Current Status and Potential Variables of MakerDAO, the ‘DeFi Veteran

MakerDAO, the 'DeFi Veteran,' has a current status and potential variables.MakerDAO is a revenue-generating machine that continues to create wealth regardless of market conditions.

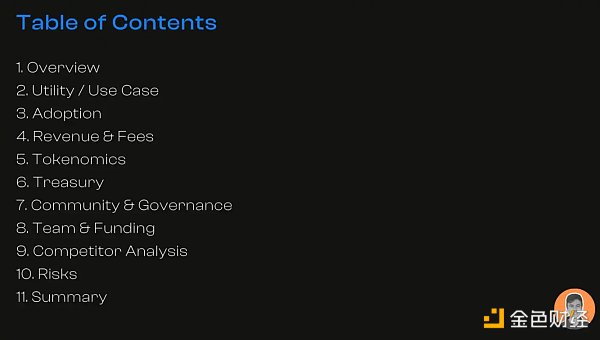

This article is the latest research report on MKR in October 2023.

The Maker protocol allows users to borrow loans by using their encrypted assets as collateral. The process works as follows:

- Can Social Tokens Recreate the Glory of DeFi Summer?

- Interdisciplinary Paper Part 2 Storage Proof, Computation, and Inflation

- Inventory of three development proposals to be launched by Ethscripitons

Users deposit collateral (approved ERC tokens);

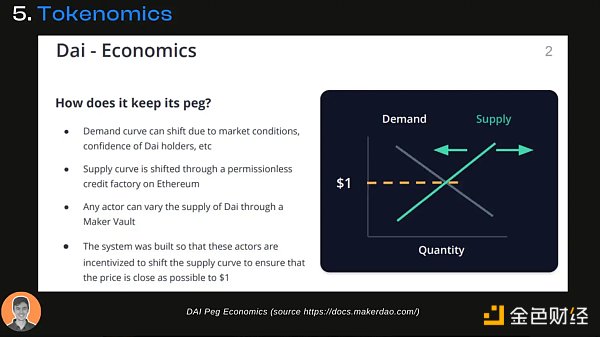

Stablecoin DAI is minted according to the collateral ratio;

DAI is currently the largest decentralized stablecoin pegged to the US dollar.

Use cases of DAI include:

Decentralized assurance of financial independence;

Users can generate currency autonomously;

Automatic savings rate (DSR);

Fast and low-cost transfer remittance;

Maintaining stability in volatile markets;

In addition, DAI can also be used to pay gas fees in certain scenarios within the Ethereum ecosystem, improving the Web3 onboarding experience for new Web3 users.

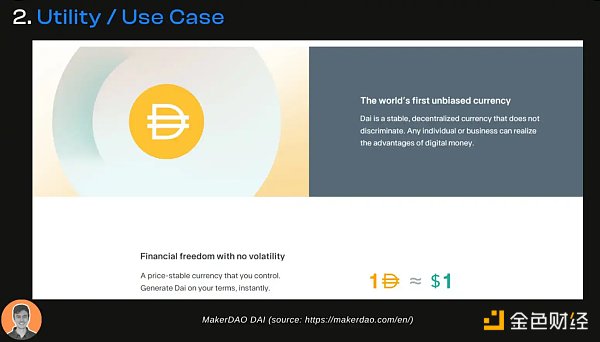

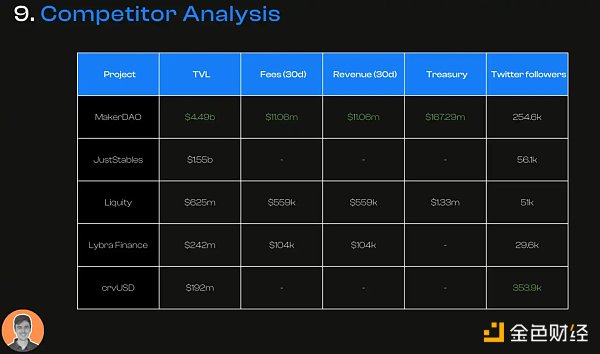

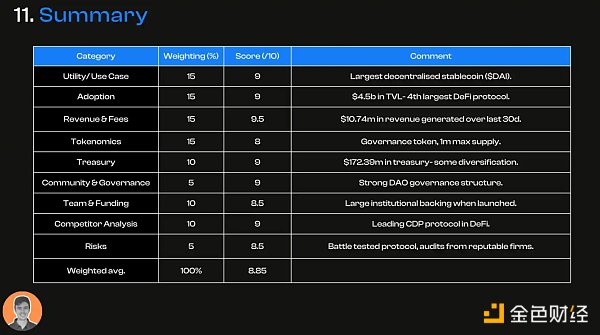

Currently, MakerDAO’s TVL is $4.5 billion, the lowest level since January 2021, a 78% decrease from the all-time high set in December 2021.

Despite this downward trend, MakerDAO still ranks fourth among all DeFi protocols (total TVL).

In the past 30 days, MKR has generated $10.7 million in revenue. When annualized, this figure reaches as high as $130.7 million, ranking it seventh among all protocols.

The fees and revenue of MakerDAO are mainly generated by the interest paid by borrowers on the platform.

MKR tokens have two main uses:

Governance;

Capital restructuring resources;

In addition to its governance role, MKR can also be used for system capital restructuring.

If the debt of the Maker system exceeds the surplus, the supply of MKR tokens may expand through debt auctions.

Therefore, this risk encourages MKR holders to self-adjust and responsibly manage the MakerDAO ecosystem to mitigate situations of excessive risk-taking.

This also means that the supply of MKR may fluctuate based on debt capitalization.

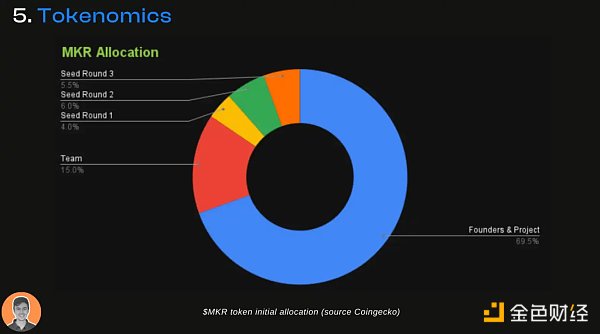

These are the current supply statistics:

Circulating supply = 901,000 MKR;

Total supply = 977,000 MKR;

Maximum supply = 1 million MKR;

Market cap = $1.27 billion;

FDV = $1.4 billion;

Market cap / FDV = 0.9;

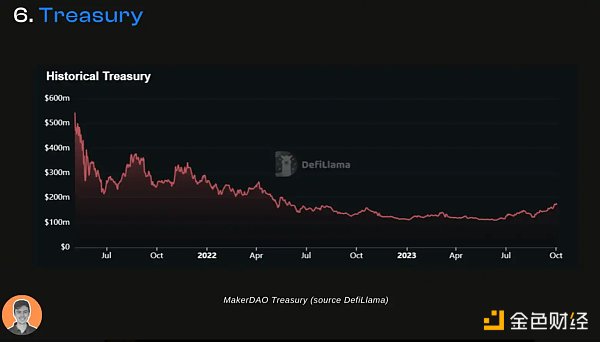

The encrypted assets in the MakerDAO treasury include:

$49.61 million stablecoins;

$800,000 BTC and ETH;

$122.38 million worth of native token MKR;

In total, the MakerDAO treasury holds $172.39 million (including native token MKR), ranking 11th among all protocols according to DefiLlama’s data.

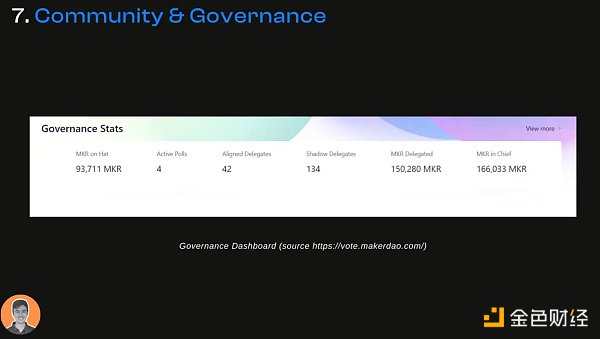

In terms of community governance, anyone can submit proposals and vote on them in MakerDAO, but only MKR holders have the right to vote on changes to the Maker protocol.

This process consists of two stages:

Proposal voting

Execution voting

These two steps ensure careful consideration before the final vote in MakerDAO.

In 2014, MakerDAO was launched on the Ethereum blockchain and has since become one of the largest DeFi applications. The protocol was co-founded by Rune Christensen and Nikolai Mushegian.

DAI is now one of the most widely used stablecoins.

In multiple token sales, Maker raised a total of approximately $54.5 million:

On December 16, 2017, $12 million was raised with participation from Andreessen Horowitz and Polychain Capital;

On April 23, 2019, $15 million was raised with funding from a16z Crypto;

In April 2019, $27.5 million was raised with participation from LianGuaridigm and Dragonfly Capital;

MakerDAO has become a prominent market leader in the Collateralized Debt Position (CDP) category, but it now faces competition from emerging protocols such as Liquity and Lybra Finance.

At the same time, in the stablecoin competition, other mature DeFi participants such as Curve and AAVE have also launched stablecoins like crvUSD and GHO.

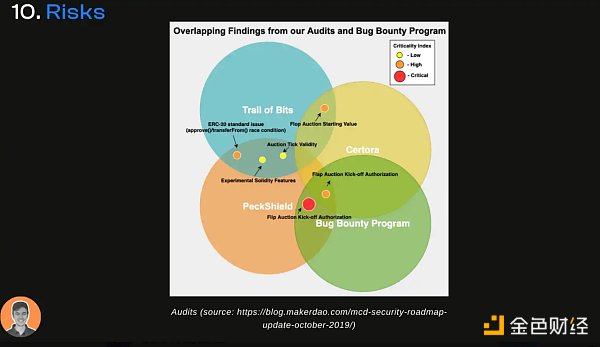

In terms of protocol security audits, Maker has completed security audits by several well-known auditing companies, including:

Trail of Bits (security review of smart contracts);

PeckShield (traditional audit);

Runtime Verification (model for verifying system logic);

Overall, I am very optimistic about the MakerDAO and DAI ecosystem. Here are some upcoming positive factors:

Launch of Sub DAOs;

SLianGuark Protocol;

RWA narrative;

5% annual interest rate on DSR;

Token split;

Brand reshaping;

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting the non-custodial liquidity protocol Hover A differentiated and hierarchical new lending system

- Layoffs, business restructuring, strategic adjustments, where will Yuga Labs go?

- Regulatory uncertainty leads to continuous 18-month decline of stablecoins

- Zimbabwe’s Central Bank Residents and Institutions Can Use Digital Tokens for Payments or Settlements

- Overview of co-processor solutions and their alternative solutions What use cases can be unlocked?

- Beyond Engineering Cryptographic Aesthetics

- MetaMask’s growth engine is losing momentum, and generalized user applications are becoming the new center of ‘entry’.