Brazilian parliamentary committee recommends prosecuting Zhao Changpeng and other Binance executives.

Brazilian committee recommends prosecuting Binance executives.Author: Tom Mitchelhill, Cointelegraph; Translation: Song Xue, LianGuai

After investigating a financial pyramid scheme in Brazil, the Brazilian Congressional Committee has recommended that local law enforcement authorities file charges against Binance CEO Changpeng Zhao “CZ” and three other Binance executives.

On October 10th, the committee released a final report of 500 pages, accusing Changpeng Zhao and local Binance executives Daniel Mangabeira, Guilherme Haddad Nazar, and Thiago Carvalho of fraudulent management practices, unauthorized operations, and unauthorized provision of securities trading.

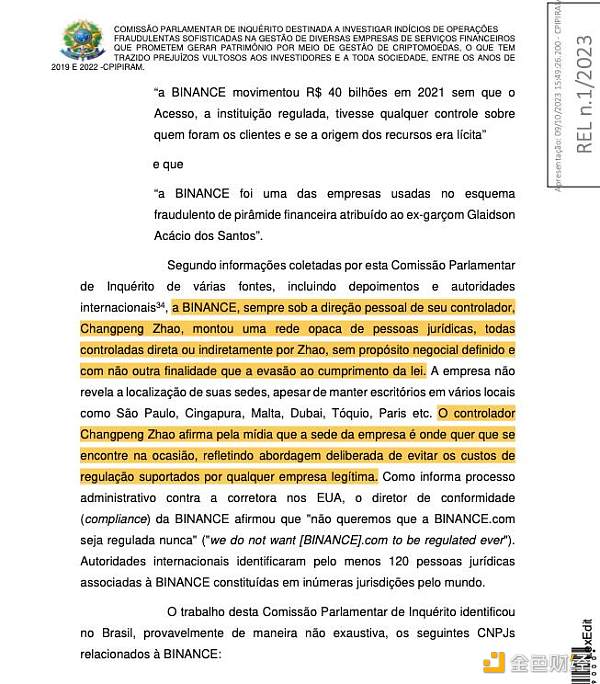

In the report, the committee led by Vice Chairman Ricardo Silva claims that Binance, Changpeng Zhao, and others “established an opaque network of legal entities, all of which are directly or indirectly under his control, with no clear business purpose other than evading legal compliance requirements.”

- AMM Triangle Liquidity Providers, Options, and AMM Translation

- REPUBLIK completes $6 million in seed funding, with a valuation of $75 million.

- LianGuai Morning News | Brazilian official suggests prosecuting Binance executive SBF, whose ambition is to become the President of the United States.

The report also recommends prosecuting an additional 45 individuals for alleged involvement in criminal schemes, who have connections to multiple cryptocurrency companies, including travel company 123milhas and cryptocurrency scheme 18K Ronaldinho.

Binance CEO Changpeng Zhao is accused of multiple financial crimes. Source: Brazilian Chamber of Deputies

Silva wrote that with Binance being accused of non-compliance with regulations in many other jurisdictions in Brazil, the operation of Binance is “suspect.”

The committee recommends that the Federal Public Ministry investigate all of Binance’s operations in Brazil, with a particular focus on tax evasion, money laundering, and support for organized crime and terrorism.

In addition, the committee recommends that the Brazilian Securities and Exchange Commission (CVM) investigate Binance’s derivative sales.

The committee claims that despite being told to stop offering derivatives trading, Binance continues to provide derivative products, which is a “repeated violation” of market regulations. Binance is already under investigation by the CVM for allegedly providing illegal derivatives products in the country.

The recommendations of the committee are not legally binding and are only suggestions to local authorities. The police and other regulatory agencies will decide whether to take further action.

Binance stated that it is “still committed” to cooperating with the committee and local law enforcement agencies in Brazil.

Binance stated that while it welcomes constructive debates on the challenges facing the cryptocurrency industry, it “strongly opposes baseless allegations of misconduct against our users or employees and attempts to target Binance.”

The regulatory hostility towards Binance comes amid broader crackdowns by government authorities around the world against the exchange.

In the United States, Binance is facing two separate lawsuits filed by local commodity and securities regulators, accusing Binance and its executives of violating multiple financial regulations.

In July of this year, the Australian financial regulatory agency conducted a search of Binance Australia’s office after revoking its derivatives license several months ago. In May of this year, Binance withdrew from Canada citing new regulatory measures.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Inventory of 16 Israeli concept coins worth paying attention to, with infrastructure and DeFi as the main force.

- Farcaster Why is the community’s response mediocre despite Vitalik’s praise and a16z’s investment?

- Did Michael Lewis’s reputation ‘crash’ by showing mercy to SBF?

- Dialogue with Superscrypt Partner of Temasek’s Web3 Fund What details of RWA development have we overlooked apart from speculation?

- OP Stack + Zero-Knowledge Proof = The ultimate game of Layer 2?

- Cosmoverse 2023 Conference Summary Glimpsing the Development Direction of the Ecosystem from the Latest Roadmap

- Head Warehouse Research Report MMORPG Blockchain Game Big Time