What are the considerations behind the “coveted” grayscale Bitcoin spot ETF?

What are the reasons for the grayscale Bitcoin spot ETF in grayscale?Author: huf, Co-founder of Pear Protocol; Translation: Frank, Foresight News

People don’t really know what BlackRock is or what they do.

First, let’s briefly introduce BlackRock’s founder and CEO, Larry Fink, because it will become important later.

- How will Wall Street’s entry into the market during the regulatory “bear” bottom affect the industry?

- Wu’s Weekly Mining News 0619-0625

- What are the considerations behind the Bitcoin spot ETF of “coveted” Belmont?

Larry Fink joined Wall Street in 1976, and he was smart and made money. He pioneered the concept of securitization (packaging different loans into bonds). Then, he was in charge of the trading department that managed these mortgage-backed securities (MBS), yes, those bonds that caused the global financial crisis in 2008.

Larry Fink then made a mistake, losing over $90 million due to a wrong bet on interest rates, which made him realize that risk management and customer trust are important.

So the ambitious Larry Fink decided to start his own company, focusing on these two principles, that is, “trust me, brother.”

To start his business, he found a colleague from Blackstone Group and obtained a credit line of $5 million. Thus, Blackstone Financial Management was born, and after 20 years of numerous mergers and acquisitions, it became BlackRock, which now has about $9 trillion in asset management, making it the world’s largest asset management company.

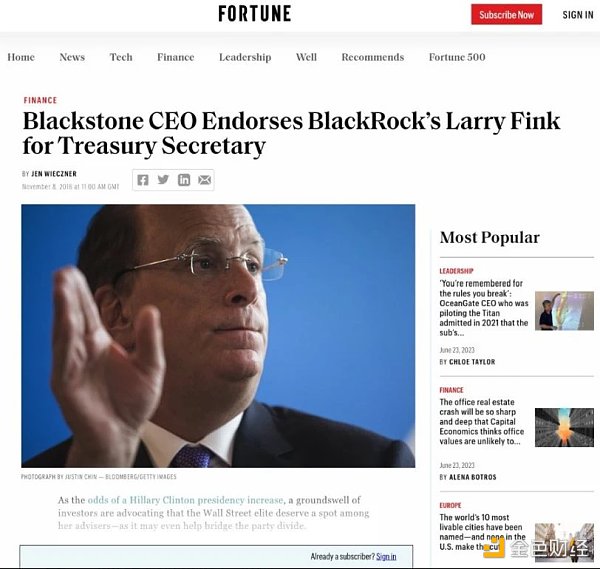

But for Larry Fink, just building a great company is not enough. In 2016, he was widely regarded as the prospective US Treasury Secretary after Hillary Clinton was elected as the US President.

He has strong political connections and background, and is a outspoken Democrat who is often heard saying “as I told Washington…”.

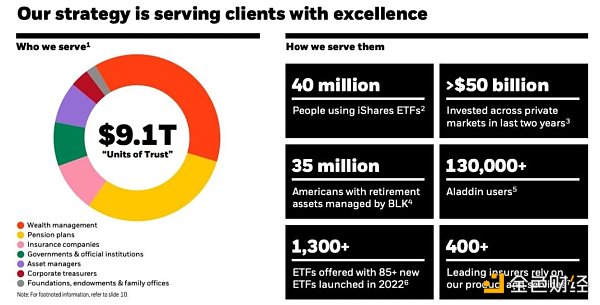

Now, let’s shift our focus back to BlackRock, this large asset management company that some people believe will “own all your bitcoins.”

However, BlackRock does not actually own anything; their clients are the real owners. BlackRock only manages these assets and does not have custody functions; it is not a bank.

Don’t believe me? You can check the first page of their annual report: “We are a fiduciary to our clients. The money we manage belongs to our clients.”

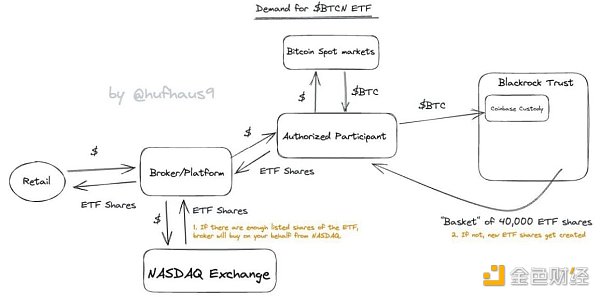

So how does BlackRock operate? It’s simple. Suppose you want to invest in US stocks. Instead of buying all the stocks yourself, and frequently rebalancing or paying taxes on each trade, it’s better to buy a BlackRock ETF or active management fund, and let them do these things for you.

You will receive a receipt to confirm your ownership of the ETF or actively managed fund (calculated as a percentage of your holdings), and then the ETF or fund will track the value and performance of these underlying assets. BlackRock cannot do much with these assets, and can only use custodian banks to hold them (repurchase only under ISDA/CSA).

Similarly, BlackRock has no power over the spot Bitcoin held in the Coinbase custody account, because Bitcoin does not belong to them at all. They only provide you with a more cost-effective buying service.

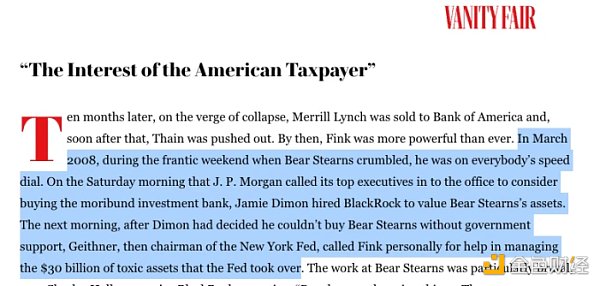

However, the real interesting thing is BlackRock’s relationship with the US government and the Federal Reserve. Do you know who ultimately managed the toxic assets taken over by the Federal Reserve from Bear Stearns in 2008?

Yes, it was BlackRock.

In addition, when Powell and the Federal Reserve wanted to start buying some corporate bonds in 2020 to help support the economy, guess who they turned to?

Yes, BlackRock again.

That’s the interesting part. Guess who the Federal Deposit Insurance Corporation (FDIC) chose earlier this year to be responsible for clearing the investment portfolios of Signature Bank and Silicon Valley Bank?

Yes, it’s still BlackRock.

As Bloomberg senior ETF analyst Eric Balchunas pointed out, BlackRock’s application for a Bitcoin spot ETF is indeed a big deal, but what is BlackRock’s overall view of digital assets?

We can find the answer on page 19 of their annual report.

BlackRock has identified some things that interest them, especially the tokenization of real-world assets (RWA), including stocks and bonds.

Remember, Larry Fink once made a big bet on debt securitization and made a big profit. That is to say, he fully understands the power of financial innovation (especially packaging assets) and its potential for new products, capital efficiency, cost advantage, etc.

But this is not BlackRock’s only focus in the crypto field. They have also put their money where their mouth is, investing $400 million in stablecoin USDC along with Fidelity and several other companies into the issuer Circle.

Circle co-founder and CEO Jeremy Allaire likes them too, as Circle uses BlackRock to help manage some of its reserve assets (although at a high cost).

What’s super interesting to me is that BlackRock chose Coinbase as the custodian of its Bitcoin spot ETF – that is, it chose a company that is being watched closely by the U.S. Securities and Exchange Commission (SEC).

It could have chosen the New York Mellon Bank, the oldest and most trusted bank in the United States, as a safe choice, as this news was big news at the time.

But then again, is this really a surprise? After all, BlackRock has already been involved in some of Coinbase’s business, such as Coinbase’s partnership with Aladdin, an integrated platform that meets BlackRock’s own and institutional clients’ needs for efficient operations and investment management.

You can quote me on this: “Aladdin to BlackRock is like AWS to Amazon.”

So what impact will this have on us? Well, the US Securities and Exchange Commission (SEC) can still reject ETFs based on two reasons:

-

Spot bitcoin can be manipulated;

-

Currently, there are no “sufficiently large” spot exchanges based on regulatory sharing agreements with Nasdaq;

Obviously, there are some parts that may change here. BlackRock doesn’t want spot bitcoin to be dominated by Binance, Zhao Changpeng, or have a holder of strong US bonds and bitcoin like Tether.

And the weak part of the entire trading chain of USDT is precisely the exchanges that use it for trading.

That’s why there’s a systemic global attack trying to shut down Binance, and why the US strongly favors a KYC-based USDC stablecoin system – BlackRock is surely angry that Tether makes more money than it does.

So after careful consideration, a Bitcoin spot ETF is a compromise solution – BlackRock aims to be the beneficiary of the traffic and fees generated in Bitcoin exchanges.

While the first application may be rejected, ETF approvals may be constantly delayed, one thing is certain, BlackRock is already licking its chops.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Unveiling the Rise of Lido: How it Consolidates its Leading Position in the Ethereum Staking Market

- What are the differences between Timeswap, a no-clearing lending agreement based on AMM, and typical lending markets?

- What will “ZKP + Bitcoin” bring? – Bing Ventures

- What will “ZKP+Bitcoin” bring?

- Revisiting the narrative of actual returns: How has the token performed? Is it outperforming the market?

- How can AI open up incremental markets for NFTs?

- Is Tesla losing favor? Ark Invest shifts focus to cryptocurrency market, betting on Coinbase and Robinhood