CoinShares In-Depth Report: Read the past, present and future of encrypted assets

CoinShares has published an in-depth report on cryptographic assets , which is very valuable. Meltem Demirors, CoinShares' Chief Strategy Officer, has written a number of insightful articles, including: " How do cryptocurrency investors interpret Dalio's "paradigm shift" investment theme? "The cryptocurrency industry is modern alchemy. "

The Coinshares report reviews major events and economic conditions in the global macro environment, the history and current state of the crypto-market, attempts to find signals from the hustle and bustle of the ocean, and attempts to understand the present and insight into the future based on historical experience and data.

The report contains many interesting points, including:

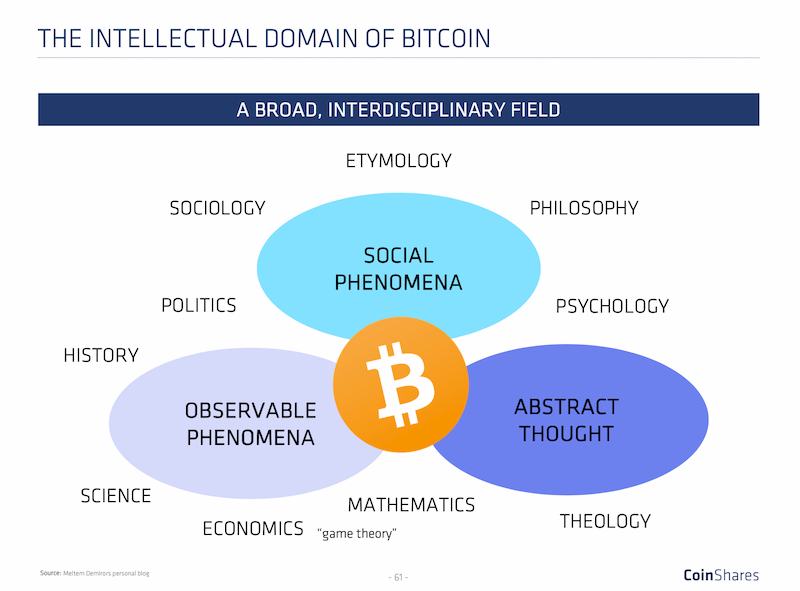

- Bitcoin is both a religion and a science

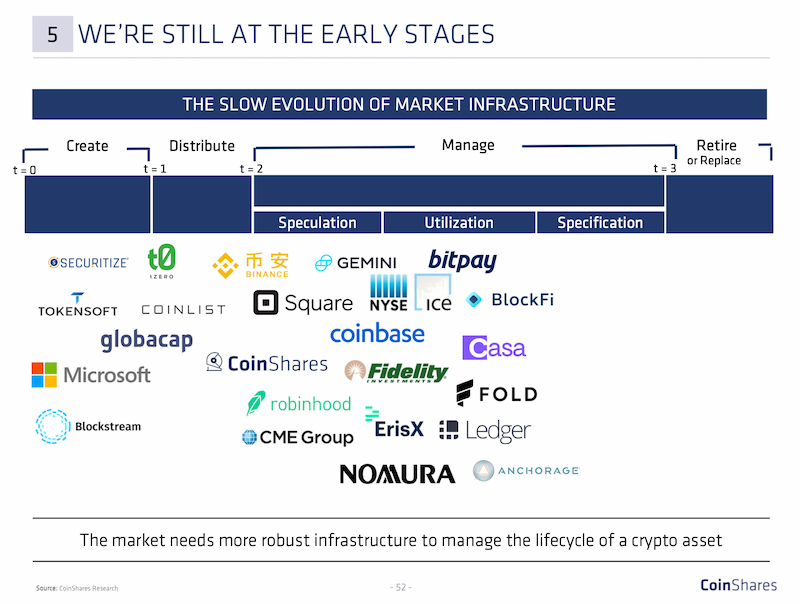

- We are still at a very early stage, and the market needs a more robust infrastructure to manage the lifecycle of encrypted assets.

- The adoption of technology is not linear

This in-depth report is 134 pages long, but each page is very valuable. Limited to the time This article only extracts and translates some of the content. I highly recommend readers to read the full report. Enjoy it!

- The generation of quantitative easing: how the Fed makes money out of thin air

- Babbitt Exclusive | Shanghai launched a virtual currency exchange to investigate and rectify actions, what do people in the industry think?

- The road to the listing of Bitcoin mining companies: once at the Hong Kong Stock Exchange, is now seeking IPO to the US

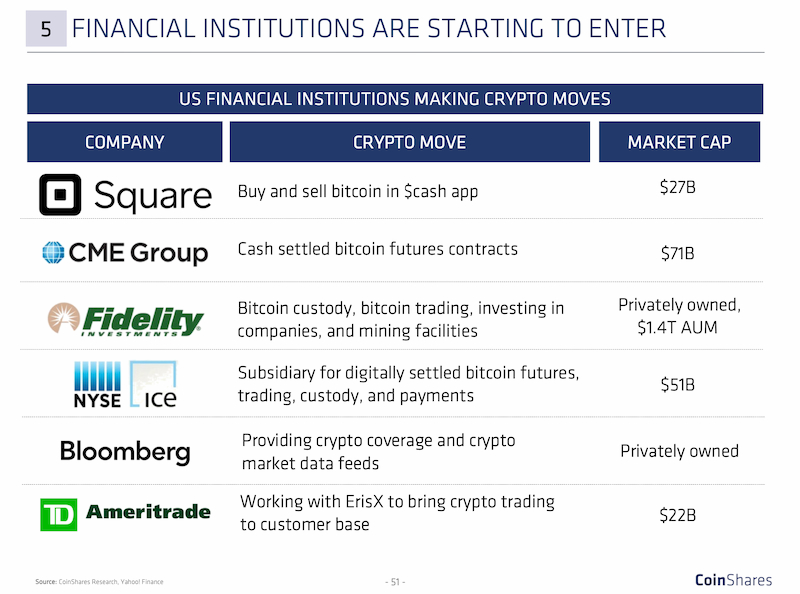

The Internet has not killed companies, it has enabled new companies to grow and makes existing companies more agile and efficient.

Bitcoin and the open financial system will not kill financial institutions, it will enable new companies to grow and make existing companies more resilient.

The number of Bitcoin users worldwide is between 35 million and 140 million, accounting for 0.5%–1.8% of the total population. In the past five years, we spent a lot of time explaining what Bitcoin is, how it works, and how it might affect the world.

In the last wave of technological change, less than 1 million PC users spent 15 years growing to 150 million people. The adoption of technology is not linear, and bitcoin is no exception.

Today, 3.8 billion people (50% of the world) have access to the Internet and 42% have access to smartphones. While many people are involved in online communities, many users still cannot benefit from the global economy and finance outside their area of residence.

In the words of Mary Meeker: History tells us that changes in the distribution of goods and services create a lot of business opportunities for savvy companies.

The Internet has helped local companies become global players, opening up a truly global market for ideas, goods and services. However, due to the complexity of regulation and the monopoly on money and payment systems, money, finance and commerce have been confined to the local market.

Bitcoin and digital assets have challenged this paradigm for the first time, creating an open global market for money and finance. The potential for this transformation cannot be underestimated.

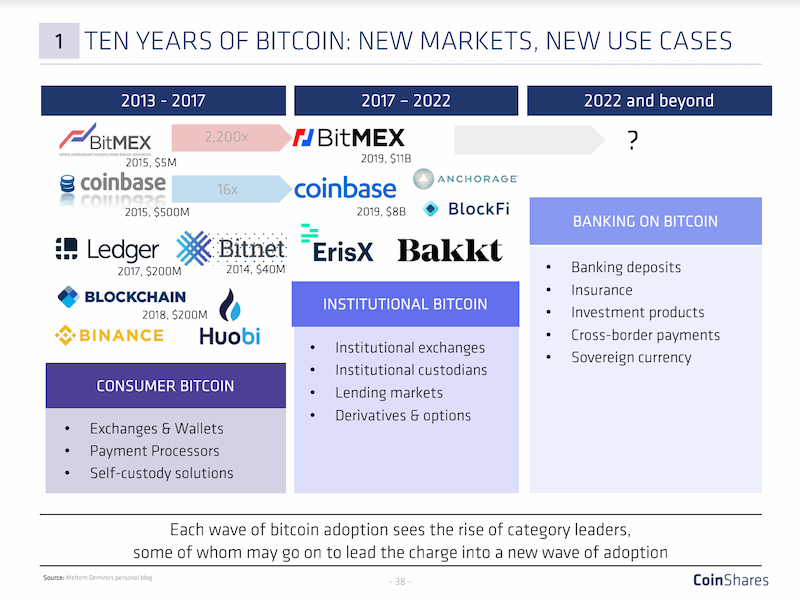

The wave of adoption of every bit of bitcoin has witnessed the rise of the leader, and some of them may continue to lead the next wave of new adoption of bitcoin.

In 2013–2017, the entire market was consumer-driven, with exchanges, wallets, payment service providers, and secure hosting solutions. The relevant players included BitMEX, Coinbase, Ledger, Blockchain wallet, and Binance.

In 2017–2022, the market value of BitMEX increased by 2,200 times to reach US$11 billion, and the market value of Coinbase increased by 16 times to US$8 billion. The entire market is driven by institutional investors, and there are exchange markets and exchanges for institutional investors. And custodians, derivatives and options.

In the more distant 2020 and beyond, Bitcoin may be bank-driven, with new use cases such as insurance, investment vehicles, cross-border payments or sovereign currency.

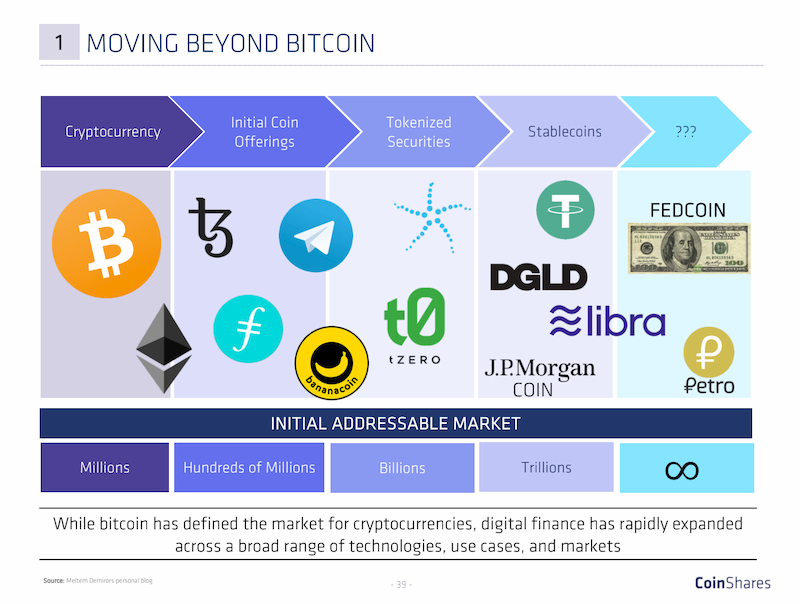

Beyond Bitcoin

Although Bitcoin defines the cryptocurrency market, digital finance has rapidly expanded into a wide range of technologies, use cases, and market segments.

From the earliest cryptocurrency to ICO, STO, and stable currency, what will be next?

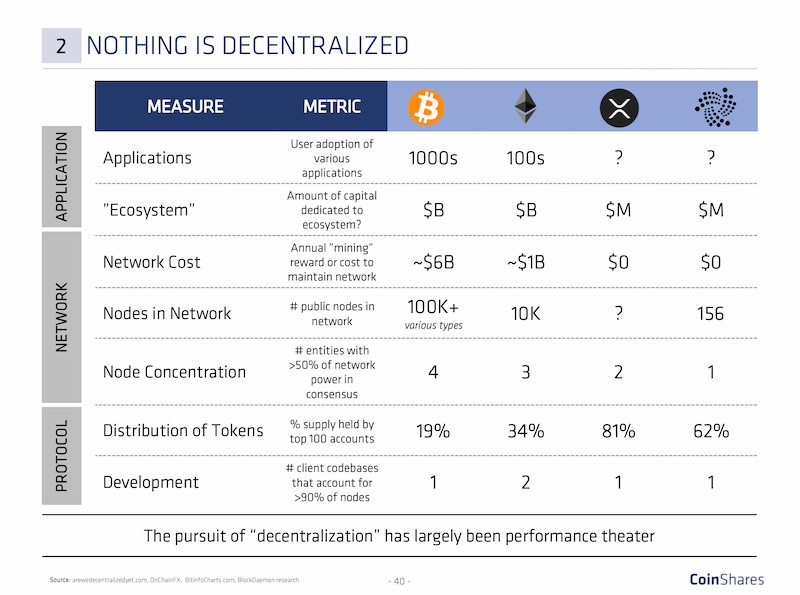

Nothing is decentralized

The following figure shows Bitcoin, Ethereum, Ruibo, and IOTA before "supporting the number of applications for the corresponding assets, the amount of funds invested in the ecosystem, the annual mining incentives or the cost of maintaining the network, the number of nodes, the degree of node concentration, and the number of tokens." Data on these dimensions for the percentage of one hundred accounts in total, and the number of client code libraries recognized by most nodes.

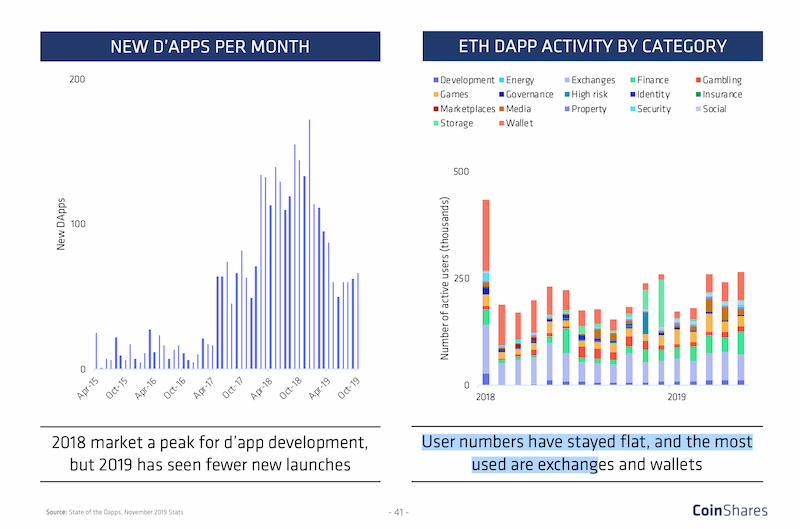

New DApp Quantity & DApp Type per month

2018 is the peak of the DApp development market, but there are fewer new DApps released in 2019; the number of users remains the same, and the most used are exchanges and wallets.

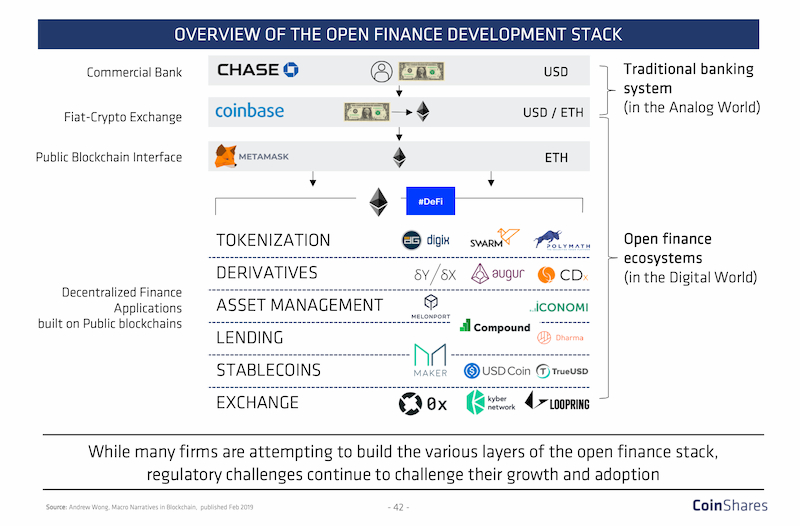

DeFi (decentralized financial application) stack map

Zhen Bencong Note: In the traditional banking system, commercial banks reserve US dollars, exchanges with legal currency imports such as Coinbase provide USD/ETH exchange services, and exchanged ETHs enter the DeFi world through public chain entrances such as MetaMask.

DeFi, which is currently established on the public chain, includes: asset tokenization platforms (DigiX, Swarm, Polymath, etc.), derivatives (dydx, Augur, etc.), asset management tools (Melonport, etc.), and loans (Compound, Dharma, etc.), stable currency (MakerDAO, TureUSD, etc.), transaction protocol (0x, Kyber, etc.).

Although many companies are trying to build agreements at different levels of the open financial system, regulatory challenges are still constraining their growth and adoption.

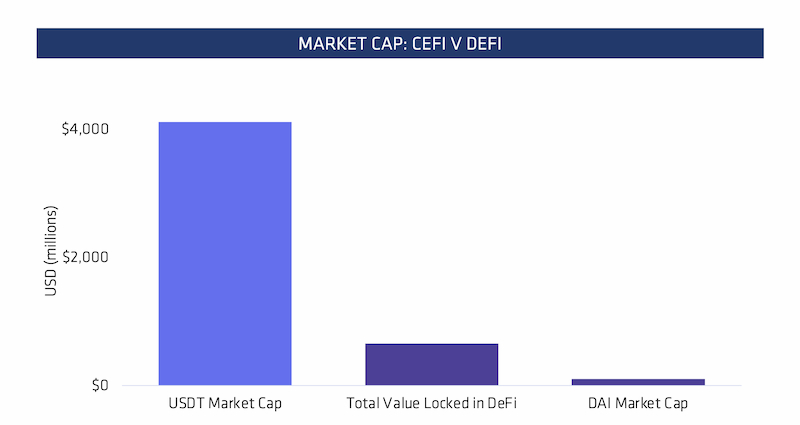

CeFi VS DeFi

Although DeFi has become an area of increasing interest, the centralized financial (CeFi) market managed by intermediaries is currently much larger.

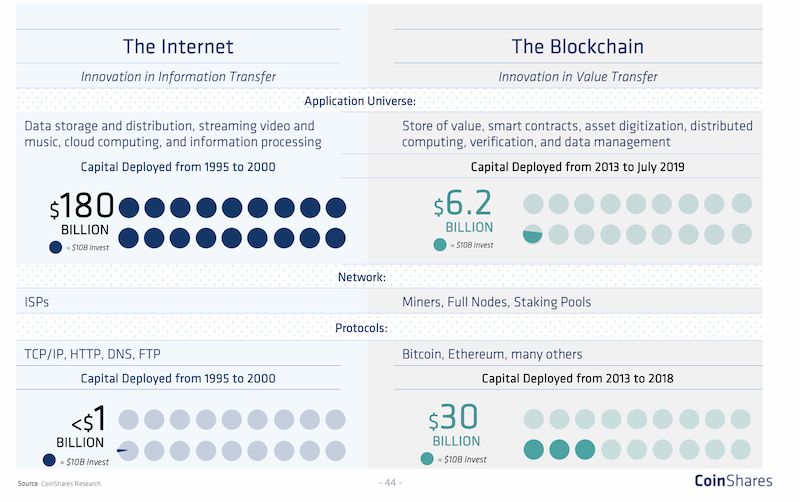

Encrypted assets subvert the theory of Internet investment

Zhen Bencong Note: In the Internet field, investing in the application layer can get the most return, and the investment agreement layer is almost unrecognizable. In the field of cryptographic assets, a large amount of capital is invested in the protocol layer, and the application layer is only 1/5 of the protocol layer funds.

This is the "fat agreement investment theory", and there are many disputes and discussions in the industry.

Related article: Will the cryptocurrency protocol become fat or thin?

There is no such thing as a "fat agreement"

Application protocol is a better investment

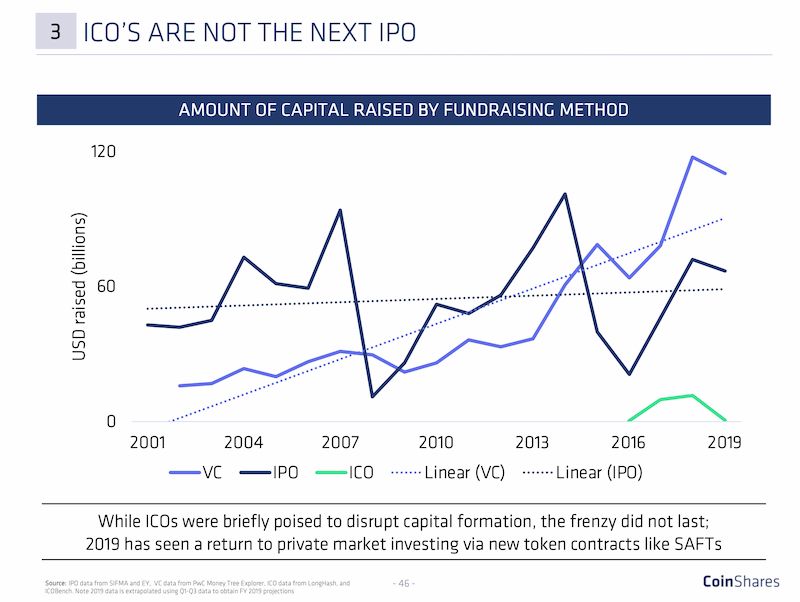

ICO is not the next IPO

This is a comparison of the relevant fundraising methods. Although the ICO has been very popular, this enthusiasm has not continued; in 2019, it returned to the private equity market.

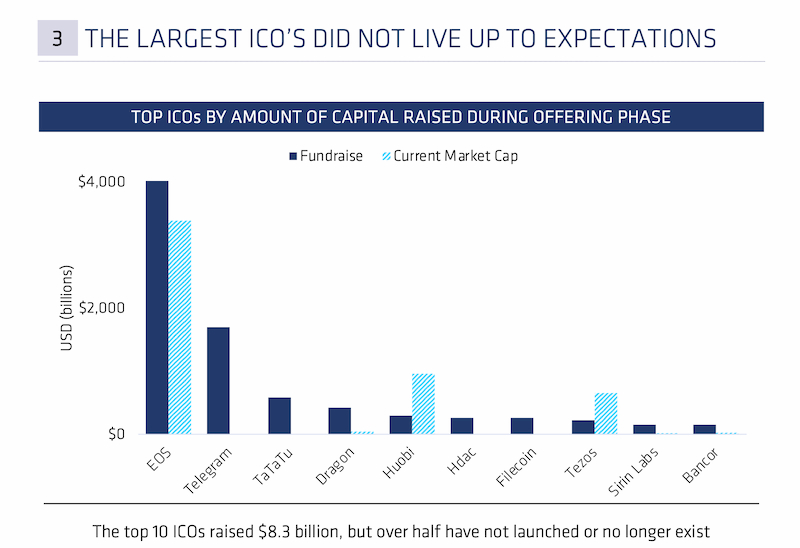

The biggest ICO project in history is disappointing

This is the comparison between the fundraising amount of the 10 most fundraising projects in history and the existing market value. Only Huobi and Tezos have not broken, and more than half of the projects have not yet been launched or the market value has plummeted.

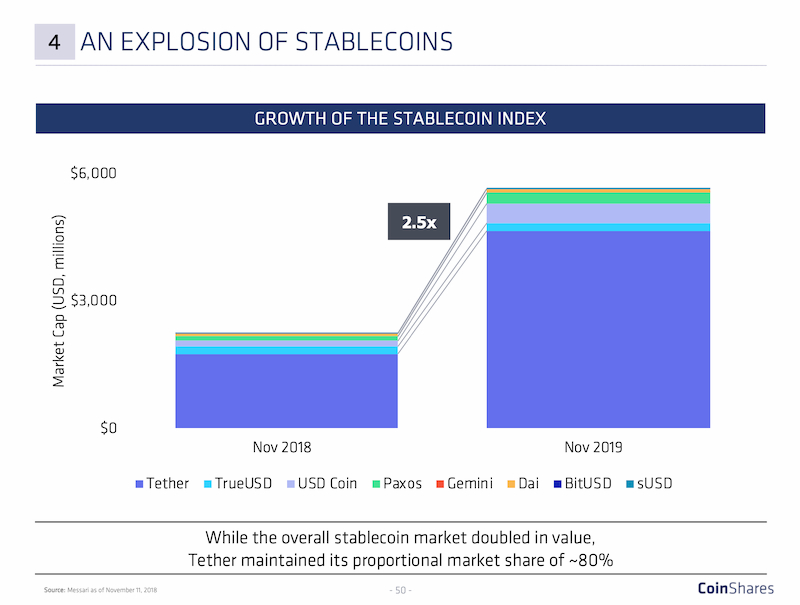

Stable currency explosion

Despite the explosive market capitalization (2.5 times) of the stable currency, USDT still holds 80%+ market share.

Financial institutions are entering!

The financial giant is entering the encryption market in a variety of forms.

We are still in the early stages

Bitcoin spans multiple disciplines

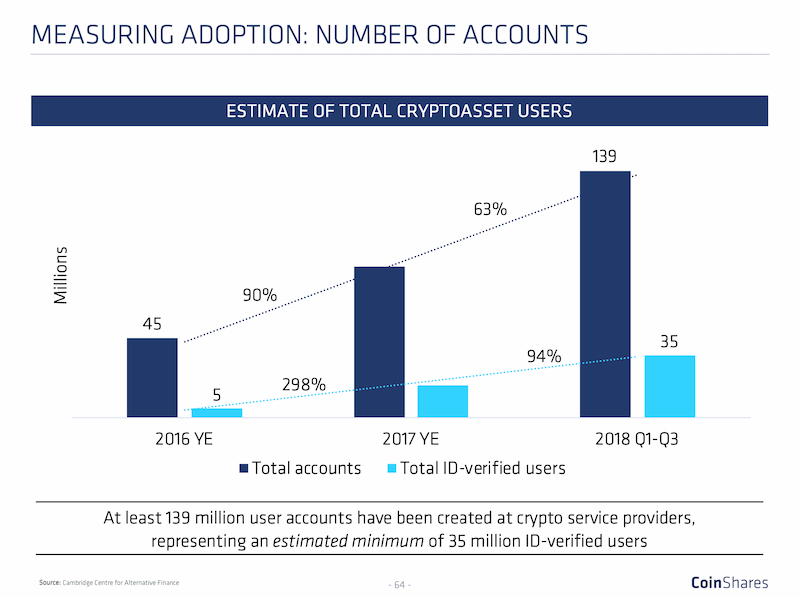

Encrypted asset users

At least 139 million users have registered with cryptographic service providers, and at least 35 million have completed authentication.

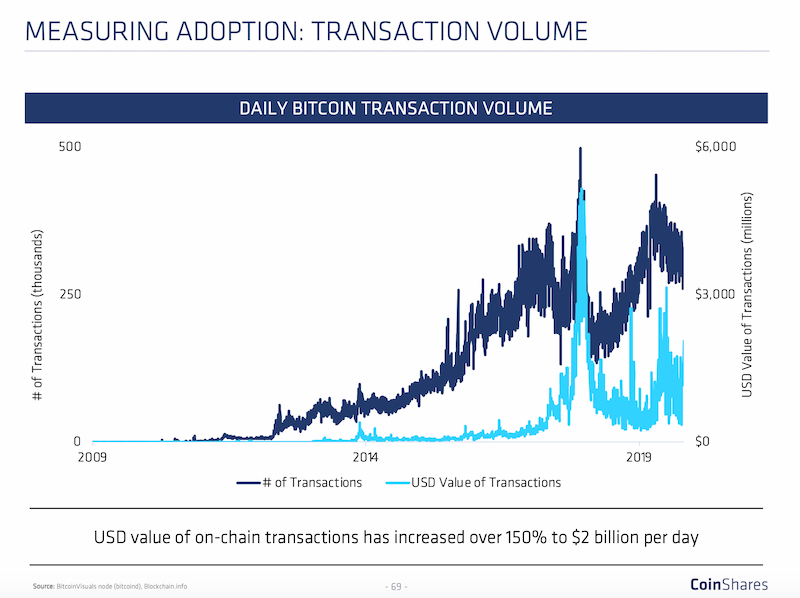

Daily total bitcoin transfer

The dollar value of the chain transactions increased by 150% to reach $2 billion per day.

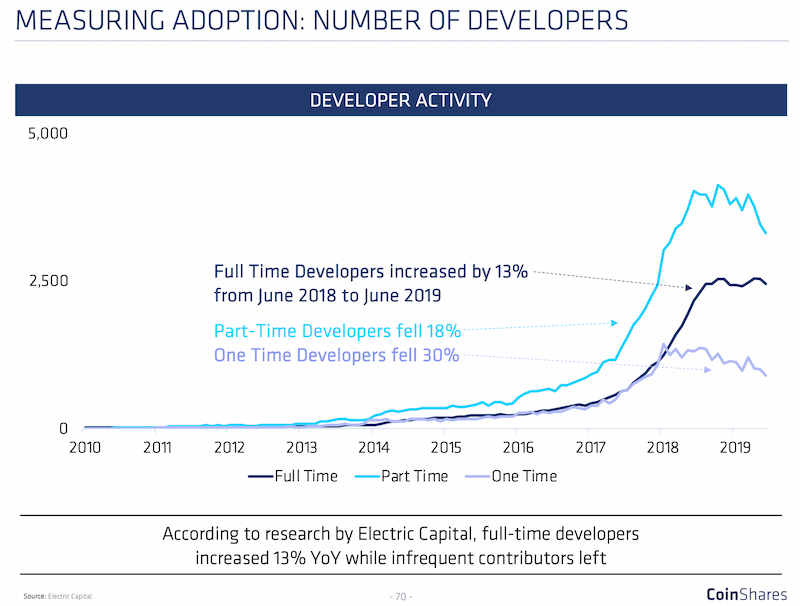

Number of developers

According to Electric Capital's research, full-time developers have an annual growth rate of 13%.

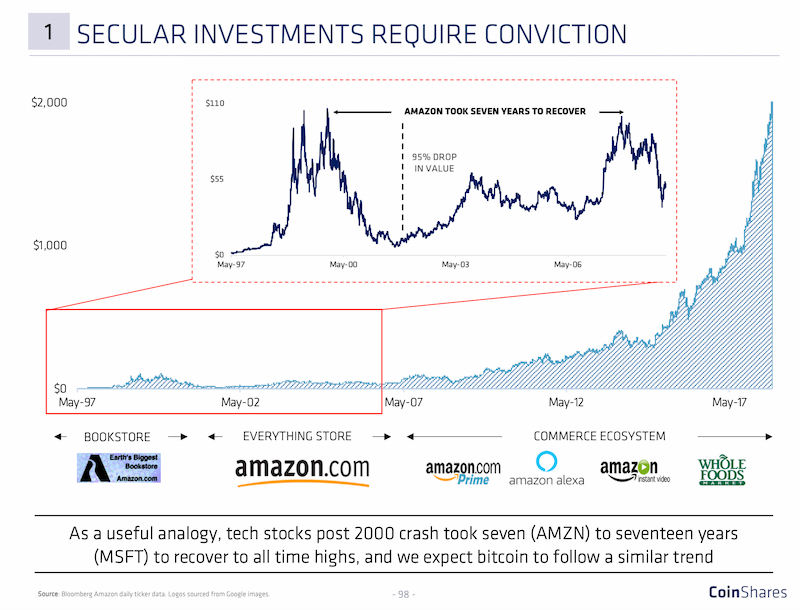

After the tech stock crash?

After the collapse of the technology stock in 2000, it took 7 (AMZN) – 17 (MSFT) years to return to an all-time high. We expect a similar trend in Bitcoin.

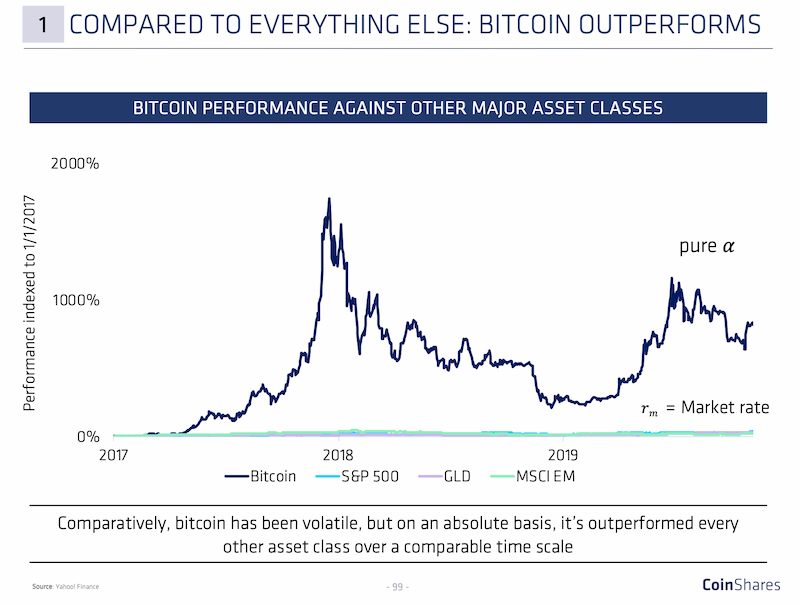

Bitcoin performs well enough

In contrast, Bitcoin fluctuates more, but on an absolute basis it surpasses all other asset classes on a comparable time scale.

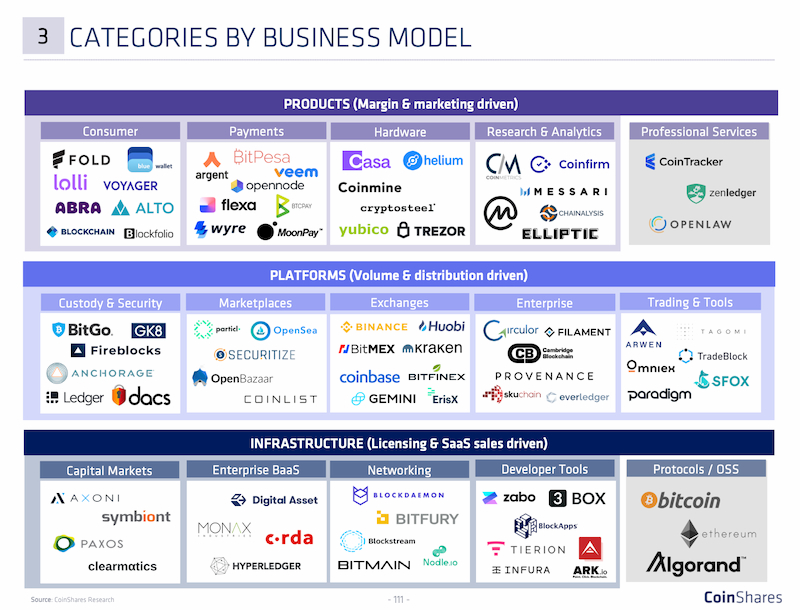

Business model in the field of encryption

Zhen Bencong Note: The above figure classifies companies or projects in the encryption field according to different business models, including development tools, hosting, hardware, data research & analysis.

Although the current business model is mostly central and is a mirror image of existing financial services, we hope to see new business models as the industry matures.

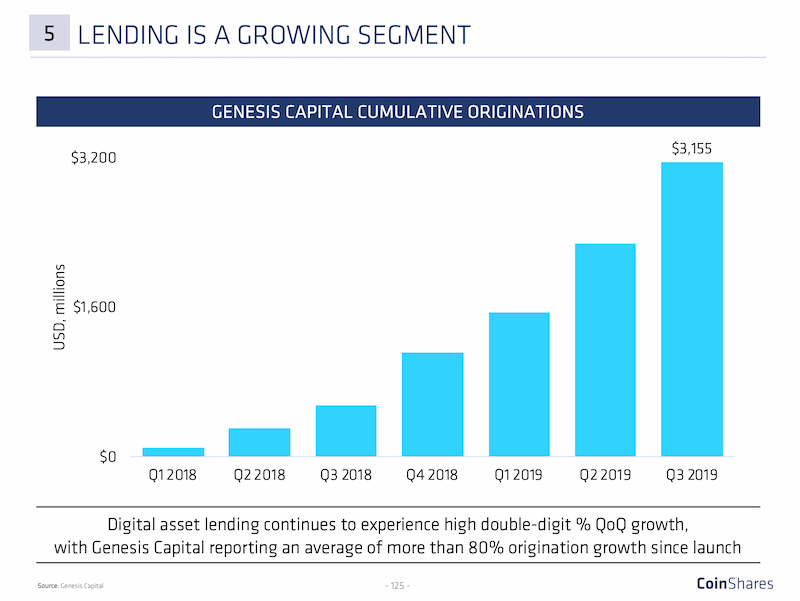

Lending business is growing rapidly

Digital asset loans continue to maintain double-digit quarterly growth, according to Genesis Capital , which has grown at an average rate of more than 80% since its inception.

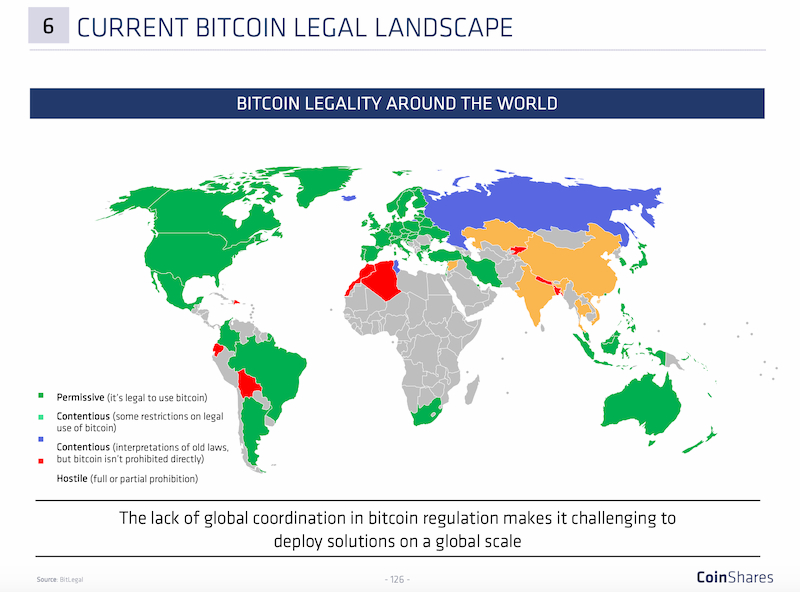

Current bitcoin legal environment

Dark green stands for permission (using bitcoin is legal); light green stands for controversy (some restrictions on the legal use of bitcoin); blue stands for controversy (applicable to old laws, but bitcoin is not directly prohibited); Red stands for hostility (full or partial ban).

Bitcoin regulation requires global collaboration, so deploying solutions on a global scale can be challenging.

Without a final game, evolution is infinite.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis: BTC's weak adjustment has not yet ended, and the trend of mainstream currency is facing a change

- Draw a blockchain social portrait

- Shanghai will complete the work on the virtual currency trading venue before November 22

- Bitcoin: the beneficiary of the era of wealth transfer

- The BRICS intends to create a single cryptocurrency for payment and settlement between member states

- Jimmy Song: I want to treat every kind of competitive currency as a scam.

- Viewpoint | On State Rent and Stateless Ethereum