Will the growth of the NFT market in 2023 come from new capital entering or from old capital circulating?

Will the NFT market growth in 2023 come from new capital or old capital circulation?Author: Helena L., Huang Z., Eocene Research

We studied the transaction volume and investment proportion of new and old entity addresses in the entire NFT market in 2023 through on-chain data analysis and address clustering algorithms, as well as the sources of transaction and capital increments, in order to reveal whether the activity and new momentum of the NFT market mainly come from old players or new entrants outside the field.

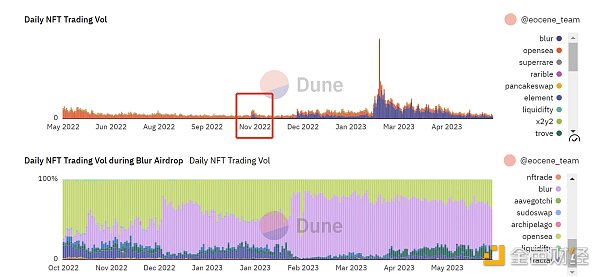

Since the end of June 2022, the NFT market has entered a bear market, but after Blur launched the Airdrop incentive mechanism at the end of 2022, the transaction volume of the NFT market has improved (Figure 1). During Blur’s airdrop activity, its contribution to the entire NFT market transaction volume continued to increase (Figure 1).

- Conversation with three senior KOLs: Bitcoin’s four-year halving cycle, the new narrative of the next bull market, and Ethereum’s “dominant” position

- First leveraged Bitcoin ETF in the US quietly opens, with a first-day trading volume of nearly $5.5 million.

- Will Bitcoin’s ecosystem be the focus of the next bull market? 5 major logics support its rapid rise.

Figure 1 NFT daily trading volume

The reward mechanism of Blur’s airdrop and the successful issuance of tokens are undoubtedly the biggest factors behind the explosive growth of NFT transaction volume in 2023. But behind the explosive growth of transaction volume, what is the real situation of the entire NFT market? In other words, whether there is actual incremental on-chain capital in the NFT market and whether new capital flows into the market, or whether it is mainly the internal circulation of old capital?

We 1) explored the sources of incremental transaction volume and capital in the entire NFT market in the second quarter relative to the first quarter; 2) compared the transaction volume and investment proportion of different entity addresses in the entire NFT market during Blur’s first and second quarter airdrop activities.

Research Process

1. Obtain trading volume data for each address

-

Firstly, we selected time intervals A (October 19, 2022-February 14, 2023) and B (February 15, 2023-May 31, 2023) for the study;

-

Secondly, we studied the trading volume and capital volume from the perspective of buyers, because the focus of the study is on “NFT market participants’ investment in NFT”;

-

Moreover, there are many participants in the NFT market during the study period, but the data shows that the top trading volume addresses that contribute 90% of the total trading volume/capital volume of the entire NFT market account for only 8% of all addresses. Therefore, for the sake of analysis, we defined the scope of the research object as “the top trading volume addresses that contribute 90% of the total trading volume/capital volume in each time period”, and thus screened out a total of over 70,000 addresses;

-

Finally, we removed wash trades and obtained the true trading volume and number of transactions for each address.

Time period A corresponds to the first quarter airdrop of Blur, and time period B corresponds to the second quarter airdrop of Blur, with the release of BLUR tokens on February 14th serving as the dividing line, as the issuance of BLUR has clearly stimulated the activity of the NFT market.

Wash trade exclusion rules: buyer=seller, buyer and seller have the same EOA fund source.

2. Determine the amount of capital invested based on trading volume and number of trades

-

Based on the trading volume and number of trades of each address obtained earlier, calculate the amount of money each buyer invested in each token_id of different NFT collections;

-

Sum up all the investment amounts of each buyer to obtain the amount of funds invested in NFT by each address.

When token_standard=erc 721, each token_id corresponds to the same token, so the amount invested for each token_id is the average price paid for buying that token_id (average price = total payment amount / number of buys); when token_standard=erc 1155, each token_id can correspond to multiple tokens, so we assume that the amount invested for each token_id is the total amount spent on buying that token_id.

3. Divide different entities based on address clustering algorithm

Based on the logic of fund association, addresses that are highly likely to be controlled by the same entity are grouped together, so as to study the sources of trading volume and funds in two time periods from the perspective of entities.

-

We stipulate that clustering is based on the following criteria: 1) there has been a transfer of ETH or stablecoins between addresses; 2) two addresses must have transferred to each other, with a minimum number of transfers: one direction >= 3 transactions, the other direction >= 1 transaction; 3) limited to transactions between addresses in 2023.

-

Use the algorithm to cluster addresses according to the above criteria, obtain different address groups, and identify whether the addresses have participated in NFT transactions in time periods A and B using s1_ind and s2_ind. If at least one address with s1_ind=1 is included in the address group, the address group is an old entity; if all addresses in the address group have s1_ind=0, the address group is a new entity.

Our algorithm can identify direct or indirect relationships between wallets. “Direct” refers to interactions between two NFT players that meet the criteria. When multiple NFT players have interacted with the same address (whether or not the address is within the scope of analysis) and the interaction meets the above criteria, these NFT players form an “indirect” link.

If s 1_ind= 1 and s 2_ind= 1, it means that the address participated in NFT transactions in both time periods; if s 1_ind= 1 and s 2_ind= 0, it means that the address only participated in NFT transactions during time period A; if s 1_ind= 0 and s 2_ind= 1, it means that the address only participated in NFT transactions during time period B.

Results and Analysis

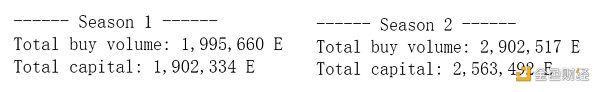

1. Data Results (buy volume is “transaction volume” and capital is “funds”; Season 1 corresponds to time period A, and Season 2 corresponds to time period B)

The output of address and entity perspectives for “the transaction volume and funds in time period B” is to compensate for the possible defects in address clustering (such as incorrectly assigning the addresses of some new entities to old entities, resulting in overestimation of the transaction and funds of old entities), so as to obtain the baseline of the data.

1.1 Transaction volume and funds in each time period:

Transaction volume and funds in time period A and time period B

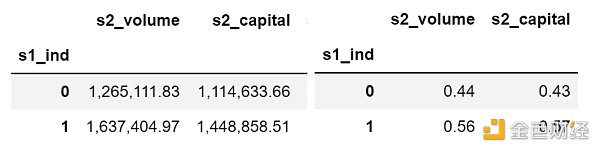

1.2 Transaction volume and funds of new and old addresses in time period B (left in ETH; right in percentage):

Transaction volume and funds of new and old addresses in time period B

If s 1_ind= 1, it is an old address, if s 1_ind= 0, it is a new address.

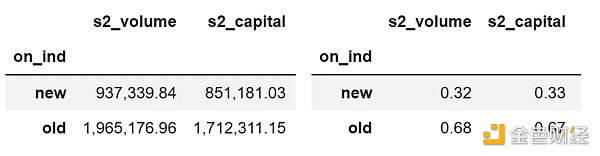

1.3 Transaction volume and funds of new and old entities in time period B (left in ETH; right in percentage):

Transaction volume and funds of new and old entities in time period B

If on_ind=old, it is an old entity, if on_ind=new, it is a new entity.

2. Result Analysis

2.1 Growth of NFT on-chain funds

The total transaction volume and funds in time period B are both greater than those in time period A, with absolute increments of 906,857 E and 661,159 E in transaction volume and funds, respectively. The transaction volume and funds are both showing an upward trend, indicating that the NFT market is generally growing.

2.2 Source of new funds

The incremental increase in funding was less than the amount of new funds invested by new entities in period B (661,159 E vs 851,181 E), indicating that the increase in funds mainly came from new entities, while at least some of the funds invested in the NFT market by old entities were shrinking.

2.3 The proportion of trading volume and capital of old and new entities

Comprehensively considering the trading volume and capital data of old and new entities in period B from the perspective of addresses and entities, the proportion of trading volume and capital of old entities is roughly between 55% and 70%.

-

Old entities account for more than half of the trading volume and capital in period B, indicating that old entities are the main contributors to the activity of the NFT market;

-

However, it should be noted that there is no significant difference in the proportion of old and new entities, so we believe that the contribution of new entities to the NFT market cannot be ignored.

Conclusion

By studying the proportion of trading volume and capital invested by old and new entities in the NFT market (old entities account for about 60% of the proportion), as well as the source of trading and capital increases (mainly from new entities), we believe that old players (old entities) are the main contributors to the activity of the NFT market, while new entrants (new entities) outside the market are the source of new momentum for the NFT market.

It should be noted that the increase in funds and the entry of new players do not necessarily mean that the NFT market is booming. This is because most of the increase is concentrated on Blur, which is highly likely to be attracted by token rewards rather than the value of NFT itself. As for how to maintain the long-term prosperity of the NFT market after the airdrop, it is still a major challenge faced by the market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What are the considerations behind the “coveted” grayscale Bitcoin spot ETF?

- How will Wall Street’s entry into the market during the regulatory “bear” bottom affect the industry?

- Wu’s Weekly Mining News 0619-0625

- What are the considerations behind the Bitcoin spot ETF of “coveted” Belmont?

- Unveiling the Rise of Lido: How it Consolidates its Leading Position in the Ethereum Staking Market

- What are the differences between Timeswap, a no-clearing lending agreement based on AMM, and typical lending markets?

- What will “ZKP + Bitcoin” bring? – Bing Ventures