Demystifying the top five reasons for Bitcoin's plunge

Guide

The BTC high-level shock continued for nearly three months and eventually evolved into an air force carnival. BTC fell below $9,000 in the early hours of September 25, and the 24-hour drop was as high as 15%, the biggest one-day drop in the year. For a time, the market has different opinions on the reasons for the plunge. We summarized the five reasons for the most market-recognized BTC plunge and analyzed the root cause of the BTC decline.

Summary

Topic: The BTC recorded the largest single-day drop in the year, which could cause the BTC to fall for five reasons. Guess one: Bakkt futures are on the line, the market fever is not up to expectations. Analysis: Bakkt has a higher threshold for opening accounts, and the willingness of institutional investors to enter the market is not clear, but it will benefit the digital pass market for a long time. Guess 2: Quantum computers will subvert cryptography. Analysis: Quantum computers are not omnipotent. There are anti-quantum encryption algorithms. Guess 3: The computing power plummets, and regulation is coming. Analysis: The average daily computing power has not fallen sharply, and regulatory risks have always existed. Guess 4: The futures delivery day effect caused the BTC to fall. Analysis: The decline is the release of the accumulated risk in the previous period, not caused by futures delivery. Guess five: impeaching the president led to a fall in risky assets. Analysis: The correlation between BTC and risk assets has yet to be verified. The above five reasons have not caused substantial negative impact on BTC. The decline is the normal release of market risk, and the callback space is limited.

- Babbitt observation | Ask yourself with common sense, do you really need the privacy of the blockchain?

- Viewpoint | Will Bitcoin exacerbate the uneven distribution of wealth across the globe?

- A hundred years of loneliness – the magical realism of the renminbi

Quotes: Below the medium-term support, the rebound is weak. The total market value of digital passes this week was US$222.04 billion, down 19.1% from last week's decline of 52.28 billion US dollars; the average daily turnover was US$63.94 billion, up 11.4% from last week. The current price of BTC is 8252 US dollars, the weekly decline is 19.0%, the average daily turnover rate is 11.2%; the current price of ETH is 174.7 US dollars, the weekly decline is 19.9%, and the average daily turnover rate is 43.6%. This week, the exchange's BTC balance was 883,000, an increase of 7672 from last week. The exchange's ETH balance was 9.245 million, a decrease of 149,000 from last week. In the BICS secondary industry, the market value of the stable pass industry rose from 1.9% to 2.4%.

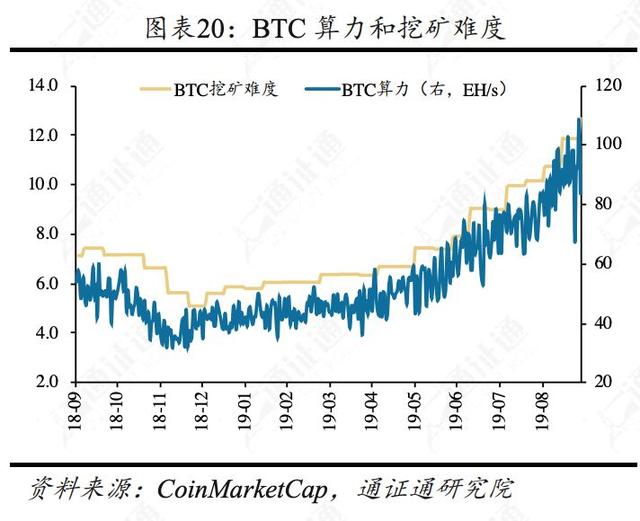

Output and heat: The difficulty of BTC has surged, the computing power has dropped, and public attention has increased slightly. BTC this week mining difficulty is 12.76T, an increase of 0.87T, the average daily computing power is 91.5EH / s; ETH mining this week difficulty 2482, an increase of 58 from last week, the average daily power of 195.8TH / S.

Industry: The plunge has not changed the prospects of blockchain technology. Bakkt futures market performance is unsatisfactory, Wall Street may be involved in a few months; CFTC Chairman: Blockchain technology is promising, do not want to lag behind other countries due to lack of supervision; SEC has begun to evaluate Wilshire Phoenix BTC ETF; former BTC core developer : Google's quantum computer breakthrough is not a threat to the encryption pass.

Risk warning: regulatory policy risk, market trend risk

text

1 Topic: Demystifying the five reasons why the BTC plummeted

The BTC high-level shock continued for nearly three months and eventually evolved into an air force carnival. BTC fell below $9,000 on the night of September 25, with a one-day drop of 12.95% and a low of $7,700, the biggest one-day drop in the year. For a time, the market has different opinions on why BTC has plummeted. We have summarized five reasons for the high degree of credibility and analyzed the real reasons behind the decline in BTC.

1.1 Guess one: Bakkt futures market performance did not meet expectations

Bakkt, the digital exchange of the New York Stock Exchange's parent company ICE, began trading on September 23. Bakkt's investors include Victoria Harbour Investment, Naspers, Microsoft Venture Capital M12, Boston Consulting, Galaxy Digital and other well-known institutions, which attracted the attention of investors before going online. Bakkt's characteristics include compliance with regulations, physical delivery, etc., which is considered by the market to be a super-profit for pushing BTC prices to continue to rise, and institutional funds will have more formal access channels.

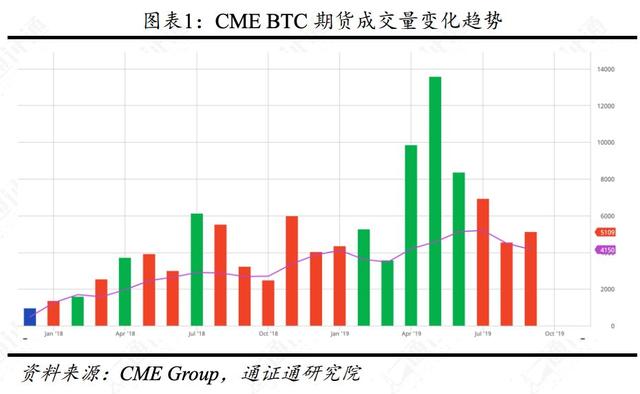

However, the volume of Bakkt is far less than the market expectation. After the launch on September 23, the monthly trading volume of Bakkt BTC was only 71 BTCs, and the legal currency was less than 700,000 US dollars, far less than the volume of existing BTC futures products such as CME, OKEX, Huobi DM, etc., less than CME. One percent of the $70 million turnover of BTC futures listed within 12 hours. On the 24th, Bakkt's trading volume was further reduced, and the monthly futures trading volume was only over 10 BTCs. Bakkt's bleak picture after going online is far less than the market expectation. Some investors interpret it as the institutional investor's interest in BTC is not as strong as expected, and led to the full-scale diving in the digital pass market in the early morning of the 25th.

Why is Bakkt trading volume bleak? First, Bakkt is a compliant SEC-regulated compliant futures exchange with a relatively high threshold for opening accounts . Bakkt requires traders to open an account with ICE Clear US registered futures commissioner (FCM, Future Commsion Merchant), including Citibank, HSBC, JP Morgan, Morgan Stanley and other famous institutions. These FCMs generally have more cooperation with institutional investors, while ordinary individual investors need to open transactions through brokers, with high barriers to entry and complicated procedures.

Secondly, BTC has seen a large increase since the beginning of the year, and institutional investors are mostly in the wait-and-see stage . BTC has risen more than 300% since March this year. It has accumulated more profitables. The investment style of institutional investors is more mature and stable. Even if there is a large amount of incremental funds, it will not instantly enter the market to raise the price of BTC. .

Finally, Bakkt is also facing competition from many similar products . Investment instruments such as BTC Futures on the Chicago Mercantile Exchange (CME), BTC Trust Fund on Grayscale, and Exchange Traded Instruments (ETN) are subject to strict regulation by their local regulations and are highly compliant, making them a good choice for BTC investment. . In May 2019, the daily average transaction volume of CME BTC futures has exceeded 1 billion US dollars, and the positions have reached more than 5,000 BTCs, which has occupied the top spot in the futures trading market. It is difficult for Bakkt to want to "catch up".

Bakkt's core strength lies in physical settlement, and the listing of Bakkt futures is a long-term positive for BTC. Major BTC futures contract products such as CME and BitMEX are delivered in cash. They do not involve physical delivery of BTC. Bakkt can attract institutional investors who wish to directly hold BTC physical goods through legal compliance. After solving the problem of compliant access, the next challenge for the organization is the safe preservation of BTC. The special hosting company established by Bakkt provides BTC hosting services for futures, and has corresponding security measures and insurance purchases. Although Bakkt has certain differentiation and advantages compared with existing futures contract products, it still takes time for institutional funds to enter the market. Switching from other exchanges to Bakkt also requires cost. In the short term, the low volume of Bakkt futures is normal and cannot be Explain that institutional investors have insufficient confidence in the future of BTC and do not constitute a substantial negative for BTC.

1.2 Guess 2: Google Quantum Computer will subvert the encryption pass?

On September 22, 2019, Google researchers released the latest research on quantum computers on NASA's official website, saying that Google Quantum Computer completed the world's most advanced supercomputer "Summit" in just 3 minutes and 20 seconds. The computing power of a specific computing task that can be completed in a million years can be increased by a billion times.

Quantum computers are considered to be the biggest threat to modern encryption algorithms such as elliptic curves. Because the computing speed is much faster than the classic computer, many encryption algorithms that are currently considered to be computationally safe will be broken by the quantum computer in a short time, which is the basis of the security of the encryption pass. Not only digital certificates, but all systems based on asymmetric encryption algorithms will no longer be secure, which will affect most applications and Internet infrastructure that rely on modern communications, such as bank transfers, online payments, and website logins.

"Quantum hegemony" is also difficult to implement.

On the one hand, quantum computers are not capable of efficiently performing all types of computing tasks. Just as a classic computer needs to perform a calculation for a particular "algorithm" of a type of computational problem, the quantum computer also needs to find a corresponding "quantum algorithm" to perform the task efficiently. Modern asymmetric cryptographic algorithms rely mainly on efficient classical algorithms that do not address a specific class of mathematical problems, such as implicit subgroup problems (including basic factorization problems of RSA, fundamental discrete logarithm problems of elliptic curves), lattice-based (Lattice The encryption system, etc., the time required for a classic computer to solve such problems increases exponentially with the size of the problem, but as long as the specific secret knowledge (key) is mastered, it can be quickly solved, so it is suitable for the encryption algorithm. For the former class of implicit subgroups, quantum computers already have efficient quantum algorithms. They also have exponential acceleration compared to classical algorithms, such as the Shor algorithm for factorization, but not for all encryption algorithms, quantum computers can be indexed. Level to improve calculation efficiency.

On the other hand, quantum computing is not only a "spear" to break through the traditional encryption system, but also a "shield" to establish a quantum security system. The theoretical design and algorithm research of quantum computer is far ahead of actual production. Google's quantum computer is more than a billion times faster than traditional computers for specific computing tasks, but it needs to crack the current elliptic curve encryption of 256 bits. Still not enough. The study of quantum computing will also spawn a number of encryption algorithms that resist quantum computing, such as cryptography based on number theory and lattice. If quantum computers are used on a large scale, anti-quantum encryption algorithms will inevitably be on the stage.

Quantum computing is not the "flooding beast" of modern cryptography. People also have enough technical reserves to deal with the impact of quantum computers on the encryption system. The decentralized encryption certificate such as BTC only needs to pass the community consensus and upgrade the anti-quantum encryption algorithm, so there is no fear that the security of the certificate system will be threatened.

1.3 Guess 3: The computing power plummets, the mine and OTC supervision is coming?

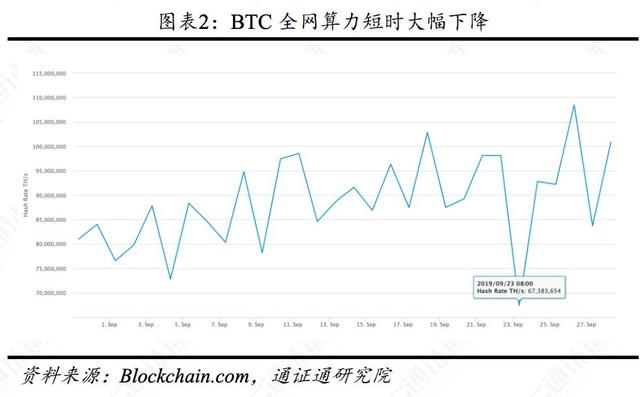

On September 24, 2019, the day before the BTC plunged, Emin G ̈n Sirer, a professor of computer science at Cornell University and a digital pass-through expert, posted on Twitter that BTC's computing power plummeted from over 100EH/s to 67.38EH/ s. This data caused panic in the market, and people worried that a problem in the BTC network would lead to the loss of a large number of miners. There are even rumors in China that the mines in Sichuan and other places will be investigated, which is why the BTC's computing power has dropped drastically.

However, on the second day after the plunge, the BTC network computing power rebounded to 108.5EH/s, setting a record high, and such rumors will not break. The computing power of the BTC network is difficult to directly count. At present, the main data websites are estimated by the BTC network difficulty and the average block time of nearly N blocks. Therefore, the most likely cause of the collapse of the estimated power estimate is the reason. It is the BTC's block time that has been greatly extended, probably due to the temporary migration of large mines.

The “94” event in 2017 has a profound impact on the blockchain industry. The state has identified 1C0, crowdfunding, etc. as illegal financing. On September 13, the China Internet Finance Association issued the "Tips for preventing the so-called "virtual currency" risks such as Bitcoin. The biggest drop in BTC on that day reached 20%, and the low of 2970 dollars was the lowest point in the next two years. This proves that BTC has a certain value base as a decentralized payment means and its back blockchain technology.

Domestic netizens also found that Li Lin, CEO of the Firecoin Global Station, recently emptied all of his history Weibo, and sent a circle of friends to clarify that he is worried about account security. However, this move is inevitably fascinating. The 1994-four years ago made the blockchain practitioners a star-studded bird, fearing that the blockchain industry would be reorganized again. BTC mining and off-exchange OTC trading is currently a gray area of domestic regulation, which is related to the output of BTC and the channel of deposit and withdrawal in the market. It is not unreasonable to think that the loss of power or regulatory risks has caused the BTC to drop this time.

1.4 Guess 4: Futures delivery day effect caused BTC to fall

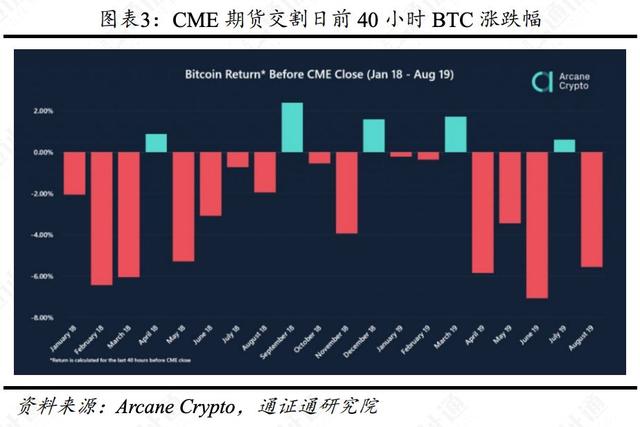

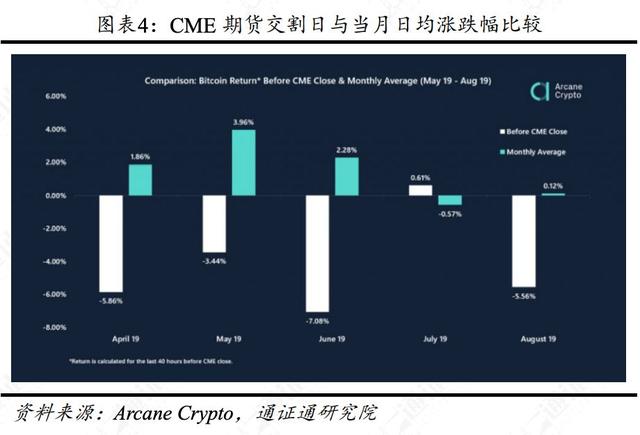

Arcane Crypto's research shows that BTC prices have a clear downside expectation on CME futures delivery dates. On the 20 delivery days after the CME futures were listed, the BTC fell on 15 delivery days, with an average decline of 2.27% in the 40 hours before the delivery date. The rise and fall of the last five months before the delivery date were -5.86%, -3.44%, -7.08%, 0.61% and -5.56%, while BTC achieved a large increase in April-June 2019.

But this plunge occurred in the early hours of Wednesday, neither nearing the CME futures delivery date nor the delivery date of the domestic futures contract. There is no reason to simply classify futures delivery as the culprit of the plunge. The root cause of this BTC plunge is the accumulation of a large number of contract positions near the $9000 in the long-term shock consolidation market. Before the plunge, the long-term position ratio of domestic mainstream platform futures contracts even reached 6:4, while the BTC price failed to break through the pressure level, resulting in the exhaustion of buying power. Unbalanced long-short ratios also caused panic and chain selling when BTC prices began to fall, resulting in a $TC fall in BTC overnight and a contraction of billions of dollars in contracts.

1.5 Guess 5: The Democratic Party advocates impeaching the president, risk assets fall

On September 23, the US House of Representatives Speaker and Democrat Pelosi said that the House of Representatives will officially launch an impeachment investigation against the current US President Trump. Trump was accused of asking Ukrainian prosecutors to restart investigations into corruption cases involving the Democratic presidential candidate Biden, in a call with Ukraine’s new president, Zelensky, and was suspected of interfering in the US election.

Affected by this news, risk assets such as US stocks and US dollar index fell, while gold rose sharply to $1,535/oz. There is a view that the logic of BTC decline is similar. But this reason is also far-fetched. BTC is known as “digital gold”, but it has a low correlation with the performance of Trump’s impeachment. On the contrary, after the BTC’s 25-day plunge, gold also launched a round of correction. The rising trend of safe-haven assets is short-term or difficult to continue.

1.6 The callback space is limited, and the long-term bull market is not expected to change.

Looking at the above five reasons, in addition to the potential domestic regulatory risks, there is no substantial negative impact on BTC. The listing of Bakkt futures has a long-term effect on boosting the market confidence of BTC. This decline is a repair of the market's bullish sentiment in the first half of the year, and it is also the release of the accumulated risk. At present, there are less than eight months from the halving of BTC. BTC has long-term moving average support at 7,000-7,500 US dollars, and there is limited room for further decline.

2 Quotes: Below the medium-term support, the rebound is weak

2.1 Overall market: fell below the medium-term support, weak rebound

The total market value of digital passes this week was $22.04 billion, down 19.1% from last week's decline of $52.28 billion. BTC fell below the medium-term support level of 9,000 US dollars. After falling to 7750 US dollars, the rebound is weak, and the market may test the long-term support of the 240-day line and the annual line.

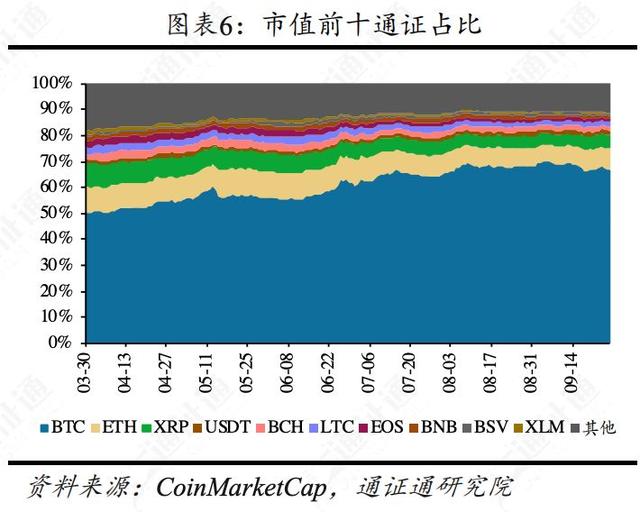

The average daily trading volume of the digital pass market was US$63.94 billion, up 11.4% from last week, and the average daily turnover was 27%, up 6% from last week. The market value of BTC accounted for 66.8%, which has declined.

This week, the exchange's BTC balance was 883,000, an increase of 7672 from last week. The exchange's ETH balance was 9.245 million, a decrease of 149,000 from last week. The exchange's BTC balance showed an increasing trend, and the selling pressure on the market was aggravated.

The USDT market value was $4.151 billion, an increase of $38.5 million from last week. The USDT premium rate is 1.0%. The USDT has a small premium outside the market, indicating that the funds are more willing to enter the market.

2.2 Core Pass: The main circulation certificate dive, before the price returns to the bull market

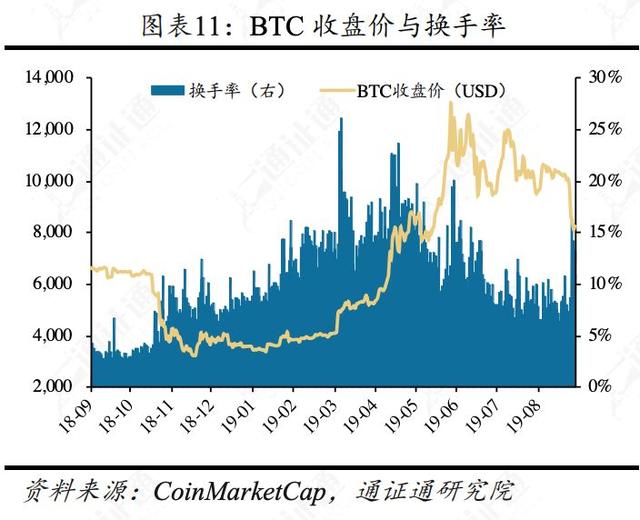

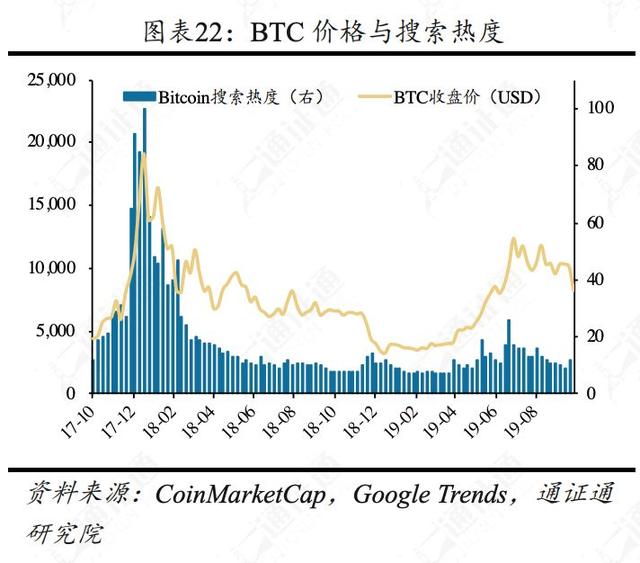

The current price of BTC is 8252 US dollars, with a weekly decline of 19.0% and a monthly decline of 15.4%. The average daily trading volume of BTC this week was 17.7 billion US dollars, and the average daily turnover rate was 11.2%. The BTC's heavy volume fell, which was more than 40% lower than the high point. The short-term shape needs time to repair.

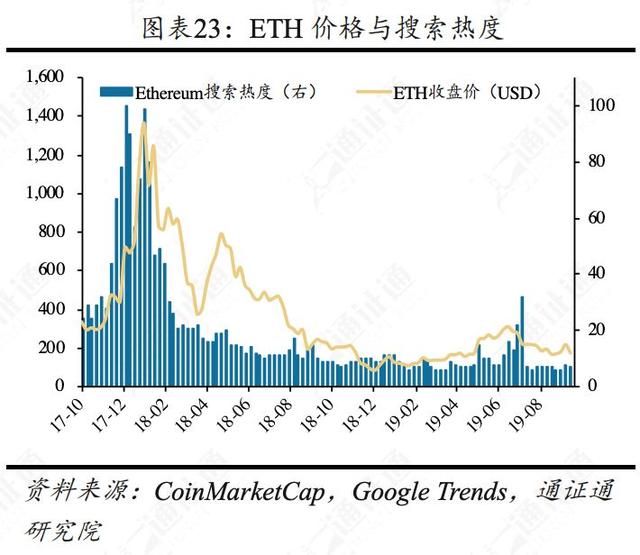

The current price of ETH is $174.7, a weekly decline of 19.9%, and a monthly increase of 0.5%. The average daily trading volume of ETH this week was 8.62 billion US dollars, and the average daily turnover rate was 43.6%. ETH completely retreated from the rebound in the previous two weeks and hit a new low of $145 in the second half of the year.

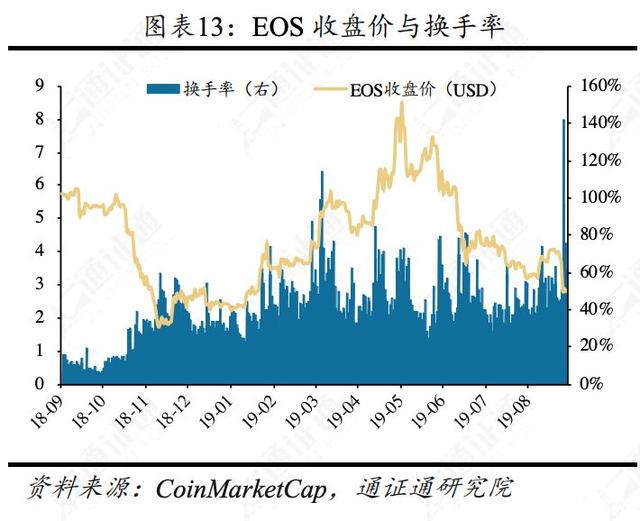

EOS is currently at $2.86, down 28.7% for the week and down 13.1% for the month. The average daily trading volume of EOS this week was 2.15 billion US dollars, and the average daily turnover rate was 73.7%. The EOS main network upgrade was well received and sold off.

The current price of XRP is 0.244 US dollars, with a weekly decline of 17.1% and a monthly decline of 5.2%. The average daily volume of XRP this week was $1.51 billion, with a daily average turnover rate of 13.8%. The XRP trend was weak and once again hit a new low in the year.

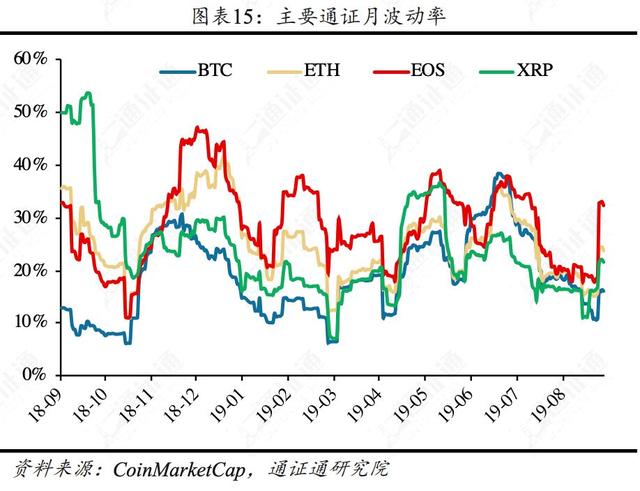

The volatility of the main pass increased sharply this week . The monthly volatility of BTC was 16.0%, up 5.3% from last week. The ethical volatility was 23.8%, up 8.7% from last week. The EOS monthly volatility was 32.4%. Last week, it rose by 14.2%; XRP monthly volatility was 21.6%, up 5.5% from last week. Declined slightly.

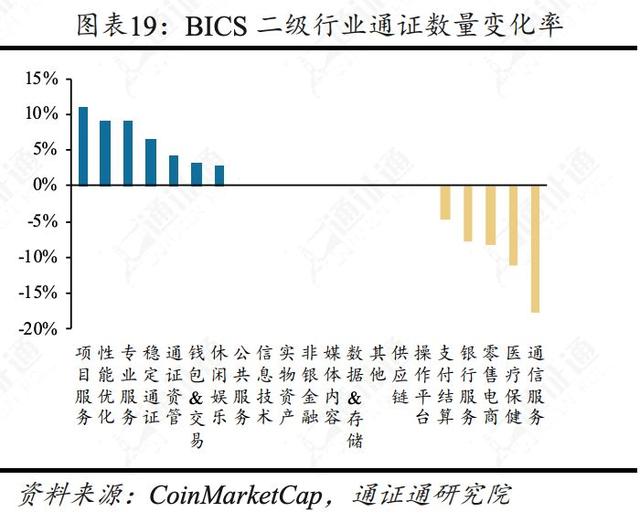

2.3 BICS industry: affected by the plunge, the market value of the stable pass rose sharply

In the secondary industry of BICS (Blockchain Industry Classification Standard), the market value of stable pass increased from 1.9% to 2.4%, an increase of 26%; the proportion of professional services market value increased. 42%. The decline in the market value of health care and data storage is more obvious.

The BICS secondary industry with more obvious increase in the number of passes this week is the project service and performance optimization; the BICS secondary industries with relatively obvious decline in the number of passes are payment settlement, communication services and medical care, respectively, down 4 from last week. One, three, one.

2.4 Market View: BTC is again “decapitated” and short-term bearish sentiment is high

The BTC briefly stopped falling after receiving five daily K-yin lines this week, but the rebound was weak and the short-term bearish atmosphere in the market was high. BTC's decline after three months of consolidation has some inertia. If it can't break through MA5 in the short term, it may continue to go down the five-day line, paying attention to the strength of support around $7,500.

Although the market has identified many reasons for the collapse of BTC, these news did not cause substantial negative impact on BTC. This decline is a repair of the market's bullish sentiment in the first half of the year, and it is also the release of the accumulated risk. At present, there are less than eight months from the halving of BTC. BTC has long-term moving average support at 7,000-7,500 US dollars, and there is limited room for further decline.

In the long run, BTC production is near, and the market's recent bad news has been digested. Our judgment on the early stage of BTC in the bull market has not changed, and investors can do a good job of asset allocation based on their own situation.

3 Output and heat: BTC is experiencing a sharp increase in difficulty, computing power is falling, and public attention is rising.

The difficulty of BTC mining has soared, and the daily average power has dropped. The difficulty of mining this week is 12.76T, which is 0.87T. The average daily power is 91.5EH/s, down 0.16EH/s from last week. The difficulty of mining this week is 2,483, which is 58% higher than last week. The force is 195.8TH/S, which is 0.6TH/S higher than last week.

This week, Google Trends's Bitcoin entry search heat was 12, and the Ethereum entry search heat was 7, and the plunge caused a slight increase in BTC search heat.

4 Industry News: The collapse has not changed the prospects of blockchain technology

4.1 Bakkt futures performance is not satisfactory, whether Wall Street will intervene is still unclear

The CEO of the BTC futures platform Bakkt, the chief executive of the Intercontinental Exchange, said that BTC futures will be settled in spot BTC instead of cash. Daily news reports that BTC prices have risen or fallen, but BTC will not receive true global recognition until institutional investors can enter the market in a compliant manner. He believes that it will take several months for Wall Street to get involved in the BTC market to be clear.

4.2 CFTC Chairman: Blockchain technology is promising and does not want to lag behind other countries due to lack of supervision

Heath Tarbert, chairman of the US Commodity Futures Trading Commission (CFTC), said in an interview with CNBC that the blockchain technology behind BTC and other digital assets is promising. He does not want to see strategic competition from other countries, such as China or the United States. Opponents develop faster than the United States because the United States does not currently have an appropriate regulatory framework.

4.3 SEC has begun to evaluate Wilshire Phoenix Bitcoin ETF

According to a public document released on Tuesday, the US Securities and Exchange Commission (SEC) has begun to evaluate proposed rule changes to determine whether to allow the New York Stock Exchange Arca to list and trade Wilshire Phoenix's BTC ETF. The ETF will allow investors to access both BTC and US Treasury bonds. From now on, the SEC will need to make a decision within 35 days.

The reason why the BTC ETF failed to pass was that there was concern about the manipulation of Bitcoin in the cryptocurrency market, and there was no clear way to prevent fraud and protect the interests of investors. Therefore, in order to pass the BTC ETF, regulators and exchanges need to address the risks and regulatory issues in the current cryptocurrency market.

4.4 Former BTC Core Developer: Google's Quantum Computer Breakdown Is Not a Threat to Encryption

Formerly BTC core developer Peter Todd made a different opinion on Google’s claim that its quantum computer has achieved “quantum hegemony”. Todd said: "This is meaningless, because Google's quantum breakthrough is for a primitive type of quantum computing, and this calculation is far from breaking cryptography. We don't even know if quantum computers are likely to scale." Google researchers Previously published in a paper published on the NASA website, Google's quantum computer was able to perform calculations that took 10,000 years to complete today's most powerful supercomputer Summit in 3 minutes and 20 seconds. Researchers say this means that Google's quantum computers have achieved "quantum hegemony."

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | People may be wrong in the search for blockchain 3.0

- The market is getting colder, the exchanges are getting stronger and stronger, and the bulls and bears are unimpeded. I am waiting for you in Wuzhen.

- Mining from entry to mastery (3): POW mining logic process

- The first week of Bakkt: not warm, the future can be expected

- Popular Science | Eth2.0 Term Decryption

- Babbitt column | Payment or stored value? BTC's future value path

- Deep adjustment period of mining industry: Bitcoin's overall network computing power has changed rapidly in the short-term mining machine pattern