Is the trend of ordinals spreading to ETH a return or a throwback?

Is ETH following the trend of using ordinals? Is it a new trend or a revival of an old one?From the transfer of BRC-20 Token issuance mode to ETH’s $FERC, to the implementation of Bitcoin NFT engraving mode on ETH by directly inserting images as Base64 strings into the Hex Data field of ETH transactions, the “engraving” method of Bitcoin NFT has been frequently copied to ETH recently, attracting the attention of many players.

It seems that the idealistic beauty of Bitcoin NFT, such as “immutable, fair, and decentralized,” has been transmitted to ETH by replicating the somewhat clumsy NFT generation method formed by Bitcoin’s characteristics. However, is this really the return of idealism?

ETH’s “On-chain” NFT

As the ETH NFT ecosystem has developed to this day, as players, we may feel helpless about many issues, such as PUA based on the whitelist mechanism, “scientists” eating up a large number of shares during public sales, lack of new narratives, and the proliferation of “dirt dogs” projects that are known to be capital manipulation but have to be rushed into. However, as a well-tested NFT ecosystem, ETH NFT has also had in-depth discussions on many issues and has been given answers by the market.

“Immutable” or “on-chain storage” seems to be a “technical issue,” but it is actually a “market issue.” ETH has discussed this issue very early on.

- Long Push: The Opportunities and Challenges of the L3 Era with the Launch of Arbitrum Orbit

- Analysis of FalconX’s On-Chain Behavior: Will the Impact of SEC Persist and Will Institutions Seize the Opportunity to Buy Low?

- The First Step of Ethereum Modularization: Introduction and Working Principles of Proto-danksharding

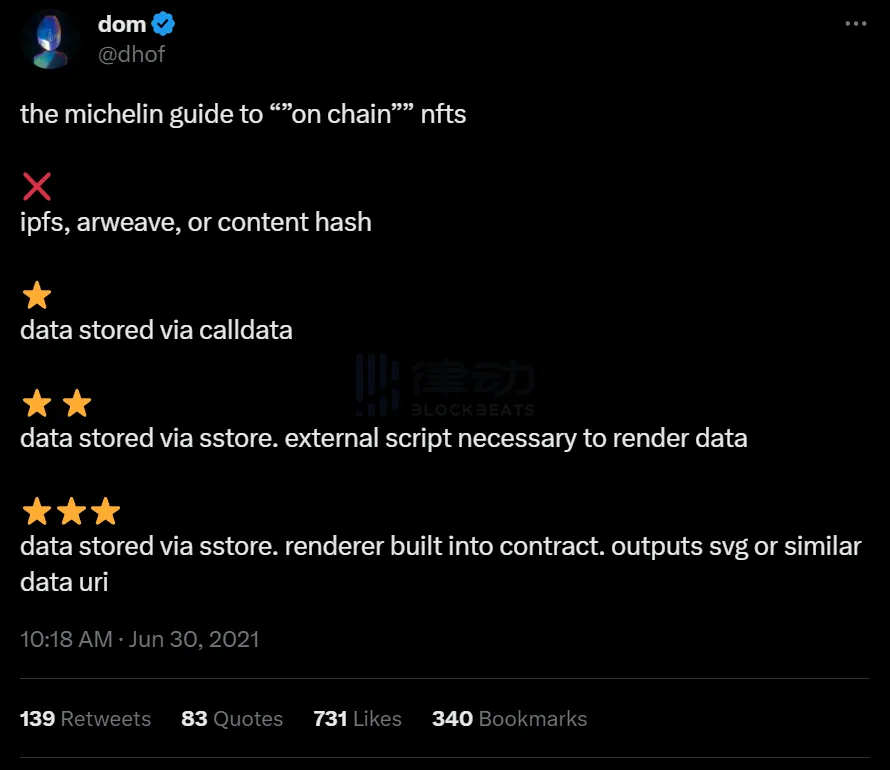

This is a tweet I found two years ago. @dhof classified ETH’s “on-chain NFT” according to different implementation methods. One-star is storing data in the calldata field of ETH transactions, two-star is storing data through EVM opcode sstore and rendering data through external scripts, and the highest three-star is storing data through EVM opcode sstore and rendering images through built-in renderers in smart contracts to output svg images or similar data URIs.

If we rate Ethscription according to this standard, Ethscription can only get a one-star rating. As mentioned at the beginning of its official website, Ethscription is implemented by storing data in the calldata field of ETH transactions. The rendering of images needs to be done through off-chain indexing, making off-chain operations decentralized by open sourcing the index.

For ETH, “full-chain NFT” is not a new thing. I can quickly recall several project names – Autoglyphs, Larva Lads, Chain Runners, and OnChain Monkeys, which are currently active in Bitcoin NFT.

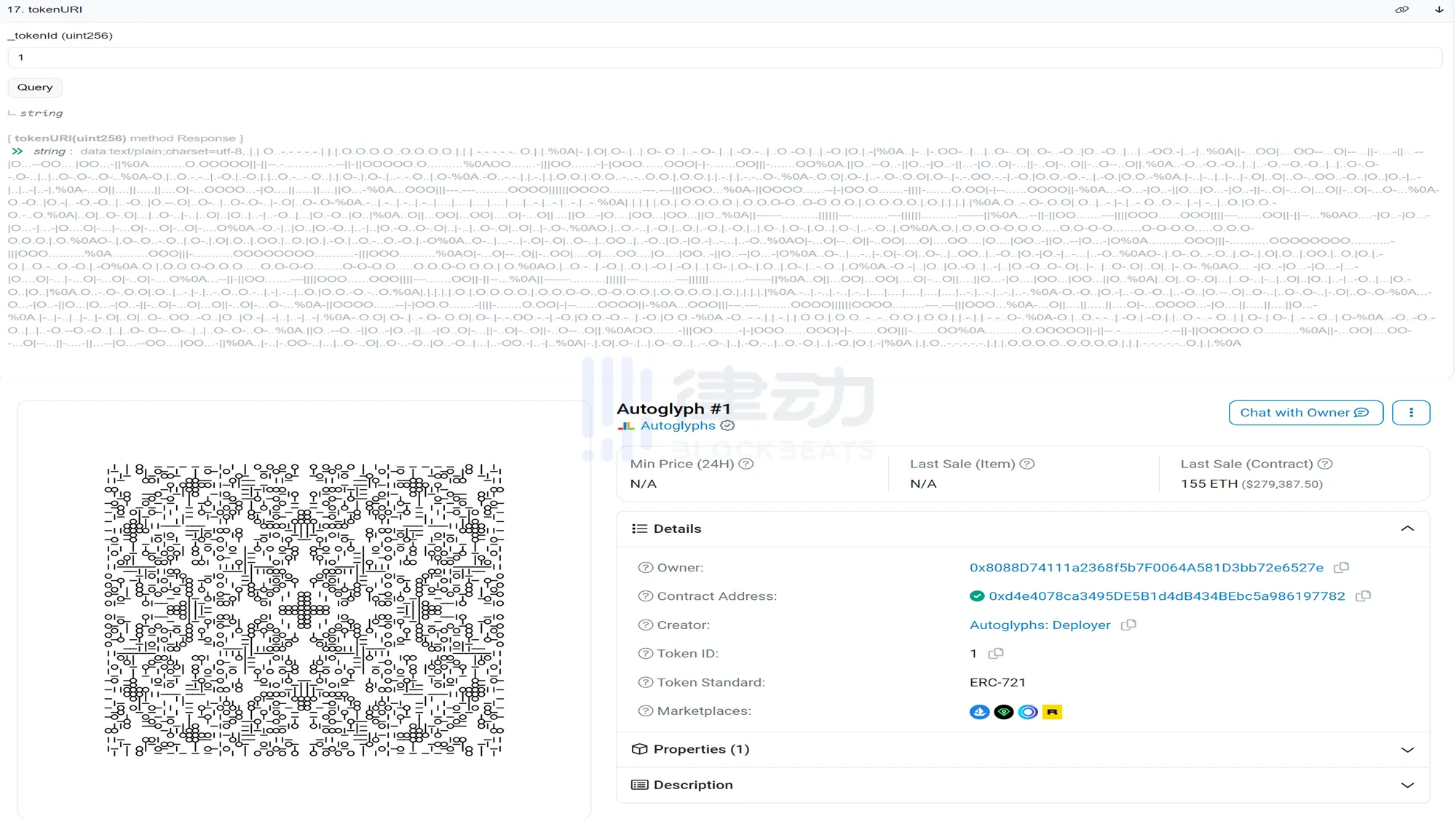

Retrieving the tokenURI of Autoglyphs, you will find a long string, and breaking this string will output an image.

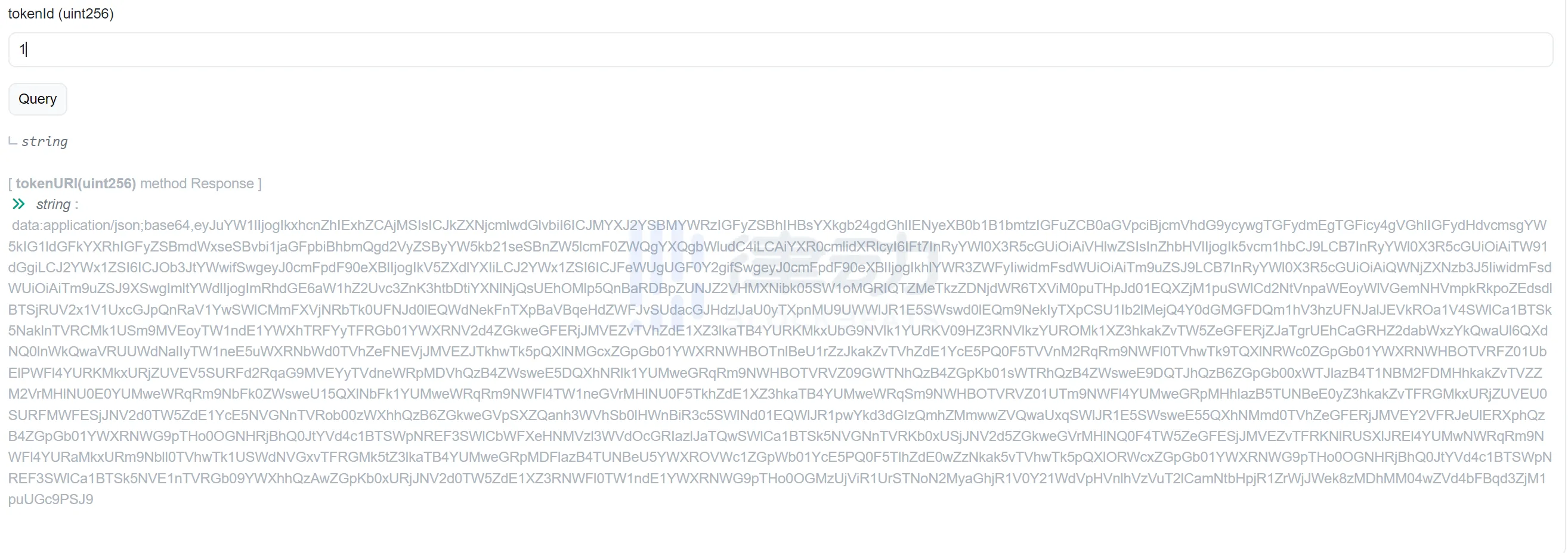

Retrieving the tokenURI of Larva Lads, you will also find a long string, but the type definition is JSON, and the content is a base64 string. Larva Lads has built-in decoding and rendering operations in the contract to ultimately output an SVG image.

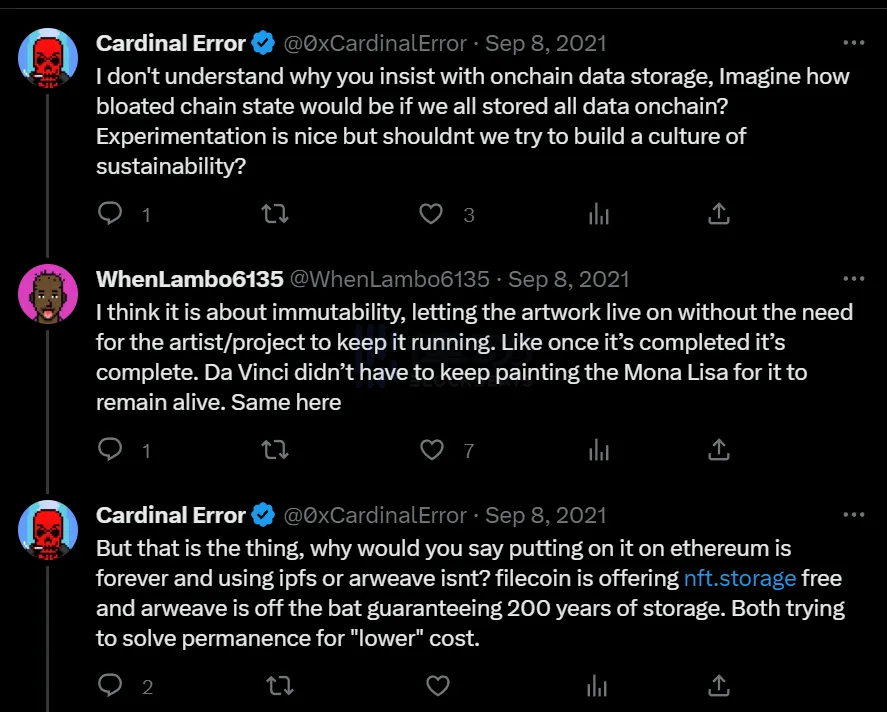

Back to @dhof’s tweet. Under this tweet, I also saw a very interesting discussion:

@0xCardinalError expressed confusion about why @dhof is so persistent about full-chain storage. Full-chain storage is cool as an experiment, but what is more important for NFT is to focus on “building a sustainable culture.” He also stated that solutions such as IPFS and Arweave reduce the minting cost of NFTs, which is actually the “market problem” I mentioned earlier. Although IPFS and Arweave are storage solutions outside of the ETH chain and there is a possibility of data loss, the ETH NFT market has given a real gold and silver choice.

@WhenLambo6135 then explains the meaning of “immutable” very well – to allow artworks to exist even when the creator/project disappears, just like Da Vinci does not need to continuously paint the Mona Lisa to maintain its existence, only to ensure that the painting is not lost and is properly stored. In some sense, this is also another understanding of the blockchain – an information storage medium supported by modern technology and consensus. Compared with paper artworks, blockchain artworks do not require complicated maintenance, only the internet and computers do not disappear, and people’s faith in the blockchain network.

@0xCardinalError mentioned the “construction of a sustainable development culture,” which, like the art creators who are indispensable to the thriving ETH NFT ecosystem, has gradually been forgotten in one “making money like drinking water” story after another. The principle of Ethscription is not new to ETH, but it has been promoted and speculated upon, and viewed from the perspective of speculation, it naturally has the famous “don’t be biased” theory. But looking at the market, most of what Ethscription and various “new technology concepts” on Bitcoin have come up with are direct copies of ETH Rock and CryptoPunks, and the most popular are still meme tokens. For example, the so-called first BRC-20 token imitation on Ethscription, $ETHS, has no index, no trading market, and not even a tech document like BRC-20. It sells for as high as 100U per sheet offsite. When I was writing this article, I even saw a KOL post a BRC-20 on BSC, and I searched Twitter and found only that KOL’s source of information, with a mint tutorial selling for $8…

Is this really a return to “idealism”?

Is “development” dependent on “market intervention”?

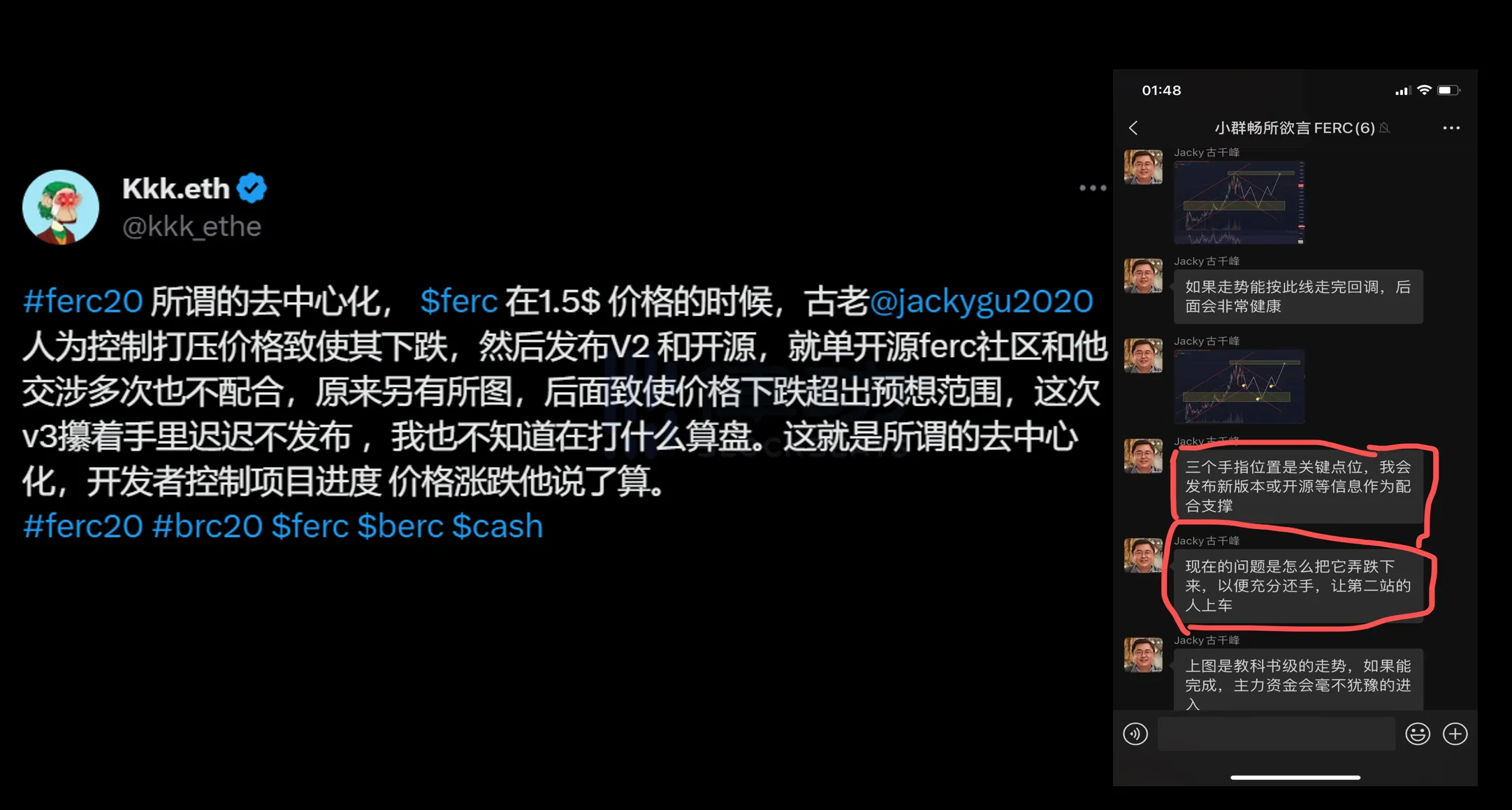

The narrative behind $FERC, which transplants the BRC-20 token issuance model to ETH, is “fairness and decentralization.” However, on June 19th, @kkk_ethe’s exposure sparked a discussion about $FERC developer Jackygu’s “market intervention.”

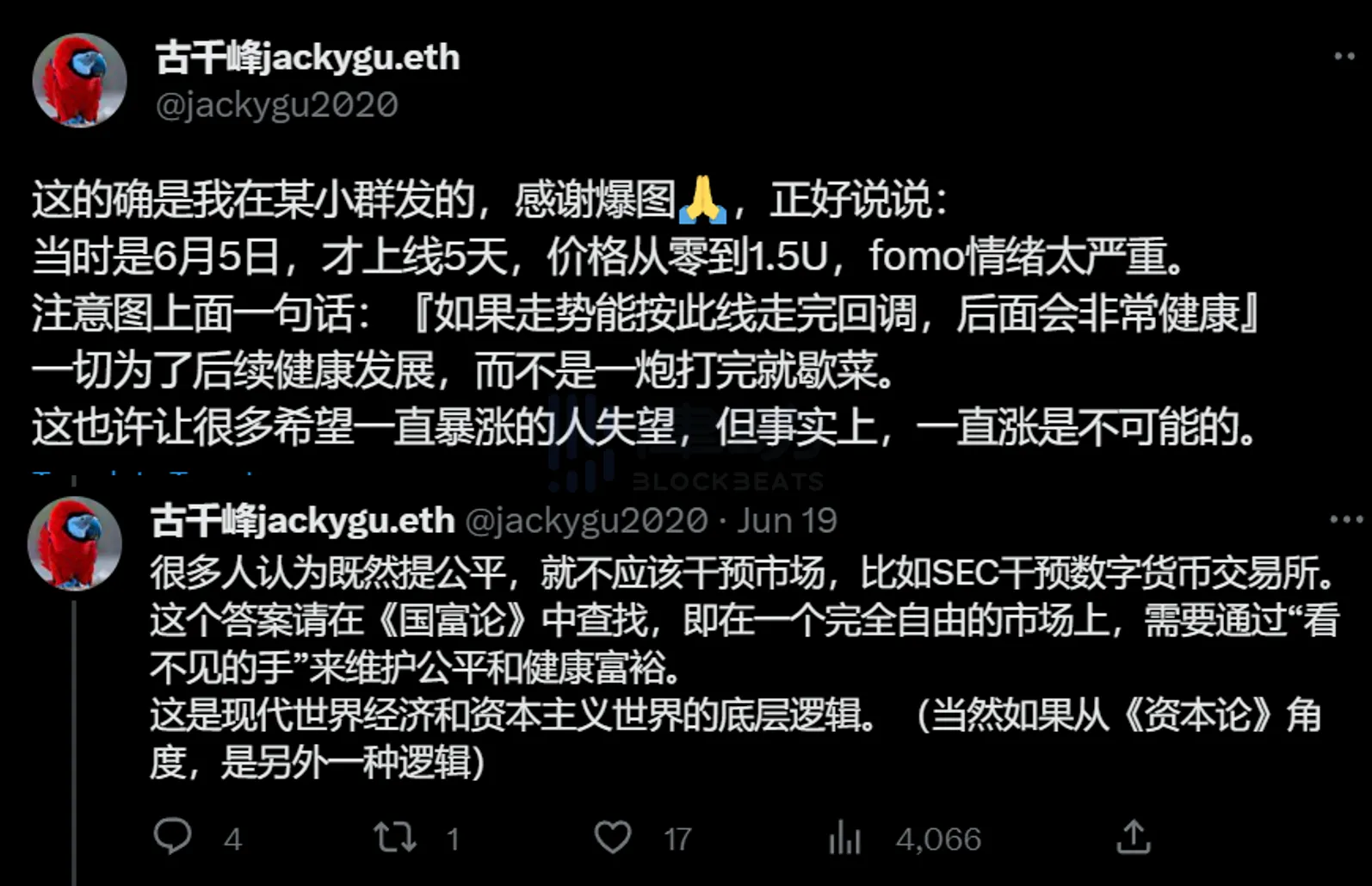

Jackygu’s response to this is:

Well… I’m sorry, I can’t understand it. I can only understand that the launch of $FERC was “fair.” But what’s even harder to understand is, can “market intervention” really achieve project development? Bitcoin, ETH, and even Doge, which one hasn’t experienced significant fluctuations? The ones that can’t be knocked down are getting stronger and stronger in the end.

In fact, the “consensus” that price fluctuations cannot dispel. The word “consensus” has been used so much that it is not about today when I buy, you buy, and we shout 100x together and wait for people to pick up the pieces, but about a genuine emotional connection and ideological resonance. Just like when Bitcoin was still very cheap, if you met someone on the street who also believed in Bitcoin, you might both light up and find each other interesting, which is a simple and direct manifestation of “consensus.” If there were no early selfless developers, no early real dreamers, could Bitcoin really have been tested for so long? If Bitcoin started to “intervene in the market” when it rose to $1, would it still have “healthy development” afterwards?

Many ETH NFT players are dissatisfied with various aspects of ETH NFTs today. There are indeed many “unfair” aspects of ETH, such as VC/CEX taking away a large amount of initial chips, whales “occupying” LaunchBlockingd, and meme tokens setting up a bunch of rules such as “blacklists” and “transaction taxes”…

However, these are not “technical” problems, but rather problems with “people”. In a decentralized world, it is ironic that we still use “decentralization” as the narrative of the project… We have come too far on the road to “making money”, and when can we go back, and do we really want to go back? Just like the “Take Token Movement” that has been mentioned all the time, if we unanimously say “no” with our actions, then the so-called “unfairness” will disappear, but the reality is not so.

Conclusion

At the end of the day, I am speechless. Let me end with the title:

The “NFT Regression” caused by Ordinals is not a return to idealism.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- AI robots are opening up new horizons

- AI can’t save 618 either.

- Understanding How Proto-Danksharding Accelerates Ethereum’s L1 Rollup Scalability

- Due to recent advancements, Web3 usernames may receive more adoption.

- TVL dilemma of ZkSync Era: The latecomers take the lead

- Inventory of the current state of the TreasureDAO ecosystem

- Bellevue Bank: Stablecoins and DeFi may become the next target of the SEC