Blockchain technology and the construction of open banks: 3 characteristics to meet 3 challenges, how to build an open banking ecosystem?

Author: Liu Enke king Menghan "Financial One account links"

Source: China Finance Journal

Editor's Note: The original title was "Blockchain Technology and the Construction of Open Banks"

Open banking is becoming a new trend in the development of the world and domestic banking industry, showing a trend of controversy. During the digital transformation, major domestic banks have also formulated an open banking strategy, actively embraced openness, and intended to build an open, shared, and win-win ecosystem, and provide customers with "ubiquitous, meticulous" banking services. However, the core of open banking is open data. How to use technology to achieve a safe and controllable shared exchange of data among all parties under the premise of regulatory compliance has presented severe challenges to large commercial banks, small and medium banks, and third-party service providers. It is also a major problem that open banks need to solve urgently. Blockchain technology naturally has a variety of characteristics such as distributed ledger, cryptography, consensus mechanism, and smart contracts. It can solve the problems of data privacy and information sharing, provide a technical foundation for all parties in the ecosystem, and truly break the barriers and cooperate. Win and realize the vision of open banking.

- New crown epidemic causes large foreign mines to close, bitcoin computing power drops by nearly 50%

- How does the Fed's unlimited "print money" affect the crypto market?

- Slump, dips, rebounds … what are the speculators discussing on Weibo?

Analysis of the pain points of the open banking platform

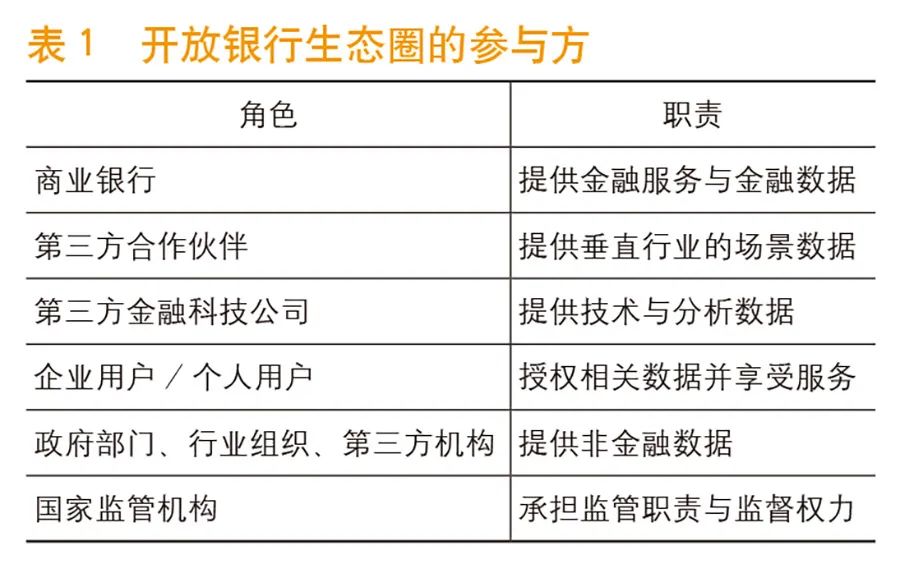

There are many market players participating in the open banking ecosystem. As shown in Table 1, the construction of the ecosystem needs to coordinate the interests of all parties and strictly protect the data assets owned by all parties.

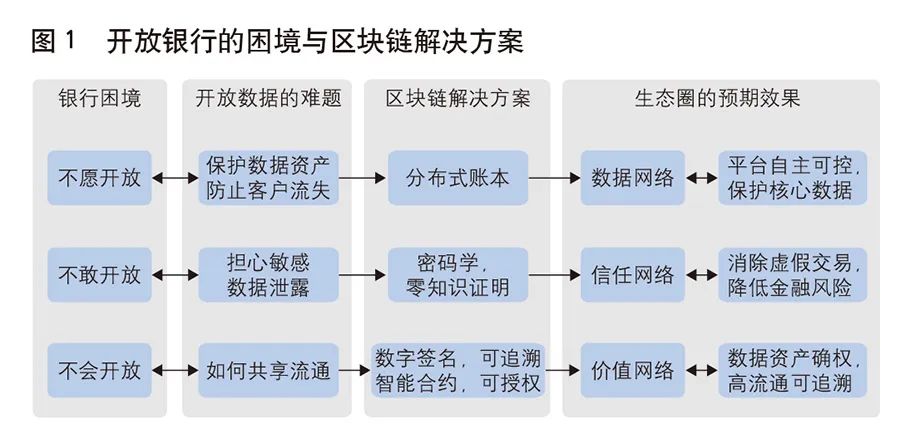

Data sharing is the core problem that open banks need to face, but it is difficult to open data. Banks are reluctant to share, dare not share, and do not share. The real deep-seated reasons can be summarized into the following three major problems.

Unwilling to share-the battle for platform dominance. If the centralized platform is led by a large bank or a third-party company, other participants will basically have no ability to control the platform, and will not be willing to share their own data assets. They also worry that once core data is shared with the platform, they will lose more than they can afford, and cause customers Sex reduction and even loss. Even if the open banking platform is jointly constructed by multiple institutions, it is relatively difficult to define the dominant party of the platform, and any party leading the platform will bring disputes or dissatisfaction from other participating institutions.

Taking the status of personal credit reporting in China as an example, China has formed a pattern of central bank credit reporting combined with one hundred bank credit reporting. In theory, it can cover personal credit data of banks and Internet financial companies. However, this mode of centralized reporting of credit data will encounter Difficulties in going to a member institution on the chain. On September 19, 2019, according to the British media "Financial Times", five institutions, led by Tencent and Alibaba, were among the eight private credit bureau shareholders of Baixing Credit Reporting, but refused to ask Baixing The letter provides personal credit data in its own product system.

Dare to share-privacy concerns remain hidden. The user data of open banking is closely related to individual or corporate customers. Protecting data privacy is the core of maintaining customer trust. Under the open bank, carrying multi-party information will not only lengthen the risk control chain, but also increase the storage point and transmission frequency of user data, and greatly increase the risk of data privacy leakage. Data sharing is not difficult for traditional technologies, but when bank user data is shared with third-party organizations, it is unable to eliminate potential security risks, and there is a possibility of external leakage. According to a report released by Risk Based Security, there were 4,000 data breaches worldwide in the first half of 2019, with a total of 4.1 billion data exposed. How to use technology to help users relieve the privacy concerns and help banks and third-party institutions to achieve data sharing and verification is worthy of in-depth thinking and research.

No sharing-data asset circulation is difficult. Electronic data is different from physical assets. Although the Internet is convenient for sharing, it is also easy to be copied in circulation and it is difficult to determine rights. First, if the data assets cannot be confirmed, accurate authorization of the data cannot be achieved. Second, if the owner, producer, disseminator, and user of the data cannot be clearly identified and the data flow is truthfully recorded, the data value and benefits cannot be obtained Make reasonable redistributions. The European Union has introduced strict General Data Protection Regulations, which impose strict legal restrictions on institutions that collect, transmit, retain or process personal information. The Cyber Security Law introduced by China in 2017 specifically strengthened and clarified the requirements for personal information protection. The widely anticipated "Personal Information Protection Law" is expected to give citizens real control over personal information. Therefore, it is a topic worthy of research on whether the technology can confirm the rights of data assets and ensure that the ownership is clear, the benefits are shared, and the risks are shared.

New model of data opening based on blockchain technology

Blockchain technology is a decentralized distributed ledger technology. Its typical technical feature is to implement a distributed ledger that is confirmed and verified across the network through a blockchain-type data structure, and realizes features such as anti-counterfeiting, anti-tampering, and traceability. . Therefore, blockchain technology is particularly suitable for decentralized, multi-participated, and jointly maintained application scenarios to enhance trust, and the opening of the banking ecosystem data is exactly the actual scenario that requires multi-party participation and pays attention to privacy protection.

Aiming at the three major challenges facing the construction of open data in the open banking ecosystem, the introduction of the three major features of the blockchain (distributed ledger, cryptography, and consensus mechanism) can escort data openness.

- Distributed ledger technology resolves platform domination

The distributed ledger technology of the blockchain enables each participant to record the ledger based on multi-party consensus, and to share and synchronize data among network members, facilitating the exchange of assets and data, and eliminating the time and expense of mediating different ledgers. Compared with traditional centralized platforms, distributed ledgers have the following special advantages: first, decentralization, which is a ledger that does not need to be stored and confirmed by a central authority; each participant in this network can obtain a unique and true A copy of the ledger, any changes in the ledger will be reflected in all the copies, no longer maintained by a centralized organization or made separate decisions; secondly, it cannot be tampered with, by proof of time stamp, hash function, end-to-end block chain Data structure, consensus mechanism and other technical applications and mechanism design. Blockchain technology has achieved the ultimate in immutability of records, increasing the cost of counterfeiting, enhancing the reliability of the ledger, and reducing auditing costs.

Adopting the traditional centralized data sharing mode, no matter whether the platform is self-built or owned by a third party, it will inevitably encounter the battle for platform dominance. If a distributed ledger is built based on the blockchain, each participant enjoys relatively equal power and the same ledger, and the system is no longer an arbitrary and centralized central platform, but an ecological network for common governance. There is the problem of platform dominance, and the problem of dominance dispute can be solved.

- Cryptography technology protects data privacy

It is relatively easy for open banks to open services and products, but once the most sensitive underlying data itself is involved, whether it is a bank or a third party, it is necessary to protect the user's privacy data to prevent leakage. Blockchain can use data encryption technology such as security technology and privacy protection technology to achieve data privacy protection.

The security technology represented by the digital digest algorithm, digital signature and encryption algorithm plays a fundamental role in the blockchain. While ensuring the security of the blockchain data, it also ensures the security of the identity of the participants. The decryption mechanism enables participants and users to fully control their own data on the chain. The data stored on the chain are encrypted by the relevant participants using their own keys, and then uploaded to the chain and shared by consensus. This ensures the security of the data and greatly reduces the possibility of data leakage. In addition, when the data on the chain is not authorized, the ciphertext data on the chain cannot be decrypted or shared, which gives the data owner true data control. Compared with the current offline authorization or APP privacy notification authorization, blockchain-based authorization can also support more elaborate field levels and realize business through the principle of minimum authorization. For example, the user may choose to authorize only the loan amount of a certain loan record in the credit report to a third party without revealing the specific purpose of the loan.

The privacy protection technology typified by zero-knowledge proof takes the standard of privacy protection to a higher level. Zero-knowledge proof refers to the method by which one party (certifier) proves a certain fact to the other party (verifier) without revealing the original information of the fact. The use of this technology can protect the privacy of the identity and the confidentiality of the data to the greatest extent. It can verify the association of data in the case of ciphertext, which not only protects the privacy of the data, but also achieves the purpose of data sharing and truly realizes the ciphertext data Available is not visible. In September 2018, the Hong Kong Monetary Authority and 12 banks launched the financial one-account trading contract financing platform to use zero-knowledge proof technology to greatly reduce the risk of trade fraud, prevent repeated financing, excessive financing, and improve banking financing. Will.

- Using blockchain to achieve data confirmation and circulation

Whether the open banking ecosystem can truly thrive depends largely on whether the underlying data assets can be efficiently circulated. In order to achieve the purpose of data circulation, it is necessary to establish a complete management mechanism for data prior authorization, use authorization, and accountability after the fact, to fully give users data control and benefit distribution rights over their own financial data.

Using blockchain non-tamperable, digital signature, consensus mechanism, smart contract and other technologies can confirm the data, and perform full-cycle recording and monitoring of data generation, collection, transmission, use and income, for data sharing and circulation Provides a solid technical foundation. Specifically, the owners, producers, and users of data assets join the blockchain network as important nodes, and use the blockchain to synchronize consensus to record in detail all aspects of data generation, circulation, and transactions, not only recording the data itself Moreover, the identity of the subject related to the data asset and its operation history are recorded, and the full node consensus witnesses that no party can deny it. In this way, all participants in the ecosystem can contribute their own data assets, and supervise asset transfer and income distribution through smart contracts, realize revenue sharing and risk sharing, greatly promote the circulation of data assets, and realize the open banking ecosystem. Win-win cooperation in the circle.

Open bank ecosystem of building a three-tier network system based on blockchain

China's open banks are in full swing, but with little success. The root cause is the lack of trust between the parties to truly open their data. The above-mentioned characteristics and advantages of the blockchain can effectively solve the problems in the process of open data, and gradually build an interconnected data network, a real and trustworthy trust network, and an efficient and secure value network, and finally build an open and cooperative win-win open bank Ecosphere.

- Data network-platform is autonomous and controllable to protect core data

In this era of information-exploded mobile Internet, on the one hand, the phenomenon of data islands is becoming more and more serious; on the other hand, all parties in the open banking ecosystem are paying more and more attention to their platforms, customers, and data, and their awareness of protection is increasing. The stronger the willingness to share data is not strong, which runs counter to the open concept of open banking. The blockchain as a financial linker, through the establishment of a common governance alliance chain, will form banks, third-party service providers, technology companies and customers to form an open banking network, breaking the data on the premise that each participant maintains the control of its own platform The island is safe and controllable. It will open and share data to form a low-level data network, laying a data foundation for business collaboration and innovation. Unlike previous centralized platforms, each participant is in a peer position in this network, enjoys relatively equal decision-making power, can well protect its core data, and does not have to worry about losing customers.

- Trust network-eliminate false trade and reduce financial risk

The non-tamperable data network greatly increases the cost of data fraud. Combined with an authorized encryption and decryption mechanism, the authenticity of data shared with business partners is greatly increased, and information asymmetry in financial services is initially alleviated. A network of trust has also taken shape. In order to further ensure the consistency and accuracy of data and change from weak trust to strong trust, zero-knowledge proofs can be used to verify the data of more business parties in ciphertext, eliminating false trades and reducing financial risks.

Taking the Tianjin General Administration ’s Tianjin Port Blockchain Cross-Border Trade Service Network, which was launched on April 17, 2019, as an example, in addition to buyers and sellers in the ecosystem that require trade financing, related parties such as logistics and customs have also been introduced. Data such as orders, waybills, and customs declarations are encrypted and uploaded to the blockchain by themselves. This information is only presented in cipher text in the perspective of other participants, but these cipher texts can be used for cross-validation. For example, when the seller initiates a financing application to the bank, the bank can use zero-knowledge proof to compare the data of various parties, such as verifying that the buyer's order and seller's invoice and the unit price and quantity in the waybill are consistent. Whether it is equal to the total amount of goods in the customs declaration, etc. By comparing the data of all parties, the trade authenticity of the bill and the matching of the information can be verified, which greatly reduces the risk.

- Value network-data asset confirmation, high circulation and traceability

The Internet transmits information, and the blockchain transmits value. The open banking ecosystem based on blockchain technology, the underlying data assets are confirmed when they are chained, and authorized transfer and sharing are performed according to the ownership of the data, not only activating the assets, but also maximizing the value of the assets Moreover, the entire life cycle of the data can be monitored, the revenue can be traced, and the value can be redistributed.

The value network injects vitality into the data network and trust network of the open banking ecosystem. As data assets are shared and transferred across platforms and institutions, new business value is continuously created and fed back to trusted parties. This positive feedback mechanism It can also continue to attract more participants, more data, and further expand and grow the ecosystem.

As an emerging business concept, open banking is being widely recognized and accepted domestically and globally. A banking ecosystem based on blockchain technology-based data networks, trust networks, and value networks can resolve the three major problems of existing self-built platforms or third-party platforms: platform dominance, privacy protection, and data circulation difficulties. The open bank has really landed and achieved a win-win situation for all parties. Of course, China has not yet issued clear regulatory regulations on open banking related fields, such as data usage specifications, open API standards, open bank definitions and boundaries, and regulatory guidelines on business practices, but I believe that in the future, with the emphasis on supervision, laws With the increasing improvement of regulations, the regulations on financial data and private data of enterprises and individuals will be more detailed, the scope of open data and the corresponding rights and responsibilities of data subjects will be more clear, and the development of open banking will be more compliant. By then, the open bank based on blockchain can gradually transition from the regulatory sandbox mode to large-scale production applications.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is there a future for Bitcoin? Is the fundamentals of the blockchain industry stable? Disciple Ren Zeping tells you the answer

- Ray Dalio's latest 4D Long Article: Quietly Changing World Patterns and Macro Cycles

- Comparison of overseas blockchain epidemic prevention with China: limited use cases, lack of government presence

- Popular science | Is distributed, decentralized, multi-centralized the same thing?

- Linked US stocks fell again, BTC pullback sentiment strengthened

- Understand the difference between token financing and equity financing

- Analysis: Ethereum, the largest "air coin" in the industry?