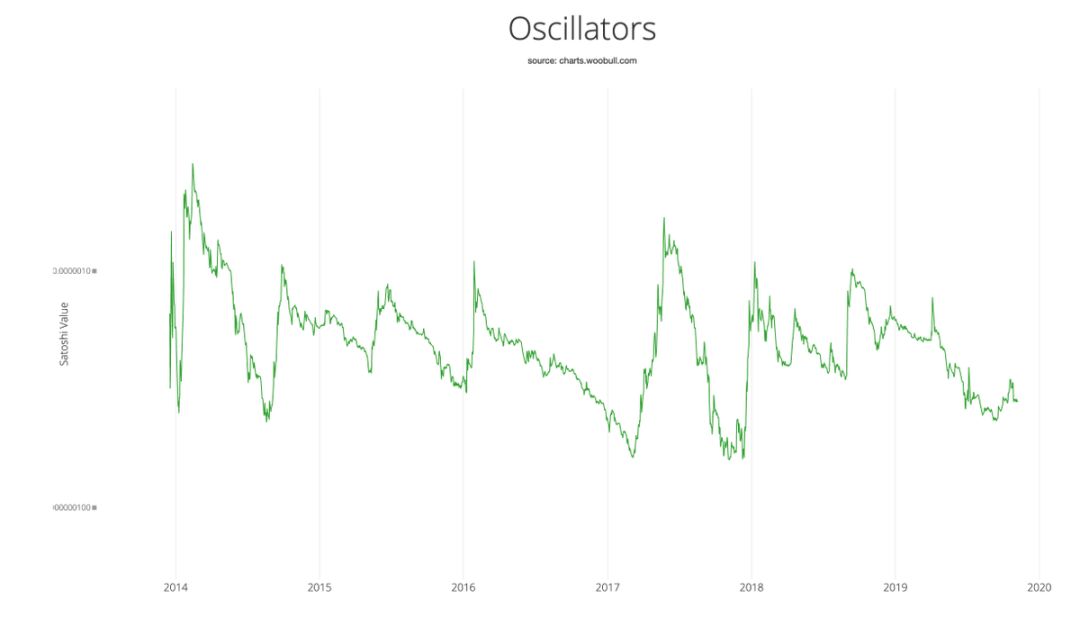

Among the oscillating tokens, the performance of DOG is worth mentioning. The dog coin is called the "extraordinary" of the coin circle. It was originally born in a joke, because the expression pack quickly became popular, and it was sought after because of the application of tipping and charity culture.

As a kind of altcoin, dog money has no technical highlights, no strong endorsement, no application landing, and the price of coins has been ignorant. According to common sense, this "three no" token has no value, but it was born in 2013. Until now, the dog currency has not disappeared, but also became the only survivor of the early digital currency, except Bitcoin and Litecoin. And from the price change chart of DOGEBTC, it is indeed a typical oscillating altcoin. Willy Woo believes that this phenomenon is most likely due to the Lindy Effect . At the same time, it is listed on almost all exchanges and is supported by most wallets and has a liquidity market .

※Note: The Lindi effect means that for something that does not naturally die, such as a technology, an idea, the life expectancy may increase for each additional day of its life.

Oscillating Token Price Curve (take DOGEBTC as an example) Image Source: Willy Woo Tweet

This shows that the value of the altcoin can have different measurement dimensions . In fact, the altcoin can create value through the economic network effect . The fact that the dog currency is an oscillating token and has the function of value storage means that many people think that “only the altcoin with innovative and cutting-edge technology can create value”.

Another interesting example is the German letter DCRBTC. Currently, its currency price is in a crucial position: it is at the end of the first bull-bear market cycle. So at present, it is not directly categorized into the oscillating altcoin. It is also necessary to pay attention to whether the price curve after it oscillates clearly on a certain horizontal line.

German letter DCRBTC price curve Picture source: Willy Woo Tweet

Willy Woo's research provides an interesting way to screen for investigative tokens. In the tens of thousands of token markets, how to quickly pick out some tokens worthy of attention and investment. After the 17-year mountain currency bubble burst, we are unlikely to see a rapid and large-scale recovery in the token market. Most of the tokens are “declining” in the process of constant market adjustment and are eliminated by the market. A very small number of investment-valued oscillating tokens will be screened out under the turmoil of the market.

When investors are screening tokens, it is crucial to use bitcoin as the unit of pricing for tokens. Oscillating tokens tend to converge with Bitcoin's performance, and their prices for Bitcoin fluctuate up and down at a certain level; at the same time, we have those release times compared to the early tokens that have had a full bull-bear market cycle. Short-term investment attitudes for tokens that have not yet completed a complete bull-bear market cycle should be more cautious.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 5G is coming, China Telecom's blockchain journey and ambition | Interview with Babbitt

- CoinShares In-Depth Report: Read the past, present and future of encrypted assets

- The generation of quantitative easing: how the Fed makes money out of thin air

- Babbitt Exclusive | Shanghai launched a virtual currency exchange to investigate and rectify actions, what do people in the industry think?

- The road to the listing of Bitcoin mining companies: once at the Hong Kong Stock Exchange, is now seeking IPO to the US

- Market Analysis: BTC's weak adjustment has not yet ended, and the trend of mainstream currency is facing a change

- Draw a blockchain social portrait