Slump, dips, rebounds … what are the speculators discussing on Weibo?

Affected by the continued spread of the new crown epidemic, investors' expectations for economic development have deteriorated, risk aversion has been high, risk assets have been sold off, and risk aversion assets have not been spared. The U.S. stock market has been fused for four times in the past eight trading days. The international oil price fell to US $ 20 / barrel. The international gold price fell to a low of nearly 1451.1 US dollars / ounce for nearly four months. The US dollar index was like a roller coaster.

Global financial markets are "breathing hard," and Bitcoin is no exception. On March 12, it plunged 37% in 24 hours, the lowest dropped to about 4,100 US dollars, the current correction has not returned to the level before the plunge. The latest Coin Metrics report indicates that the correlation between Bitcoin and the S & P 500 Index reached a record high, and the correlation coefficient on the 12th reached a historical high of 0.52, which indicates that the crypto asset market is becoming more closely linked with the existing traditional markets.

Bitcoin resonates with global assets, and currency users who originally belonged to the niche circle also resonated with global investors for a while. The plunge, U.S. stocks, dips, rebounds, contracts, halving … PAData sorted out 1,617 Weibos, telling you what the currency people are discussing in the mainstream domestic public opinion field?

- Is there a future for Bitcoin? Is the fundamentals of the blockchain industry stable? Disciple Ren Zeping tells you the answer

- Ray Dalio's latest 4D Long Article: Quietly Changing World Patterns and Macro Cycles

- Comparison of overseas blockchain epidemic prevention with China: limited use cases, lack of government presence

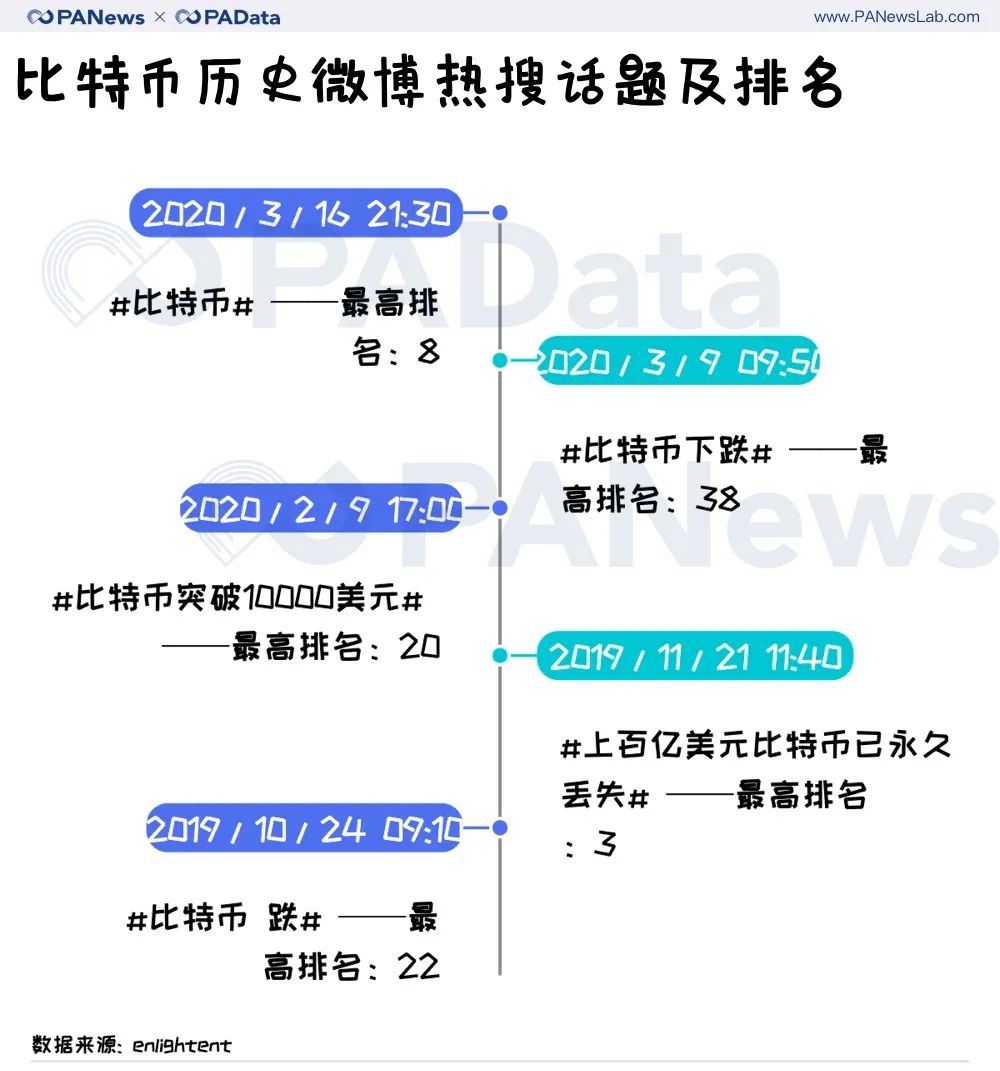

The most expensive hot search list in history, 5 hot searches 3 times

In the evening of March 16th, the topic # Bitcoin # went on Weibo again, once ranking No. 8 on the hot search list, accumulating 2 hours and 30 minutes on the list. According to a popular blog post published by Sina Finance that day, "According to the quote from the trading platform Bitstamp, # Bitcoin # fell short-term to below $ 4,500, a 16% drop in the day, and continued to brush lows since April 2019."

Bitcoin has been on the hot search, and Weibo netizens "Ah, hey, hey, Dickson" joked, "It took so much money, and finally the last hot search." According to CoinMarketCap data, the market value of Bitcoin on the 16th was about 916.33 100 million US dollars, a decrease of 6.986 billion US dollars from the previous day. The "cost" of this hot search is huge.

In fact, the "cost" of bitcoin's hot search every time is not small, which is much higher than the market price of general buying list. According to the historical statistics of enlightent Yunhe data, there are 5 hot search topics containing the "Bitcoin" keyword, which are # Bitcoin #, #Bitcoin Falling #, #Bitcoin Breakthrough 10000 USD #, # 10 billion USD bitcoin has been permanently lost # 、 # Bitbitdrop #. Including the neutral topic # Bitcoin #, three of the five topics were hotly searched for due to the decline in the price of the currency, and only one was searched for due to the rise in the price of the currency.

In fact, the "cost" of bitcoin's hot search every time is not small, which is much higher than the market price of general buying list. According to the historical statistics of enlightent Yunhe data, there are 5 hot search topics containing the "Bitcoin" keyword, which are # Bitcoin #, #Bitcoin Falling #, #Bitcoin Breakthrough 10000 USD #, # 10 billion USD bitcoin has been permanently lost # 、 # Bitbitdrop #. Including the neutral topic # Bitcoin #, three of the five topics were hotly searched for due to the decline in the price of the currency, and only one was searched for due to the rise in the price of the currency.

However, the topic with the highest search ranking has nothing to do with the rise and fall of the currency price. The topic related to bitcoin ownership #tens of billions of bitcoin is permanently lost # It is the highest ranked on the top search ranking and is the most popular among national users. Follow bitcoin related topics.

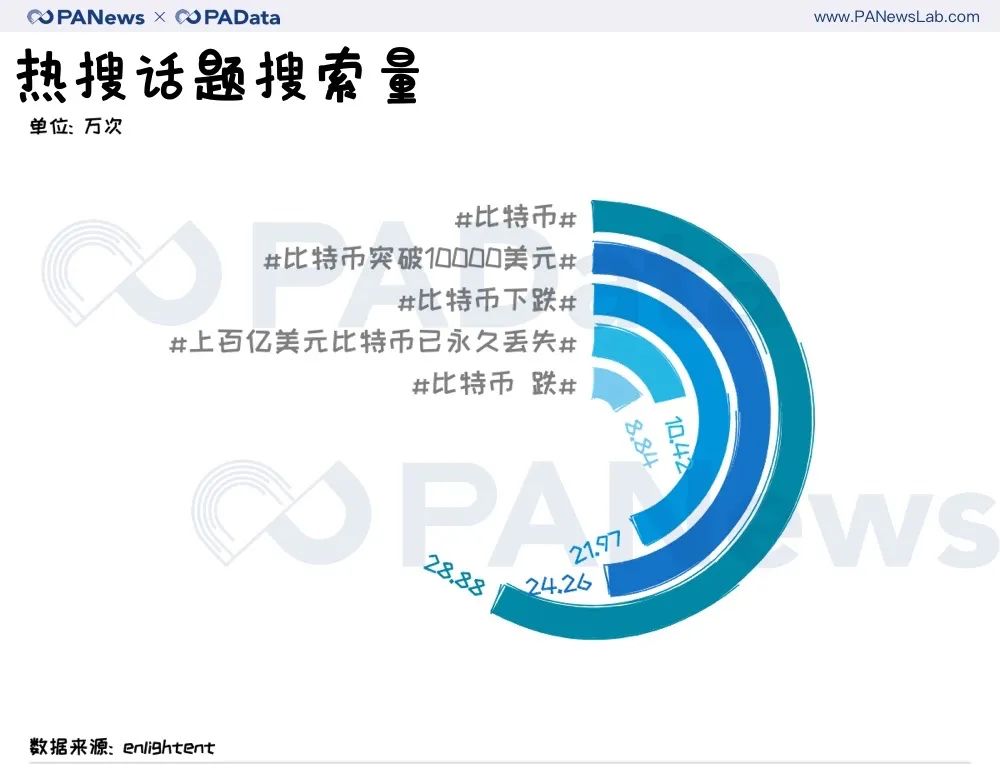

The most recent search for hot topic # Bitcoin # reached 288,800 times, which is the most searched of all hot searches. It seems that this fall following the general environment has also allowed Bitcoin to gain a wider range of attention. . The topics with higher search volume include #Bitcoin Breakthrough 10000 USD # and #Bitcoin Drop #, both of which have exceeded 200,000 times, which are 242,600 times and 219,700 times, respectively.

And the topics on the list last year #hundreds of billions of bitcoins have been permanently lost # and #Bitcoin Drop # searched only 104.2 thousand times and 88,400 times respectively, significantly lower than the other three new hits on the hot list this year. Search volume for the topic. It can be seen that after one year, the attention of Bitcoin has increased significantly.

# Bitcoin # is highly related to # 美股 #

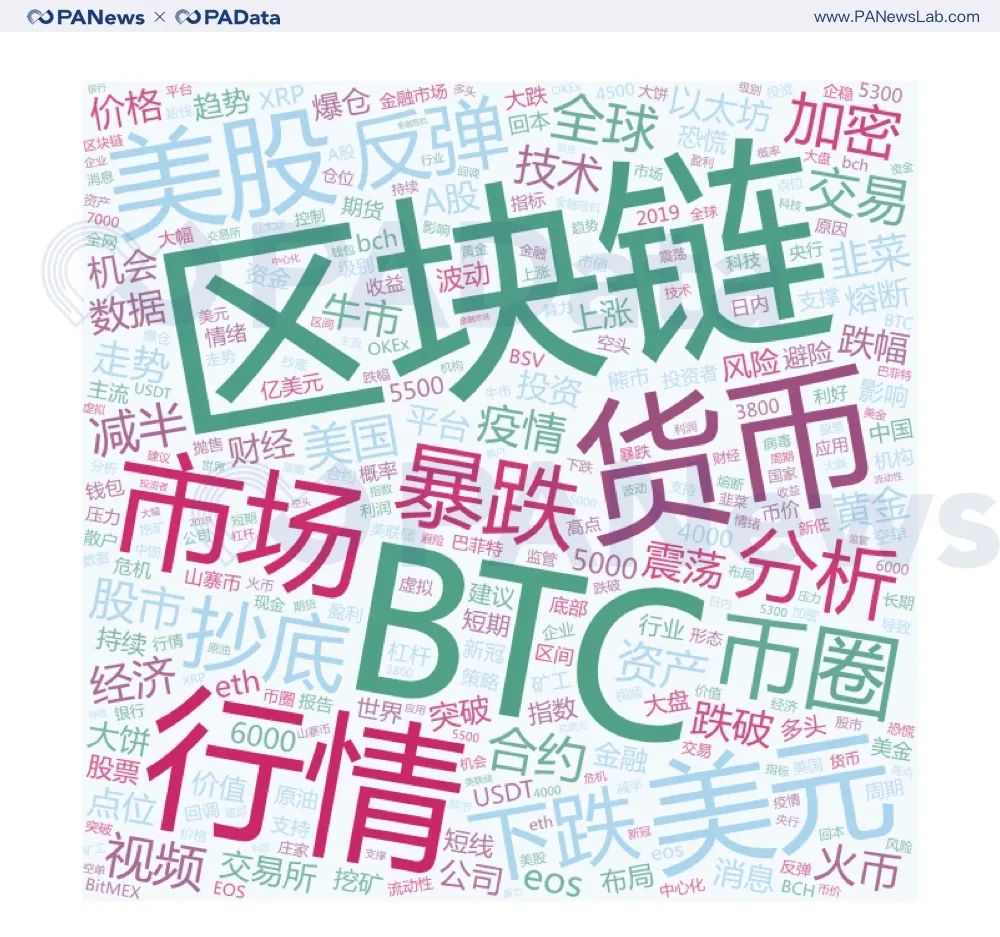

PAData conducted a text analysis of the most popular 1617 Weibos (excluding pictures, videos and secondary comments) under the topic # Bitcoin # on March 23 and found that in addition to the keyword "Bitcoin" (and synonymous " BTC "), words that appear more than 100 times also include" blockchain "," currency "," quote "," USD "," market "," US stocks "," slump "," currency circle ", "Down," "Bottom," "Bounce," "Global," "Contracts," "Assets," "United States," etc.

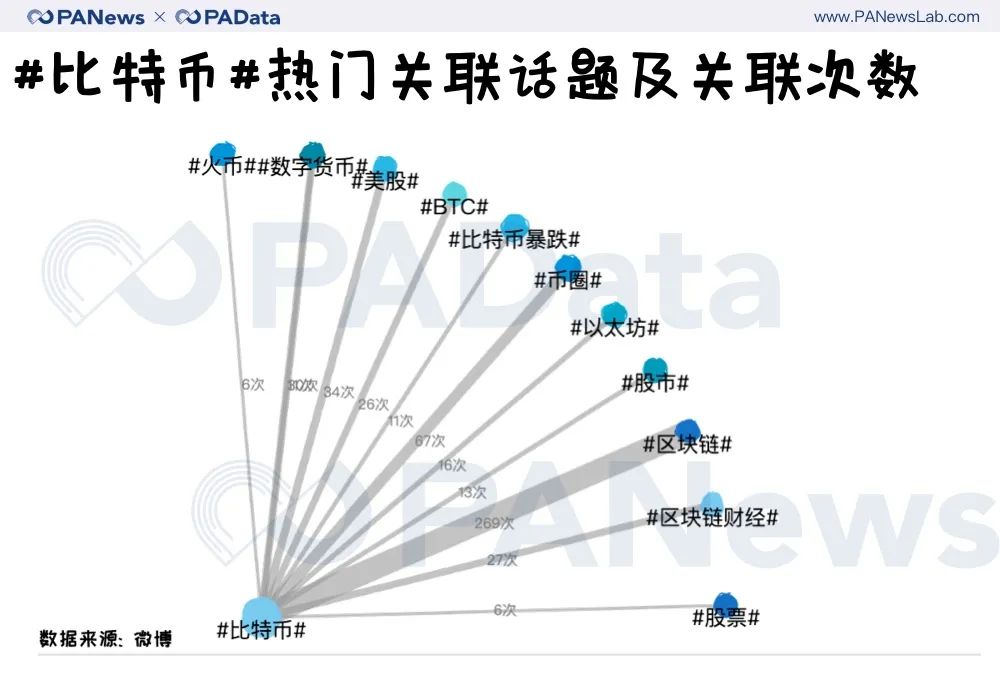

From the perspective of topic correlation, # Bitcoin # and # blockchain # are the two topics with the highest correlation, with 269 correlations, followed by # Bitcoin # and # TokenCircle #, with 67 correlations. Times.

The relevance of # Bitcoin # and # 美股 # is close behind, reaching 34 times, but it is worth noting that the relevance of # Bitcoin # and # 美股 # is # Bitcoin # in all combinations of topics outside the circle The most relevant combination.

Moreover, the correlation between # Bitcoin # and # Stock # and # Stock # is also relatively high, reaching 13 and 6 times, respectively. This means that not only from the perspective of data research, the correlation between Bitcoin and the S & P 500 Index is increasing, but also from the perspective of investor public opinion, investors are increasingly incorporating Bitcoin into the global financial market for consideration. The reverse promotes the link between Bitcoin and the S & P 500 Index. In the exchange, Huobi is the most connected.

The mainstream narrative of Weibo netizens, everyone is an analyst

From the high-frequency words and related topics, it is not difficult to see that the mainstream narrative of the popular microblog under the topic of # Bitcoin # mainly focuses on the recent trend of bitcoin and the trend of global financial markets. After excluding pure information microblogs, product promotion microblogs, and other emotional expression microblogs, they can be further divided into four categories of first-class narrative topics, including why Bitcoin has fallen recently? How is the recent profit? Why did you lose money? What's next for the market?

Among them, Weibo, which analyzes why Bitcoin has fallen recently, accounts for 15.77%, Weibo, which analyzes recent losses, accounts for 12.90%, and Weibo, which shares recent personal profit, accounts for 20.43%, judging the next market The trend of Weibo accounts for about 50.90%.

On these topics, netizens on Weibo have some relatively consistent opinions, and these opinions constitute the secondary narrative content. Regarding why Bitcoin has fallen recently, many Weibo netizens believe that this is related to the epidemic or the deterioration of the global economic situation, and some netizens believe that this is related to the return of the US dollar and the institution's downturn.

Regarding the "contract massacre" caused by the recent bitcoin plunge, Weibo netizens believe that this is related to the banker's position, and also to the excessive use of leverage by investors, and some netizens believe that this is related to the outage of the exchange line.

The recent personal profit can be divided into lost and earned. The next trend of the market is mainly divided into the perspective of long holdings from belief holdings and oversold rebounds, or the short view from the perspective of global liquidity shortages and economic downturns.

Looking at the public opinion on the topic of Weibo # Bitcoin # in combination with the time dimension, it can be found that on the 13th after the plunge, netizens with a bullish view on Weibo reached a recent high. For example, the netizen "yanglinjian" said: "# Bitcoin # Bitcoin fell to 4,000 US dollars, and once again went out of the ghost gate, I always believe that after the plunge, there will be a surge, and now it is a good opportunity to make a bottom." "I think:" # Bitcoin # is still waiting for the bottomless now. When the opportunity has come, BTC is now the price of cabbage. Have you ever seen BTC sold at a discount? Now it is the best that you can earn when you buy it. Good opportunity, don't miss it. "

On March 13th, there were also many Weibos that analyzed why Bitcoin fell. Weibo netizen "Kaixin stacy 涪" said: "# Bitcoin # The epidemic continues like this, the global stock market will continue to fall, and assets are connected. The currency is definitely affected, but the degree of impact is different, and now is a good opportunity for bitcoin to dip. "In addition, Weibo, which shared personal gains, was at a recent low.

After a round of oversold bounces and then fell, from March 18th to 20th, the analysis of the future market trend on Weibo reached a high point. Unlike the 13th, the recent public opinion on the future trend is stalemate. For example, netizen "CryptoApprentice" believes that "the short-term high point has arrived, and there are up to 1,000 knives." "Xinjinling" believes: "Continuously killing, even in a crisis, there will be a rebound. US stocks are another example, but what needs to be understood is that this is a financial crisis, the flag is down, do n’t be flustered and fantasies, financial markets A long-term bear market, including the currency market, may have just begun. "

Netizens with opposite views believe that with the quantitative easing policies of governments in various countries, Bitcoin will rise after market liquidity is supplemented. For example, netizen "Chain Haiqingluo" believes: "The European Central Bank announced a 5 trillion bailout, and Japan also plans Throw 30 trillion! Bitcoin will soon rise. "" Eos Jun "believes:" US stocks have reached new lows and Bitcoin has not reached a new low. This is a good sign that Bitcoin is stronger than U.S. stocks after one step. After the rebound, you can still look forward to Bitcoin's rebound. "

During the period from 16th to 18th, many netizens shared personal benefits. On the 21st to the 23rd, the analysis of why Weibo caused huge losses began to increase, which was related to the fermentation of the exchange line and the rights protection event.

Someone is stuck in FCoin, and some people earn 500%.

Recently, the price of bitcoin has fluctuated violently, and the mood of investors has followed.

Many Weibo netizens failed to get rich in danger, but lost money instead. Some of these people took the high position to be zeroed, someone copied the bottom half of the mountain, and someone opened a leveraged speculation and was liquidated … but these are not the worst, the worst one of the netizens did not have the opportunity to participate in this market because he Of Bitcoins cannot be withdrawn in FCoin.

Some people lose money and others make money, but few people can make a lot of money in this kind of roller coaster-style market. Most people who make money make small profits. After they make less money, they will not love wars, and there are even some netizens. If you do n’t pay or lose less, you make money.

In the personal benefits shared by netizens, it is not difficult to see that most netizens' current investment targets are futures and leverage. Such financial instruments can certainly be rich overnight, but it cannot be ignored that the opposite of the risks involved is one night. Zeroing. Blockchain practitioner Ji Dongfa Weibo reminded investors, "Less to use leverage to participate in a hugely volatile market, or hold cash to observe it, and then find a suitable opportunity to enter."

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Popular science | Is distributed, decentralized, multi-centralized the same thing?

- Linked US stocks fell again, BTC pullback sentiment strengthened

- Understand the difference between token financing and equity financing

- Analysis: Ethereum, the largest "air coin" in the industry?

- Digital Dollar Foundation: America Needs Real "Digital Dollars"

- Will the USDT market cap exceed Bitcoin? Stablecoin has become a strategic highland of blockchain

- Blockchain and agency risk: we just need to trust the code