Bitcoin is 11 years old. Has he grown up?

On October 31, 2008, a person named Nakamoto Satoshi posted a research paper entitled "Bitcoin: A Peer-to-Peer Electronic Cash System" in the mailing group of the Cryptography Forum. Three months later, he turned the theory into reality and dug up the first batch of 50 bitcoins on a small server in Helsinki, Finland.

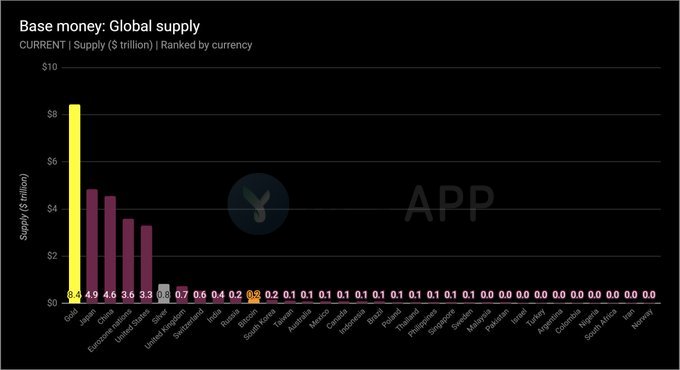

Today, 11 years later, once two pizzas can be exchanged for 10,000 bitcoins, the price of one has risen to $9,100, and the total market value of bitcoin has reached $1,647,17,266,358, which will help you count it. The string number is 164.6 billion. This figure also allows Bitcoin to surpass the Australian dollar, Canadian dollar and other legal currency, successfully ranked among the world's 11th largest currency, and the gap with the Russian ruble is very limited.

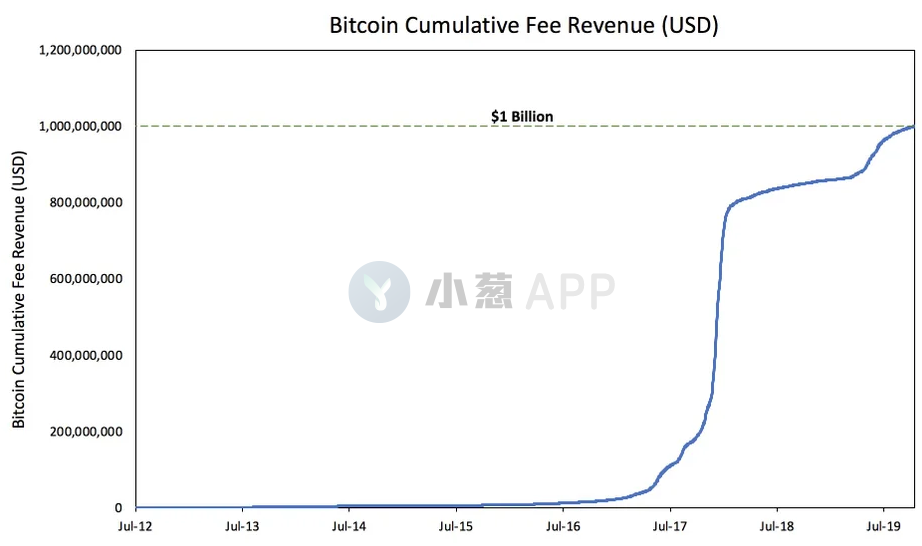

More than a week ago, the 18 million bitcoins were officially dug up, and the scallions sorted out 12 18 million milestones in the history of Bitcoin (see " Writing after the 18 million bitcoins were dug up: these" The 18 million milestone is also worth remembering . In the last few days, the total transaction fee of Bitcoin has also officially exceeded the $1 billion mark, and the market has reached an important milestone.

- Genesis Capital's third quarter report analyzes opportunities for cryptocurrency lending

- The domestic public chain Yuanjie DNA released the digital identity application Bitident (Bidden) to help the rise of the digital economy

- The digital currency of Chinese listed companies (below)

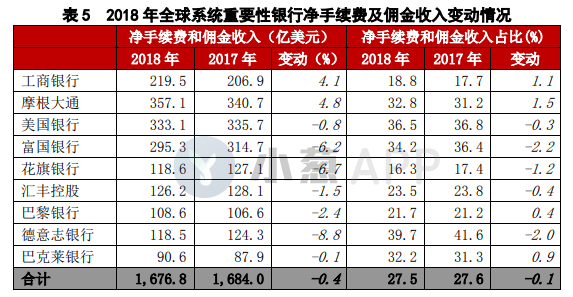

But is this number really big? I checked the report of the 2018 Operational Performance Analysis and Outlook of Global Systemically Important Banks issued by the ICBC Institute of Urban Finance in May this year. The article published the commissions/fees of several major banks in the world in 2017 and 2018. Performance, specific data see the following picture:

In the case of work behavior, in the two years of 2017 and 2018, ICBC’s annual net fee and commission income exceeded $20 billion. Even the lowest value of the single-year data in the above chart, that is, the net fee and commission income earned by Barclays Bank in 2017 reached 8.79 billion US dollars. And the number we just mentioned is that the total transaction cost since the birth of Bitcoin has just reached $1 billion.

Perhaps there are always bitcoin fans who have proven the bitcoin's value-added effect in the past few years to prove that Bitcoin is strong enough, but the volume of this market is really only a younger brother than the traditional financial market.

To put it another way, Bitcoin's current total market capitalization is more than $16 billion. As of October 31, the total market value of A shares in Kweichow Moutai is 148.326 billion yuan, which is about $107.749 billion at current exchange rates. In other words, Bitcoin, a new global asset, has a very large gap from the total market capitalization of a listed company in Maotai.

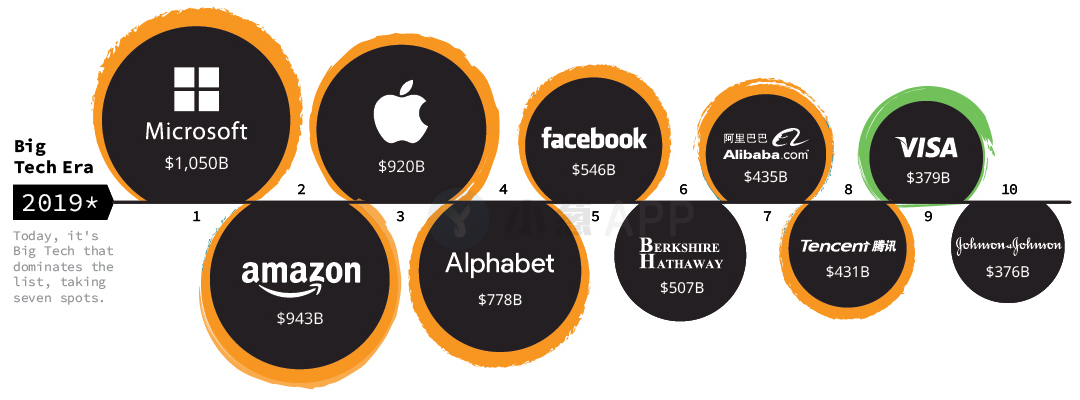

And if we compare the total market value of Bitcoin with the market value of the technology giants like the sky…

Even if the total market value of the entire cryptocurrency market is more than $240 billion, there is a huge gap in the face of the market value of these technology companies. The total market value of the entire cryptocurrency market is not even as much as a quarter of Microsoft's market capitalization.

In terms of volume, the third quarter report released by the World Gold Council in mid-October showed that the average global gold transaction volume in September reached 183 billion US dollars per day, which was a significant decline compared with August. According to data released by Coinmarketcap, the volume of the entire cryptocurrency market in the past 24 hours was only $86.956 billion, of which the bitcoin volume was only $26.262 billion. It can be seen that bitcoin and even the entire cryptocurrency market have a huge gap with gold in terms of liquidity performance.

Regardless of “scale” or “traffic”, Bitcoin and the entire cryptocurrency market are still very different from traditional financial assets. Since 2017, the market coverage of cryptocurrencies and public opinion since the big bull market has indeed reached a considerable The high standard, and from the price point of view, the growth rate of Bitcoin is indeed called "the skybreaking", but after all, the meal is to be eaten bit by bit, the road is also to go step by step, for the cryptocurrency, we are fortunate to be able to witness Its growth process, why should it be so urgent?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The contract market will add another fierce will explain the currency China strategy

- SpaceX also engages in IEO? Musk is forced

- How to develop a "no coin" public chain?

- QKL123 market analysis | Federal Reserve cut interest rates as scheduled, safe-haven assets fluctuate (1031)

- The German Banking Association published a paper calling for the establishment of a programmable digital euro

- Top 10 DeFi Big Chain Life

- Everything you want to know: details of the first disclosure of Bitcoin options on the Chicago Mercantile Exchange