Libra Utopia and China's Legal Digital Currency Opportunity

introduction

text

1. Libra-led private enterprise currency trend

- New Plan of Ant Blockchain and New Trends of BAT Blockchain Strategy

- Interpretation of the most popular asset valuation model in the encryption circle EoE: MV=PQ

- Mining from entry to proficiency (2): mining form summary and investment priority

Before the emergence of Libra, a stable currency, a series of stable coins had already occupied a certain market. According to the collateral, it can be divided into stable tokens based on legal currency mortgages (such as USDT), stable tokens based on digital asset collateral (such as Dai) and unsecured “algorithm central bank” stable tokens (such as Basis). Libra is the first type of stable currency based on a currency collateral and will be based on a basket of currencies (possibly including US dollars, Euros, British pounds, Japanese yen, Singapore dollars, etc.).

Before and after the emergence of Libra, along with a wave of private-dollar digital currency issuance boom, as shown in the table below.

Creation and redemption: JPM credit endorsement ($2.6 trillion in asset size), 1:1 redemption with the US dollar in the JPM designated account.

Transfer: Only JPM's KYC-certified institutional clients (banks, brokers, and companies) can be chained. The application scenarios include cross-border payments for large corporate customers, securities trading, and the replacement of US dollars through JPM Coin. It helps to eliminate counterparty risk, settle risk, reduce liquidity requirements, and achieve immediate payment.

technology: It is distributed on the free blockchain Quorum and will support other platforms and be licensed to external companies in the future.

progress: In February 2019, a successful pilot project was announced, which is still in the early stage of development. It is planned to expand the scope of the pilot in the second half of the year.

IBM is a "network operator" that provides support for APIs and accounts, and money processing software. Currently, the signatory banks such as the RCBC Bank of the Philippines, Bradesco Bank of Brazil, and Busan Bank of South Korea are responsible for the currency exchange + bookkeeping + legal currency exchange. The parties reconcile the books, and the participating banks participate in the issuance and accounting. The end user can initiate a transaction, view the transaction, and settle the currency as a national currency.

issued: Bind WMT to the common currency to issue digital currency.

Information storage: The WMT information is stored in a block in the blockchain.

exchange: Use WMT as a refund when purchasing WMT or returning.

limit: According to the relevant documents of WMT, it is judged whether the WMT is restricted.

Judgment record: Record the judgment in the block.

Purchase History: Use WMT to record the shopping history of each user.

Calculate the offer: Calculate the forecast error reduction and cost reduction caused by “predicting demand using WMT purchase records” and “predicting demand without using purchase records”.

Use the offer: Based on the different products and forecast accuracy rates purchased by different consumers, part of the cost saved by Wal-Mart is converted into a discount for consumers' current consumption.

Restricted use: In the case where WMT is restricted, the offer is used to purchase the specified goods and services.

Unrestricted use: Use the offer to purchase any goods and services without WMT restrictions.

WMT reserve: Store the excess WMT in the WMT reserve.

Second, Libra's Utopia

Libra's overall design is similar to the traditional French currency issue, as shown in Figure 1.

Source: Author drawn according to publicly available materials

Currently included

Technology and trading platform: Booking Holdings, eBay, Facebook/Calibra, Farfetch, Lyft, Spotify AB, Uber Technologies, Inc.

Telecommunications: Iliad, Vodafone Group

Blockchain industry: Anchorage, Bison Trails, Coinbase, Inc., Xapo Holdings Limited

Venture capital industry: Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures

Non-profit organizations, multilateral organizations and academic institutions: Creative Destruction Lab, Kiva, Mercy Corps, Women's World Banking

The Libra Association will be responsible for technical routes (such as public chain upgrades), reserve asset management, dividends and incentive management, institutional management (such as members, distributors, etc.), emergency response (such as cyber attacks, etc.), and joining the Libra Association. The threshold for members to get the seats on the board and one person, one vote (regardless of the initial investment, up to one vote).

Compared with traditional payment systems, Libra meets the demands of different parties, helps account parties to make large payments, remittances, and allows recipients to reduce transaction costs. It also allows traditional institutions to observe and respond to innovative means.

1. Low operating cost

Blockchain replaces manual reconciliation to bring efficiency and error reduction

2. Low transaction costs

Libra in-system transactions do not need to pay to central agency agencies

3, low margin to reduce costs

Real-time synchronization of account books strengthens inter-agency public trust, reduces margin requirements, and reduces the additional cost of margin

1. Different regulatory requirements faced by countries

a. When it is recognized as a securities cryptocurrency

Libra associations and distributors issuing Libra are subject to securities issuance regulations

b. When it is recognized as a payment cryptocurrency

Libra associations and distributors need to hold a payment license or a crypto asset exchange license and a reserve requirement

2. Anti-money laundering risk

There are many conflicts and challenges in cross-border regulation, how to meet the baseline standards of global regulation

There is a conflict between law enforcement, evidence collection and administrative supervision.

3. Capital security and information security

Volatility may affect user acceptance as a payment tool

Transactions may be irrevocable, resulting in fraudulent and operational errors that cannot be recovered

4. Uncertainty of regulatory policies

The identification of the nature of Libra by national regulators depends on many subjective factors and may have different positions, leading to greater uncertainty in regulatory policies.

Long arm jurisdiction of national regulatory authorities

Therefore, although Libra has a very good fantasy, there are still many challenges from the real landing. The biggest challenge comes from how to deal with the supervision, as well as many issues including privacy issues, run-off risks and so on. It is still in the Utopia stage.

Third, the response: the central bank legal digital currency

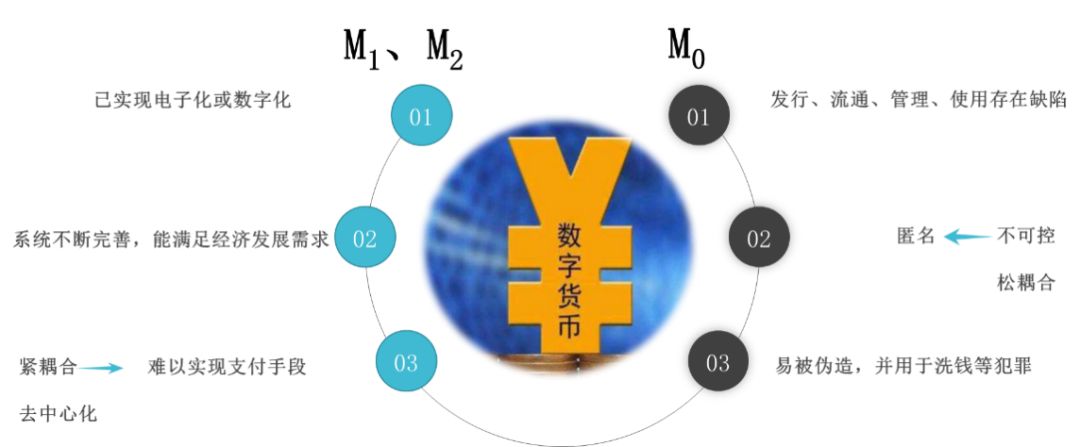

Figure 2 The central bank's legal digital currency focuses on the replacement of M0

Source: The author is based on Fan Yifei. Some considerations about the central bank's digital currency. First Financial Daily, 2018-01-26 (A05)

Source: The author is based on Fan Yifei. Some considerations about the central bank's digital currency. First Financial Daily, 2018-01-26 (A05)

In the interview, "The Evening Post" asked Huawei's founder Ren Zhengfei about whether Facebook should issue Libra Chinese companies.

Ren Zhengfei replied: China can also issue such a currency, why should it wait for others to issue it?

discuss

Regarding why the central bank issues and how to issue digital currency: In terms of technology, the central bank must maintain technical neutrality, not necessarily using blockchain technology, and related technologies, and can refer to the patent office for relevant patent applications. At present, the central bank's digital currency goal is to replace M0. The goal of the system is to establish a two-tier system. In the general currency trading system, there is a settlement system between the lines. The latter is the settlement of the digital currency, and the transaction process is completely changed. This is one of its advantages. At the same time, according to Governor Zhou Xiaochuan, the regulators maintain an open attitude and welcome private companies to launch their own programs to compete with each other and allow the market to choose a dominant solution. The central bank can choose to cooperate with companies to issue mixed SCBDCs. Another goal of the central bank to issue digital currency is to cross-border settlement targets. If China seizes this opportunity, it may challenge the existing international status of the US dollar. Moreover, after the financial crisis, the central bank's monetary policy tools were insufficient, and the emergence of CBDC may provide new monetary policy tools for the management of the central bank.

Regarding whether the central bank issues digital currency to replace M0, will there be a magnifying effect: First, for the cash issue, the central bank’s No. 11 text in 2018 mentioned that it should encourage innovation in many forms. Cash has other functions besides payment, no matter what. The hundred dollar bills will not disappear completely, and China’s national conditions will definitely exist. This view was also confirmed by the release of new banknotes by the central bank in August. At the same time, as mentioned in the Libra white paper, it is not a substitute for the current payment system, but a supplement to the digital currency.

Regarding why the central bank takes over the issuance of digital currency: mainly because of the public nature of the currency, the currency has many goals besides convenience, especially credit creation. In the process of currency internationalization, the central bank is most worried about internationalization of sovereign currency credit. The impact of creation creates problems of controllability. Therefore, the central bank wants to cut the credit creation function and liquidity function of the currency. In China, it is the exit of an M0 banknote and the embedding of an M0 digital currency. In foreign countries, it is necessary to avoid credit. The function of creation is utilized.

https://www.jpmorganchina.com.cn/country/CN/en/detail/1320572440065

2. Introduction to IBM World Wire

Https://www.coinspeaker.com/ibm-todd-scott-stellar-lumens/

3. Introduction to Walmart Currency

Http://www.elecfans.com/blockchain/1057360.html

4. Chain Tower Technology, Wal-Mart Digital Currency Research Report

Http://www.dyhjw.com/gold/20190816-71276.html

5. Introduction to Libra

https://libra.org/zh-CN/?noredirect=zh-Hans-CN

6. Griffoli MTM, Peria MMSM, Agur MI, et al. Casting Light on Central Bank Digital Currencies [M]. International Monetary Fund, 2018.

7. Fan Yifei. Some considerations about the central bank's digital currency. First Financial Daily, 2018-01-26 (A05)

Source: Fudan Development Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market analysis on September 30: BTC weekly line is not optimistic, you need to be cautious when you are long

- Encrypted Notes | Harmony proposes the "impossible four corners" theory, the extended dilemma enhanced version

- Chainlink's first Chinese trip ended successfully, opening a trip to South Korea today

- 2019 blockchain landing application report: cross-border trade

- Babbitt interviewed to find real use cases for blockchain, Blockstack wants to sand in the app waves

- Is your cognitive growth keeping pace with the development of the cryptocurrency market?

- Read the digital securities and blockchain in one article: opportunities, challenges and risks