Can Social Tokens Recreate the Glory of DeFi Summer?

Social Tokens Recreating DeFi Summer's Glory?Friend.Tech is on fire.

This model, centered around KOLs and allowing fans to buy and sell “shares” of KOLs, is not complicated and has a bit of a “P&G” flavor. However, in the bearish environment of hot topics and scarce liquidity, Friend.Tech has indeed created a wave of SocialFi.

For example, Star Arena, which has recently skyrocketed on Avalanche, has remained the focus of attention despite the ups and downs of Avalanche’s founder calling the shots and the contract vulnerability causing funds to be lost.

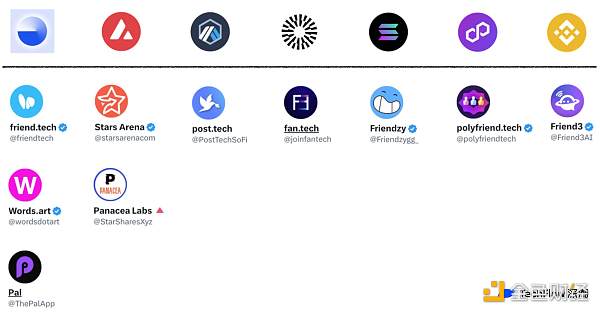

At the same time, the trend is spreading:

- Interdisciplinary Paper Part 2 Storage Proof, Computation, and Inflation

- Inventory of three development proposals to be launched by Ethscripitons

- Interpreting the non-custodial liquidity protocol Hover A differentiated and hierarchical new lending system

Starting from Base on L2, FT’s mirror projects quickly emerged on other ecosystems such as Avax, Arbitrum, Solana, Polygon, and Bnb. These projects are making different improvements and innovations based on FT, trying to capture this hard-won heat;

And on Twitter, a large number of crypto-related topics and accounts continue to discuss and introduce FT and other projects, as if there is a fear of missing out on a billion.

DeFi Summer, a familiar taste

Pursuit of returns, emergence of mirror projects, continuous topics… Does all of this feel somewhat familiar?

Yes, you can easily associate it with the DeFi Summer of 2020.

Chris, a partner at well-known VC Placeholder, said that social P&G is the new DeFi Summer, and described the development process of projects like FriendTech as similar to DeFi Summer:

An experiment -> Traffic influx -> The emergence of a viable model -> Attracting more attention and perfecting the experience -> The emergence of larger-scale applications -> Getting everyone involved within 18-24 months.

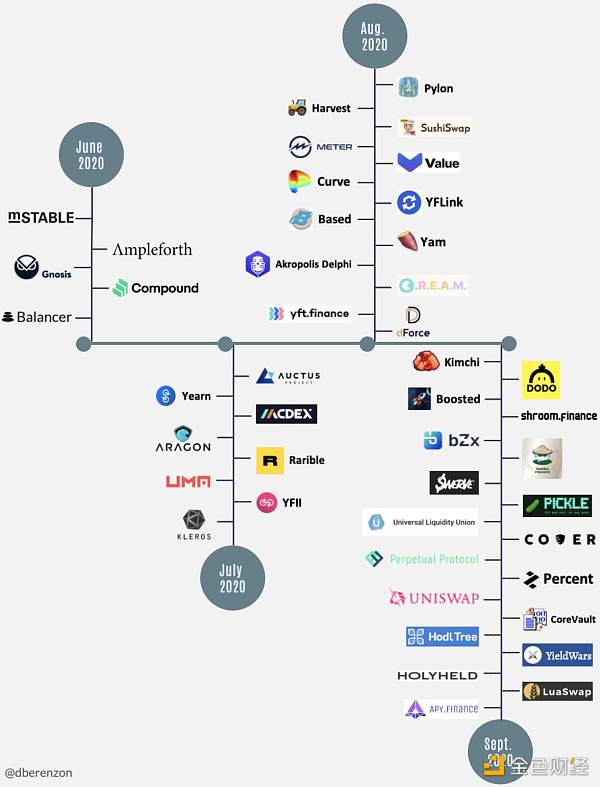

If you carefully review the DeFi Summer three years ago, you will find that this development path does indeed feel familiar.

In June 2020, Compound implemented the “liquidity mining” gameplay on a large scale, attracting many players to provide liquidity. Subsequently, various protocols discovered the viability of this model, started to learn from and improve the design of liquidity mining, and made adjustments to tokens and economic models to attract more people to join.

In the end, the TVL of the entire DeFi track soared from $1 billion in June to $10 billion in October, and the number of users also increased dramatically. At the same time, gas fees on Ethereum also reached a historic high at that time.

A concept of liquidity mining, a leading project, led to a whole summer of prosperity and established a solid position for DeFi.

A concept of social P&G, a leading project like Friend.Tech, is driving the mirroring of various ecosystems. Will it ignite a wave of SocialFi? Practitioners also seem to smell a similar taste and are eagerly awaiting the market turning point.

Craving Traffic, Igniting Traffic

SocialFi’s popularity surge seems to follow a similar development path as DeFi Summer, but it faces a more challenging market environment — the entire market seems to be thirsting for traffic.

When the market is bearish, various Layer 2 solutions emerge in abundance. With no significant difference in technology and performance, every Layer 2 hopes to find a traffic grabber and gain attention and liquidity in the competitive environment.

As a result, we saw the emergence of Friend.Tech, which caused a skyrocket in Base’s TVL and quickly rose to prominence in the competition of Layer 2, securing a solid position.

This desire for traffic is even more evident on the “almost outdated” Layer 1.

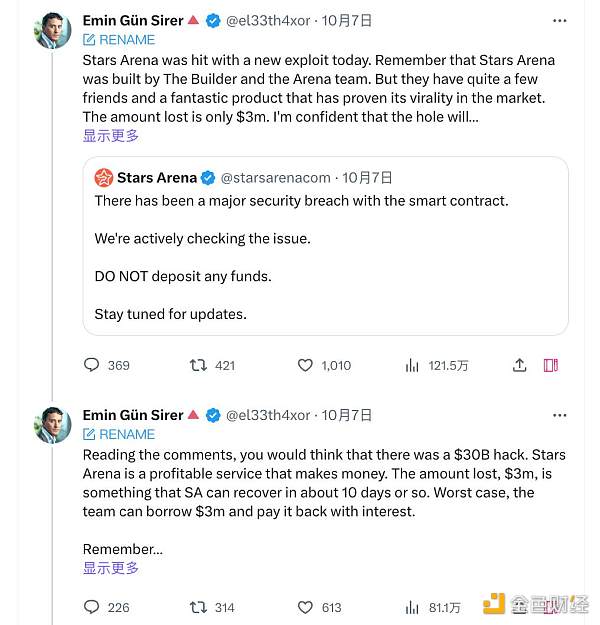

Gun, the founder of Avalanche, has publicly expressed support and optimism for Star Arena since its appearance. Even when Star Arena was hacked due to contract vulnerabilities and all funds were stolen, Gun called for giving new applications some room for trial and error, waiting for their recovery and rebuilding.

Regardless of whether Star Arena is an official development of Avalanche or a so-called “Chinese project,” the founder’s public endorsement clearly shows the thirst for traffic on Layer 1 public chains.

A phenomenal application can bring new life to a stagnant public chain ecosystem, which is even more precious in the current spotlight on Layer 2.

It is the voices and participation of key figures that further confirm the basic logic of attracting traffic to products like FT and SA:

By attracting people’s expectations or incentives, attracting traffic to complete the cold start of the product; then using appropriate dissemination strategies to ignite more traffic and increase the network effect of social products.

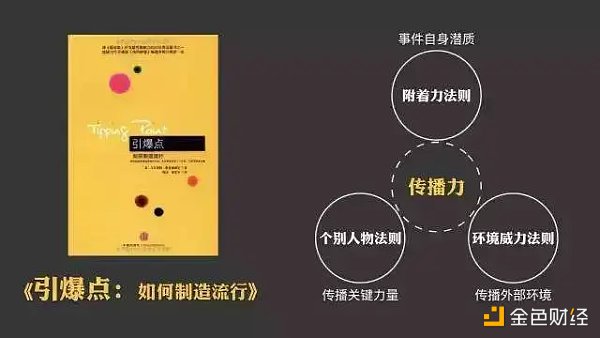

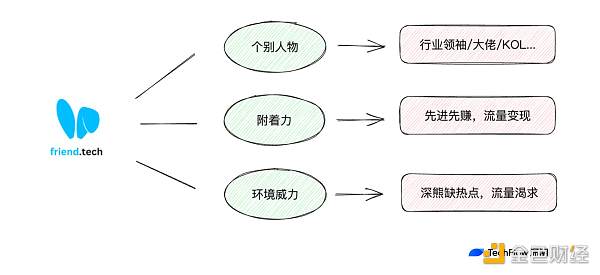

Using the theories in the classic book “The Tipping Point” in communication studies, three major laws need to be followed for a product or topic to become popular:

-

The Law of the Few: For information to become popular, it must be spread by certain individuals with social skills, vitality, enthusiasm, and charm.

-

The Stickiness Factor: Once the information becomes practical and meets personal needs, it becomes unforgettable.

-

The Power of Context: The spread and popularity of information require favorable external conditions.

These three laws can be applied more specifically to SocialFi products like Friend.Tech:

Within this communication logic, we can see more and more people joining Friend.Tech. Players who were previously hesitant and analyzing are now starting to try it out under the continuous influence of certain individuals and the attractive stickiness, eventually becoming extremely popular in the bear market’s lack of hotspots.

Meanwhile, users of FT also chose to withdraw due to the decreasing profits caused by the internal competition of robots, naturally providing space for a group of imitators to absorb this overflow of traffic.

Clearly, Friend.Tech is the first, but it won’t be the last. Imitators make minor innovations, improve the user experience, or add new gameplay on the existing basis in order to better attract traffic, just like what Sushiswap did to Uniswap back then.

Question Pangs, Understand Pangs, Become Pangs

Friend.Tech has made a good start in spreading, but the question is whether it can sustain like DeFi Summer?

Compared to DeFi’s liquidity mining, although it is also a means of attracting users by providing profits, and earlier participation in liquidity mining has higher returns than later participants, in terms of income sources, the income of DeFi products and LPs comes from the transaction fees generated when other users use them, rather than simply earning money from the next participant.

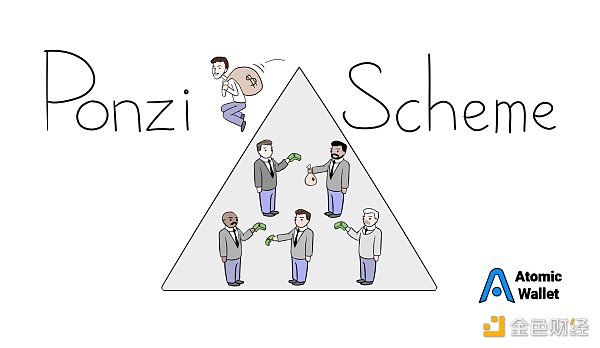

And social products like FT have very obvious pang characteristics, which means that early participants are more likely to earn money from later participants, and the latter may bear higher purchase costs.

Therefore, from an economic design perspective, in some aspects, FT is not like DeFi, but more like the once popular StepN. Once there are no more users joining, will the entire chain also become difficult to maintain and eventually fall into a death spiral like most GameFi projects?

But don’t forget that StepN, as a consumer-level crypto application, once successfully broke into the mainstream and gained a high level of popularity and user base. After that, there has been no similar consumer-level application in the entire crypto industry.

From this perspective, the pang structure in the economic design of StepN actually played a positive role in quickly acquiring users in the early stages: if you run first, you will earn first, don’t believe it, you won’t come.

And today, when the infrastructure is homogeneous and abundant, and everyone is expecting the social track to produce the next truly consumer-level crypto application, completely denying and questioning the pang structure of Friend.Tech is obviously not a practical choice.

Question Pangs, Understand Pangs, Become Pangs.

Based on the premise that understanding the pang structure is not the same as understanding the pang scam, making appropriate use of the pang structure has become a necessary path for crypto applications to achieve development by attracting traffic.

Competing in terms of user experience, crypto applications cannot match mature Web2 products; talking about compliance, crypto applications operate on the boundary between black and white; discussing demands, crypto applications do not have a popular and indispensable rigid demand.

So, how to make users impressed and take that step from not using to using?

The current answer is probably incentives and profits. The earlier you come, the more profits you make, using the money-making effect to attract more users. It does have some pang flavor, but for Crypto, it is an inevitable part of application development.

Success and failure are both side effects.

History has shown that applications or projects that only focus on side effects without continuously providing more external value cannot attract users for a long time. They either rug pull or passively die out.

In this regard, side effects are a means, not an end.

Whether Friend.Tech or Star Arena can provide more functions and gameplay beyond profits, retain users with practical features after successful launch, and offset the “latecomers’ disadvantage” caused by side effects, still needs time to verify.

A Reappearance of Prosperity?

Can social side effects reproduce the prosperity of DeFi Summer? In the short term, it is difficult, in the author’s opinion.

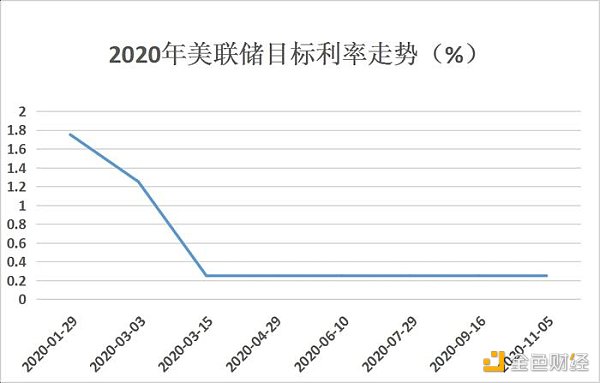

Firstly, the macroeconomic environment they are in is different. In 2020, the Federal Reserve cut interest rates twice in March, reaching zero, and launched a quantitative easing (QE) program with a total amount of 700 billion US dollars. The flooding also led to the hot cryptocurrency market. The maintenance period of low interest rates coincided with the time frame of DeFi Summer, as shown in the figure below.

Currently, we are facing liquidity tightening, capital outflows, and the Federal Reserve’s interest rate hike cycle. VCs are also extending olive branches to the AI industry. SocialFi does not have the same loose environment as it did back then to sustain its popularity.

Secondly, their sources of income are different. As mentioned earlier, the income of DeFi products and LPs comes from the transaction fees generated when other users use them, rather than simply making money from newcomers. On the other hand, the current side effects of Friend.Tech are very obvious, and the existence of automated robots has led to a sharp increase in the cost for newcomers. This is not a very healthy money-making model for users; it is more like a zero-sum game.

If there are no continuous updates in terms of functionality and more players entering, the possibility of the fortress being breached from within is greater.

Lastly, their level of demand is different. DeFi is naturally born for finance. The orientation of the product itself is how to earn profits more freely, efficiently, and conveniently. To some extent, it is a “necessary demand for transactions”.

On the other hand, the focus of SocialFi is theoretically on Social rather than Fi. Apart from profits, ordinary users do not have an urgent need to choose a cryptocurrency application that is clearly inferior to mainstream social software in terms of functionality and user experience. The current situation where Fi surpasses Social cannot be changed in the short term, and there is a greater possibility of dispersing after the speculative effect fades.

However, it is undeniable that today’s social side effects have been successful in acquiring users, and the presented features are by no means the ultimate form.

Instead of expecting them to reproduce the prosperity of DeFi Summer, it is better to expect them to create a new path and make a scene.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Layoffs, business restructuring, strategic adjustments, where will Yuga Labs go?

- Regulatory uncertainty leads to continuous 18-month decline of stablecoins

- Zimbabwe’s Central Bank Residents and Institutions Can Use Digital Tokens for Payments or Settlements

- Overview of co-processor solutions and their alternative solutions What use cases can be unlocked?

- Beyond Engineering Cryptographic Aesthetics

- MetaMask’s growth engine is losing momentum, and generalized user applications are becoming the new center of ‘entry’.

- LayerZero Security Prospects and Ecological Opportunities Capture