Genesis Capital's third quarter report analyzes opportunities for cryptocurrency lending

Original source: Genesis Capital

Compile: Sharing Finance Neo

Source: Sharing Finance

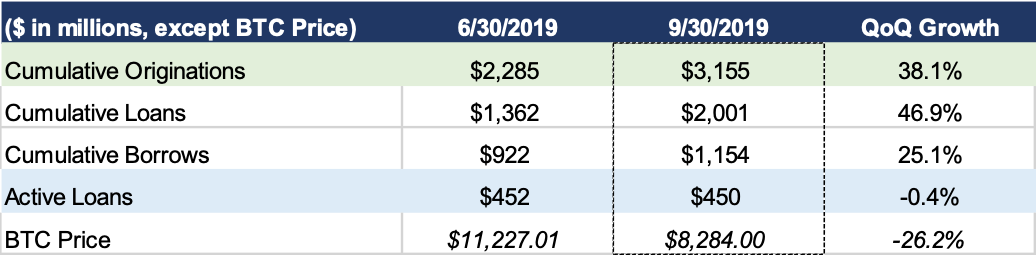

Today, Genesis Capital, the world's largest institutional digital asset lending platform, released its third quarter report. The report shows that Genesis' digital asset lending business continues to grow. In the third quarter of 2019, Genesis added $870 million in new loans, breaking the record of $746 million in the previous quarter, with stable coins accounting for more than 30% of the loan. As of September 30, 2019, the active loan balance was $450 million, although bitcoin prices fell sharply during this period, but remained roughly the same as the previous quarter.

- The domestic public chain Yuanjie DNA released the digital identity application Bitident (Bidden) to help the rise of the digital economy

- The digital currency of Chinese listed companies (below)

- The contract market will add another fierce will explain the currency China strategy

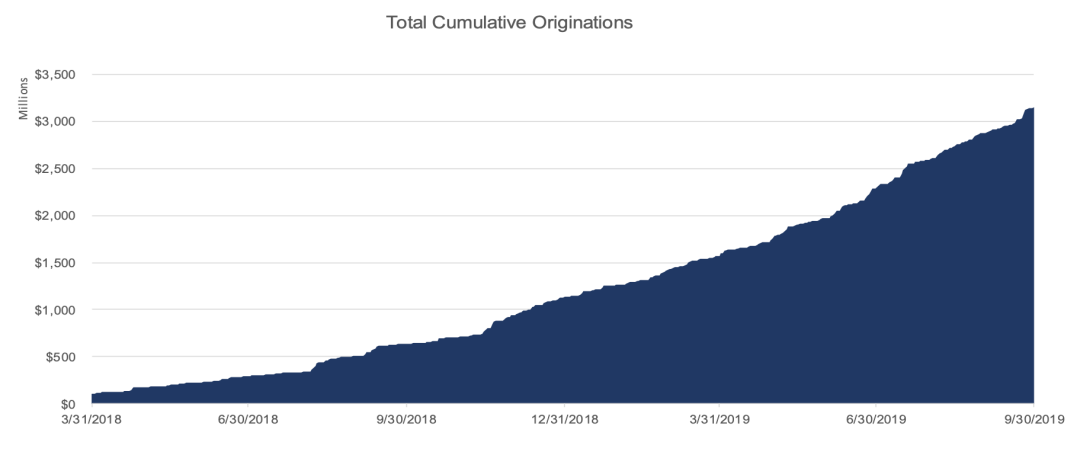

Since Genesis started its loan business in March 2018, QoQ (seasonal revenue growth/recession rate) has increased its loans by 38.1%, achieving strong growth for the sixth consecutive quarter, with total loans reaching $3.1 billion. Genesis' loan portfolio maintains its value primarily by adding cash (US dollar and stable currency) loans, offsetting the decline in the nominal value of outstanding crypted loans.

In this report, we will delve deeper into the continued growth of the global cash lending market and the opportunities for large financial institutions to achieve extraordinary returns relative to credit market risk.

Quarterly portfolio

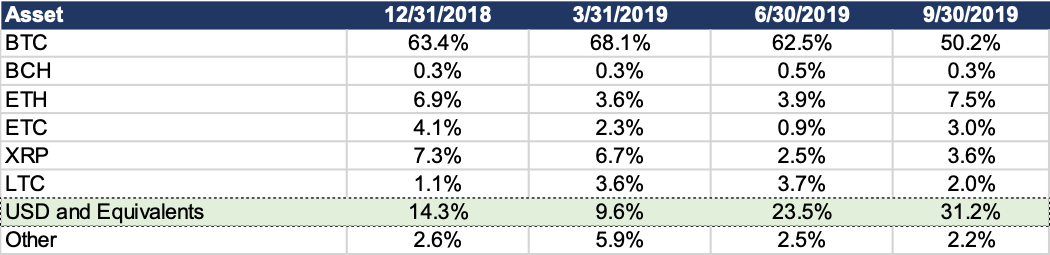

As can be seen from the above chart, the ratio of cash loans to loan balances has increased significantly for two consecutive quarters. As of the end of the third quarter, cash loans accounted for 31.2% of our active loan portfolio, up from 23.5% at the end of the second quarter and 14.0% at the end of last year. As we mentioned in the second quarter report, the international demand for US dollar borrowing has been strong. Due to the traditional banking friction, a large part of this cash demand translates into stable companies like USDC and PAX. This trend has had a major impact on our portfolio composition and counterparty composition.

The newly issued US dollar bonds in the third quarter took a portion of the active BTC loans, as altcoin's demand increased slightly.

International demand for cash loans supported by BTC

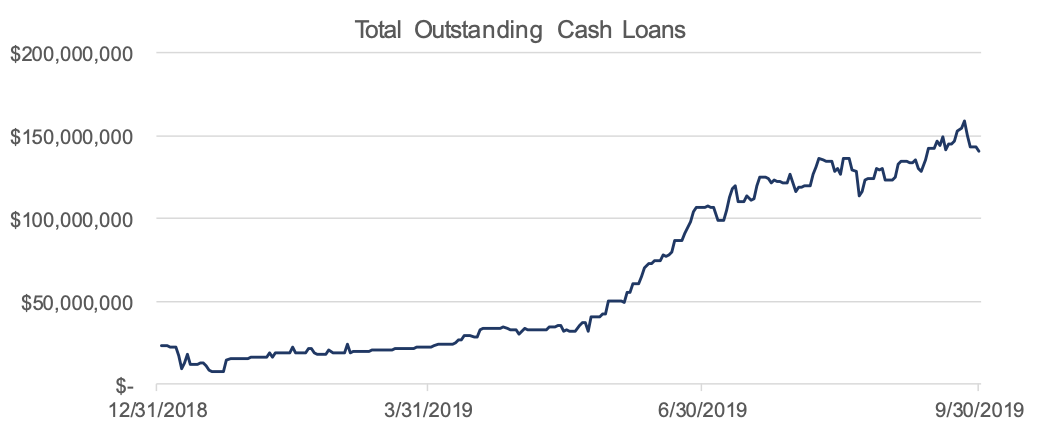

The chart below shows the total amount of cash loans so far. At the beginning of this year, our total outstanding cash was about 20 million US dollars. After a moderate increase to 40 million US dollars at the end of the second quarter, the third quarter of outstanding cash loans increased nearly 4 times, reaching a high of 160 million US dollars in mid-September. point. Currently, our total cash loan is $140 million – the recent decline in outstanding loans can be attributed to deleveraging after the spot has fallen from $10,000 to $8,000, and the futures curve has flattened, while in the third quarter For most of the time, the futures curve was in a steep price.

When we look closely at the counterparties who borrowed cash, we found strong international demand, while demand in Asia is growing steadily.

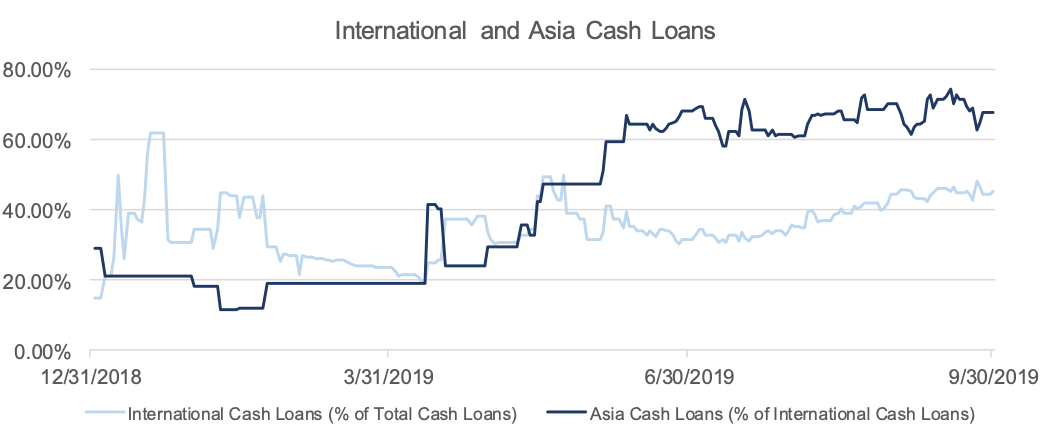

The chart below shows the percentage of international counterparties' cash loans as a percentage of total outstanding cash loans (today) and the percentage of Asian counterparty cash loans to outstanding international cash loans.

There was a huge, discontinuous, step-by-step change in the ratios in the first quarter and the second quarter—because an average of only about $30 million in cash loans was outstanding during this period, returns and new loans significantly changed the book composition. However, in the third quarter, the time series became more continuous as the amount of cash issuance and outstanding loans increased significantly. Currently, international counterparties account for 45% of outstanding cash loans, of which nearly 70% are from Asia.

For many years, China has been experiencing currency “flight” and the government has been trying to limit the transfer of RMB. Although the Chinese government has tried to limit the direct exchange of RMB to Bitcoin, there are still many channels for RMB to flow into the digital currency ecosystem, such as through Yuan/USDT, localbitcoins (a peer-to-peer bitcoin trading website) and direct transactions with miners. Once in the digital currency, it is easy to convert to the US dollar or other stable currency. We believe this capital flow is one of the larger drivers of Asian cash demand. In addition, there are some of the world's largest bitcoin mining companies in Asia. As mining companies become more mature, they can optimize their balance sheets by using BTC for cash financing to pay for electricity and other costs.

From a macro perspective, each time a BTC is used to borrow $1, the cash is used primarily in one of two situations: speculation or working capital. Speculation is the easiest, and cash is used to buy more bitcoins and leverage to do more. An example of a working capital use case is that a mining company is usually BTC wealthy and cash-strapped, choosing to use BTC-controlled cash financing to pay for electricity contracts. In the end, both use cases promoted selling pressure on the US dollar and foreign currency, increased the speed against the US dollar, and increased the liquidity of BTC bids.

Asset-based loans in the digital asset market

As miners, hedge funds, trading companies and individuals continue to grow their demand for cash, one can't help but ask: “Who will meet this demand?” BTC investors usually only get asset returns in a limited way , so Since current supply is greater than demand (especially in a bull market), interest rates are still relatively low. However, investors and cash holders have multiple ways to generate asset returns. Although these cash holders are participants in the digital asset ecosystem, they can easily invest in other asset classes, such as stocks, traditional bonds, and real estate. Given these other revenue opportunities, cash lenders in the digital asset market can demand higher interest rates than their BTC counterparts.

Another important consideration for cash lenders in the digital asset market is whether they accept the level of risk borne by mortgage assets such as BTC and whether such returns/risk conditions are superior to traditional returns. Because these questions have no clear answer, and many large cash holders, such as banks, asset management companies, and private lenders, have not fully entered the encryption economy, the supply of cash is relative to BTC and other large digital assets such as ETH. Supply is usually limited.

In order for the cash supply to expand as demand grows, we need to see more banks willing to lend into the field. This means they need to conclude that BTC-backed loans have a risk-adjusted rate of return that is higher than traditional loans.

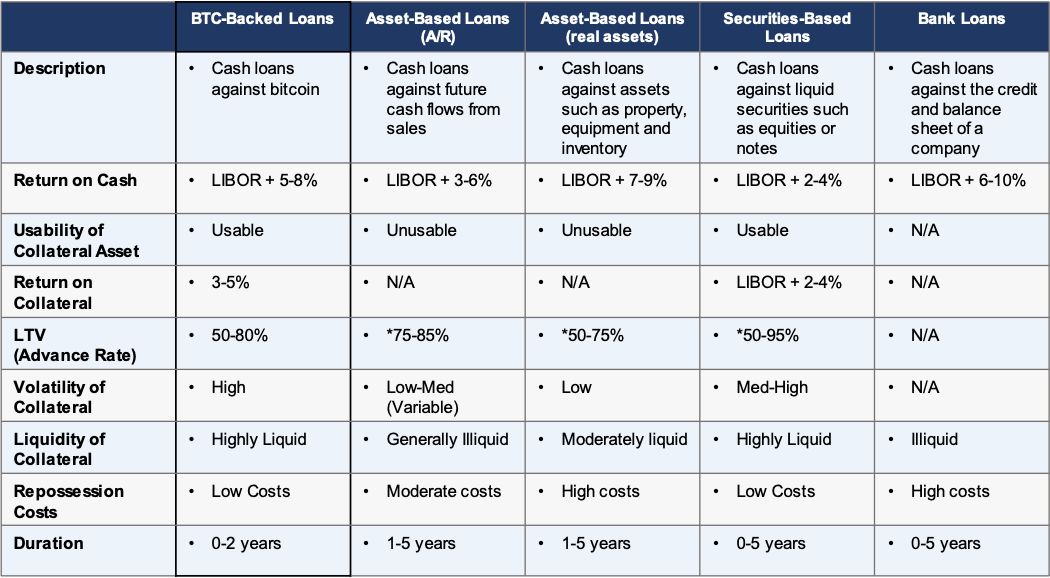

Below, we highlight some common credit structures that Lenders will evaluate in relation to BTC loans :

There are many credit structures and opportunities in the capital market. The above picture only highlights some of the more common structures. We chose these structures because they are compared to BTC-supported loans when assessing the expected return and risk of capital.

Although BTC is very different from the assets that support traditional loans, it has some of the same assets that can be used as collateral if properly managed.

Revenue forecast

When considering the lender's interest rate range for cash, BTC-backed loans are at the high end of this range, most similar to loans for real estate such as inventory, equipment or real estate. However, unlike BTC-backed loans, collateral is usually sent directly to the lender, who directly controls the assets. Traditional physical asset collateral is usually mortgaged to the lender through a legal agreement, and the lender can't actually control the collateral unless the borrower defaults. Given the unique ability to control collateral assets over the life of the loan, the lender can generate additional returns if there is an interest rate market for the asset. In the BTC market, there is a natural bid for BTC loans between agencies. For example, Genesis's loan yield is about 30,000 BTC.

In summary, given that lenders can use BTC collateral to earn additional interest during the loan period, the return on BTC-backed cash loans may be significantly higher than traditional asset-based loans. This concept has been magnified because the average loan value of a BTC-based loan is typically between 50-80%, which makes the lending institution's allocation value in the BTC higher than the lending to the borrower.

Risk prediction

Traditional lenders may argue that there is a greater risk of using Bitcoin as a collateral than other assets. Bitcoin has volatility, bearer custody and overall risk, but if managed properly, it also has the risk of reducing the risk. Because bitcoin volatility is still large compared to traditional assets, lenders must be very proactive in monitoring LTV (prepayment rate) over time.

The attractiveness of Bitcoin as collateral depends to a large extent on the bank's ability to hold bitcoin, manage margin calls and compulsory liquidation. If bitcoin prices fall rapidly, lenders need to ensure that borrowers add more bitcoin collateral to support the loan, or if the price continues to fall, there is a systematic selling solution. Having said that, bitcoin is very mobile. People can sell millions of dollars in bitcoin on the exchange or OTC market at a relatively low cost in a matter of seconds. Bitcoin clearing is much more economical than comparing the cost of these forms with the cost of recovering other forms of collateral in traditional loans.

Take the inventory of a manufacturing company as an example. If the manufacturing company defaults, the lender will be protected by the cash value of the equipment collateral. To truly realize this value, lenders will have to work with another company that specializes in selling equipment or parts. The costs associated with the partnership and the depreciation charge for the sale of the equipment. Most importantly, the value of this device is far less transparent than the value of Bitcoin. Clearing Bitcoin collateral is a much simpler process, and it will ultimately be more economical if the lender has the necessary procedures and has several tried and proven hosting solutions to hold the collateral.

Summarize BTC- based loan opportunities

BTC-based loans are still in the early stages, and there are not many large institutional lending institutions actively involved. The demand for cash in the digital asset market is high and seems to be growing. Because of this imbalance, cash lending rates may remain at a fairly high level until there is more supply, and yield opportunities may be more attractive than credit opportunities in traditional markets. Lenders who choose to participate ultimately need to be familiar with Bitcoin's infrastructure to properly manage the volatility and escrow risks in this area.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- SpaceX also engages in IEO? Musk is forced

- How to develop a "no coin" public chain?

- QKL123 market analysis | Federal Reserve cut interest rates as scheduled, safe-haven assets fluctuate (1031)

- The German Banking Association published a paper calling for the establishment of a programmable digital euro

- Top 10 DeFi Big Chain Life

- Everything you want to know: details of the first disclosure of Bitcoin options on the Chicago Mercantile Exchange

- This man knows cryptocurrency better than Zuckerberg.