Bitcoin: the beneficiary of the era of wealth transfer

Foreword: This generation of people has accumulated a lot of wealth because the American baby boomers enjoyed the American economy's economic dividend. In the next few decades, the baby boomer generation will gradually age and their wealth will gradually shift to their children, which is the millennial generation. Millennials' recognition of cryptocurrencies such as Bitcoin and distrust of traditional financial institutions will be key reasons for Bitcoin to become a beneficiary of the era of wealth transfer. This article is from The Rhythm of Bitcoin, translated by the chain to Allen.

In the next few decades, millennials will be the richest generation in history. Banks should start to worry because millennials have begun to switch to unconventional banks, and Bitcoin will be the beneficiary of this huge “wealth transfer era”.

(photo by David Shankbone)

- The BRICS intends to create a single cryptocurrency for payment and settlement between member states

- Jimmy Song: I want to treat every kind of competitive currency as a scam.

- Viewpoint | On State Rent and Stateless Ethereum

We define the population (22 to 37 years old) born between 1981 and 1996 as a millennial generation who will be a key determinant of the future of Bitcoin and other cryptocurrencies. According to the US Census Bureau's population projections, Millennials will surpass the richest baby boomers in history and become the most adult generation in the United States. This is an important moment, one of the main reasons is money. The baby boomers enjoyed record long-term economic expansion, creating a boom in wealth accumulation. They will pass on a huge $68 trillion in wealth to their children, the largest transfer of wealth ever.

- Silent generation: born in 1928-1945 (73-90 years old)

- Baby boomer generation: born in 1946-1964 (54-72 years old)

- Generation X: Born in 1965-1980 (38-53 years old)

- Millennials: Born in 1981-1996 (22-37 years old)

- After the millennial generation: born in 1997 (0-21 years old)

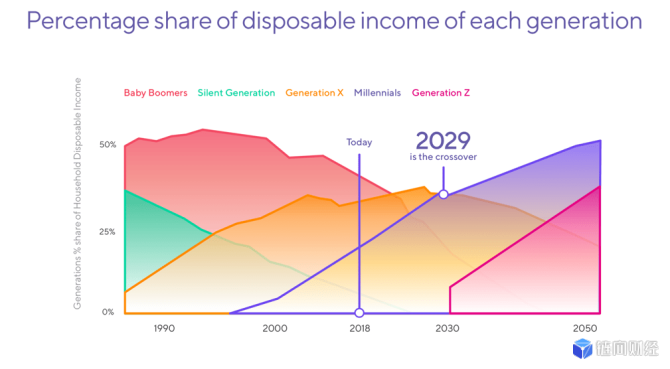

It happens faster than we think. The disposable income of millennials is expected to grow to $7 trillion over the next decade, and by 2030 their wealth will be five times that of today.

With so much wealth, how will millennials deal with it? It's very simple, either spend it or save it. But how does the bank adapt to this equation? The answer is not as simple as the previous generations, because Millennials clearly have a distrust of the bank. According to the Millennial Disruption Index, a three-year study of 10,000 millennials, most millennials (71%) said they would rather go to the dentist than I would like to hear anything from the bank. This mistrust is not entirely unreasonable.

The millennial generation we defined was born in 1981, and their lives and concepts were determined by events in early 2000. At the time, they were "aged large enough to experience and understand the 9/11 event, and at the same time be able to emerge as a young man out of the 2008 recession." The first decade of the 21st century is full of instability, and banks are the first to bear the brunt.

The 2008 global financial crisis has sounded alarms for many people, especially millennials. These seemingly stable institutions have helped many people realize the "American Dream" of buying a house, buying a car, and setting up a family. In the end, millions of people are in debt. The bank knows that most of the debt is never repayable. The worst result of this greed is that American taxpayers have to bail out to prevent the entire economic system from collapsing.

The 2008 financial crisis was the worst financial disaster since the Great Depression, causing widespread devastating damage to millions of American families. A total of more than $13 trillion in family wealth has disappeared, 11 million people have been displaced, and 9 million Americans have lost their jobs. (President of the House Financial Services Committee, Congresswoman Maxine Waters)

Even the world's largest brokerage, Merrill Lynch, with more than $2.2 trillion in client assets, was not spared and collapsed almost overnight (finally acquired by Bank of America). If an institution disappears in an instant and takes away the rest of the financial system, then it is not difficult to understand the millennial concerns and trust in the same system.

Not only is the big turmoil like the collapse of Merrill Lynch, but some small things will also cause people to gradually become distrustful. Wells Fargo was later captured on the spot and opened 2 million deposit and credit accounts in the name of the client without the customer's consent. These fake accounts are designed to help meet the company's bonus quota. Wells Fargo’s reaction at the time was to keep on the court until it was forced to pay a small fee, and then released an ad in the last ten years: Sorry, we promise that this will be different.

But is this really different this time? Millennials have made it clear that they will not accept any apologies. A Harvard study found that only 14% of Millennials believe that Wall Street “does the right thing at all times or most of the time”. 83% of Americans believe that today's Wall Street is no more ethical than 2008.

A bank is a place that lends you an umbrella when the weather is fine and asks for it when it rains.

– Robert Frost

Obviously, traditional banking is far from a perfect institution. Let the millennial generation trust a system that has proven to fail, and the risk is too great.

Past events have highlighted the instability of banks, and it is logical for millennials to consider storing wealth through other forms. Most of the Millennials (68%) will strongly consider abandoning traditional banking relationships and switching to technology companies' digital banking and payment services, such as Facebook, Google, Apple and Amazon. In stark contrast, only 32% of baby boomers are ready to make the same shift.

This is not to say that all millennials do not like their banks. According to a survey by Scratch, about half (53%) believe that the personal banking they currently use does not have any distinction from other competing banks. The reason for accepting this traditional banking system is that there seems to be no other better option.

In connection with the alternative banking business, although the scale is not as good as the four technology giants mentioned above, as of the first quarter of 2019, PayPal's Venmo application has 40 million users, while Square's Cash application has 15 million users. Therefore, it is not surprising that one-third of millennials think they will not need a bank at all.

This inherent distrust of the institution lays the foundation for a new investment approach. According to a survey by eToro, Millennials believe that cryptocurrency is an asset compared to the traditional Wall Street securities market. The survey, commissioned by independent research firm Provoke Insights, asked 1,000 online investors aged 20 to 65 in the United States about stock exchanges, cryptocurrency exchanges and 401(k) retirement benefit plans. Forty-three percent of millennials respondents say they trust cryptocurrency exchanges more than American stock exchanges.

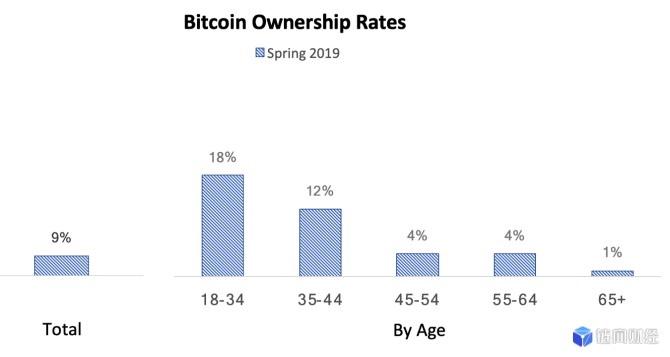

Aside from the factors of trust, some millennials are already using cryptocurrencies, and there may be more in the future. A quarter (25%) of Americans between the ages of 24 and 38 who have a personal/common income of $100,000 or have $50,000 in investable assets hold or use cryptocurrencies. Another 31% are interested in using cryptocurrency. Another powerful data comes from a study by Blockchain Capital, which found that 9% of American adults surveyed have bitcoin, 18% of whom are 18-34 years old. Millennials have chosen systems based on mathematics and code rather than systems of traditional institutions. This gap is almost twice or even three times that of the previous generation.

Millennials are deeply influenced by technology, both past and present. From this generation, innovation has exploded exponentially. Most people may grow up using both landline and iPhone. From the analog world to the digital world, this is an incredible change. "A world at your fingertips" is not just AOL's slogan. The ability to access everything online is the first time in history that has affected the entire generation. Millions of generations have different behaviors and experiences than previous generations. This is an unprecedented digital education. It makes it difficult for leaders and institutions to see the world from their perspective. They grew up in an era of technological change, globalization and economic turmoil.

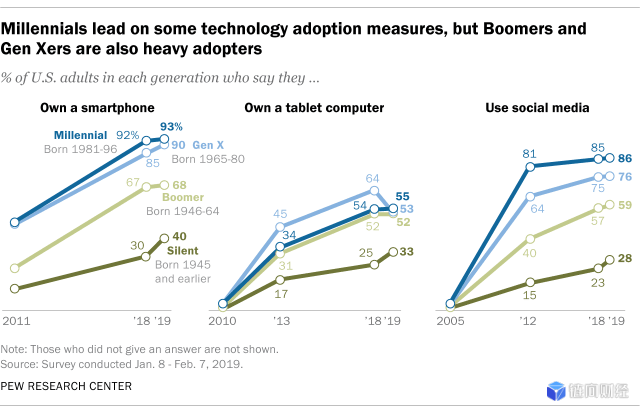

Their ability to use, apply and understand different technologies quickly differentiates them from other generations. After all, they were among the first to grow up around digital technology, including broadband Internet, home computers, video games, social media and smartphones. According to the Pew Research Center, more than 90% of millennials (93%) own smartphones, while 90% of X generations, 68% of baby boomers and 40% of silent generations own smartphones. .

Millennials are already reshaping the economy. This includes new dynamics, a new, fully digital reality. Moving from traditional sports to e-sports or competitive video games is a perfect example of this generation's transformation. The history of sports dates back to the era of civil BC, and it is not surprising that they are still popular today. Surprisingly, the rise of e-sports is at least the same for older generations. The millennial generation occupies the vast majority of the audience in the e-sports industry, accounting for 73% of the total.

Recognizing the scale of development of video games and digital media in recent years is very important. One of the main reasons for opposing the value proposition of Bitcoin is that it exists only in digital form, which is invisible to most people. But this is indifferent to millennials. If there is any difference, it is Bitcoin, the selling point of assets.

E-sports is the fastest growing sport in the world. Last year, digital sports events in the United States almost beat all other sports events.

- NFL (American Professional Football League) 141M

- eSports (e-sports) 84M

- MLB (American Major League Baseball) 79M

- NBA (American Professional Basketball League) 63M

- NHL (National Hockey League) 32M

- MLS (American Professional Football League) 16M

The League of Legends is one of the most popular video games in the world. Every year, Riot Games hosts competitions with teams from around the world. The semi-final of 2019 attracted 4 million viewers, which does not include a large number of Chinese audiences.

E-sports is a global phenomenon that will attract more attention in the future. Last year, the final of this event had 200 million viewers in China and millions of viewers in other countries. However, just 10 years ago, the founder of the sport almost decided not to host the event. They believe that there is no need to watch e-sports. In the first competition in 2011, there were only about 1,000 spectators, and now there are hundreds of millions of younger generations watching.

The game involves unique digital currencies, which are purely digital currency obtained through battle or trade, whether it be coins or gold. The player can then redeem this "in-game currency" into other goods or equipment. This generation can easily buy, sell and participate in transactions.

Initially, these virtual currencies existed entirely within the gaming environment. Many games have now evolved to allow players to purchase more "game currency" with real-world French currency. Once the virtual wallet has enough "game currency", you can purchase goods and services.

Fortnite is a relatively new video game with $2.4 billion in revenue last year. Surprisingly, this game is completely free. But to buy some content in the game (for example, the character uses different clothing), the player needs to convert the US dollar into the company's virtual currency. The majority of the company's revenue comes from selling its own created virtual currency. Last year, Fort Night was not the only impressive entity to sell in game currency:

- League of Legends: $1.4 billion

- King Glory (European version): $1.3 billion

- Elf Pokemon GO: $1.1 billion

- Candy Legend: $1 billion

We are in the digital age. Digital currency is inevitable.

The pace from virtual currency to cryptocurrency is smaller than many people think. Bitcoin has many of the same characteristics as the currency that the younger generation is used to. Here's a comparison of Bitcoin's simple use with banks:

Use Bitcoin:

1. Download a wallet

2. Receive your funds

Use bank:

1. Going to the bank during the business hours of the bank will generally conflict with the working hours of 9 to 5

2. Present your ID card, many people may not even, at least in the United States, because it takes time and resources to do ID card

3. Provide your social security number, because you must hold it for life, it is easy to be identity theft

4. If the minimum deposit or any other conditions are not met, the bank will charge a hidden fee.

5. Make an initial deposit amount, or even open an account yourself

6. Present the proof of address and the bank will ask for some previous bills.

7. Pass the legal document reading ten pages (or even hundreds of pages), sign the privacy right, and the bank is excused when you lose money.

8. Wait a week, your funds are processed, only to find that someone sent you a wire transfer "lost" and forgotten, until a week later you call the bank. It’s not enough to call your bank. You have to talk to the teller in person and then be told to call the bank’s wire transfer department.

9. Where and how you use the newly acquired funds are subject to bank supervision, and you must believe that the bank will not disappoint your trust.

To be fair, this description is a bit exaggerated. This example is just to highlight the differences that Millennials have become accustomed to. Like the Internet, Bitcoin provides instant feedback and has no borders like the Internet. Millennials want simple, straightforward and on-call services without any restrictions.

When it comes to the “great wealth transfer” of the baby boomer generation to the millennial generation, we can be sure that Bitcoin is positioned as a tool for storing wealth. The millennial generation showed a strong tendency to embrace the digital age with open arms and at the same time dismiss the traditional financial system.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Starting from the bottom of the card currency: the world's wealth of 36 billion, members were arrested one after another, Chinese believers are still

- Beginner's Guide | Why choose a highly liquid exchange?

- QKL123 market analysis | For the central bank digital currency, what is the country's intention? (1115)

- Is ransomware causing bitcoin to skyrocket? Seems to be really related

- Babbitt column | Before the release of dividends and opportunities, the blockchain industry will usher in a strong supervision

- BTC has repeatedly tested key support areas, and short-term bullish resistance is weak

- The most influential industry star! Coinbase CEO is on the "Times of the Next Generation" list of Time magazine