Blockchain Industry Weekly: The total market capitalization of blockchain assets this week fell 18.89% from last week.

The total market capitalization of blockchain assets this week fell by 18.89 % compared with last week , and the market value of 93 projects in the TOP100 project fell to varying degrees . According to the coinmarketcap data, as of September 29, 2019, the total market value of global blockchain assets reached 215.962 billion US dollars, down 18.89% from the previous week. The total market value of the top 100 projects was 211.439 billion US dollars, a decrease of 19.22%. There are 3 new projects entering TOP100 this week, namely VITAE, FTT, MCO. On September 29th, Bitcoin price was $8194.19, down 18.63% from last week, and Ethereum was $170.5, down 19.4% from last week. The turnover of 24h this week decreased by 8.24% compared with the same period of last week; the total market value and average market value of physical property tokenization projects in TOP100 project decreased the least, and the global blockchain asset TOP100 project classification was stable.

This week, bitcoin computing power fell , Ethereum's computing power increased , bitcoin mining difficulty this week, Ethereum mining difficulty increased on a sequential basis; this week, bitcoin block average size increased , block average transaction times decreased , Ethereum The average size of the block increased , and the average number of transactions in the block decreased ; this week, the bitcoin miner fee decreased , and the Ethereum miner fee increased; INS is still the most active code item.

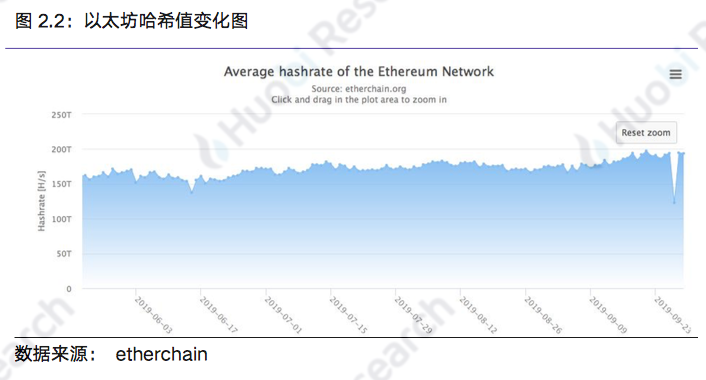

The average value of the bitcoin net hash value is 91.55EH/s, which is 1.17% lower than last week. The average value of the Ethereine network's hash value this week was 193.71 TH/s, which was 1.84% higher than last week. The difficulty of mining bitcoin this week remained at 12.03T, up 1.19% from last week. The average mining difficulty of Ethereum this week was 2451.547T, up 0.04% from the previous month; Bitcoin net output was 1036, down 4.69% from last week; Ethereum's total net output data for this week was 47167 The chain fell by 0.68%.

- Demystifying the top five reasons for Bitcoin's plunge

- Babbitt observation | Ask yourself with common sense, do you really need the privacy of the blockchain?

- Viewpoint | Will Bitcoin exacerbate the uneven distribution of wealth across the globe?

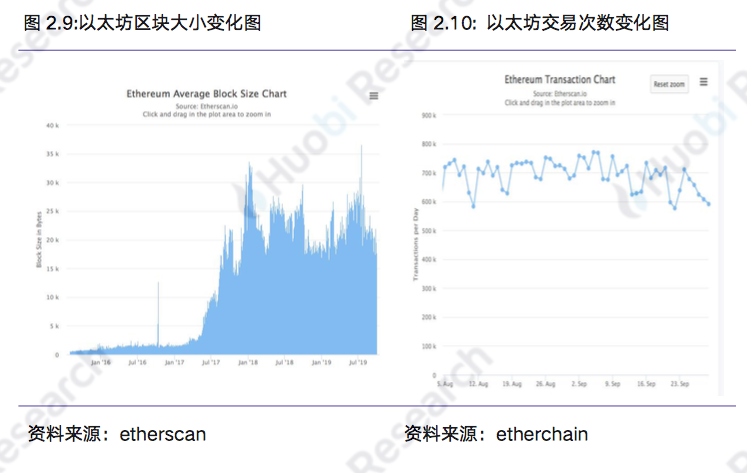

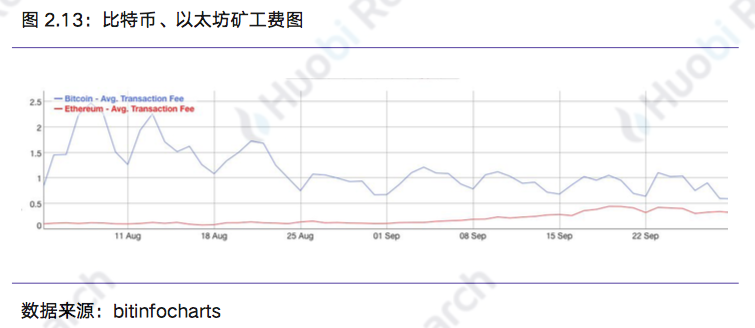

This week, the average size of the Bitcoin block increased, and the average number of transactions in the block decreased. The average size of the block in Ethereum increased, and the average number of transactions in the block decreased. According to blockchain.info data, from September 23 to September 29, 2019, Bitcoin averaged 1.04MB per block this week, up 0.97% from the previous month, and the average number of transactions per block was 2191. The chain fell by 0.32%. According to the calculation of the erasescan data, the average size of the entire network block of Ethereum this week was 17629bytes, up 2.12% from last week. According to the etherchain statistics, the average number of transactions per block this week was 100.87, down 3.70% from the previous month. This week, bitcoin miners’ fees have fallen, and Ethereum’s miners’ fees have risen. As of September 29, 2019, Bitcoin had an average miner's fee of 0.602 USD on the day, down 6.67% from the previous quarter. Each miner's fee in Ethereum was 0.347 USD, up 6.12% from the previous month. According to blockchain.info data, as of September 29, the total number of blockchain wallet users reached 42,215,640, up 0.29%, adding 121,940. According to the calculation of etherchain data, as of September 29, the total number of Ethereum addresses was 740,784,81, up 0.54%, and the number of new addresses was 401,330.

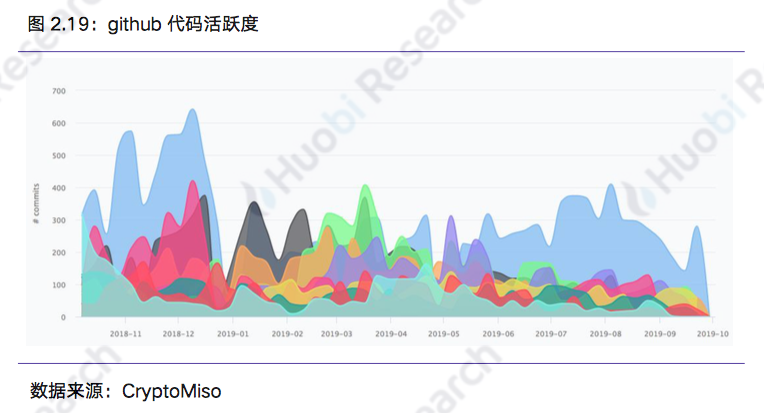

INS is the most active github code for this week. From September 23 to September 29, 2019, INS was the most active in the github code, with 282 commits this week.

In terms of community activity, Facebook's Tron, Bitcoin, and Ethereum's public homepages are ranked in the top three; in Twitter, the top three fans are Bitcoin, Ripple, and Tron.

This week, a total of two investment and financing projects in the blockchain industry were counted . TenzShield was invested by Angel Wheel and the cloud-like blockchain was invested by A+.

Report body

1. One week market review

1.1 Overall overview of the industry

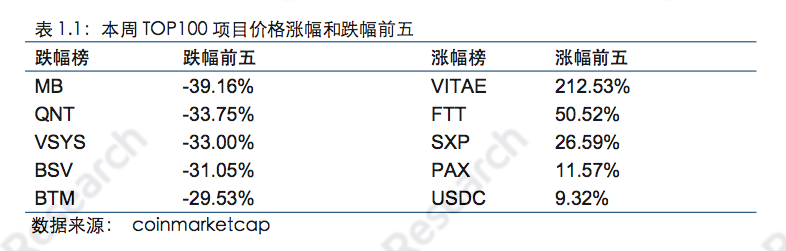

The total market capitalization of blockchain assets this week was down 18.96 % from last week , and the market value of 93 projects in the TOP100 project fell to varying degrees . According to the coinmarketcap data, as of September 29, 2019, the total market value of global blockchain assets reached 215.962 billion US dollars, down 18.96% from last week. The total market value of the top 100 projects was 211.439 billion US dollars, a decrease of 19.22%. Among them, VITAE has the largest increase in market value, the market value increased by 212.23% from last week, and the market value rose from 149th to 96th; Minebee (MB) had the largest decline in market value, down 39.16% from last week, and the market value decreased from 43 to 52 people. Three new projects entered TOP100 this week, namely MCO (MCO, market value fell 15.27%, ranking from 105 to 98), FTX Token (FTT, market value rose 50.52%, ranking increased from 139 to 49), Dynamic Trading (DTR, market value rose 6.18%, ranking from 106 to 92), VITAE (VITAE market value rose 212.33%, ranking from 149 to 96). The biggest increase in the TOP100 project this week was VITAE, which rose by 212.23%. The biggest price decline was Minebee, which fell by 3.916%. On September 29th, Bitcoin price was $8194.19, down 18.63% from last week, and Ethereum was $170.5, down 8.24% from last week.

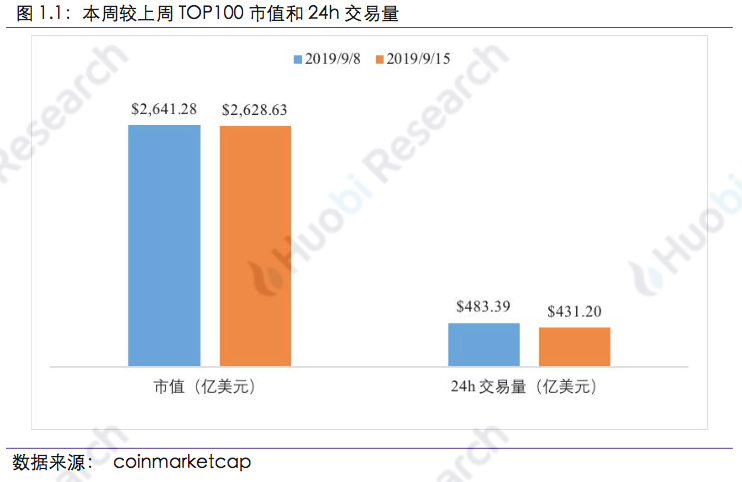

This week's 24h transaction volume decreased . On September 29, 2019, as a whole, the turnover of 24h decreased by 8.24% compared with the same period of last week. In this week, 33 of the TOP100 projects increased in 24h, and the 24h transaction volume of 24 projects increased by more than 20% this week. Twelve projects rose more than 50%, with the largest increase being NPXS, an increase of 525.65%. This week, 67 projects in the TOP100 project fell in 24h trading volume. The 24h trading volume of 32 projects fell more than 20% this week, and the 7 projects fell more than 50%, with the largest drop being MONA, with a drop of 68.82%.

This week's 24h transaction volume decreased . On September 29, 2019, as a whole, the turnover of 24h decreased by 8.24% compared with the same period of last week. In this week, 33 of the TOP100 projects increased in 24h, and the 24h transaction volume of 24 projects increased by more than 20% this week. Twelve projects rose more than 50%, with the largest increase being NPXS, an increase of 525.65%. This week, 67 projects in the TOP100 project fell in 24h trading volume. The 24h trading volume of 32 projects fell more than 20% this week, and the 7 projects fell more than 50%, with the largest drop being MONA, with a drop of 68.82%.

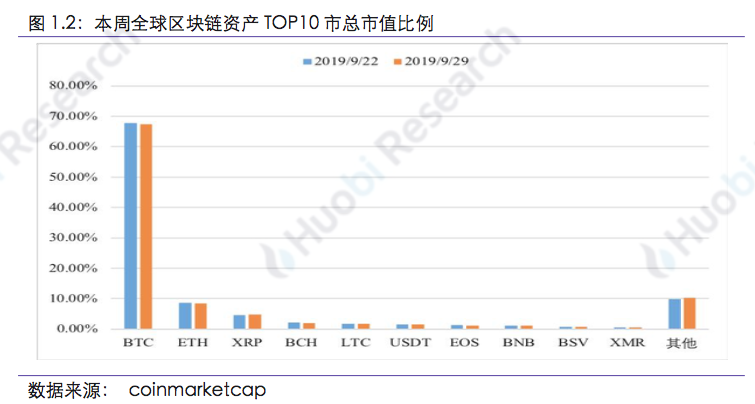

The market value of the TOP10 project fell , and the proportion remained stable . On September 29, the market value of TOP10 assets was US$193.58 billion, down 19.4% from last week, accounting for 89.64% of the total market capitalization of blockchain assets, down 0.54 percentage points from the previous month. The market value of the TOP10 project is basically stable. The market value of BTC this week accounted for 67.41%, which was 0.42 percentage points lower than that of last week.

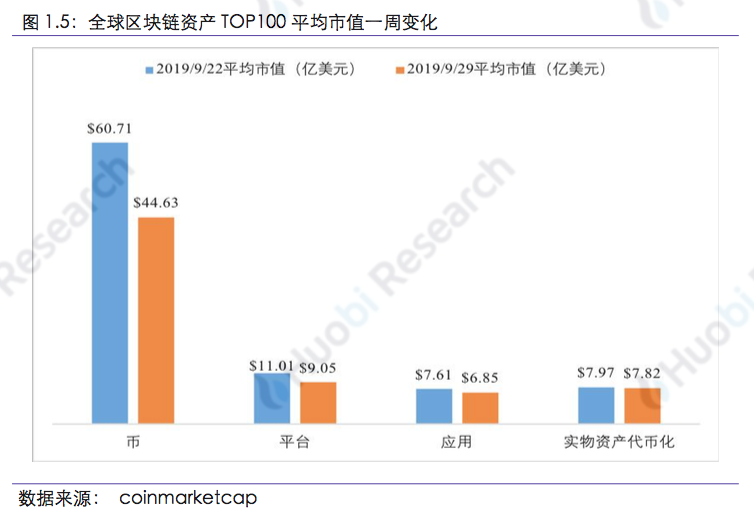

1.2 Performance of different types of projects In the OP 100 project, the total market value of physical assets and token- based projects decreased the least , and the average market value of coins decreased the most . On September 29, 2019, in the global blockchain asset TOP100 project, the total market value of the currency project was 160.657 billion US dollars, down 18.81% from the previous month, the average market value was 4.463 billion US dollars, down 26.49% from the previous month; the total market value of the platform projects was 262.31. US$100 million, down 20.60% from the previous month, with an average market value of US$905 million, down 17.87% from the previous month; the total market value of application projects was US$19.858 billion, down 15.81% from the previous month, with an average market value of US$685 million, down 10.01% from the previous month; The total market value of the certification project was 4.692 billion US dollars, down 1.83% from the previous month, and the average market value was 782 million US dollars, down 1.83% from the previous month.

1.2 Performance of different types of projects In the OP 100 project, the total market value of physical assets and token- based projects decreased the least , and the average market value of coins decreased the most . On September 29, 2019, in the global blockchain asset TOP100 project, the total market value of the currency project was 160.657 billion US dollars, down 18.81% from the previous month, the average market value was 4.463 billion US dollars, down 26.49% from the previous month; the total market value of the platform projects was 262.31. US$100 million, down 20.60% from the previous month, with an average market value of US$905 million, down 17.87% from the previous month; the total market value of application projects was US$19.858 billion, down 15.81% from the previous month, with an average market value of US$685 million, down 10.01% from the previous month; The total market value of the certification project was 4.692 billion US dollars, down 1.83% from the previous month, and the average market value was 782 million US dollars, down 1.83% from the previous month.

This week, the global blockchain asset TOP100 project classification is stable. On September 22, 2019, among the top 100 projects in the market capitalization, the number of currency projects increased by three, the number of applied projects decreased by three, and the number of physical asset tokenization projects was unchanged. The market value accounted for the largest proportion of coins, accounting for 76.54%.

This week, the global blockchain asset TOP100 project classification is stable. On September 22, 2019, among the top 100 projects in the market capitalization, the number of currency projects increased by three, the number of applied projects decreased by three, and the number of physical asset tokenization projects was unchanged. The market value accounted for the largest proportion of coins, accounting for 76.54%.

Note: The Firecoin Blockchain Application Research Institute divides it into four categories: “coin”, “platform”, “application” and “physical assets pass” according to the different attributes of the blockchain assets. Coin: refers to a type of asset developed based on blockchain technology that does not correspond to a specific usage scenario and whose main function is only the transaction target. The asset value is mainly reflected by liquidity;

Note: The Firecoin Blockchain Application Research Institute divides it into four categories: “coin”, “platform”, “application” and “physical assets pass” according to the different attributes of the blockchain assets. Coin: refers to a type of asset developed based on blockchain technology that does not correspond to a specific usage scenario and whose main function is only the transaction target. The asset value is mainly reflected by liquidity; Platform: refers to a class of assets that are related to the underlying technology development of the blockchain and supported by the use rights or participation rights of such platforms;

Application: refers to a type of asset that is associated with a specific application scenario and is supported by certain usage rights, participation rights, or dividends;

Pass-through of physical assets: refers to a class of assets that are linked to actual assets such as gold and the US dollar and supported by the value of physical assets.

2. Technical ability analysis

2.1 Analysis of the difficulty and benefit of cryptocurrency production

This week, bitcoin computing power fell, and Ethereum’s computing power increased. From September 23 to September 29, 2019, the average value of the bitcoin net hash value was 91.55 EH/s, which was 1.17% lower than last week. The average value of the Ethereine network's hash value this week was 193.71 TH/s, which was 1.84% higher than last week.

The difficulty of mining bitcoin this week and the difficulty of mining in Ethereum all increased. As of September 29, Bitcoin's mining difficulty remained at 12.032T this week, up 1.19% from last week. The average difficulty of mining in the Ethereum network this week was 2451.547T, an increase of 0.04% from the previous month.

The difficulty of mining bitcoin this week and the difficulty of mining in Ethereum all increased. As of September 29, Bitcoin's mining difficulty remained at 12.032T this week, up 1.19% from last week. The average difficulty of mining in the Ethereum network this week was 2451.547T, an increase of 0.04% from the previous month.

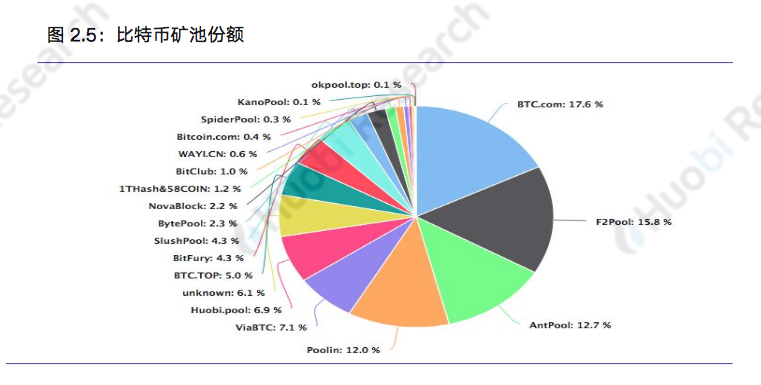

Bitcoin's total number of weekly net exports fell by 4.69 %, ViaBTC ranked higher, SlushPool ranked lower, F2Pool, AntPool, and SlushPool ranked unchanged ; Ethereum mining pool, the number of blocks dropped by 1.27 %, the top five ranked higher The week does not change . In the past week, the data of Bitcoin's entire network was 1036, down 4.69% from last week. The top five were BTC.com, F2Pool, AntPool, Poolin, and ViaBTC, respectively, 182, 164, 132, 124, 74. The proportions were 17.57%, 15.83%, 12.74%, 11.97% and 7.14%, and the computational powers were 15.94EH/s, 14.37EH/s, 11.56EH/s, 10.86EH/s and 6.48EH/s, respectively. In the past week, the total data of Ethereum's entire network was 47,167, down 0.68% from the previous month. Among them, the top five mining pools are SparkPool, Ethermine, F2pool_2, Nanopool and zhizhu.top, with blocks of 14000, 9922, 5399, 4637 and 2190, accounting for 29.68%, 21.03%, 11.44%, 9.83% and 4.63%.

Bitcoin's total number of weekly net exports fell by 4.69 %, ViaBTC ranked higher, SlushPool ranked lower, F2Pool, AntPool, and SlushPool ranked unchanged ; Ethereum mining pool, the number of blocks dropped by 1.27 %, the top five ranked higher The week does not change . In the past week, the data of Bitcoin's entire network was 1036, down 4.69% from last week. The top five were BTC.com, F2Pool, AntPool, Poolin, and ViaBTC, respectively, 182, 164, 132, 124, 74. The proportions were 17.57%, 15.83%, 12.74%, 11.97% and 7.14%, and the computational powers were 15.94EH/s, 14.37EH/s, 11.56EH/s, 10.86EH/s and 6.48EH/s, respectively. In the past week, the total data of Ethereum's entire network was 47,167, down 0.68% from the previous month. Among them, the top five mining pools are SparkPool, Ethermine, F2pool_2, Nanopool and zhizhu.top, with blocks of 14000, 9922, 5399, 4637 and 2190, accounting for 29.68%, 21.03%, 11.44%, 9.83% and 4.63%.

2.2 Activity statistics This week, the average size of the Bitcoin block increased , and the average number of transactions in the block decreased . The average size of the block in Ethereum increased , and the average number of transactions in the block decreased . According to blockchain.info data, from September 23 to September 29, 2019, Bitcoin averaged 1.04MB per block this week, up 0.97% from the previous month, and the average number of transactions per block was 2191. The chain fell by 0.32%.

2.2 Activity statistics This week, the average size of the Bitcoin block increased , and the average number of transactions in the block decreased . The average size of the block in Ethereum increased , and the average number of transactions in the block decreased . According to blockchain.info data, from September 23 to September 29, 2019, Bitcoin averaged 1.04MB per block this week, up 0.97% from the previous month, and the average number of transactions per block was 2191. The chain fell by 0.32%.

According to the calculation of the erasescan data, the average size of the entire network block of Ethereum this week was 17629bytes, up 2.12% from last week. According to the etherchain statistics, the average number of transactions per block this week was 100.87, down 3.70% from the previous month.

According to the calculation of the erasescan data, the average size of the entire network block of Ethereum this week was 17629bytes, up 2.12% from last week. According to the etherchain statistics, the average number of transactions per block this week was 100.87, down 3.70% from the previous month.

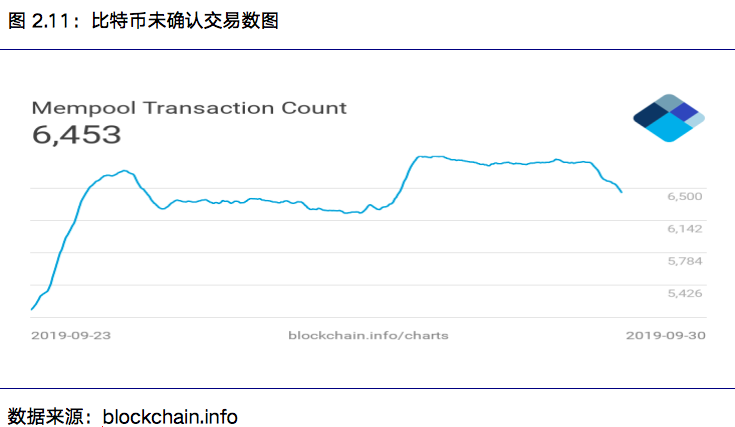

The average number of unconfirmed transactions in Bitcoin increased by 25.01 % this week, and the average number of unconfirmed transactions in Ethereum fell by 12.4 %. As of September 29, the average number of unconfirmed transactions in Bitcoin for 7 days was 6,453, up 25.01% from the previous quarter. The average number of 7-day unconfirmed transactions in Ethereum was 64170.361, down 12.40% from the previous month, with the lowest value being 4293 and the highest value reaching 97682.

The average number of unconfirmed transactions in Bitcoin increased by 25.01 % this week, and the average number of unconfirmed transactions in Ethereum fell by 12.4 %. As of September 29, the average number of unconfirmed transactions in Bitcoin for 7 days was 6,453, up 25.01% from the previous quarter. The average number of 7-day unconfirmed transactions in Ethereum was 64170.361, down 12.40% from the previous month, with the lowest value being 4293 and the highest value reaching 97682.

This week, bitcoin miners’ fees have fallen , and Ethereum’s miners’ fees have risen. As of September 29, 2019, Bitcoin had an average miner's fee of 0.602 USD on the day, down 6.67% from the previous quarter. Each miner's fee in Ethereum was 0.347 USD, up 6.12% from the previous month.

This week, bitcoin miners’ fees have fallen , and Ethereum’s miners’ fees have risen. As of September 29, 2019, Bitcoin had an average miner's fee of 0.602 USD on the day, down 6.67% from the previous quarter. Each miner's fee in Ethereum was 0.347 USD, up 6.12% from the previous month.

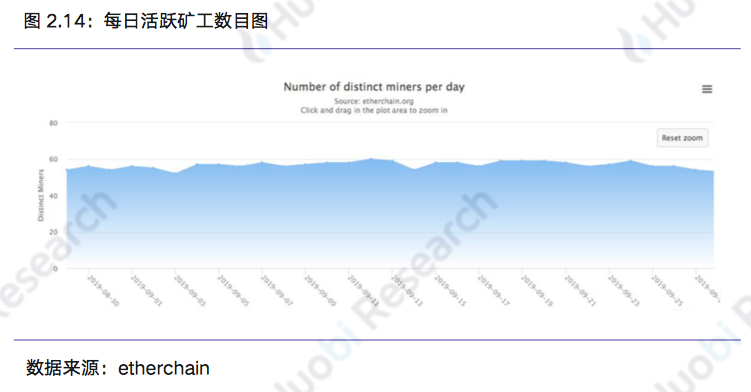

The average number of active miners in Ethereum declined this week. From September 23 to September 29, 2019, the average number of active miners in Ethereum was 56.57, down 2.21% from last week's average (58).

The average number of active miners in Ethereum declined this week. From September 23 to September 29, 2019, the average number of active miners in Ethereum was 56.57, down 2.21% from last week's average (58).

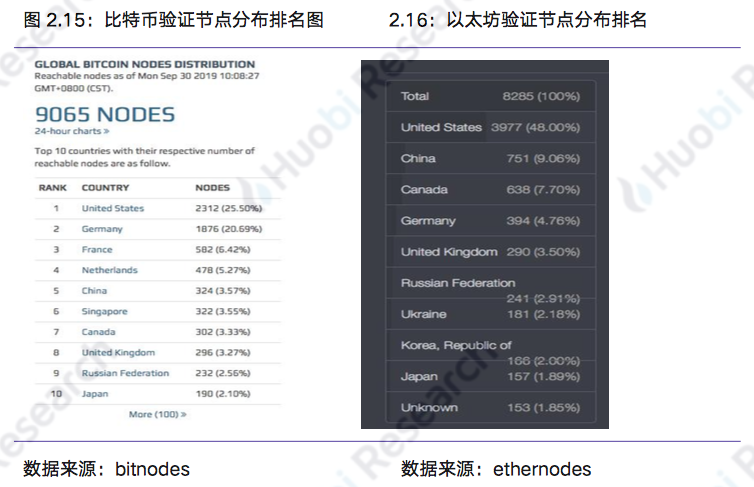

The number of Bitcoin verification nodes decreased, and the number of Ethereum verification nodes increased. As of September 29, 2019, the number of Bitcoin verification nodes reached 9065, a decrease of 2.86% from the previous month, of which 2,312 nodes in the United States accounted for 25.5%; Germany had 1,876 nodes, accounting for 20.69%; China ranked fifth, with 342 nodes, accounting for 3.57%. On September 29, the Ethereum global verification node reached 8,285, an increase of 0.80% from the previous month, of which 3977 nodes in the United States accounted for 48.00%, China had 751 nodes, accounting for 9.06%, and Canada had 638 nodes, accounting for 7.70. %.

The number of Bitcoin verification nodes decreased, and the number of Ethereum verification nodes increased. As of September 29, 2019, the number of Bitcoin verification nodes reached 9065, a decrease of 2.86% from the previous month, of which 2,312 nodes in the United States accounted for 25.5%; Germany had 1,876 nodes, accounting for 20.69%; China ranked fifth, with 342 nodes, accounting for 3.57%. On September 29, the Ethereum global verification node reached 8,285, an increase of 0.80% from the previous month, of which 3977 nodes in the United States accounted for 48.00%, China had 751 nodes, accounting for 9.06%, and Canada had 638 nodes, accounting for 7.70. %.

The total number of Bitcoin users and Ethereum addresses increased this week. According to blockchain.info data, as of September 29, the total number of blockchain wallet users reached 42,215,640, up 0.29%, adding 121,940. According to the calculation of etherchain data, as of September 29, the total number of Ethereum addresses was 740,784,81, up 0.54%, and the number of new addresses was 401,330.

The total number of Bitcoin users and Ethereum addresses increased this week. According to blockchain.info data, as of September 29, the total number of blockchain wallet users reached 42,215,640, up 0.29%, adding 121,940. According to the calculation of etherchain data, as of September 29, the total number of Ethereum addresses was 740,784,81, up 0.54%, and the number of new addresses was 401,330.

INS is the most active github code for this week. From September 23 to September 29, 2019, INS was the most active in the github code, with 282 commits this week.

2.3 Community Activity Statistics As of September 29, 2019, Facebook's Tron, Bitcoin, and Ethereum 's public homepages ranked the top three, with 980,000 , 494,000, and 156,000 fans. In Twitter, the top three fans are Bitcoin, Ripple (XRP) and TRON , with a total of 983,000, 939,000 and 469,000.

2.3 Community Activity Statistics As of September 29, 2019, Facebook's Tron, Bitcoin, and Ethereum 's public homepages ranked the top three, with 980,000 , 494,000, and 156,000 fans. In Twitter, the top three fans are Bitcoin, Ripple (XRP) and TRON , with a total of 983,000, 939,000 and 469,000.

3. Blockchain Weekly News

3.1 Industry Applications

1. ConsenSys and WWF launch charity transparent platform

ConsenSys, a blockchain created by current ETH co-founder Joseph Rubin, and the Impacto platform jointly launched by the World Wide Fund for Nature (WWF) bring transparency to philanthropy. According to a announcement released on September 24th, a new partnership between ConsenSys and WWF led to an Ethereum blockchain-based platform called Empio, which is designed to oversee and fund projects in NGOs and independent companies. . The driving force of the program is to track how the company's funds are used in social impact projects. In early September, it was reported that the New York non-profit NGO Rainforest Foundation US in Central and South America hoped to support anti-forest deforestation through encryption and blockchain technology. Binance Charity, a charity at Bince, a large cryptocurrency exchange, also started a campaign to help support Hurricane Dorian.

2. Australian startups will provide 20% return on investment through token purchases of fuel

Australian start-up Incent plans to buy fuel at the United Petrol gas station for a limited time, providing a 20% return on investment with INCIN tokens. Incent announced in a press release that was released on September 26th, and attendees will have registered on the platform to get tokens to synchronize their bank accounts. The company also claims that the crypto asset in question is "the first cryptocurrency in all purchases made by Australia at the United Gasoline Station." It is reported that United Gasoline has more than 450 gas stations in Australia. According to the press release, the advantage of the system relative to the points issued by the classic company is that these tokens cannot be depreciated or stopped by the company and there is no plastic card.

3. Animoca brand will develop blockchain-based MotoGP Manager game

Blockchain and artificial intelligence company Animoca Brands Corporation Limited has partnered with sports management company Dorna Sports, SL to develop a blockchain-based MotoGP manager game. According to a press release shared with Cointelegraph on September 26, Animoca Brands completed a strategic investment and raised a $1 million ($677,600) investment, including the founder of AP Capital and Moses Tang, founding chairman of Goldman Sachs Asia Pacific. The company plans to use part of the funds to promote manager games.

4. MediConnect completes PoC to track drugs throughout the supply chain

Blockchain startup MediConnect has completed a proof of concept (PoC) workflow designed to track drugs in the supply chain and begin integrating the online pharmacy UK Meds process into its platform. Based on a press release shared with Cointelegraph on September 26th, MediConnect established the foundation and methodology for proof-of-concept finalization, which will enable the tracking and management of prescription drugs throughout the supply chain from manufacturer to end user. MediConnect also plans to complete a pilot program in 2020 that includes up to 10 participants. As part of the trial, MediConnect integrated the online pharmacy UK Meds process into its blockchain-based platform to track products and prevent the abuse of prescription drugs through its supply chain.

5. Unilever said that its blockchain advertising purchase pilot saved the company money

According to a report released on September 26, Unilever Luis Di Como's executive vice president of global media told advertising news campaign that the use of blockchain helped the company save money. The consumer packaged goods giant said that the media investment in the pilot project did not leak. The system is reported to allow for more efficient ad reconciliations in the "Advertisers ensure that the actual contractual agreement is delivered". In the past 18 months, Unilever has been working with the computing giant IBM on the project. It is estimated that Unilever uses a blockchain platform to save 2-3%.

3.2 International policy

1. ECB President: Stabilizing coins and cryptocurrencies are not suitable for alternative currencies

On September 27th, European Central Bank President Mario Draghi pointed out in a letter to European Parliament member Eva Kaili that the European Central Bank System (ESCB) is closely monitoring the cryptocurrency industry. development of. Draghi added: “ESCB is analyzing crypto assets and stable currencies to understand its potential impact on monetary policy, payment and market infrastructure security and efficiency, and financial system stability.” Despite the positive attitude towards new technologies, Della Kyrgyzstan clearly believes that the stability of the currency and the cryptocurrency is generally not high. “So far, stable currency and crypto assets have had limited impact in these areas, and they have not been designed to make them a suitable substitute for money,” he said. Draghi added, thanks to continued technological innovation in the cryptocurrency industry. Rapid development, the ECB's assessment may be different in the future.

2. Brazilian regulators prohibit foreign exchange brokers from offering BTC options

Cointelegraph Brasil reported on September 25 that the Brazilian Securities Commission (CVM) has banned forex brokers from offering bitcoin (BTC) options. On September 25th, CVM issued a public warning about XM Global Limited's violations through the Director of Market and Intermediary (SMI) Relations. CVM noted in the warning that XM Global Limited does not have the right to operate in Brazil or to deal with customers residing in Brazil. CVM ordered an immediate suspension of investment products in the foreign exchange or derivatives sector. If this condition is not met, the company will be fined 1,000 reais per day ($239). Brazil's Cointelegraph reported that XM is the main trading platform, but Brazil banned the foreign exchange market and no company was authorized to sell such options in the country. The company began trading Bitcoin against the US dollar in 2017. As Cointelegraph reported at the end of August, Thai securities regulators also warned the public that counterfeit entities pretend to be legitimate digital currency trading companies operating overseas.

3. Six Swiss exchanges postpone the launch of blockchain-driven digital exchanges

The Swiss SIX Swiss Exchange has delayed the release of its “fully regulated” encrypted trading platform, SIX Digital Exchange (SDX). According to an official announcement issued on September 23, SIX has launched a prototype of its digital trading platform and Central Securities Depository (CSD). It is now expected to be fully launched in the fourth quarter of 2020. SDX was first announced in July last year and is scheduled to be launched in mid-2019. At the time, there was a press release stating that SDX intends to be "a fully integrated transaction, settlement and hosting infrastructure for digital assets," which it claims is the world's first "providing fully integrated end-to-end transaction, settlement and hosting services." ".

4. Uzbekistan government triples electricity bill for encrypted miners

In the government of Uzbekistan has ordered a 300% increase in cryptocurrency miners for electricity. According to a declaration on September 27, the Cabinet of Ministers of the Republic of Uzbekistan has issued a decree that cryptocurrency miners must pay three times the existing electricity tariffs. This provision is a decree issued by President Shavkat Mirziyoyev on August 22, 2019, entitled “Accelerating measures to improve energy efficiency in the economic and social sectors, implementing energy-efficient technologies and developing renewable energy” and further stimulating rational use. The energy of electricity consumers. In September last year, Mirziyoyev ordered the establishment of a national blockchain development fund called “Digital Trust”. The fund's main goal is to integrate the blockchain into a variety of government programs, including healthcare, education and culture. The organization will be responsible for international investment in the Uzbek digital economy. At the beginning of the same month, a decree that legalized cryptographic transactions (also making it tax-free) came into force in the country. According to the law, foreign citizens can only trade cryptocurrencies in Uzbekistan by establishing subsidiaries in Uzbekistan.

3.3 Technical progress

1. 10,000 nodes operate BTC lightning network at new historical high levels

According to the real-time LN statistical site 1ML, the number of Bitcoin (BTC) Lightning Network (LN) nodes reached 10,000 for the first time. According to 1ML data, the number of nodes on LN has increased by 3.17% in the past 30 days. As of press time, this number reached a record 10,003 network nodes. At the same time, as of press time, the number of nodes with active channels was 5,975, which was only 0.34% higher than the total number of channels totaling 36,246. LN is a Layer 2 blockchain protocol designed to provide high-speed transactions for Bitcoin, where nodes are independent payment channels between parties, allowing them to send and receive BTCs between each other. When asked what features should be added to LN to attract more BTC users, the spokesperson chose atomic multi-path payment, which is said to play an important role in the Bitcoin ATM. They added: "For the widespread adoption of lightning networks, it is important to have software that integrates wallets with accounting functions."

4. Primary market investment and financing dynamics

This week, a total of two investment and financing projects in the blockchain industry were counted . TenzShield was invested by Angel Wheel and the cloud-like blockchain was invested by A+.

Disclaimer

1. The Firecoin Blockchain Research Institute does not have any relationship with the digital assets or other third parties involved in this report that affects the objectivity, independence and impartiality of the report.

2. The information and data cited in this report are from the compliance channel. The source of the data and data is considered reliable by the Firecoin Blockchain Research Institute and has been verified for its authenticity, accuracy and completeness. However, the Firecoin Blockchain Institute does not guarantee any authenticity, accuracy or completeness.

3. The contents of the report are for reference only, and the facts and opinions in the report do not constitute any investment advice for the relevant digital assets. The Firecoin Blockchain Institute shall not be liable for any damages resulting from the use of this report, except as required by laws and regulations. Readers should not make investment decisions based solely on this report, nor should they rely on the ability of this report to lose independent judgment.

4. The information, opinions and speculations contained in this report only reflect the judgment of the researcher on the date of the final report. In the future, based on industry changes and the updating of data information, there is the possibility of updating opinions and judgments.

5. The copyright of this report is only owned by the Firecoin Blockchain Research Institute. If you want to quote the contents of this report, please indicate the source. If you need a large reference, please inform in advance and use it within the allowable range. Under no circumstances may any reference, abridgement or modification of this report be made in any way.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A hundred years of loneliness – the magical realism of the renminbi

- Babbitt column | People may be wrong in the search for blockchain 3.0

- The market is getting colder, the exchanges are getting stronger and stronger, and the bulls and bears are unimpeded. I am waiting for you in Wuzhen.

- Mining from entry to mastery (3): POW mining logic process

- The first week of Bakkt: not warm, the future can be expected

- Popular Science | Eth2.0 Term Decryption

- Babbitt column | Payment or stored value? BTC's future value path