Borrow money to the DeFi agreement? Good returns, but first assess the risk

This article is intended to help you understand the risk assessment framework for evaluating borrowing money for an agreement. First, you can help you identify ways to deal with risk: manage, avoid, ignore, or insure. Then help you evaluate the loan agreement from the dimensions of technology, external factors, and economic incentives.

So, what are the risks?

When someone says, "You can earn more than 10% of the annual interest rate," your first reaction may be "This sounds like a scam." But this is not always the case. If you have enough interest to learn more, then your next question is: "Well, but what are the risks?"

Next, we'll outline an advanced framework that will help you understand the risks involved in interacting with various DeFi systems. Instead of giving a fixed, quick score or a specific answer, it will provide you with the basic tools to help you with your assessment and decision making. Also, it's important that you don't have to know the Solidity code to solve the problem.

- 7 years to receive a $2 billion fee, Coinbase claims to be a unicorn unicorn

- The digital currency exchange has been caught in the throat by the legal currency.

- Privacy is the future, but the privacy currency is not

Consequences and possibilities

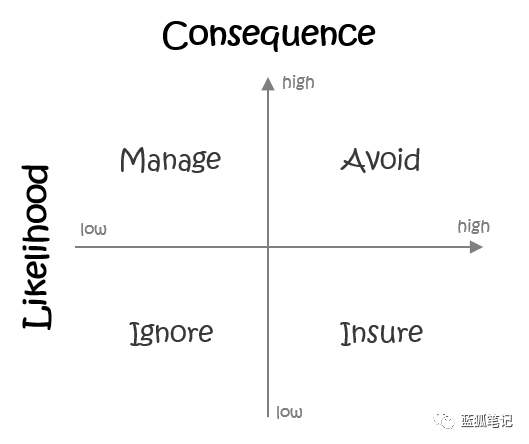

The first step in understanding risk is to break it down into two main factors, the possibilities and consequences. As you can see, it helps to separate these two factors, not only to understand the risks, but also to take appropriate measures on how to manage them.

- possibility

The probability that the risk actually occurs. Is it a relatively common situation? Still a rare event? Even an event that never happens?

What happens if an event occurs? Does it lead to major or small financial losses, or catastrophic failures that result in the loss of your entire investment? It depends on how each risk is assessed, and it is critical to understanding how to manage risk. Quite simply, the matrix below will guide you through the action.

- Avoid

Any high probability and serious consequences should be avoided and this risk cannot be properly managed or insured at a reasonable price. This is a category of "scams," but it can also be applied to a wider range of areas.

The combination of high likelihood and low consequences forms part of day-to-day management, and you can take responsibility for yourself or pay others to help you manage. For example, due to changes in interest rates between different DeFi protocols, measures can be taken to optimize the rate of return.

Low likelihood and low consequences are usually not worth worrying about. It's not worth the time and cost of managing it, so it's perfectly reasonable to ignore them.

The remaining categories are a combination of low likelihood and high consequences, and risk-adjusted returns should be improved as much as possible. At least you should understand the scenarios of serious consequences and what can lead to these consequences. (Blue Fox Note: In order to help lenders reduce risk, there are also projects that have developed insurance services, which further demonstrates that DeFi is basically a parallel world of the existing traditional financial world, and it presents new features such as no fixed lending. Period, variable interest rate, etc.)

Three risks in the loan agreement

Now that we have a common risk management framework, how do we determine the events or risks that may occur? High probability risks are usually more obvious because they tend to occur during normal operation of the platform. For example, interest rate changes, low mortgage rates lead to liquidation, slippage costs, and so on. The risk of serious consequences is where you need to spend more time thinking, because here you will fully understand the scope of risk return.

There are three main types of risks when using various DeFi platforms. Depending on the platform, each risk can result in significant capital loss. So understanding these three risks is very important.

Technical risk

Smart contracts have the risk of not running as expected by the developer. It is very difficult to write code that has no errors at all, so there is always a certain degree of technical risk. Auditing smart contracts, extensive testing, formal verification, and “combat testing” can all reduce technical risk.

A simple indicator is the holding time of its funds, which may be an aspect of a reasonable measure of technical risk, because even smart contracts that have undergone rigorous “combat testing” may have problems in the past.

2. External risks

The risk of external information affects the operation of smart contracts, thereby jeopardizing the interests of users. For example, a oracle may provide malicious data, a manager may change system parameters, or may choose a governance program. (Blue Fox Note: For example, changes in the mortgage rate may result in the asset being liquidated.)

If there is no level of technical ability, this is usually more difficult to assess. However, in general, there are always articles that explain how much control a manager has and where external risk factors are.

Some platforms have begun to introduce time-locked governance controls, which allow users to extract their funds when any changes occur. There are also some platforms that do not have the risk of external factors, such as Uniswap. (Blue Fox Note: Because Uniswap does not rely on oracles, etc.)

3. Risk of economic incentive failure

Many smart contract systems, especially in the DeFi space, rely on economic incentives to encourage network participants to perform certain operations. These incentives may not be sufficient or sufficient to encourage the correct behavior of network participants, causing other users to be adversely affected.

For example, the incentives in the MakerDAO smart contract may be too aggressive, and if the ETH price falls by a large and fast rate, the anchoring of the DAI and the dollar may be broken. (Blue Fox Note: MakerDAO currently has 150% over-collateralization and is beginning to move toward multi-asset mortgages)

The first thing to do is to think about the worst and then decide if you are willing to take risks. For example, in the Compound agreement, the worst case of economic incentive failure is that it may result in funds being unable to be taken out for a period of time, rather than the risk of complete loss of funds. Depending on each person, this situation may be tolerable or unbearable.

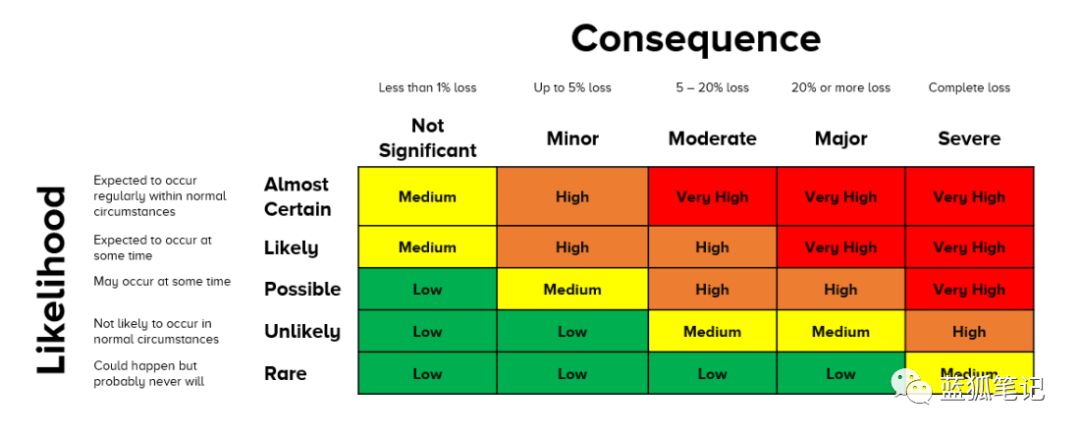

Once you understand the risks, you can evaluate the risks based on a matrix of more details before deciding how to deal with them. Whether it is to avoid, manage, ignore or insured.

Interacting with DeFi Smart Contracts is a new behavior and a risk, but in many cases they can be fully understood and managed appropriately. If you first understand the various modes of failure, then over time, you will be in a better position to grow your cryptocurrency wealth.

Risk Warning: All articles in Blue Fox Notes can not be used as investment suggestions or recommendations. Investment is risky. Investment should consider individual risk tolerance. It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | Bakkt options before the CME; quantum computers are not enough (1025)

- Opinion: Why is Bakkt's failure not surprising?

- Bitcoin prices continue to fall, will the mining machine stop?

- Galaxy Digital will launch new bitcoin fund in November

- Speed reading | 5 sentences summarizing Vitalik's ETH2.0 series blog post, Nic Carter talks about the evolution of bitcoin as a safe-haven asset

- Google, Internet Stock and Ethereum

- BiClub realizes full automation of OTC platform and helps build a large-scale digital asset financial service system