Deep adjustment period of mining industry: Bitcoin's overall network computing power has changed rapidly in the short-term mining machine pattern

Recently, the price of Bitcoin continued to fall, from around 12,000 US dollars on the left high (August 6) to around US$ 8,100 in recent days (September 29), and the drop in 54 days was about 32.5%. On the other hand, the overall network computing power also showed a short-term decline. BitInfoCharts showed that bitcoin's total network computing power fell to a low point on September 27, which was about 79.9EH/S, which was 19.3% lower than the recent high of 99.1EH/S on September 16. According to media reports, the instantaneous power of the whole network fell to 67EH/S on September 23, with the biggest drop of about 34%.

The price of coins and the power of calculations have fallen, and the panic in the market is pervasive. Will Bitcoin continue to fall? Does the decline in computing power mean that the mining boom is no longer there? From the correlation between currency prices and computing power, where is mining now? How will the future develop?

PAData Inghts:

- Zcash masks address vulnerabilities or reveals full node IP address (with solution)

- About digital asset hosting services, you want to know are here.

- Who is the "Whampoa Military Academy" in the field of blockchain in China?

The mining machine "Big Three" may have changed

Bitcoin, Jianan Zhizhi and Yibang International are the “Big Three” among the mining machine manufacturers. Last year, three companies sought listings on the Hong Kong Stock Exchange. Although they all ended in failure, the “Big Three” had a lot of profit in the last round of bull market. However, according to the latest mining profitability rankings, in addition to the ant's mining machine in Bitland is still in the forefront, Jianan Zhizhi and Yibang International's mining machines have fallen out of the top ten .

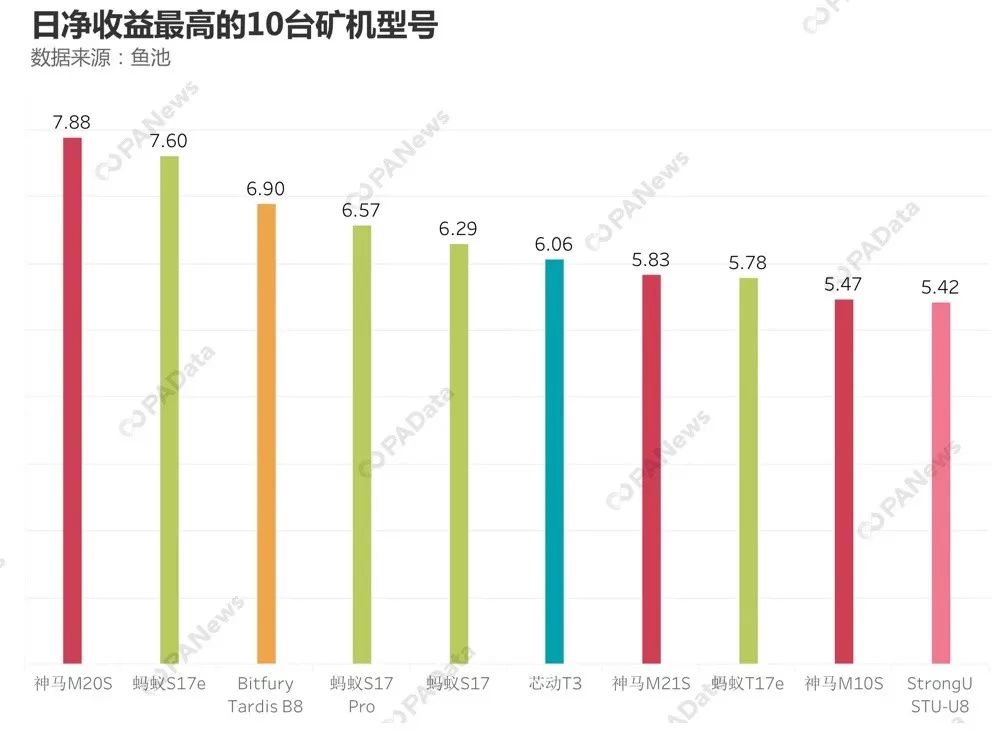

The profitability of mining machines reflects the R&D and innovation capabilities of mining machine manufacturers to a certain extent, which is crucial for any technology company. According to the statistics of the list, when the electricity bill is 0.04 US dollars / kWh, the single net gain of a single mining machine is the Shenma M205 mining machine under Bit Micro, which has reached about 7.88 US dollars. Followed by Bitland's ant S17e, the daily net income per unit is about 7.60 US dollars, and the foreign mining machine manufacturer Bitfury's Tardis B8 also reached a single daily net income of 6.90 US dollars.

Among the top 10 mining machines with the highest daily net income, Bitcoin still performed the strongest. The ant mining machine series accounted for 4 seats, followed by Bitmicro's Shenma series, which accounted for 3 seats. In addition, Core Dynamic Technology, Bitfury and Strong U each occupy one seat. However, Jianan Zhizhi's Avalon mining machine and Yibang International's Wingbit Mining machine did not enter the top 10 of the profit list.

Judging from the ranking of the list, the pattern of the “Big Three” has been loosened, and new mining machine manufacturers are grabbing the market.

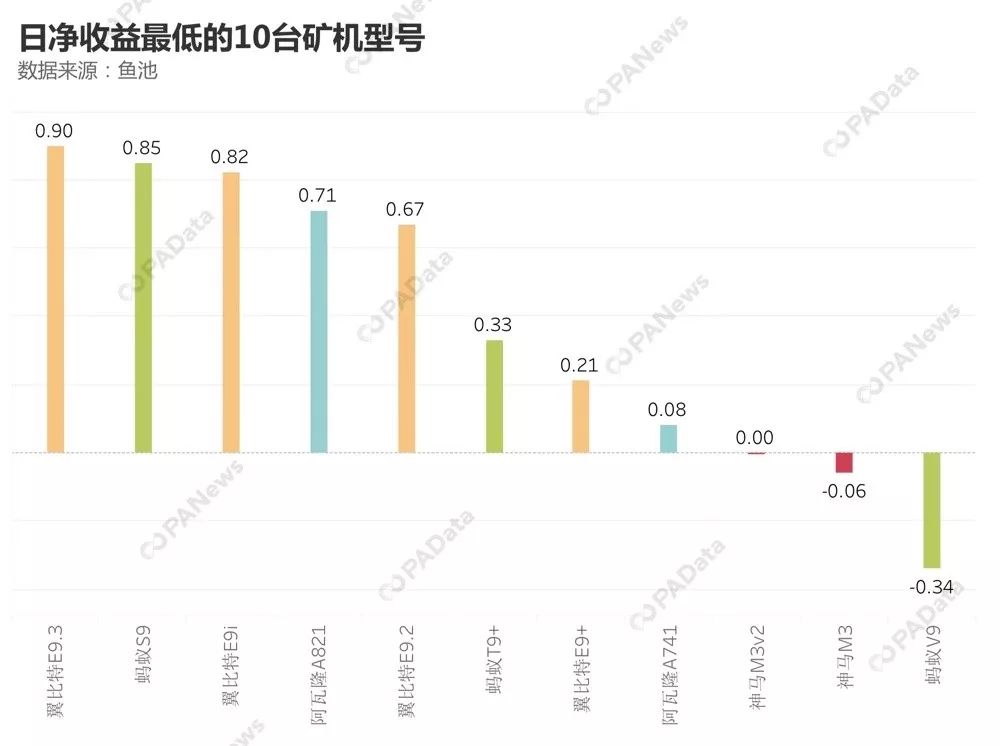

According to the current currency price, there are already 2 mine machines that will lose money when they start up. They are Shenma M3 and Ant V9. The net income per day is -0.06 US dollars and -0.34 US dollars respectively. Shenma M3v2 is also close to loss. The net income per day is close to $0. In addition, wing net E9.3, ant S9, wing bit E9i, Avalon A821, wing bit E9.2, ant T9+, wing bit E9+, Avalon A741 single net income are also less than 1 dollar. These 10 models of mining machines are the most profitable in the market.

It can be seen that the mining machines with the worst profitability in the market are mainly from the early mining products of Bitian, Jianan, and Yibang International. The power of these mining machines is mostly lower than 15T, and it is very likely that they have already been mined by miners. The replacement market is upgraded to a new product, and the actual market share may be extremely low. Therefore, according to the current currency level, the mining industry is still profitable and may still be considerable.

Mining is at the end of the adjustment period

When PAData observed the Bitcoin mining cycle earlier, it was found that from the relationship between the bitcoin price and the computing power in the past ten years, the development of the mining industry has a three-year periodicity, with a main profit period of about 1 year and 2 years. The adjustment period consists of the left and right.

The main profit period refers to the increase in the calculation power over a period of time is less than the increase in the price of the currency (the slope of the blue function in the above figure > the slope of the red function), the period in which the mining obtains excess profits, and conversely, the increase in the calculation power over time. If the increase is greater than the price of the currency (the slope of the blue function in the above figure < the slope of the red function), the drop in mining profit is an adjustment period. From January 2010 to June 2011, from May 2013 to December 2013 and from January 2017 to December 2017, it was the three main profit periods in the past decade, from July 2011 to April 2013. From January 2014 to December 2016, it is an adjustment period. From January 2018, it will enter the latest round of adjustment period.

Judging from the relationship between the growth of the currency price and the calculation power this year, the increase of the calculation power is obviously larger than the increase of the currency price. It is still in the adjustment period starting from January 2018, and there is no special situation of the reverse cycle. However, according to the adjustment period of about 2 years in history, it is currently at the end of this round of adjustment period.

If the time range of observation is narrowed down, it can be seen from the inside of the current adjustment period that a small profit period has occurred during the large adjustment period. From the beginning of April to the beginning of July this year, the price of the currency rose rapidly, and the increase exceeded the increase in computing power during the same period, forming a small profit period. However, since the negative price of the currency has increased, the computing power has returned to 96EH/S from the low point (September 27th). The increase in the price of the currency is significantly less than the increase in the calculation power, and the mining industry is still returning to the adjustment period.

The CEO of BTC.com, head of the head mine pool, said in an interview with PANews earlier that the mining industry does have such a cyclical law on the surface, but the formation mechanism behind it is very complicated, and it will be subject to the mining machine production cycle, chip development cycle and so on. The impact of the external environment.

Rising difficulty is an inevitable trend

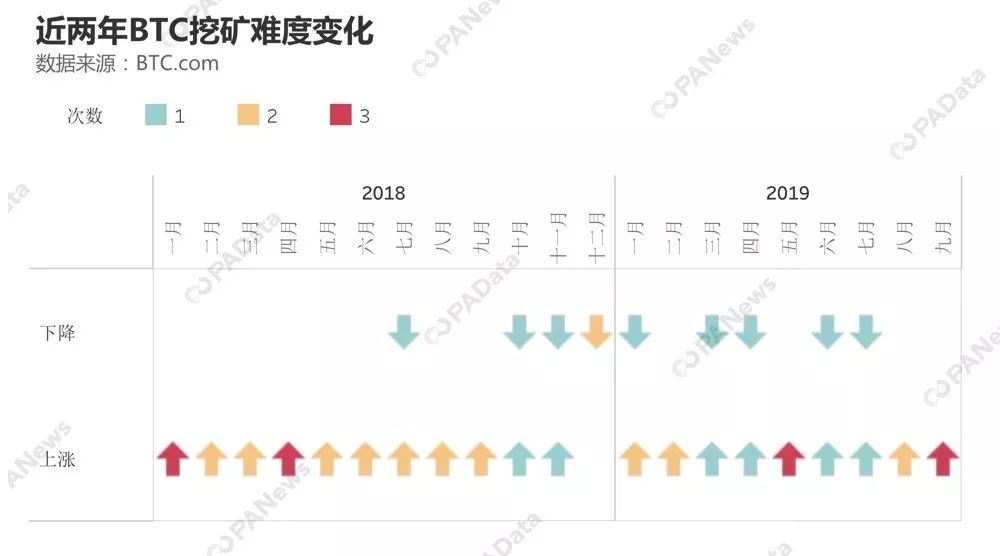

PAData counts the number of difficulty adjustments during the current adjustment period. It can be seen that only in the one month of December 2018, the difficulty is lowered twice in a single month, and the difficulty in the 12-month single month is only raised. Most of the time, The number of difficulty adjustments in a single month is also more than the number of downward adjustments.

Rising difficulty does not mean that the price of the currency rises, or the rise in the price of the currency does not mean that the difficulty rises. According to the statistics of PAData earlier, there is no statistical correlation between the change of mining difficulty and the price of the currency (refer to "Who is blowing" Bull Market Charge? 》 ). For example, from January to April 2018, the difficulty of each month is continuously increased by 2-3 times, but the price of the currency has already fallen from the highest point in the same period. At this time, the difficulty is still raised because the price of the currency increases when the price of the currency increases at the end of 2017. the result of. Similarly, there is a continuous increase in the difficulty of mining for five times from August to September this year.

Howard Marx, the co-chairman and founder of Oak Capital, believes that a series of events in the cycle have a causal relationship in the book Cycle. In the mining cycle, the rise in the price of the currency – the increase in computing power – constitutes a causal chain reaction. However, the process of triggering the causal reaction mechanism has a certain lag. Zhuang Zhong also said in the interview that he saw the price of the currency from the market began to mine, and there will be a time lag of about two to three months in the middle.

Therefore, the market does not need to over-interpret the continuous upward adjustment of the difficulty of mining in the near future. From the historical cycle, this may be the lag effect brought by the short-term small profit period in the current round of adjustment period. Moreover, the calculation power of the new mining machine will only be higher and higher. For example, the Bitfury Tardis B8 has reached 80T, the Shenma M20S has reached 68T, and the ant S17e has reached 64T. The inevitable result of the new mining machine being put into use is that the whole network has increased in computing power. From this perspective, in the long run, it is almost inevitable that the difficulty will continue to rise.

Text, data and visualization | Carol

Edit | Bi Yi Tong Source | PANews.io

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpretation of the Ethereum Yellow Book (3): The Economic Mechanism behind Gas and Transaction Fees

- Libra Utopia and China's Legal Digital Currency Opportunity

- New Plan of Ant Blockchain and New Trends of BAT Blockchain Strategy

- Interpretation of the most popular asset valuation model in the encryption circle EoE: MV=PQ

- Mining from entry to proficiency (2): mining form summary and investment priority

- Market analysis on September 30: BTC weekly line is not optimistic, you need to be cautious when you are long

- Encrypted Notes | Harmony proposes the "impossible four corners" theory, the extended dilemma enhanced version