U.S. traditional institutions improve Bitcoin financial infrastructure, good news in Q1 2020

Author: Yang Zhou (PayPal Financial founder and CEO, US Treasury trading expert, has worked for PricewaterhouseCoopers Hong Kong Financial Services)

Editor's Note: The original title was "Traditional American Institutions Are Perfecting Bitcoin Financial Infrastructure, Waiting for the Spring of Bitcoin"

Traditional U.S. institutions are still pushing for the further improvement of the Bitcoin financial infrastructure. Traditional cryptocurrency investment institutions, individuals, and speculators have maintained steady growth in funding requirements. The bitcoin market in the first quarter of 2020 may have good news.

The bitcoin market in 2019 is full of "black swan" events.

- Inventory: 4 important moments to change the trend of the crypto market in 2019

- Babbitt enters cross-border finance, joins banks to launch China's first blockchain re-export trade product

- Japan's KOL Bitcoin: Mad study, keep chasing, and strive to build a trusting society | 8 问 文 版

Facebook's launch of the Libra project is one, and high-level Chinese government proposals to promote the development of blockchain technology are another. After the two "Black Swan" incidents, the price of Bitcoin was quickly pushed up to more than 10,000 US dollars, which excited the market for a while.

However, with the progress of Libra blocked and the recent negative repression of virtual currencies in the domestic Chinese media, the positive effects of the "Black Swan" incident began to fade away quickly, and the price of Bitcoin seems to have returned to fundamentals. Future time .

Overall, the current bitcoin market is in a stage of lack of enthusiasm. Miners seem to be in a hesitant state and are not ready to make a determination to re-inject new miners, while traditional funds that have been highly expected have not yet been large-scale. When entering the market, only investors and speculators dance alone with the fluctuations in prices.

After April of this year, miners benefited from the rise in the price of bitcoin and enjoyed the dividends brought by the super cheap electricity in the flood season, and spent a happy time. From PayPal Finance's own business observations, after April, the borrower's borrowing demand for miners has declined significantly, indicating that the miners' earnings are very considerable and the lending motivation has disappeared.

With the increase of computing power, we originally expected that the mining union will gradually phase out old machines and purchase new machines in the second half of the year, which will bring a lot of capital requirements. However, the plunge in prices in mid-September suddenly stopped miners. Although bitcoin prices skyrocketed shortly afterwards under the influence of Chinese policies, it left miners in awe.

As a result, we saw that a large number of S9 machines were transformed, and after reducing power consumption, they continued to invest in mining operations, and their cost performance was similar to that of new machines. Even if some miners had previously paid a deposit for purchasing futures miners, they did not seem to be in a rush to place an order to put the miners into production, and due to the drop in the price of bitcoin, miners began to negotiate prices with the miner manufacturers again.

At the same time, although some new miners have entered the market this year, although they are in urgent need of funds, because they have not received enough bitcoin, it is difficult to obtain loan support.

Under such circumstances, investment and speculative demand have become the main driving force for the growth of lending platforms.

The demand for funds from traditional cryptocurrency investment institutions, individuals, and speculators has continued to grow steadily, because most of them have the concept of holding bitcoin, so they would rather obtain funds by pledged bitcoins before investing or trading, Not willing to sell bitcoins easily.

The inter-agency fund lending market is one of the few surprising developments. Although compared to the traditional financial inter-agency market, the cryptocurrency inter-agency fund lending market (let's call it CIBOR) is still very small, but with the increase in the number of lending platforms, the demand for funds between peers has become more urgent. As for who the ultimate borrowers of these institutions are, it is not yet possible to identify, so I think it will take time to confirm the size of the future potential of this market.

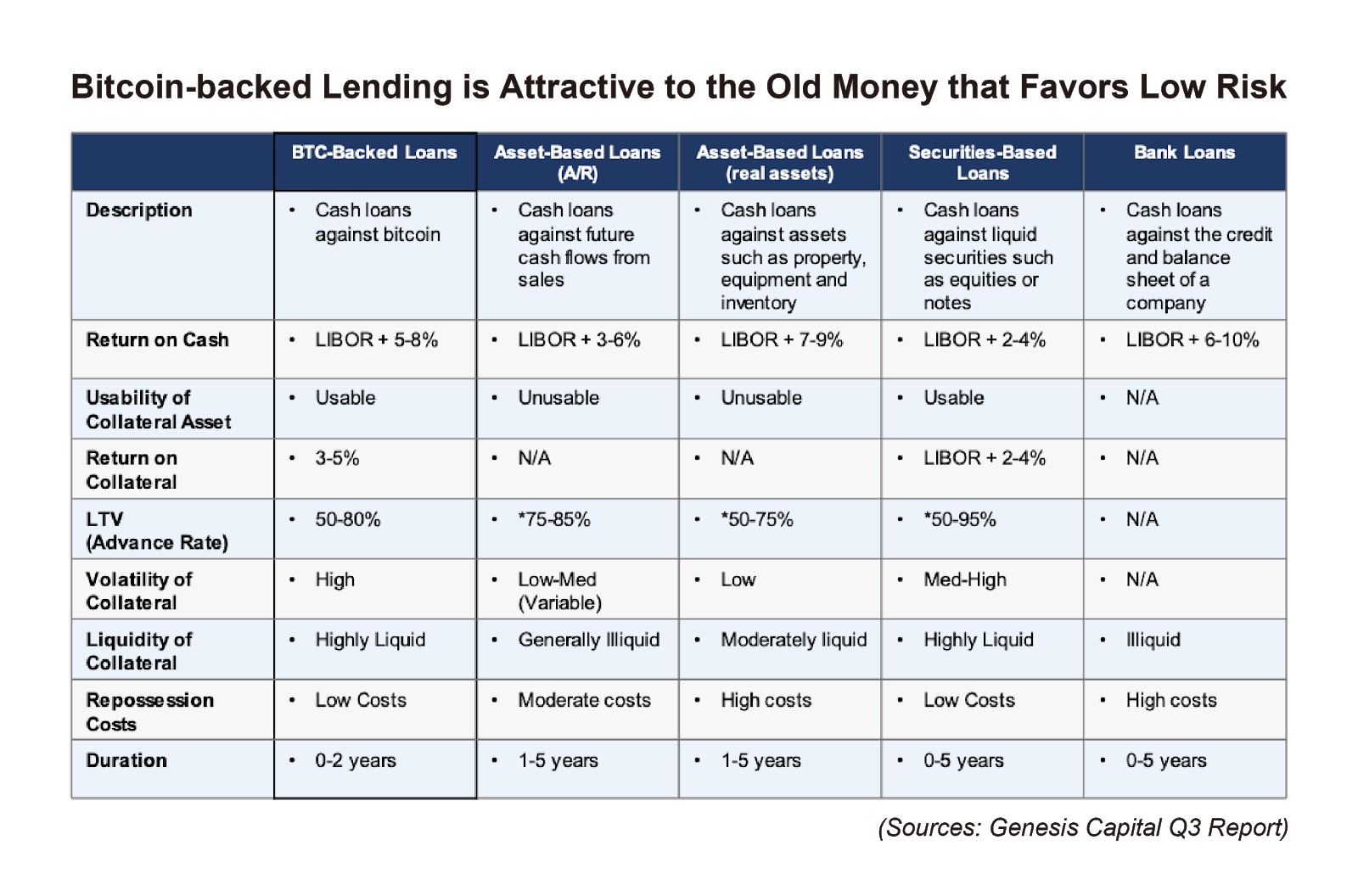

The attractiveness of Bitcoin pledged borrowing to traditional financial low-risk appetite funds

Source: Genesisi Capital Third Quarter Report

As Christmas approaches, a Chinese buzzword is applied, and there is not much time left for Bitcoin this year. Will the market make a sudden turn? It is not impossible.

Chinese mining machine manufacturer Jianan Technology successfully landed on the NASDAQ in the United States, consolidating investors' confidence and optimism in Bitcoin in the Chinese market.

In addition, after the opening of BAKKT, despite the disappointing trading volume, with the two new product derivative contracts-options based on Bakkt Bitcoin monthly futures (commodity code BTM) and Bitcoin monthly cash delivery futures (commodity code (BMC)-launched, and its option products are about to go online, we can see that traditional US institutions are still advancing the further improvement of the Bitcoin financial infrastructure.

These developments may indicate that a potential rise is brewing. Therefore, I expect that there will be good news in the bitcoin market by the first quarter of next year.

After all, winter is here, can spring be far behind?

This article first appeared on the Bitcoin Magazine website and was originally titled " Waiting for Bitcoin Spring and the Next Bull Market ".

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Pioneering exploration of fiat currencies in European countries

- Research Report | Survey on Blockchain Application of Charity

- How to value DCG with three core businesses: Grayscale, Genesis and CoinDesk?

- Legal analysis of smart contracts: What is the difference between smart contracts and traditional contracts?

- US SEC proposal proposes to expand the scope of "qualified investors"

- Inventory: Who will predict the price of Bitcoin in 2019?

- Global Blockchain Financing Track Top 20: 1,543 venture capital investments with a total funding of more than 79.2 billion yuan