Blockchain in the annual report of listed companies: a comparative analysis of six state-owned banks

The financial industry has always been regarded as the best field of application for blockchain. As a representative of the financial industry, banks have long been concerned about and explored blockchain. In recent years, with the development of blockchain technology and related policy support, the application products on the ground have gradually enriched.

At present, some domestic listed banks have issued their 2019 annual reports. Firebird Finance has selected six state-owned commercial banks: Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, China Bank of Communications, and China Postal Savings Bank. Brief comparative analysis.

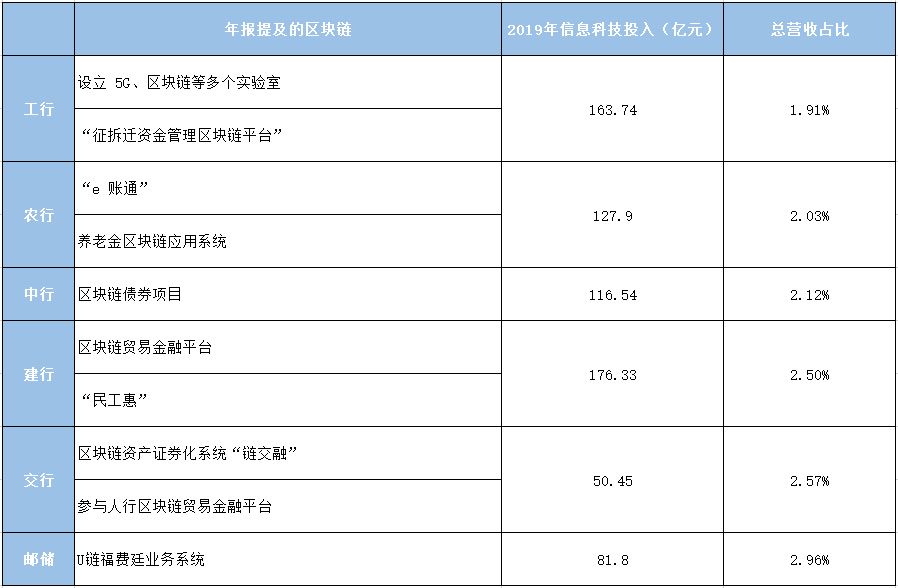

From the content of the annual report, among the six major banks, Agricultural Bank of China and Postal Savings Bank have the least interest in blockchain; Bank of Communications and ICBC have set up special laboratories to explore and incubate blockchain technology; from the perspective of investment in information technology in 2019, CCB invested the most at 17.633 billion yuan, followed by ICBC, and at least the Bank of Communications at 5.045 billion yuan. From the case of landing, there are not many blockchain products mentioned in the annual report.

- More than 60 organizations in Europe and the United States jointly developed: Rehabilitation Certificate for New Coronavirus Patients Based on Blockchain

- Blockchain war "epidemic" action (1): big data application

- Observation | Is the open source of the blockchain the biggest flaw in the business model or the strongest defense?

In addition, based on the annual report, Firebird Finance traces the general status of blockchain development in various lines.

Industrial and Commercial Bank of China: the first state-owned commercial bank to record

In this year's annual report, Bank of China mentioned the blockchain laboratory, the "Requisition and Demolition Fund Management Blockchain Platform" jointly released by the Xiong'an New District Management Committee, and the use of blockchain and other technologies to promote the smart transformation of outlets. In addition, the bank also won the "Top Ten Blockchain Application Innovation Award".

ICBC has an early layout of the blockchain, and attaches great importance to it. In 2017, at the 2016 annual performance press conference of ICBC, ICBC Chairman Yi Huiman stated that with the development of financial technology, including the use of new technologies such as big data, artificial intelligence and blockchain, the traditional technology of the banking industry Bringing very big challenges. In a changing era, if we can not fully grasp, then the future development and competition of banks will be in a very passive position. To this end, in 2016, the head office of ICBC has established seven innovation laboratories, including the blockchain and biometrics laboratory. There are nearly 500 people in the seven major laboratories and they have been engaged in some cutting-edge technical research. In addition, the bank also participated in the research work of the central bank's digital currency issuance and blockchain-based digital bill trading platform.

In 2017, the self-controllable blockchain 1.0 platform was launched. In May 2018, the first patents related to blockchain were exposed.

In October 2018, officially released the enterprise-level blockchain technology platform "ICBC Seal Chain" with independent intellectual property rights, which was applied to more than 60 scenarios such as fund collection, fund clearing, fund disbursement, and bank-enterprise interconnection. Specific applications include Guizhou's poverty alleviation investment fund management blockchain platform, Xiong'an demolition fund management system, China-Europe single-pass cross-border trade platform, Ningxia smart government system, network financing financial service system (ICBC e- letter), etc.

In 2019, ICBC has two blockchain products-ICBC Seal Chain and ICBC's blockchain-based financial services. It has passed the filing of the domestic blockchain information service of the Internet Information Office and became the first state-owned commercial bank to record.

Agricultural Bank of China: focusing on agriculture, rural areas and farmers

In the annual reports of the six major banks, the Agricultural Bank and the Postal Savings Bank are least interested in blockchain. ABC mentioned in its annual report that in terms of the application of blockchain technology, it has landed the first domestic pension alliance chain-in cooperation with Taiping Pension Insurance Co., Ltd. to launch a pension blockchain application system; launched a blockchain-based technology 'S online supply chain financing product "e-Account Connect", which provides core supply chain enterprises and suppliers with full-process online financial services such as issuance, splitting, transfer, factoring financing, payment due and payment, etc. to develop credit products Service innovation. Among them, the pension project was launched in 2018.

In May 2016, ABC established a blockchain research project group. In July 2017, the “e-chain loan”, an agricultural e-commerce financing system based on blockchain, was put into operation. In October 2017, standards and regulations related to the Agricultural Bank ’s enterprise-level blockchain technology were formulated.

Two products will be launched in 2018, one is a digital point project and the other is a pension project. The pension insurance project is the pension management of the blockchain in cooperation between the Agricultural Bank of China and China Pacific Pension Insurance Co., Ltd., including account management, asset custody management, investment management and many other aspects. Both the "e-chain loan" and the pension project are the blockchain platforms used by Hangzhou Funchain Technology Co., Ltd.

In 2019, ABC put into operation a brand new online supply chain financing product-"e Account Link", and completed the first factoring financing loan at the Shandong branch on September 6. It is understood that “e-Account Connect” is an account receivable management service platform independently developed by Agricultural Bank based on blockchain technology. The product revolves around the needs of core supply chain enterprises and upstream suppliers for “transaction + financing” and can provide receivables. Full-process online financial services such as account issuance, split, transfer, factoring financing, and payment due.

According to Zhao Yundong, deputy general manager of the Agricultural Bank of China R & D Center, Zhao Yundong said, "ABC will continue to deepen the application of blockchain technology in the next few years, and expand and improve the scene in the established supply chain system, points system, asset management system, etc To allow new technologies to further empower the innovation and development of financial businesses. "

Bank of China: multi-faceted efforts and cooperation

Bank of China mentioned blockchain in its overseas business segment, BOC Hong Kong. The bank also stated that it will build innovative R & D bases in the Xiong'an New Area, the Yangtze River Delta, and the Guangdong-Hong Kong-Macao Greater Bay Area, and actively promote the application scenarios of new technologies such as 5G, Internet of Things, and blockchain. In addition, the annual report mentioned a blockchain project-the industry's first blockchain debt issuance project. In December 2019, Bank of China launched the country's first bond issuance system based on blockchain technology, and successfully applied it to the issuance of BOC's 20 billion small and micro enterprise special financial bonds.

The Bank of China is more active in the exploration of the blockchain field. According to the 2017 annual report of the Bank of China, the Bank has been actively developing the application of blockchain in the fields of trade finance, biometrics technology, poverty alleviation, and rental housing in the past year. Tencent and Ali cooperate. For example, the iOS version of the blockchain e-wallet (BOCwallet) was launched, the blockchain technology was tested with Tencent, the blockchain-based house rental cooperation with Ant Financial in Xiong'an was submitted, and a report was submitted to the State Intellectual Property Office. A patent on the expansion of the blockchain, etc.

In 2018, BOC also made a lot of progress, such as launching a blockchain-based cross-border remittance business with China UnionPay, jointly launching the blockchain Forfaiting trading platform with CITIC Bank and China Minsheng Bank, and completing the first cross-bank asset transaction.

When answering investor questions on the interactive platform, Bank of China stated that as of the end of November 2019, the business applications of Bank of China's blockchain technology are mainly concentrated in cross-border remittances, trade settlement, electronic wallets, digital notes, collateral valuation, and public welfare. In the fields of poverty alleviation and digital security, 37 patents have been submitted to the State Intellectual Property Office.

China Construction Bank: Fintech invests the most

In its annual report, CCB mainly mentioned a blockchain product and a blockchain application case. The report pointed out that the bank deployed domestic letters of credit, forfaiting, international factoring, refactoring, etc. on the blockchain trade finance platform, with a cumulative transaction value of more than 400 billion yuan. In addition, the use of blockchain and big data technology innovation launched the "Migrant Worker Benefit" platform, serving more than 4 million customers.

It is understood that CCB's blockchain trade finance platform went live in April 2018, and has deployed functions such as domestic letters of credit, forfaiting, international factoring, and factoring. In October 2019, China Construction Bank officially released the "BCTrade2.0 Blockchain Trade Finance Platform", which added new functions, including cross-chain and inter-bank transactions.

"Migrant Worker Benefit" platform is to use blockchain, big data, Internet of Things and other technologies to solve the problem of migrant workers' salary issuance. Since its promotion at the end of 2018, the "Migrant Worker Benefit" business has been implemented in all 37 branches.

On February 20, Forbes announced the second Global Blockchain Top 50 list, and China Construction Bank was the first banking institution in China to enter the Forbes Global Blockchain Top 50 list. According to information released by Forbes, China Construction Bank currently operates 9 blockchain projects, including drug traceability, house leasing, provident fund interconnection, and carbon credits. Among them, BCTrade has developed the farthest, connecting 60 financial institutions such as China Postal Savings Bank, Bank of Shanghai and Bank of Communications with 3000 manufacturing enterprises and import and export companies.

In the 2019 annual report, CCB invested 17.633 billion yuan in financial technology, ranking first among the six major banks.

Bank of Communications, China: Focus on asset securitization

Bank of Communications has more descriptions of blockchain in its annual report. The annual report points out that Bank of Communications has adopted blockchain technology in its asset securitization, industrial chain finance, domestic letter of credit, and Forfaiting. In 2019, Bank of Communications established the Bank of Communications Laboratory to provide incubation support for blockchain, big data, 5G and other R & D projects. At the same time, the Bank of Communications also released the first innovative product of green asset-backed notes enabled by blockchain technology.

In terms of the application of blockchain technology, "chain blending" is the industry's first blockchain asset securitization platform launched by Bank of Communications. At present, it has issued 8 asset-backed securities with an issued amount of nearly 100 billion yuan; issued 4 asset-backed notes , With an issue amount of RMB 3.1 billion. The "Chain Integration" platform also won the "Top 10 Blockchain Innovation Application Awards" by The Banker magazine in 2019.

Overall, the Bank of China's application of blockchain technology is mainly concentrated in the two areas of asset securitization and letter of credit transactions.

In April 2018, the Bank of Communications Blockchain domestic letter of credit project was put into operation, which realized the end-to-end transmission of information and documents, reduced the intermediate links of document mailing, greatly improved the speed of domestic letter of credit transactions, and greatly reduced transaction costs.

In June 2018, Bank of Communications launched the self-developed Jucai Chain blockchain platform for the first time, specifically for asset-backed securities to speed up the issuance process.

In December of the same year, Bank of Communications officially released the country's first blockchain asset securitization platform-"Chain Integration". The platform has obtained two technology patents-"a cross-institutional process solution based on smart contracts" and "Fabric blockchain management solution based on smart contracts."

Compared with other banks, Bank of Communications's blockchain application has a smaller scope of application, and it focuses on asset securitization, which is also one of its unique advantages. In 2019, the Bank of Communications invested 5.045 billion yuan in information technology, ranking last among the six major banks.

China Postal Savings Bank: Early exploration, single product

Postal Savings Bank has the least interest in the blockchain, and only mentioned one application in the annual report-the U-chain Forfeiting business system went online and completed the first cross-chain transaction. But this does not mean that Post does not value blockchain.

It is understood that the Postal Savings Bank's exploration of blockchain technology began in 2015, and a special research group on blockchain technology was established in October to conduct research on blockchain technology and product innovation. In early 2016, after research and evaluation, the bank selected two business scenarios of asset custody business and forfaiting business to apply blockchain technology.

In October 2016, the U-chain custody business system of the Postal Savings Bank was successfully launched. This is the first time that the Chinese banking industry has applied blockchain technology to the bank's core business system. In June 2018, the U-Chain Forfaiting system of the Postal Savings Bank was launched, and the first blockchain Forfaiting inter-bank transaction was completed in September of the same year. The biggest feature of the system is to realize the four core functions of inter-bank domestic letter of credit full-chain transaction, trade financial asset information matching under domestic letter of credit, asset transaction and business full-process management. It is understood that the bank mainly adopts the Hyperledger Fabric.

In 2019, the Postal Savings Bank invested 5.045 billion yuan in information technology, ranking second from the bottom of the six major banks.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Video: Blockchain opens a new chapter in medical health (Part 1)

- Video: Blockchain opens a new chapter in medical health (Part 2)

- Can Brave succeed in challenging Google Chrome with over 1 billion users?

- Opinion | 19 useful indicators to measure the progress of blockchain

- Video | OK Blockchain 60 Lecture: How Blockchain Works

- Video | OK Blockchain 60: Why is Blockchain called Blockchain?

- 7 Key construction projects in provinces and cities in 2020 involve billions of funds from the blockchain to help industrial development