A bit of a bit of a bitcoin contract: Prosperous derivatives will pave the way for institutional investors

The entry of exchanges such as Bakkt will definitely bring the contract market to a new competitive landscape, and its variety and compliance will continue to improve. No matter who becomes the next "king of the futures exchange", the existence of bitcoin will be more and more accepted, and the bitcoin derivatives market will reach a new level of prosperity.

Bitcoin has been in existence for more than a decade. From the initial OTC trading, to on-floor trading, to a series of derivatives trading, it has gone through decades of financial development in a very short time. To a certain extent, Bitcoin is probably the most derivative asset that ordinary people can access, which is one of the most interesting phenomena in the financial market.

So what is a futures contract? Why do people use it? What is the difference between a futures contract and leverage? Who is the king of the next futures exchange? This article will answer these questions.

- The central bank issued the "FinTech Development Plan": Strengthening the development and application of distributed databases

- He donated $100,000 in bitcoin to the Amazon Rainforest but was dismissed by BitPay.

- Bitcoin volatility is too high, but I still continue to hold bitcoin

Friends who are interested in the Bitcoin derivatives market can view this article as an introductory article.

01

What is a futures contract?

The financial derivatives market is a derivative of financial markets, mainly including futures contracts or options. Derivative transactions in digital currencies (mainly Bitcoin) are mainly based on futures contracts.

A futures contract is a standardized forward "contract" that deals with the purchase and sale of something at a predetermined price at a specific time in the future. In the Bitcoin contract market, there are two main types of "term contracts" and "persistent contracts".

Perpetual contracts Compared to fixed-term contracts, the perpetual contract has no expiration date, never settles settlement and the price is almost the same as the spot price (the basis is 0).

Regular contracts generally use "week" or "quarter" as a cycle for settlement. The simplest pricing model for futures prices is: Bitcoin futures price = Bitcoin spot price* [1 + no risk rate (remaining delivery date / 365 days)]

Therefore, it can be found that the closer the contract is to the delivery date, the closer the price is to the spot price.

Bitcoin price for different delivery date at the same time

Since digital currency is difficult to make an accurate pricing, contracts that are farther away from the delivery date generally reflect market expectations in the form of spot and futures price differences. Spot prices are higher than futures contract prices, and investors are generally not optimistic about the market outlook. Spot prices are lower than futures contract prices, and investors are generally optimistic about the market outlook. Of course, the price difference is only a reflection of market sentiment. Whether it is really able to change the price of futures contracts is the rise or fall of spot prices.

Spot and futures price difference

The leverage multiple of a futures contract is generally determined by the exchange, usually 5, 10, 20, 100 or even 500 times. In the case of idealization, regardless of handling fees, etc., the net profit margin calculated in bitcoin standard: net profit margin = [(opening price – closing price) / closing price] * leverage multiple

Take the 20-fold leveraged bitcoin contract as an example, assuming a bitcoin price of $100. When the price of Bitcoin rose to $105.2637, the net profit was 1 bitcoin; when Bitcoin fell to $95.2381, the principal was lost. The opposite of empty positions is the opposite.

02

Target group: speculators, hedgers, alternative coin parties

Futures contract traders generally fall into two categories, one is speculators and the other is hedging.

In the traditional commodity market, futures contract traders are mostly hedgers. Hedging is mainly to carry out equal and opposite trading activities on the same type of goods in the spot market and the futures market to minimize risks.

Hedging and speculation are often only one line apart, such as Cathay Pacific (not only for futures contracts but also for options). Fuel accounts for the bulk of airline costs, so most airlines hedge their fuels to control fuel costs. Before 2015, Cathay earned revenue from the hedging and tasted the sweetness, thus increasing the position. Normal airlines have only 1 to 20% of fuel on the market, while Cathay Pacific has reached 60%. The big position and the wrong direction of the judgment resulted in a four-year loss of 24.2 billion yuan.

In the digital currency circle, there is another group of people who are the target of futures contracts, that is, the alternative coin party.

Normal coin holders use French currency to convert to digital currency, which means that only a steady stream of French currency can make the number of digital currencies more. However, for those who calculate on a digital currency basis, there is a benefit to futures contracts: when the price of a digital currency is rising or falling, more digital currencies can be obtained by going long or short.

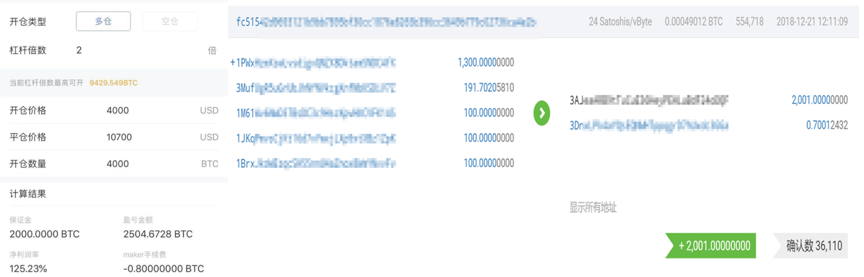

For example, a big industry in the industry bought 2,000 bitcoins in December 2018 and opened more with 2 times leverage. Today, bitcoin is worth $10,700 and earns at least 2,500 bitcoins. (Please note: it is 2 times leverage. If you open 20 times leverage like a retail investor, 2000 bitcoins have already exploded. Carbon chain value reminds readers to pay attention to controlling risk in the derivatives market.)

03

What is the difference between leverage and futures?

In the digital currency exchange, where a futures contract market is opened, a leveraged transaction is generally opened. What is the difference between the two, and what are the similarities?

The biggest difference between the two is that the market is different. Leveraged trading exists in the spot market, while futures contracts are an independent market built by the exchange, so the futures contract market of different exchanges may have a large difference in short-term market (such as pin).

Second, leveraged trading is a multiple of the enlarged principal, while futures contracts are subject to price fluctuations. At the same time, there are differences in transaction costs between the two. Leveraged transactions generally charge interest on a daily basis, while leveraged transactions are generally charged only at the time of sale (or delivery).

In digital currency trading, since futures contract transactions are independent markets, market makers are often required to provide liquidity. Therefore, the type of leveraged trade will be greater than the type of futures contract.

From the perspective of speculation, the similarities between the two are the use of small funds for excessive speculation, expanding the risk while expanding the benefits.

There is no absolute difference between the two methods. At some point, the two can be combined. Choosing the best way for you, the highest odds is the best investment tool.

04 The next king of the futures exchange

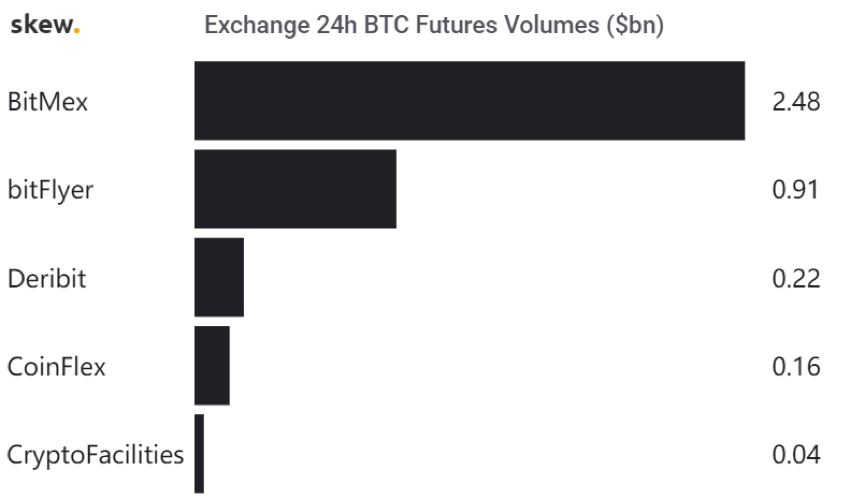

As far as Bitcoin futures contracts are concerned, BitMEX is currently the well-deserved leader. Bitcoin futures contracts on BitMEX account for more than 60% of global Bitcoin futures contracts. The tree is big, and this is one of the reasons why BitMEX has recently been targeted by US regulators.

But can BitMEX always dominate the boss? At the moment, it is difficult.

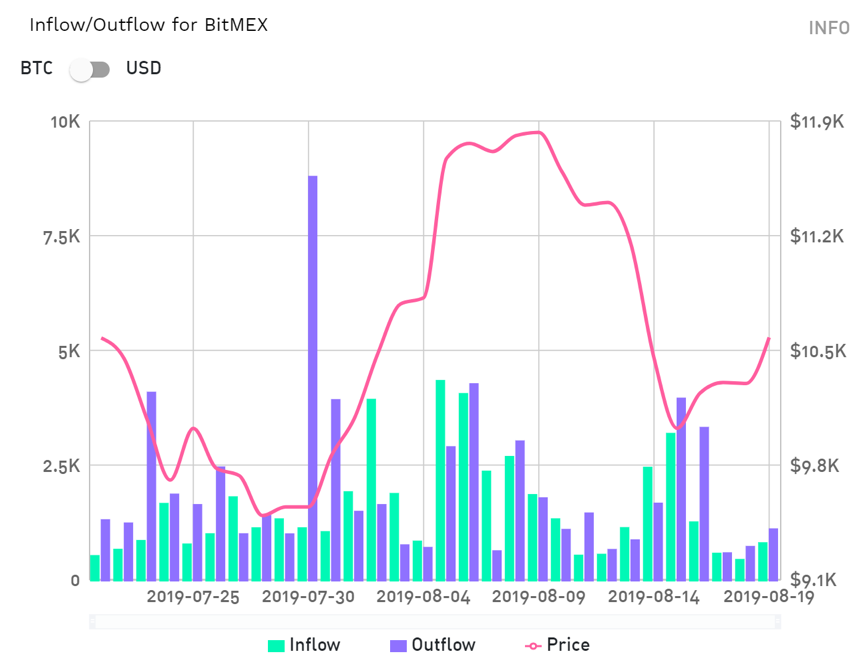

On July 19, Bloomberg reported that the US Commodity Futures Trading Commission (CFTC) is investigating BitMEX. BitMEX netted $73 million in bitcoin on the day when there was no significant abnormality in bitcoin inflows and outflows on other exchanges. And until now, it is in the state of daily average net outflow (as shown in the figure, the purple column is longer than the green column).

Coincidentally, Bakkt, the parent company of the NYSE's parent company, conducted a futures acceptance test on July 22. At the same time, CFTC lit up the green light for Bakkt, and the New York Financial Services Authority (NYCFS) also approved the "managed" photo. This means that Bakkt's Bitcoin futures contract business is ready to go. Vaguely revealing a regulatory layer to suppress the breath of BitMEX to help Bakkt open the way.

Bakkt's transactions consist of ICE Futures US, ICE Clear US and Bakkt. Bakkt is currently the most powerful opponent for BitMEX to predict, as both use bitcoin for physical settlement.

At the same time as Bakkt entered, institutional investors also showed unprecedented interest in cryptocurrencies (especially bitcoin). However, Bitcoin's volatility is too large, and a derivatives market that provides a robust hedging tool boom will be a prerequisite for some institutional investors to enter. The appearance of Bakkt just paved the way for their entry.

In addition to Bakkt, LedgerX, SeedX and other exchanges have also been approved by the CFTC to become a company capable of trading digital currency derivatives. At the same time, the Firecoin Exchange launched its own contract business in 2018, and users grew rapidly; the world's largest cryptocurrency exchange, the currency exchange, will also launch its own bitcoin contract business. Because these exchanges have a huge pool of user traffic, their entry into the contract business will also have an impact on BitMEX.

The entry of exchanges such as Bakkt will definitely bring the contract market to a new competitive landscape, and its variety and compliance will continue to improve. No matter who becomes the next "king of the futures exchange", the existence of bitcoin will be more and more accepted, and the bitcoin derivatives market will reach a new level of prosperity.

Author: hydrogen 3

Source: Carbon chain value

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin for $0.32, they dreamed back to 2009 today

- Why do Morgan, Facebook, Wal-Mart and other giants tend to use the alliance chain to release stable coins instead of public chains?

- Introduction | Market Development Model and Ethereum 2.0 Development Process

- Accounted for up to 64%, this report says cryptocurrency transactions are concentrated on low-quality platforms

- I sold the mining machine and I went to the shoes.

- Is there an internal contradiction in the Libra Association? Foreign media: At least 3 members are considering launching

- The central bank released the 2018 annual report: four times mentioned the digital currency, saying that "the stage has progressed" (PDF full text)