Looking back at the four bull markets that Bitcoin has experienced, the major lessons that are worth learning

The so-called "experts" on Wall Street are habitual creatures. Their behavior patterns are as predictable as tides.

When a market soars into a bubble zone, they will emerge from every corner and cheer for the “strong fundamental forces” that drive price increases.

When the bubbles inevitably rupture, they rush to predict the demise of the bubble. Moreover, when a new bull market is being formed, they will immediately release the final ceremony.

People's understanding of Bitcoin is still not very clear. The cryptocurrency is a criticized asset. Some people say that Bitcoin is the "mother of all bubbles", and some people say that cryptography has no future.

- Staking: The new wave of mining in the PoS era, value investment or the correct way to open

- Market Analysis: BTC is blocked at $11,200, and the risk of short-term retracement increases

- Early comments: BTC broke the million yuan shock adjustment, BCH led the show to lead the mainstream currency

Few "experts" will tell you that both market and market analysts are affected by cyclical patterns.

After experiencing a huge bull market, Bitcoin ended up with a crazy parabolic speculative climax, which we call "the climax." When the speculators retreat in panic, the currency market collapsed.

And it will last for a few months, forming a sideways trend or further decline, only the persistent believers can survive, and then it will start a new bull market, repeat this cycle, and end up with a launch orgasm.

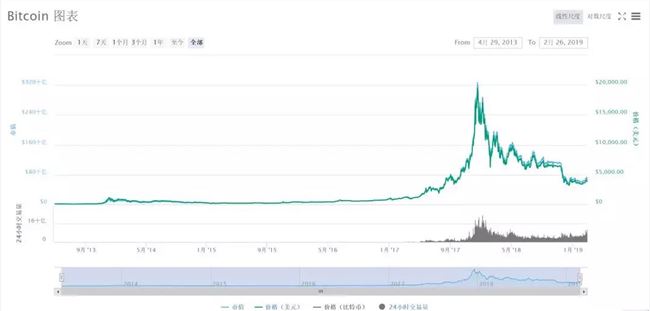

Just eight years ago, in September 2010, the price of Bitcoin was close to 6 cents. Today, the same assets are traded at a price of $10,000 per token, with a return rate of more than 160,000 times.

Looking back at the four bull markets that Bitcoin has experienced since its launch, it's not easy to go from 6 cents to $10,000. It's not a straight line. But this is the key to the problem: it happens in a cyclical pattern that is ultimately predictable. There are many experiences and lessons worth learning from!

First bull market cycle

September 2010 to June 2011

Bitcoin began this cycle with a strong but non-parabolic rise, rising from 6 cents to 80 cents in April 2011. Prior to this, the rise of Bitcoin was mainly driven by Bitcoin users and long-term investors who understood the technology and shared a vision with the founders.

Then, suddenly, ordinary investors began to swarm in. But this market is still small, and its liquidity is extremely low, unable to accommodate a large number of people.

As a result, the price of Bitcoin soared, and Bitcoin was soaring from 80 cents to a high of $36.

Followed by bitcoin plunged 93%. Just like today, the opponents have appeared again – talk about "a failed experiment" and talk about "the demise of bitcoin."

Second bull market cycle

October 2011 to April 2013

Like the previous bull market cycle, Bitcoin soared from a low of $2 to about $10, a five-fold increase.

It is a pleasure to buy and hold investors (nicknamed "HODLers") early in the previous cycle. However, those who bought at $35 during the crazy upswing in the previous cycle are still frustrated.

This enthusiasm will come back in early January. The king of passwords broke through $13 and began to accelerate again. In April 2013, a bubble high of $260 broke out.

Total growth from bottom to peak: about 13,000%. But again, the vast majority of this crazy rise has been squeezed into just two months, from February 2013 to April 2013.

This madness brought even greater anger to investors. In less than a week, Bitcoin prices fell back to $50 on April 15 and instantly plunged 80%.

Third bull market cycle

April 2013 to December 2013

As always, the rebound from the low of $50 in April was initially slow, reaching a level of $100 on October 1, 2013.

As before, this is a huge price explosion in the last two months: it reached $1,160 in December, a surge of 1160%.

Irrational prosperity not only affected ordinary investors, but also affected the media that praised encryption technology… Until the next bubble burst, Bitcoin ushered in the longest bull market at that time.

Bitcoin fell from a high of $1,160 in December 2013 to a low of $150 in January 2015, a drop of 87%.

The bear market is so long and so profound, bitcoin evangelist Andreas Antonopoulos said he is worried about the future of encryption technology.

But as before…

Even at the bottom, investors who bought at the beginning of the cycle have doubled their original investment.

In addition, this is the beginning of the biggest bull market in the history of Bitcoin…

Fourth bull market cycle

January 2015 to December 2017

It will take several years for Bitcoin to recover from the big bear market in 2014.

Then, the big move will start in 2017, because Bitcoin has risen sharply from about $1,000 in January to about $5,000 in October.

However, as in the previous three cycles, the public did not begin to devote themselves until the last two months of the bull market. Prices are skyrocketing. By December, Bitcoin soared to a high of nearly $20,000.

Of course, the crash will inevitably follow. Bitcoin fell to $5,800 on February 6, 2018, a drop of 70%, and fell to $3,600 a year later.

Many analysts who are unfamiliar with the previous bull market cycle believe that this seems to be a "new phenomenon." But as you can clearly see, it is by no means.

This is a feeling of deja vu.

文 | 内参君

Special statement: ICO projects in the blockchain industry are mixed, and the investment risk is extremely high; all kinds of digital currencies are difficult to distinguish, and users need to be cautiously invested. "Intra-chain participation" is only responsible for sharing information, does not constitute any investment advice, and all investment behaviors of users are not related to this site.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Xiao Lei: Bitcoin once again broke through 10,000 US dollars. Is it a scam or a revolution?

- New FATF regulations: All cryptocurrency exchanges around the world need to share customer data

- Babbitt’s column explains Libra through Alipay.

- Babbitt column 丨 Facebook's ambition

- The Libra effect continues, and the G7 Group in developed economies has established a cryptocurrency working group.

- Read Libra in a text: the difference between Q coins, Alipay and Bitcoin

- Millions of people in South Korea use “honeycomb accounts”, and the loss of funds is the biggest hidden danger