Blockchain Weekly | Facebook opens a long-term game with global regulation

Summary

Libra will enable countries around the world to pay more attention to digital currency R&D and regulation. Due to Facebook's huge influence, its leading legal currency behavior has made the global regulatory authorities and industry pay more attention to the blockchain – even have to re-examine the all-round impact of market economy and social governance brought about by blockchain innovation. . While the supervision of major countries in the world is advancing, all countries recognize that blockchain and digital currency are inevitable innovation highlands in the future, and supervision requires more encouragement and support.

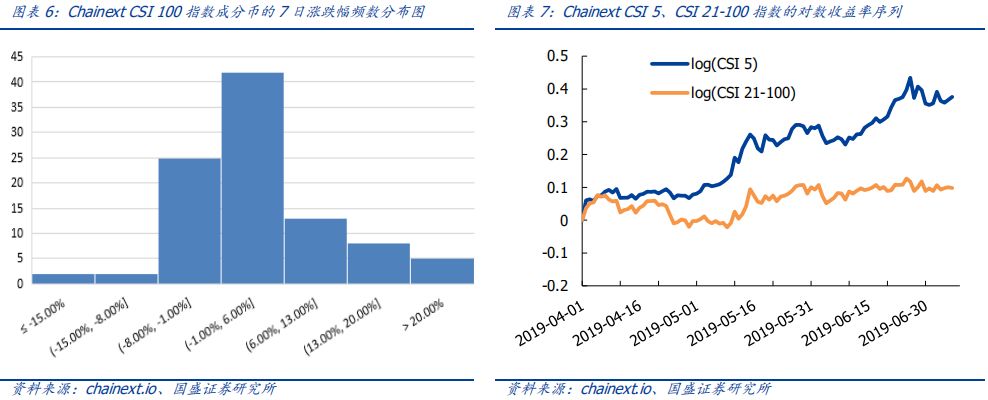

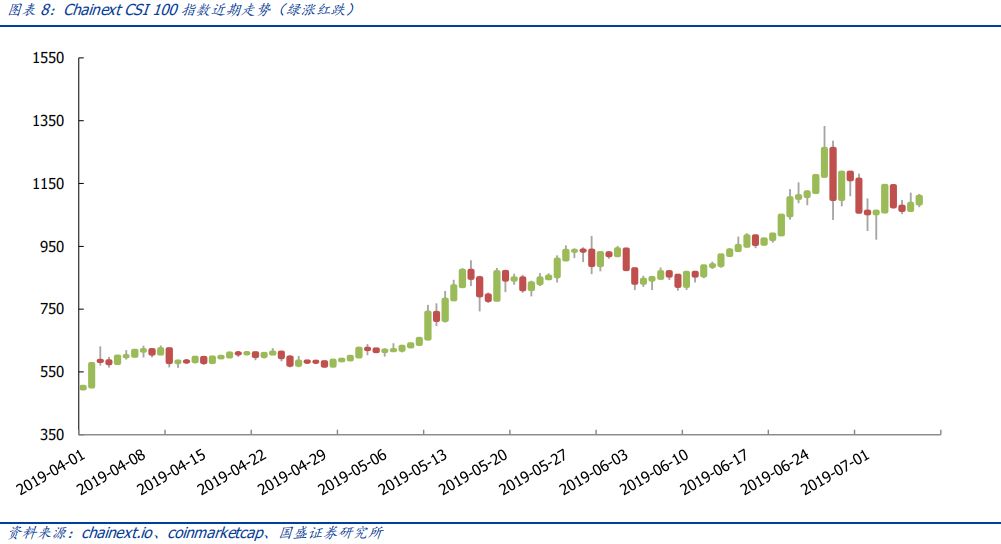

Last week's market review: Chainext CSI 100 increased by 4.60%, and the pure currency in the segmentation sector performed best. From the perspective of subdivision, the pure currency, commercial finance, and basic chain sectors outperformed the Chainext CSI 100 average, +17.43%, +11.85%, +7.54, entertainment social, Internet of things & traceability, storage & computing. The payment transaction, AI, and base enhancements performed worse than the Chainext CSI 100 average, +4.44%, +4.24%, +3.2%, +1.11%, -0.18%, -1.33%, respectively.

Risk warning: regulatory policy uncertainty, project technology progress and application landings are not as expected, and cryptocurrency-related risk events occur.

- Zhou Xiaochuan: Libra represents the trend of digital currency, China should take precautions

- Number said | In the first half of 2019, blockchain private placement financing of 11.851 billion yuan exceeded 60% of funds invested in the US market

- Attack on the big body! Goldman Sachs sets up a digital asset team or competes with Morgan

1. Hotspot tracking: US lawmakers call for a moratorium on Libra, Facebook opens a long-term game with global regulation

On the eve of the hearing, the long-term game between Libra and regulation has begun. Recently, five Democratic members of the US House Financial Services Committee suddenly sent a letter to Facebook executives such as Zuckerberg, calling for a suspension of Libra/Calibra's work. Libra and Calibra may help a new global financial system centered on Switzerland, which will challenge US monetary policy and dollar status. “This will raise serious privacy, transactions, national security and monetary policy issues. Not only Facebook’s more than 2 billion users, investors, consumers and the wider global economy should be concerned about this.” June 18, 2019, The Libra white paper, a cryptocurrency created by Facebook and 27 industry giants, was released. This is the first cryptocurrency project jointly led by global Internet, finance, telecommunications and other multi-domain giants. A total of 28 companies, including Facebook, MasterCard, Visa, PayPal, Uber, Lyft, Spotify, etc., have formed a Libra partnership and are headquartered in Switzerland. Facebook has published a white paper and hopes to recruit more than 100 companies to join the partnership. To this end, the US Senate Bank, Housing and Urban Affairs Committee will hold a hearing on Facebook on July 16 for Facebook's new cryptocurrency Libra. Maxine Waters, chairman of the House Financial Services Committee, announced that the committee will hold a hearing on Facebook on July 17 for Libra's cryptocurrency-based payment platform program Libra. On the eve of the hearing, the game between Facebook and regulation has begun – in addition to the United States, many governments or officials in India, France, the European Union, Japan and Thailand have expressed their opinions or opinions on Libra. Earlier media reports that Indian officials expressed a rejection attitude, the Bank of Japan also expressed concern about the potential risks of Facebook's Libra cryptocurrency project, worried that Libra cryptocurrency is difficult to regulate, may bring risks to the financial system. Earlier, Bank of Japan Governor Haruhiko Kuroda said that he would pay close attention to whether Libra would be widely used for payment and to assess the impact on existing financial and payment systems.

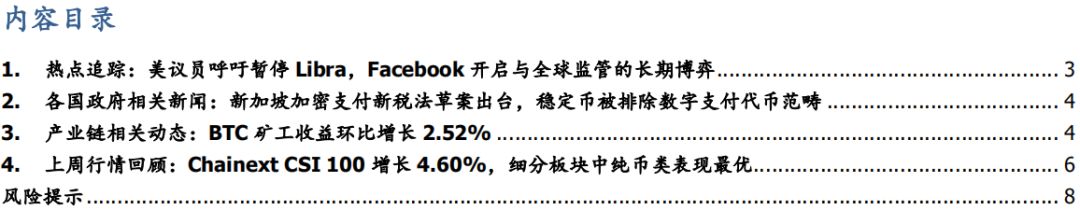

Libra will enable countries around the world to pay more attention to digital currency R&D and regulation. Due to Facebook's huge influence, its leading legal currency behavior has made the global regulatory authorities and industry pay more attention to the blockchain – even have to re-examine the all-round impact of market economy and social governance brought about by blockchain innovation. . While the supervision of major countries in the world is advancing, all countries recognize that blockchain and digital currency are inevitable innovation highlands in the future, and supervision requires more encouragement and support. Wang Xin, director of the Research Bureau of the People's Bank of China, said recently that the direct issuance of digital currency by the central bank will help improve the effectiveness of monetary policy and promote the central bank's digital currency research and development in the future. The next step is to explore digital finance to better support the development of the real economy. It is also necessary to improve the framework of the financial technology regulatory system, develop regulatory technology, and strengthen the construction of digital financial infrastructure. The Singapore Revenue Agency recently published a draft on the payment-based digital currency taxation scheme, which proposes to waive the GST for payment-based digital money supply from January 1, 2020. The draft will continue to seek public comment from now until July 26. According to the Singapore Revenue Authority, according to the country's current policy, the payment of digital currency is subject to the provision of taxable services. Enterprises selling, issuing and transferring digital payment currencies are subject to consumption tax, but when these payment digital currencies are used to purchase goods. At the time of service and service, the consumption tax has to be paid again, resulting in double taxation. Therefore, it is recommended to exempt the consumption tax for the payment-type digital money supply.

The blockchain is currently facing the attention of the former regulators and the industry, and Libra's most realistic significance lies in this.

2. Relevant news of various governments: The draft new tax law for Singapore’s encryption payment was introduced, and the stable currency was excluded from the digital payment token category.

The UK Financial Market Conduct Authority (FCA) is preparing a ban on the sale of crypto derivatives to retail investors. In a document entitled "Limiting Contracts to Sell Different Products to Individuals," the FCA said regulators will soon issue a consultation paper discussing issues that may ban cryptographic derivatives such as Bitcoin futures and other encryption-related trading products. FCA noted that this move follows the public commitments in their previously published UK Encrypted Assets Working Group Final Report, and that the new rules in the forthcoming document will replace the final regulatory requirements for CFDs based on encryption.

3. Industry chain related dynamics: BTC miners' revenue increased by 2.52% from the previous month

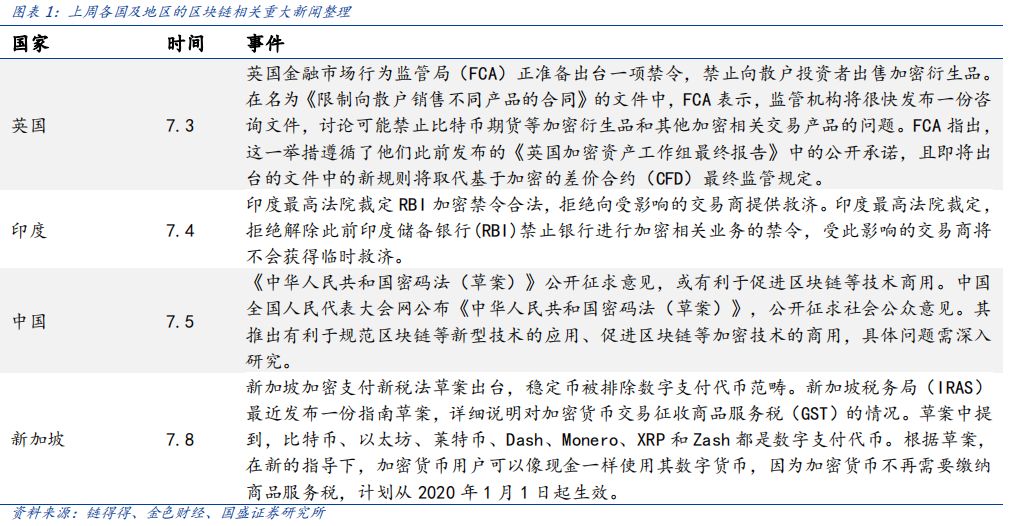

Last week, BTC added 2,561,000 new transactions, an increase of 0.30% from the previous month; ETH added transactions of 5,390,800, down 9.71% from the previous month. Last week, BTC miners' average daily income was US$249.78 million, up 2.52% from the previous month; ETH miners' average daily income was US$4.175 million, down 5.00% from the previous month.

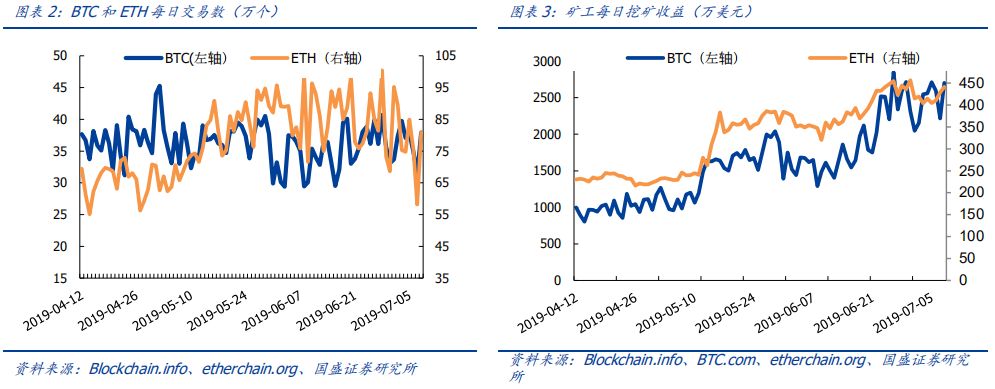

Last week, the average daily computing power of BTC reached 67.34EH/s, up 12.27% from the previous month; the average daily computing power of ETH network reached 171.38TH/s, down 0.50% from the previous month.

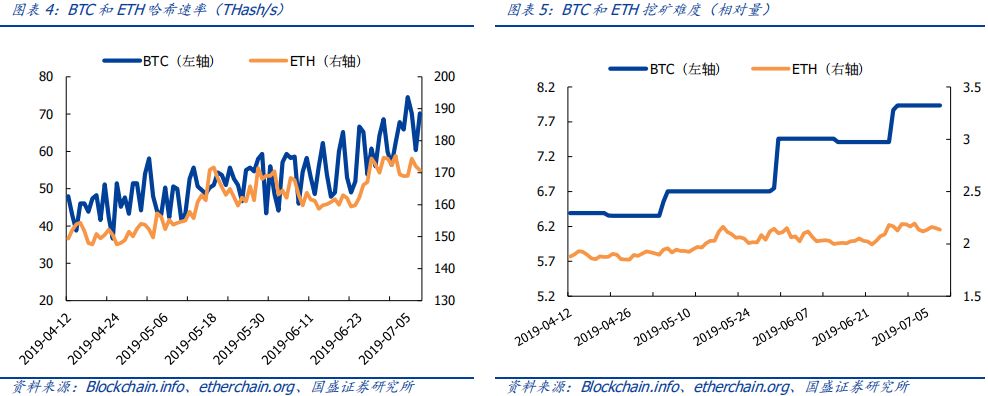

Last week, the difficulty of mining the whole network of BTC was 7.93T, which was 2.05% higher than the previous month. The next difficulty adjustment date was July 9th. The estimated difficulty value was 9.08T, and the difficulty increased by 14.38%. The average mining difficulty of ETH whole network last week was 2.15T, down 0.52% from the previous month.

4. Last week's market review: Chainext CSI 100 increased by 4.60%, and the pure currency in the segment was the best.

From the perspective of subdivision, the pure currency, commercial finance, and basic chain sectors outperformed the Chainext CSI 100 average, +17.43%, +11.85%, +7.54, entertainment social, Internet of things & traceability, storage & computing. The payment transaction, AI, and base enhancement sectors underperformed the Chainext CSI 100 average, +4.44%, +4.24%, +3.2%, +1.11%, -0.18%, -1.33%, respectively.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis: USDT issuance, BTC giant single

- Beijing Haidian District uses blockchain technology for the first time to break down information barriers

- Market Analysis: BTC is approaching $13,000, and short-term risk increases should not be chased

- Opinion: Why not optimistic about BitTorrent speed

- Take stock of central bank officials' important points: What is Libra's inspiration for the central bank's digital currency?

- Exchange captures EOS super nodes

- Opinion: power is power