Blockchain enters the automotive industry: layout to "front", Nuggets in "after" | zinc

From steam engines, fuel engines to motors, the drive system of the car is changing, the relationship between the car and the people is subtly changing, the ecology is becoming more diverse and the industry chain is changing.

People have not only the physical form of the car, but its digital image is gradually becoming visible. "A car is a book," data sharing has become a common need of the automotive industry. The blockchain acts as a trusted machine and can participate in maintaining the same book with all parties.

- As Facebook joins, the digital currency camp fights against the encirclement

- Bitcoin will continue to fall close to $7,600? The bearish pattern of bear market is re-emerging in 2018

- PlusToken project risk analysis: multi-layer promotion mode MLM gameplay, smart dog moving bricks and holes

Sales of Waterloo, the automobile industry is on the eve of great changes

According to data from the China Association of Automobile Manufacturers, domestic vehicle sales in the first half of 2019 fell 12.4% year-on-year to 12.3 million units, which has been declining for 12 consecutive months.

At the same time, sales in the global automotive market are also declining. In early July, the Morgan Stanley Research Report predicted that global auto production would fall by 4% in 2019. The New York Times commented that the traditional auto industry is facing the impact of auto-electricization, sharing, automation, etc., and is facing a dark moment.

Sales have been affected by Waterloo, and the automotive industry has been on the eve of great changes.

Formally, the rise of new energy vehicles is also impacting the traditional automobile industry. Domestically stipulated new energy vehicles refer to three types of pure electric vehicles, plug-in hybrid vehicles, and fuel cell vehicles.

Take the pure electric vehicle as an example, its core component is “three electric”: motor, electric control, battery, and has high technical barriers. In the era of complex fuel vehicles, OEMs occupy a central position in the industrial chain. Now, with the change of technology, the core of the industrial chain will also change.

Xu Wei, a new energy vehicle expert, believes that with the advent of pure electric vehicles, the assembly process of automobiles is less difficult, and the core position of the automakers is no longer in the past, instead focusing on the user's car experience and tapping the value space of the aftermarket. At the same time, as the user sinks, the car operation process is continuously simplified, and the scene is continuously expanded and optimized.

In terms of business, the habit of consumers has changed from "buy a car" to "use a car."

The McKinsey survey shows that China's next-generation car buyers are "networked" people, and their interest in owning private cars does not seem to be large, and they no longer regard cars as a necessity. 52% of them think that no private car does not affect daily life, 36% agree that it is not important to have a car in the current era, and 38% said that if they have free shared travel, they are willing to give up their own private car.

In addition, for a new generation of buyers, private cars are no longer just vehicles, and the in-car experience is becoming more and more important, such as smart interconnection and automatic driving.

The auto industry is shuffling, and although car ownership is still growing, sales are declining and the industry is beginning to seek a transition to the aftermarket. The rules of the game for different vehicle manufacturers, suppliers, distributors, financial institutions, consumers, etc. will also be re-enacted.

In the collaborative scene of long chains, data plays an extremely important role, and there is a use of blockchains.

Blockchain in the automotive field

The combination of the blockchain and the automotive industry is still in the early stage. There is not much report on the summary of the case. After the zinc link interviewed many companies in the industry, it was found that Deloitte's summary is more comprehensive.

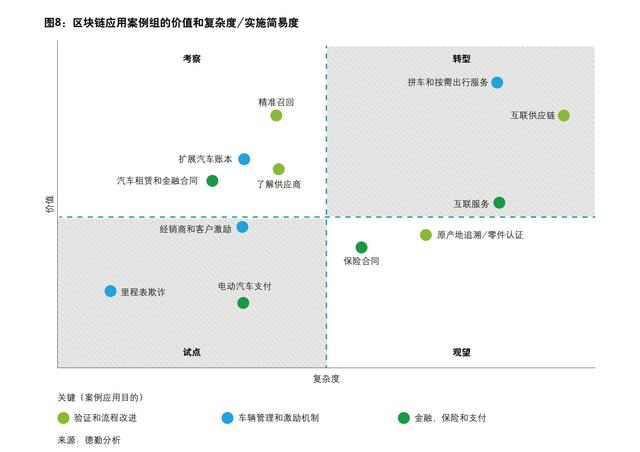

Its "blockchain in the automotive industry" report believes that the practical application of blockchain in the automotive industry is divided into three categories, one is verification and process improvement, which can improve the efficiency of the process in the automotive supply chain and back-office; second, vehicle management and Incentive mechanism to improve vehicle information and usage data throughout the industry; third, finance, payment and insurance.

Wang Jianzong, general manager of Ping An Technology's Federal Learning Technology Department, believes that the use of blockchain's distributed storage, non-tamperable, intelligent contracts, asymmetric encryption and other features can be used to record the complete lifeline of vehicles, solve vehicle data integrity issues, and ensure data security. Promote the value of data.

1) Vehicle logistics: improving supply chain efficiency

The communication cost of traditional automobile logistics work is extremely high. The business side needs to repeatedly confirm the plan, deal with the plan and the actual mismatch, involving a large number of documents. In order to clarify the rights and responsibilities of all parties, each link must be endorsed by credit and signature.

The Wanxiang blockchain builds a vehicle logistics platform “transport chain” based on the blockchain, including logistics management module, reconciliation settlement module and supply chain financial module, which basically covers the whole business scenario of vehicle logistics, from order planning and waybill. Management, process tracking, vehicle signing, financial reconciliation, settlement invoicing, and supply chain finance.

Zhao Zilong, head of the application department of Wanxiang Blockchain Industry, believes that this is something that traditional programs cannot compare. “All data generation, transmission and recording are handled by the system provider. This first makes the data credibility less favorable. ""

Today, based on the blockchain, the parties maintain the same ledger, and the platform does not touch the data privacy of all parties. Financial empowerment based on trusted data helps suppliers to obtain services provided by financial institutions more easily, and the platform can also design incentives for all parties to get something.

In this alliance chain ecology, the automakers are still at the core. In the real business scenario, the blockchain can only guarantee relative fairness and transparency.

2) Carbon credit, build ecology

The only partner of the chain, Qian Chengcheng, told Zinc Link that only the chain and BYD developed “carbon credits” based on the data of its open platform. Users contributed the mileage data of new energy vehicles and obtained the carbon credits of the response. Carbon credits get insurance service discounts and redeem other goods. At present, an application has already landed.

He believes that carbon credits can also be applied to subsidies for new energy vehicles. Carbon credits are directly related to mileage, which can eliminate the fraudulent behavior of fraud. In addition, the commercial value of “carbon credit” can be explored by ecological co-construction, and the eco-linkage of different products of the same customer group can enhance consumer loyalty.

3) Sharing travel

In addition to Internet companies such as Didi, Uber, and more, traditional car companies have joined the competition queue.

In March 2018, BMW and Mercedes-Benz announced that the two parties will merge their shared travel business, charging business, parking business, network car business, and set up a new company, each holding 50%. The two traditional car companies joined forces to jointly attack the shared travel market.

Among them, the blockchain bears the underlying foundation of data sharing. Under the premise of protecting their privacy and privacy, passengers and drivers, between the owner and the vehicle, can query the information of people and vehicles through the blockchain. Regarding the application of the blockchain in shared travel, it can be seen in detail that the zinc link has previously reported "blockchain + travel: ideal plump, realistic skinny".

4) Automotive life cycle management

4) Automotive life cycle management

Car lifecycle management is a huge proposition, from the front loading process of the car to the aftermarket of the car. Most automakers are currently in the data collection phase. As for how to use the data, how to find a commercial closed loop is still a problem to be solved.

Zhao Zilong believes that car recall is one of the scenes. Car quality recalls may not only face huge claims, but the damage to the brand is also immeasurable.

The quality traceability based on blockchain can be traced back to every important part of each batch or even every key component from raw materials, production, logistics, sales, etc. The vehicle enterprises can quickly locate the problem batch, find the cause, and reduce the follow-up Problems and losses.

Qian Chengcheng told Zinc Link that only the chain provides technical support and consulting services for BMW's vehicle lifecycle management. “It is still in the commercial testing stage and needs to find suitable scenes with partners”.

"In the future, the shape of the car will be divided into 'physical' and 'digital', and each car will be a book from the end of production to the end of its life cycle."

He believes that used car trading, car insurance personalized pricing, etc., are all application scenarios that the blockchain can explore.

Financial or the most widely used scene

Lin Yao, CEO of Molian Technology, believes that the large customer base of car life cycle data is insurance companies and banks. "With data, naturally think of realizing, after the car assets are digitized, based on these credible, unique, non-tamperable data, plus the agency's actuarial model, such financial products are probable to make money."

Related financial sectors in the automotive aftermarket include insurance, auto finance (trust, consumer lending, financial leasing).

Taking auto finance as an example, Fang Yushu, founder and CEO of the pigeon blockchain, told Zinc Link that in 2018 China's auto finance market added 1.4 trillion yuan, while the penetration rate was only 40%. A large number of private financial leasing and small loan companies are unable to obtain direct financial support due to insufficient principal credit. They are precisely the “main force” of auto finance business.

Today, these can be done on a DApp.

Fang Yushu exemplifies that the car claims to apply for a loan, to mortgage a 300,000 car, and to buy another car. He can submit personally identifiable information on the DApp and issue a loan application. His data will be transmitted to the credit risk control department of financial institutions such as banks. Through the “smart decision tree”, the loan applicants will be graded quickly, and the feedback will be obtained within two minutes. “Can you borrow, how much can you borrow? ".

Fang Yushu believes that the data-transparent management based on blockchain can reduce the trust cost of this group. Trusts, banks, regulators, financial leasing companies, investors and technology providers jointly maintain a decentralized ledger to ensure that the uplink data is not tampered with, authentic, and the data on the chain protects data privacy through hash encryption. .

Fang Yushu told Zinc Link that there are currently 7 institutions on the CarBaaS platform. The personal credit information of the user (lender) is obtained by the licensee to the central bank's credit information center. The car data on the chain is guaranteed by the Internet of Things such as car GPS.

The parent company of the pigeon blockchain is Shanghai Caihuabao. In order to better carry out financial risk control for auto insurance products, they take the car GPS business as the starting point and conduct risk assessment on the car. As of last year, the size of the domestic market segment has already accounted for 38%.

The layout is "before" and the Nuggets are "after"

The Deloitte report believes that the commercial value of blockchains in different applications in the automotive industry is different.

On the one hand, the commercial value of the blockchain in the automotive field lies in the integration of the automotive supply chain. The blockchain can improve the efficiency of the industrial chain collaboration. It can be simply summarized as the integration of the pre-installation market; on the other hand, the application is in the automotive aftermarket. Such as insurance, maintenance, finance, leasing, etc.

Combined with the current decline in sales in the automotive industry, many car companies are also transforming into “post”, trying to explore greater business value in the aftermarket.

Xu Wei told Zinc Link that in the past, to control the complicated car of the system, the driver not only had to drive, but also to understand the car. Now, the driver's threshold is lowered, and in the future, no human driving is required. In the past, the car was a vehicle. Nowadays, people pay more attention not only to their travel functions, but also to in-car entertainment. In the future, there may be office, rest and social.

No matter what kind of application, it is inseparable from the credible data of the car.

At present, car-related data can be roughly divided into two categories, one is the car life cycle data, and the other is the car owner (driver data) data. The latter needs to be granted by the owner himself. The former can be collected by sensors. In the past, many car companies have been able to collect data on auto parts, and now these data feedback will be more real-time.

Real-time interaction from car data, Lenovo to the generalized car network. Although the concept of car networking has been proposed for a long time, it is still in the stage of allowing every car to connect to the Internet.

Lin Yao told Zinc Link that the current new car network accounted for only 20%, and is expected to reach 50% in 2020. It will take at least three years to reach 100%.

The form of car networking refers to embedded networking, that is, the sensor collects data of auto parts and transmits data to the gateway TBox of the central control station in the car. After the gateway preprocesses the data, the data is exchanged with the cloud by means of the communication module.

Lin Yao believes that the degree of advancement of the Internet of Vehicles depends on the automobile front-loading market . Therefore, Molian Technology first deployed the upstream industry and cooperated with cellular wireless module manufacturers to deploy the IoT wallet BoAT on the cellular wireless module of the Internet of Vehicles application. It has reached the top ten head module manufacturers in the world. Strategic cooperation.

The car networking industry chain is long, data security privacy and protection run through all aspects of the car network, and the network security issues involved are complex. Once the data is not well protected, the risk of cyber attacks increases.

Lin Yao told Zinc Link that government legislation is the source. It is necessary to clarify the ownership of data through the law, and then divide the income of the data through technology and business models.

As for the ownership of data, Qian Chengcheng believes that the future car data should belong to the owner of the car, not the car manufacturer. The owner contributes data and enjoys the commercial value of the data.

Wang Jianzong has the same view. At present, the application data of the Internet of Vehicles is collected and utilized by vehicle manufacturers and vehicle networking service platform vendors. The collected data such as vehicle owner identity information, vehicle static information, vehicle dynamic information, and user driving habits, etc. Both belong to the user's personal privacy information.

From physics to digital, the automotive industry will face tremendous changes. The industry is shuffling and the rules of the game will be reworked.

The layout of the pre-installation market determines the degree of digitization of the car, and the development of the post-market determines the richness of the car ecology. The blockchain combines the Internet of Things to form the infrastructure for trusted data. With data collection, it is more necessary to find application scenarios for these data and explore the commercial closed loop of data in order to open the blockchain market in the automotive field.

Editor's note: This article was first published on the WeChat public number zinc link (ID: xinlianjie-)

Author: Chen Haining; Editor: Wang Qiao

If you need to reprint the article, please use WeChat to open a whitelist.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | Others panic, I am greedy, the time to ambush the altcoin? (0724)

- From the Internet era, how does the blockchain move toward consumer applications?

- Lawyer Interpretation: What are the doorsteps for buyer rights protection in mining machinery disputes?

- Introduction | Beyond the Beacon Chain: Execution Environment in Eth2

- About bitcoin mining, things you don’t know

- What is the article describing the future cap of the DeFi world?

- 9012, why don't you buy bitcoin?