Unveiling the Rise of Lido: How it Consolidates its Leading Position in the Ethereum Staking Market

Lido's Dominance in Ethereum Staking RevealedLido Protocol Sees Data Surge in May

With solid fundamentals, a strong ecosystem, and a reliable community, Lido Finance, the largest liquidity staking protocol, has become a successful example of the DeFi ecosystem.

Lido’s revenue comes from charging users a 10% staking reward as a fee, which is distributed to Lido DAO, node operators, and an insurance fund. After the launch of Lido V2, as users were able to flexibly swap stETH for ETH, its staking data continued to rise, and its revenue in May surged by 22%, the fastest-growing DeFi protocol.

In terms of TVL data, Lido has become the largest DeFi protocol with assets worth $12.7 billion, more than twice the TVL of the second-place Makerdao.

- What are the differences between Timeswap, a no-clearing lending agreement based on AMM, and typical lending markets?

- What will “ZKP + Bitcoin” bring? – Bing Ventures

- What will “ZKP+Bitcoin” bring?

Since the beginning of this year, Lido’s TVL has been on the rise and has benefited from the implementation of the Ethereum upgrade. Since the launch of Lido V2, its TVL has increased by 15%.

As most of the liquidity on Lido is composed of ETH, the increase in TVL indicates that stakers have locked more tokens back into the protocol. As shown in the chart above, the stable increase in active users on Lido protocol last month also confirms this.

Looking at Lido’s APR for LSD and the ratio of the protocol’s native token market cap to TVL, its data is relatively strong compared to other competitors, making it a secure and steady type of yield, which is also an important reason for its stable position.

Lido’s Main Competitive Advantages

Lido mainly benefits from its: 1) LSD’s natural advantages; 2) long-term stable operation to obtain continuous advantages.

First of all, stETH has a natural advantage, and its holders benefit from the token’s deep liquidity, making it one of the preferred liquidity collateral options for core users. The widespread integration of collateral in DeFi has increased the use cases for the token. stETH can be used throughout the DeFi ecosystem, providing liquidity for exchange pools on Lido or other platforms, and can also be borrowed on certain platforms. For mature capital seeking the best investment attribute combination, it is obviously more attractive than ordinary LSD, further enhancing Lido’s competitive advantage in staking derivatives.

Lido has been operating smoothly for many years, and the gap between it and its closest competitors (Rocker Pool, Frax) will widen over time, while squeezing out profits and crowding out the market space of other competitors, making more and more stakers choose Lido.

Lido’s Decentralization Commitment

First of all, Lido is actively using a DAO governance structure for operation. Lido supporters can use LDO tokens to vote on proposed updates to the platform and participate in resolutions for the overall direction of the organization.

Secondly, the launch of Lido V2 also marks a further step forward on its decentralized path. In the staking route of V2, anyone can develop an entry for new node operators, from independent validators to DAO organizations to distributed validator technology (DVT) clusters, to create a more diverse validator ecosystem together.

Moreover, the Ethereum staking protocol upgrade of Lido supports a buffer pool, allowing stETH holders to quickly exit staking from Lido, achieving a key milestone in the truly “allow staking” + “exit staking” Ethereum staking ecosystem.

In addition, Lido is recruiting more Lido node operators to increase its underlying diversity. At the same time, the execution layer client diversity of Lido has also been improving in the past two quarters. Lido has been insisting on the diversity of operators and validators to reduce the risk of downtime or censorship while maintaining network performance and neutrality.

Lido’s Dual Governance Mechanism Proposal

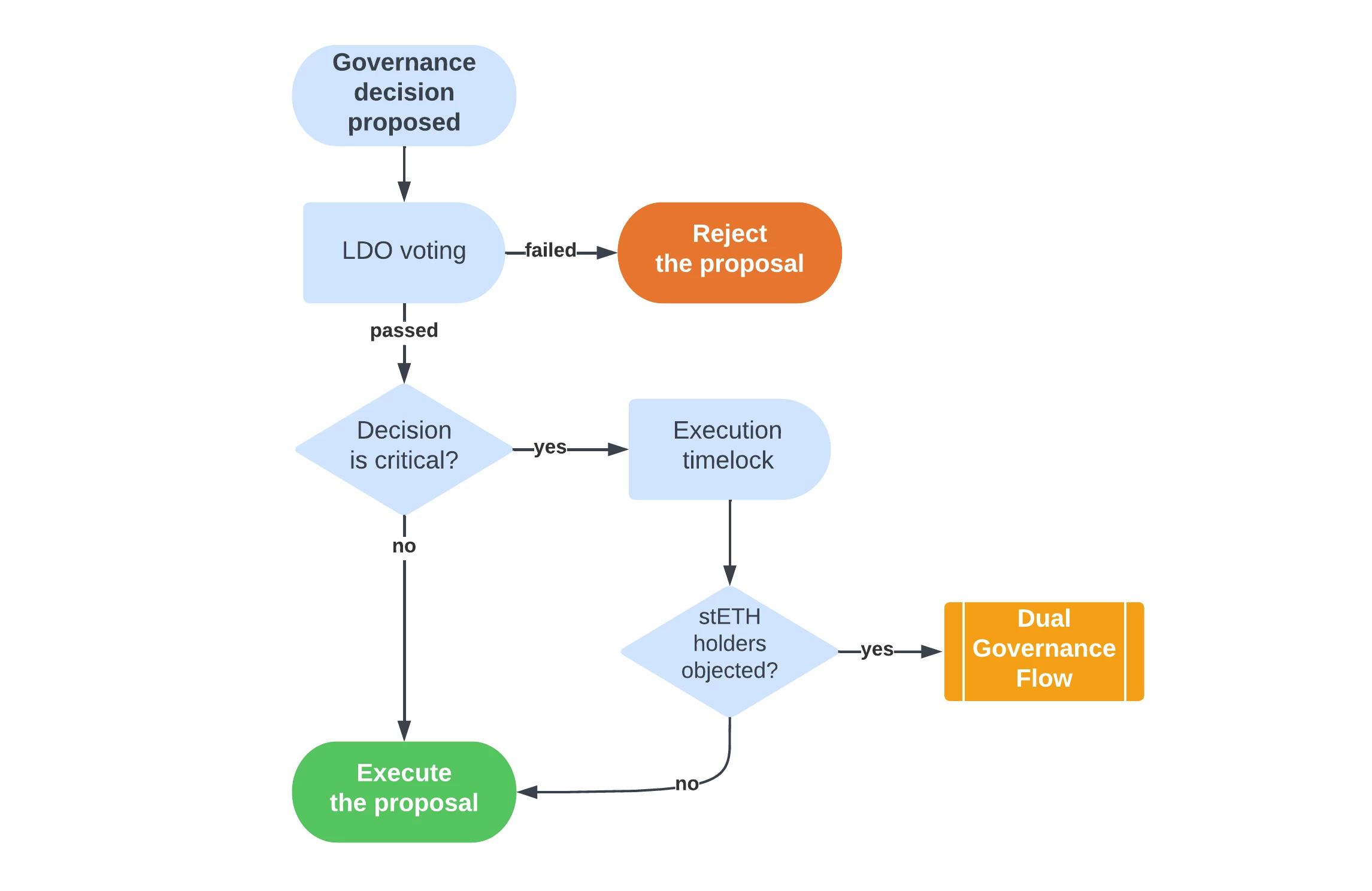

While insisting on decentralization, Lido is also trying to reduce the risk of its own system. The LDO+stETH dual governance proposal is a self-improvement attempt. The Lido ecosystem is currently governed by its protocol token LDO, which gives users the right to vote on activities, upgrades, and changes on the platform. stETH, on the other hand, maintains a 1:1 redemption ratio with ETH and represents the amount of ETH staked by users.

Considering the huge amount of staked ETH controlled by the protocol, Lido’s core developers believe that they must change the governance model of the Lido DAO and propose a “LDO+stETH” dual governance proposal to resist moral hazard (Lido’s staked ETH has now reached 7.19 million ETH, which is 1 million ETH higher than when the proposal was made). The proposal aims to address the delegate proxy problem that currently exists in the governance state, where LDO holders (agents) may act in their own interests and ignore the interests of stETH holders (principals).

Pledgers are actually more concerned about the interests of the Ethereum network, and the interests of LDO holders are not completely aligned with it. In the worst case, LDO holders could theoretically act maliciously, steal ETH pledged in smart contracts, and abuse their control over the liquidity pledge code. This is because Lido DAO has the ability to upgrade the stETH contract, allowing it to destroy stETH from any address and mint it to another address. This means that although the DAO does not directly control the ETH supporting stETH, it can steal funds from users by modifying the code, destroy their stETH, and mint it elsewhere.

The goal of proposing a dual governance plan is to better adjust the incentive mechanism of both parties and eliminate such incidents. Under this plan, LDO holders can still propose protocol changes, but stETH holders also have a veto power and the right to reject proposals deemed “critical governance decisions.” This is crucial for protecting the interests of pledgers and preventing governance from being controlled or the protocol from being unbalanced.

Although the proposal has not yet been implemented, as the number of stETH continues to rise, the dual governance proposal will be put on the table for discussion again.

Lido Benefits from SEC Regulation of CEX Pledges

Last week, the U.S. Securities and Exchange Commission sued Binance and Coinbase. The scope of the charges against these two exchanges is different, but there is a common theme- the SEC is investigating the pledge services provided by these two CEXs to their U.S. users. Although the SEC’s complaint is not specifically aimed at Ethereum pledge solutions, the agency has hinted that they are willing to investigate Ethereum pledges.

In February of this year, as part of a settlement agreement with the SEC, Kraken was forced to terminate its Ethereum pledge service for U.S. users. SEC Chairman Gensler claimed that “everyone in this market should be aware of this.” And the SEC’s investigation of centralized exchange pledges will further benefit Lido’s larger share of the ETH pledge market.

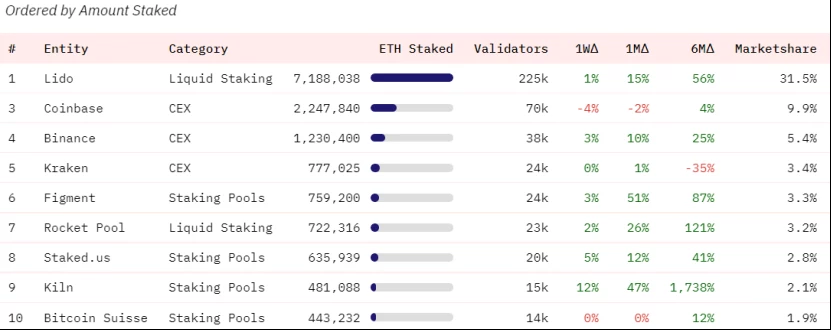

Although withdrawals are allowed after the Shanghai upgrade, Lido still maintains its dominant position in Ethereum pledges. Deposits this month have increased by more than 900,000 ETH (15%). Lido’s market share increased from 31.4% to 31.5% – which proves that the protocol has turned past success into continued dominance in the future.

The Risks of Over-Growth in Lido Staking

After overwhelmingly voting against self-imposed deposit restrictions in June 2022, the Lido governance organization chose to continue ignoring the threat posed by its constantly rising staking ratio. While it may appear that self-imposed deposit restrictions indeed go against the best interests of LDO token holders and harm Lido’s profitability, the risks to the entire staking system of not imposing self-restraint are also very real.

Recently, more and more Ethereum holders have begun to oppose Lido, with some suggesting that if Lido refuses to self-restrain, the community should forcibly correct its behavior. While this suggestion is worrying, it is unlikely that we will see this type of control implemented at the base layer, as it involves a hard fork and could potentially disrupt Ethereum’s fragile social consensus layer.

Ethereum developer Danny Ryan and others have warned of the danger of “cartelization” of staking, pointing out that Lido can extract high profits compared to non-staking pool capital. A report by Ethereum supporters Bankless suggests that the Lido community should be concerned about the over-growth of its staking share (staking centralization), which could curb the prospects for future demand for Ethereum block space.

Currently, the platform’s staked amount is approaching the first threshold, about 33.3% of ETH staked. In theory, reaching this threshold makes Ethereum more vulnerable to manipulation by attackers. This would degrade the core properties of Ethereum’s value proposition, providing potential attackers with greater power over the chain. If Lido continues to grow at an uncontrolled rate, it will inevitably surpass these thresholds and pose systemic risks to the ecosystem. Therefore, the continued rise in staking share is a double-edged sword for Lido, which still has a long way to go in terms of decentralization and systemic risk improvement.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Revisiting the narrative of actual returns: How has the token performed? Is it outperforming the market?

- How can AI open up incremental markets for NFTs?

- Is Tesla losing favor? Ark Invest shifts focus to cryptocurrency market, betting on Coinbase and Robinhood

- Exploring Do Kwon’s “New Home”: Overcrowded Balkanspaz Prison

- Volatility Shares will launch the first leveraged bitcoin futures ETF next Tuesday.

- Will the rebound of Bitcoin prompt large institutions to take action, and will the regulatory framework for cryptocurrency assets become a political achievement of the election?

- Weekly Selection | Multiple institutions apply for Bitcoin spot ETF; Wall Street-backed exchange EDX Markets to launch; Bitcoin rebounds to $30,000, did the old money enter the market?