BlackRock’s Bitcoin ETF Key Dates and Timeline for Listing

BlackRock's Bitcoin ETF Timeline for ListingAuthor: huf, Pear Protocol co-founder; Translator: Blockingxiaozou

In this article, we will learn about the key dates and timetable for BlackRock’s Bitcoin spot ETF and what we need to prepare for in the coming weeks…

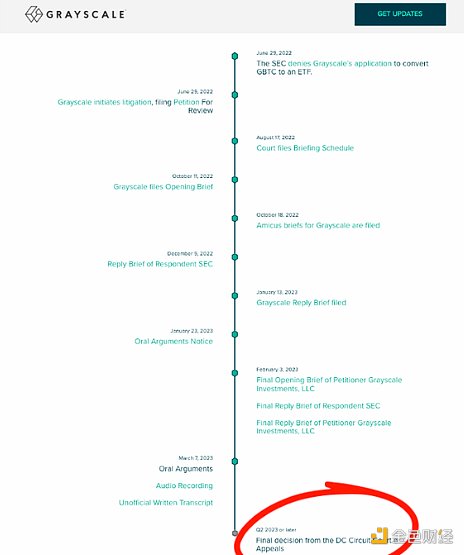

Quick review: Last year, Grayscale filed a lawsuit against the SEC, which banned it from converting GBTC into a spot ETF. The court’s ruling will be announced at some point in the coming weeks or months (time is running out). If the lawsuit is successful, the ruling will pave the way for a potential spot ETF. BlackRock’s application for listing at this time is not a coincidence.

- Can you make money by running a node? How to choose a public chain? We talked to a node operator.

- Victory belongs to the long-termists: June 2023 Secondary Market Trading Strategy

- Will the growth of the NFT market in 2023 come from new capital entering or from old capital circulating?

Looking at this timetable, you might think that there is not much action before August 12, 2023. But that’s not the case!

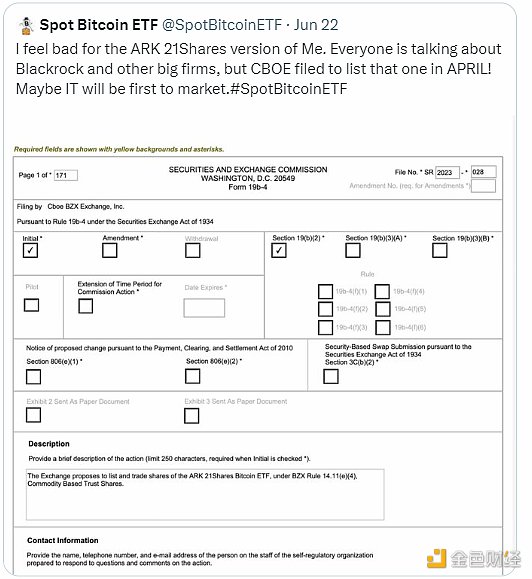

Notice that ARK/21 shares also submitted an application for a spot Bitcoin ETF in April 2023. There may be a result on June 29 (Thursday), which is likely to be rejected.

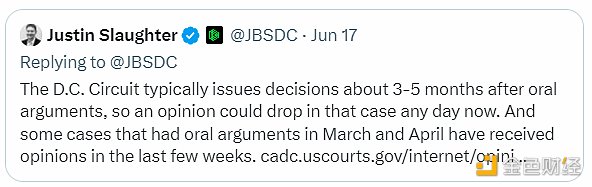

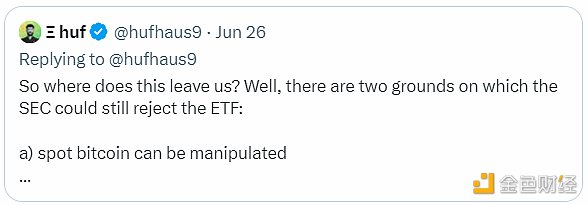

Also, any day after June 26, we may hear the court’s ruling, either in favor of or against Grayscale. If they succeed, the likelihood of BlackRock’s application being approved will soar, as Grayscale’s argument is, “Brother, how can you approve a futures-based ETF?”

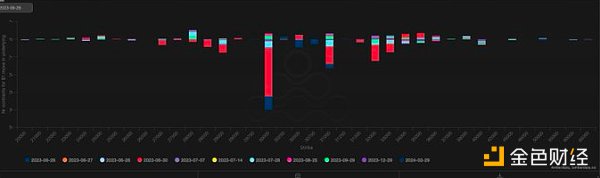

Let’s take a look at the trading situation on several specific dates.

June 26-30:

There are a lot of options OI (option investments) in the Bitcoin market that will expire this Friday.

Position: Buy between 284,000 and 292,000 U.S. dollars due to long liquidation and/or the rejection of the ARK/21 shares ETF.

July 1 to August 11:

The SEC still has reasons to refuse, but experts say Grayscale has an 80% chance of winning the lawsuit, in which case Bitcoin prices may be higher.

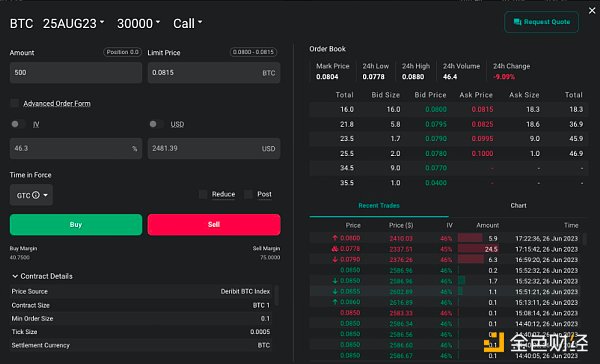

Position: Long BTC/short ETH, long BTC/short MATIC, long 25August23, $30,000, IV less than 50%.

August:

The most likely outcome is that SEC will delay the listing, especially considering the pending legal case against Coinbase.

Position: Adjust bullish options, pair trading TP (before August 12). Avoid leverage. Prepare for shorting.

At this stage, a rejection/delayed result will bring short-term bearishness, which also proves my point that the ETF news is to divert attention from the LT plan:

(1) COIN must be regulated.

(2) We do not want to see Tether earning $6 billion in interest from the US government.

(3) Crack down on Binance.

(4) KYC’s USDC system.

This is one of the rare opportunities the market really cares about.

If the spot ETF is approved: BTC will exceed $100,000.

If the spot ETF is delayed: BTC will fall.

If the spot ETF is rejected: BTC will fall, altcoins will fade, regulation will take shape, and crypto M&A.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Conversation with three senior KOLs: Bitcoin’s four-year halving cycle, the new narrative of the next bull market, and Ethereum’s “dominant” position

- First leveraged Bitcoin ETF in the US quietly opens, with a first-day trading volume of nearly $5.5 million.

- Will Bitcoin’s ecosystem be the focus of the next bull market? 5 major logics support its rapid rise.

- What are the considerations behind the “coveted” grayscale Bitcoin spot ETF?

- How will Wall Street’s entry into the market during the regulatory “bear” bottom affect the industry?

- Wu’s Weekly Mining News 0619-0625

- What are the considerations behind the Bitcoin spot ETF of “coveted” Belmont?