How much do you know about the history of Ethereum? Here is a brief history

Ethereum (Ethereum) is a global open source blockchain platform for decentralized applications (DApps), supported by smart contracts and embedded in the local digital currency Ether (ETH). On Ethereum, you can write code to control the transmission of digital value according to programming conditions. Ethereum is mainly used for three purposes: one is to store the value in ETH, the other is that users send or receive payments in ETH to settle transactions, and the third is to promote network operations (that is, enable DApps) through transaction fees paid in ETH, These costs are calculated based on the execution code.

In November 2013, Vitalik Buterin released a white paper conceptualizing Ethereum. With the contributions of seven co-founders and other developers, the network was launched in June 2015. The initial development was led by Ethereum Switzerland GmbH (EthSuisse) and is currently supervised by the Ethereum Foundation, a non-profit organization headquartered in Switzerland.

Before its establishment, Ethereum aimed to expand the main functions of Bitcoin as a peer-to-peer (P2P) digital currency by integrating a platform that can deploy smart contracts and more complex structures (such as DApps and distributed autonomous organizations (DAO)). Its progress is driven by the joint efforts of its global developer community. Ethereum ’s global developer community is considered to be the largest of all digital currency networks. Currently, Ethereum is in the fourth stage of development, called Serenity or Ethereum 2.0, which will be launched in several stages and is expected to be completed after 2022.

| assets | Ether (ETH) |

| Network establishment time | 2015.7.30 |

| Price (USD) | $ 265.41 |

| Total market value (USD) | $ 29.1 billion |

| Circulation supply (percentage of expected supply in 2050) | 109.7 million / 81.2% |

| Estimated supply in 2050 (ETH) | About 135.1 million |

| Current mining rewards | 2 ETH |

| Current annualized inflation rate | About 4.5% |

| Average block time | About 13 seconds |

| Market segmentation | Digital currency smart contract universal platform |

Table 1: Ethereum summary statistics (as of February 12, 2020)

- Global blockchain status: Asia is the most competitive, and Africa is the largest target market?

- Observation | Xiong'an Blockchain's 3rd Anniversary: From the first tree with an "identity card" to the official opening of the blockchain laboratory

- Yao Qian: Three major scenarios and solutions in which blockchain may be applied to central bank digital currency

A brief history of Ethereum

In the next section, we will briefly introduce the three main periods in the history of Ethereum: one is the event before the network started; the second is the infamous DAO hacking in June 2016; the third is the recent and future development of Ethereum. Planning stage.

Part 1: Before the network starts (early 2013 to July 30, 2015)

In 2013, Vitalik Buterin, an early Bitcoin contributor and co-founder of Bitcoin Magazine, used Ethereum as the "world computer" proof of concept for the first time in the original white paper. As an early adopter of Bitcoin, Buterin put forward such a view that digital currency and its related blockchain can be more convenient than simple P2P electronic value transfer. In order to realize this grand vision, he set out to create a complete virtual ecosystem, which includes global blockchain and smart contract programming platforms. Both will be supported by the local digital currency ETH.

By directly integrating programming capabilities into the Ethereum protocol, developers around the world will be able to use Ethereum ETH to automatically pay for and design new decentralized applications hosted on public blockchains. Through the use of smart contracts, applications on Ethereum can automatically transmit information and value under dynamic conditions, thereby providing customized business models for the new Internet economy (ie Web3.0)

In late 2013 and early 2014, Buterin co-founded Ethereum with Mihai Alisie, Amir Chetrit, Charles Hoskinson, Anthony Di Iorio, Dr. Gavin Wood, Joseph Lubin and Jeffrey Wilke. Shortly thereafter, Gavin Wood coded the first functional implementation of Ethereum in the Yellow Book and detailed the technical details of the protocol, including the Ethereum Virtual Machine (EVM) and the smart contract programming language Solidity. On a parallel path, two entities were established and overseen the development of Ethereum: the profitable institution EthSuisse established in February 2014 and the non-profit institution Ethereum Foundation established in July 2014.

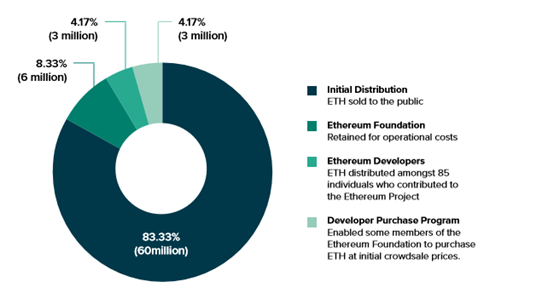

When the network was launched on July 30, 2015, based on the approximately US $ 18 million raised from the first crowdfunding conducted between July and August 2014, 72 million ETH was created and distributed. At the same time as the network started, it was decided to dissolve EthSuisse and designate the Ethereum Foundation as the only organization dedicated to accelerating adoption and use.

On April 30, 2016, blockchain and Internet of Things (IoT) solution company Slock.it announced the launch of "The DAO" on Ethereum. DAO is positioned as a decentralized venture capital fund, raising more than US $ 150 million during the 28-day crowdfunding window. DAO grants voting rights to members based on their investment ratio, and members can vote to fund projects. If a project proves to be profitable, members will be rewarded based on the terms of the relevant smart contract and their shares in DAO.

However, DAO did not work as planned. On June 17, 2016, an anonymous hacker used an error in the smart contract code that built DAO to withdraw about 60 million US dollars of ETH from the isolated wallet address. Therefore, the ETH market has experienced a massive sell-off, and investors have sold their shares.

In view of the inability to recover stolen funds, there is a debate within the digital currency community on how to better correct this situation. Finally, it was decided to perform a hard fork on July 20, 2016 and create a new version of the Ethereum blockchain. This version will be called Ethereum, delete all theft records and restore the stolen ETH to the original owner. The original Ethereum protocol was renamed to Ethereum Classic, and its original token was renamed to ETC. Ethereum Classic retains transaction history, including DAO theft, to maintain the basic principles of decentralized management and non-tampering.

Today, Ethereum and the classic Ethereum network coexist and are only just beginning to interoperate in many ways. Although the two networks are similar in function and actual application function, since the hard fork, the underlying separation between them has led to major differences in technical architecture, development philosophy, and governance principles.

Part 3: The four stages of Ethereum (July 30, 2015-?)

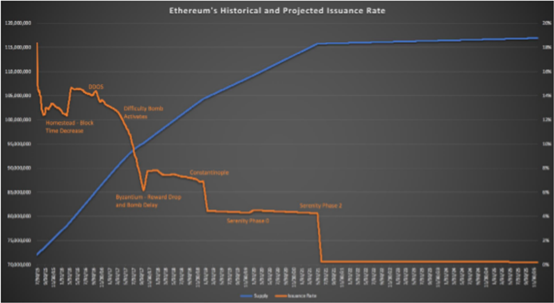

The development of Ethereum is divided into four main stages, some of which are subdivided into multiple stages. Each stage is integrated into the main protocol like a hard fork, and the functions are fully tested in the testnet. Over time, the roadmap has evolved to reflect community consensus. The contribution to the Ethereum project is to achieve Serenity in its final stage. The goal at this stage is to become a globally scalable payment network and smart contract platform that resist centralized governance.

Phase 1: Frontier- On July 30, 2015, the Ethereum network was established to enable users to mine ETH and test basic functions.

Phase 2: Homestead- On March 14, 2016, Solidity was updated and several dimensions of parameters were added, including natural gas prices and costs.

Phase 3: Metropolis – Byzantium- On October 16, 2017, privacy and security were improved by adding zk-SNARK and difficulty bombs (as the basis for inflation ETH issuance).

Phase 3.5: Metropolis – Constantinople- February 28, 2019 improved smart contracts and explored scalability solutions using state channels.

Stage 4: Serenity-Ethereum 2.0 -Expected after 2022? Will be implemented in several stages, converting Ethereum to Proof-of-Stake (PoS) protocol, including Ethereum Web Components (eWASM), to improve network performance and expansion Supported smart contract programming language.

For a comprehensive description of the features introduced in each of the four phases, please refer to EthHub.

Define the characteristics of Ethereum

The Ethereum network aims to expand the use cases of Bitcoin and serve as a decentralized world computer. Although Bitcoin uses a limited scripting language that only allows P2P value transmission, Ethereum is designed to be computationally versatile and Turing complete, facilitating more advanced types of programmable data interaction with ETH.

Nevertheless, Ethereum and Bitcoin still have some of the following characteristics, although their respective degrees are different:

• Decentralization : Ethereum currently uses PoW, effectively eliminating the need for central agencies (such as governments and financial institutions) to verify transactions or network operations based on smart contracts. Buterin claims that the blockchain is politically and architecturally decentralized, but logically centralized, where nodes have equal power in the network and must collaborate to verify transactions. It is worth warning that although the governance design is decentralized, there may be risks associated with the decentralization of mining pools in the Ethereum network. As of February 12, 2020, the two largest mining pools controlled more than 50% of the network hash rate

• No authorization required: anyone can participate in the network.

• Security: In the PoW protocol, the network "is safe as long as honest nodes control more [energy] than collective attacker nodes." An attacker who attempts to conduct fraudulent transactions on the blockchain must find the required blocks, change the transaction data, and then dig out each successive block until the fraudulent block is confirmed by the network. This is a so-called 51% attack. The main threshold for these attacks is that their computational cost is high and the benefits are uncertain, so it is unlikely to happen. Although the 2016 DAO hacking attack raised concerns about the security of Ethereum, Atzei et al. (2016) found that the main reason for the attack was a vulnerability in Solidity (the programming language used to design Ethereum smart contracts), not the network itself Loophole. However, it is worth noting that with the completion of Serenity, Ethereum will transition from the PoW network security model to the PoS network security model. As a major update to the Ethereum network, any failure to properly implement such changes may have a significant adverse effect on the value of Ethereum.

• Open source: The source code of the Ethereum project is available on the Internet, and anyone can access, contribute, or fork for free. This is an important feature for building trust and accumulating users, as evidenced by the fact that the Ethereum project has the most active developers in all digital currency communities. Users can make Ethereum Improvement Proposals (EIP), which is a functional proposal aimed at improving the network and following strict technical guidelines.

• Transparency: All transactions are recorded on the Ethereum blockchain and can be viewed publicly anywhere in the world.

• Pseudo-anonymity: The public wallet address is not directly linked to any identifiable personal information. However, in the current state, complete anonymity is difficult to achieve. This is because the addresses involved in any Ethereum transaction are permanently and publicly visible on the blockchain. Information such as multiple transactions or escrow solutions from a wallet or data breaches on exchanges can basically be traced back to personal identities.

• Deflationary supply: At the beginning, 72 million Ethereum were created. The supply of ETH increases according to the deflation mechanism, which will continue to adjust as the network matures. However, there is no specified maximum supply limit. Establishing a transparent money supply and issuance schedule is essential for evaluating the long-term investability of digital currencies.

The main features of Ethereum

Ethereum is the first digital asset that combines the platform and smart contract functions. It consists of the following elements, which are essential for understanding the network and its many applications.

Ethereum (ETH)

ETH is a digital currency unique to Ethereum. It has three main purposes: one is to store value in ETH, the second is to allow users to send or receive ETH to settle transactions, and the third is to pay transaction fees (called "Gas") through ETH to promote network operations (enable DApps), these The cost is calculated based on the execution code. Gas is an internal value unit used for smart contract code execution, which is calculated by measuring the calculation cost of executing a given instruction. Miners and smart contract programmers charge transaction fees in ETH based on an equal amount of Gas. The smallest unit of Gas price is Wei, where 1018 Wei is equal to 1ETH.

Smart contract

A smart contract is a line of code that can facilitate the exchange of anything of value, such as money, information, property, or voting rights. They are uploaded to the blockchain, and the executed transactions cannot be tampered with. Using smart contracts, users can send or receive ETH, create markets, store registered debts or commitments, represent property or company ownership, transfer funds under a set of logical instructions, and form new digital assets in a compliant sale or issue . The concept of smart contracts was first proposed by Nick Szabo, a famous computer scientist specializing in digital currencies and the founder of BitGold, which was discussed in a 1997 white paper.

Solidity

Solidity is the main programming language of Ethereum. It is used to write smart contracts, develop DApps, build DAOs, and operate Internet of Things (IoT) devices based on Ethereum technology. Other languages of the Ethereum network, such as Vyper, still exist, while other languages, such as Serpent and Mutan, have been deprecated.

Decentralized applications (DApps)

DApps are apps, programs, or tools built using smart contracts in the Ethereum network. DApps have potential use cases in many areas, including financial services, asset management, supply chain management, identity management, and encryption and transmission of data storage. Some popular DApps built on the Ethereum blockchain include MakerDAO, CryptoKitties and IDEX. Especially MakerDAO, which is currently the largest decentralized finance (DeFi) platform. As an actual application of Ethereum, it is possible to democratize financial services. As of February 12, 2020, approximately 3.1 million ETH was locked as collateral for DeFi.

Decentralized Autonomous Organization (DAO)

A decentralized autonomous organization (DAO) is an organization that is independent of the central management agency. Unlike traditional company ownership distribution among shareholders, DAO is owned by those who provide tokens, and they also receive voting rights. In addition, the rules of DAO are determined by the smart contract that comes with it.

Ethash algorithm

Although Ethereum's Ethash and Bitcoin's SHA-256 both use PoW, the two protocols differ in the way they handle ASICs (dedicated miners). In Ethash, GPUs (graphics processing units) are the preferred device, and GPUs are relatively cheap compared to ASICs for SHA-256. Therefore, the mining process of Ethereum is more equal and the entry cost barrier is lower. It also reduces the possibility of centralized mining and reduces the risk of network attacks. However, the cost of adopting Ethash is that the calculation requires more memory. For more technical details of Ethash, please refer to the open source guide on Github.

Ethereum Virtual Machine (EVM)

The EVM was created by Dr. Gavin Wood in 2014. For details, see the original Ethereum Yellow Book, the technical version of the white paper. A virtual machine (VM) is software that simulates the behavior of a computer. It is essentially a running environment that is used to perform any activity on an ordinary computer. It allows users to test functions and eliminate the risk of attack and failure on the host computer hosting the virtual machine. If the virtual machine is attacked and some functions are impaired, the user only needs to log out of the virtual machine.

The EVM handles the state of the Ethereum blockchain and executes all smart contracts, DApps and DAOs on the network. It is Turing complete, which means that as long as there is enough time and memory, the program will run until completion. This is a major innovation in blockchain technology because it allows complex conditional logic and provides a basis for more complex programs. Other virtual machines, such as SputnikVM, are under development and are increasingly used in Ethereum blockchain projects.

Mining rewards

In the beginning, 72 million ETH was created and distributed to the public, the Ethereum Foundation and developers. Ethereum is equipped with a mechanism to suppress inflation to control the issuance rate of new ETH. The current upper limit is 16 million ETH added annually. The consideration behind this is to prevent the arbitrary creation of money, leading to hyperinflation or manipulation.

Miners who successfully confirm transactions and upload them to the blockchain will receive block rewards for their efforts, thereby providing incentives, which promotes the exponential growth of network usage. The block reward starts at 5 ETH, decreases to 3 ETH after the Byzantine hard fork, and decreases to the current 2 ETH after the Constantinople hard fork. Like Bitcoin, Ethereum miners may also receive additional ETH transaction fees.

Since its inception, the history of block rewards is as follows:

• Block # 0 to Block # 4,369,999: 5 ETH

• Block # 4,370,000 to Block # 7,280,000: 3 ETH (change via EIP-649)

• Block # 7,280,000 to date: 2 ETH (changes made through EIP-1234)

Potential advantages of Ethereum

Compared with traditional financial institutions, payment channels and other digital currency networks, the design of the Ethereum protocol has three potential advantages:

1. Pioneering smart contract function: Ethereum is the first digital currency network that integrates a smart contract platform. Because of this feature, real-world use cases begin to emerge and maintain value (such as DeFi). Considering the status of Ethereum as the second largest digital currency network in the past few years, we must recognize the influence of Ethereum in the digital asset category and traditional financial fields.

2 . Active developer community: Ethereum is one of the most popular digital currency networks in all indicators of Github activities, including the number of submissions, total contributors, total number of project observers and total number of stars

3. Institutional and enterprise support: The Enterprise Ethereum Alliance (EEA) is an organization dedicated to promoting the adoption and use of Ethereum by businesses and individuals. It also strives to build enterprise blockchain solutions and potential private chain and alliance chain versions of the Ethereum blockchain to meet previously unmet business needs. It consists of more than 450 multinational companies, including Microsoft, JPMorgan Chase, Toyota and Intel. It is a trend that more and more companies join EEA. Under this trend, mature companies are exploring the value of blockchain technology and investing a lot of time and resources in related plans.

Potential risks of Ethereum

There are some important trade-offs to consider when choosing between different digital currency networks to use and invest in. The choice usually depends on the digital currency that best meets the user's needs. Below we outline the four main risks associated with investing in Ethereum:

Scalability issues

Like many digital currencies, Ethereum faces limitations in terms of scalability. Currently, the network can only process 15 transactions per second on average, while traditional payment channels, such as VISA, process approximately 1,700 transactions per second. Ethereum has made several adjustments to accommodate the scalability challenges posed by its original design. However, scalability is still one of the biggest challenges facing the Ethereum network and is still an active area of research for developers.

Two methods are currently being studied to solve the scalability problem of Ethereum: one is on-chain, or layer 1 (referring to the main blockchain). The second is off-chain, or layer 2 (refers to the realization of functions outside the main blockchain, such as Plasma, side chains, payment channels, and status channels).

For more information about the scalability features of the Ethereum 2.0 project, please refer to the Ethereum Github.

Degree of decentralization

The degree of decentralization of the Ethereum network may be risky, especially with regard to mining pools. For example, as of February 12, 2020, the top two mining pools controlled more than 50% of the network hash rate.

competition

Ethereum faces fierce competition from many common platform digital currency networks, including Ethereum Classic, Horizen, Eos and Tezos. Each of them may be regarded as a direct or indirect competitor of Ethereum, and it remains to be seen whether DApps, smart contract functions or other use cases provide better services in one or some of the use cases. These networks may also fail collectively, or due to the power of market competition, some combination of them will succeed at the same time. However, compared to the aforementioned (and other) competitive networks, Ethereum has a higher adoption rate and extends to developers, exchange listings, applications, and underlying network infrastructure such as wallets and front-end payment processing software.

Instability of smart contracts

Since transactions generated by smart contracts may be difficult to stop or reverse, any loopholes in the underlying code may weaken the network. For example, a vulnerability in DAO in 2016 allowed an unknown attacker to transfer approximately 60 million USD worth of ETH to an isolated wallet address. This incident triggered controversy in Ethereum, leading it to fork into two networks: Ethereum and Ethereum Classic. In 2017, Parity Technologies' multi-signature wallet software Parity was affected by two hacker attacks. The first time was in July 2017, resulting in the theft of USD 30 million of ETH, and the second was in November 2017, resulting in the freezing of approximately USD 160 million in ETH. Smart contract technology is relatively new and is still in open source development.

Monetary policy concerns

There is no maximum supply cap for ETH, and the monetary policy roadmap seems somewhat ambiguous. Several proposals have been made, suggesting that the Ethereum network set a cap on supply to introduce currency scarcity and prevent arbitrary currency creation. In particular, in EIP960, Buterin proposed a supply cap of 120 million ETH, but this was not accepted by the community.

Regulatory uncertainty

The US Securities and Exchange Commission (SEC) stated that certain digital assets may be considered "securities" under the federal securities laws. So far, the US Securities and Exchange Commission has only identified two digital assets, Bitcoin and Ethereum, and it does not intend to treat them as securities. However, tokens, products, and businesses built on the open source Ethereum network have many regulatory considerations and may pose further risks to Ethereum prices.

to sum up

Ethereum initiated the second wave of innovation in blockchain technology, expanded the use cases provided by Bitcoin, and consolidated its unique position in the digital currency ecosystem. The ultimate goal of Ethereum is to become a leading smart contract compatible digital currency platform. Although the 2016 DAO hacker attack caused the Ethereum Ethereum classic hard fork to be controversial, Ethereum maintained its position as the second largest network in the digital currency ecosystem by market value, and proved its resilience with the support of many supporters . Ethereum has a network of users, developers and enterprises all over the world. It has huge development momentum in terms of technology and community, and it is difficult for competitive platforms to replicate.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Video | Chen Xiaohua: Two attributes, six dimensions, and one center of the blockchain

- The application prospect of blockchain technology in sudden public safety incidents: how to realize "digital city governance" and "digital epidemic prevention"?

- Fragmented identity data, reshaped on the blockchain

- Industry Blockchain Weekly | Blockchain project selected as a typical case of the Ministry of Justice

- Inventory of China's four major trade areas: what has the blockchain "horse enclosure" done over the years?

- Global assets seek anchor under the crisis, which may become the starting point of Bitcoin's eternal bull market

- MakerDAO founder: The foundation will be dissolved in two years, and the preliminary draft of the governance transfer plan will be announced next week