Interpreting the non-custodial liquidity protocol Hover A differentiated and hierarchical new lending system

Understanding Hover, a unique and layered non-custodial liquidity protocol for lending“Hover is an innovative player in the DeFi lending track. In addition to innovating in its own mechanisms (lending model, governance system) to obtain internal driving force, it also gains external driving force by relying on the growing Kava and Cosmos ecosystems. It has great development potential.”

Similar to DEX, lending is also one of the most important foundational components in the DeFi world. It bears the responsibility of on-chain liquidity and value transmission. The earliest on-chain lending platform can be traced back to ETHLend (predecessor of AAVE) in 2017. It was the first decentralized lending market on Ethereum, matching individual lenders and borrowers who wanted to participate in collateralized loans in a secure and reliable manner.

To ensure its security and trustlessness, the platform uses smart contracts on Ethereum to store user funds and their collateral, facilitating P2P lending protocols. The platform opened up a range of DeFi features, allowing traders to leverage or short cryptocurrencies, while businesses and consumers could obtain cash flow and liquidity without selling their underlying collateral. However, as an on-chain matching market, lending parties need to be matched one-to-one, which makes the use of ETHLend itself quite complex and liquidity poor.

In September 2018, Compound launched a new algorithm and open-source protocol with autonomous money markets on Ethereum, allowing anyone to earn interest or borrow cryptocurrencies (overcollateralized) in a trustless manner without interacting with counterparties. Through point-to-contract design and dynamic lending rate mechanisms, Compound stood out and laid the early foundations for the DeFi lending sector. Many subsequent mainstream lending protocols (including improved versions of AAVE, etc.) are based on Compound and further enhanced to achieve richer functionality and better user experience.

- Layoffs, business restructuring, strategic adjustments, where will Yuga Labs go?

- Regulatory uncertainty leads to continuous 18-month decline of stablecoins

- Zimbabwe’s Central Bank Residents and Institutions Can Use Digital Tokens for Payments or Settlements

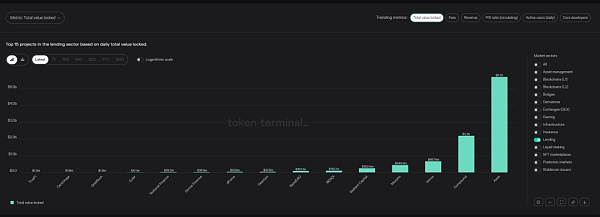

Focusing on the lending sector itself, leading lending protocols such as Venus, AAVE, and Compound have maintained their leading position in the market, and continue to lead in total value locked (TVL), trading volume, and other data.

Therefore, for emerging lending protocols, differentiating competition from leading lending protocols is necessary for further success. Hover is a representative emerging on-chain lending protocol that has adopted a very smart layout to achieve differentiation in building the lending ecosystem.

On the one hand, the Hover protocol itself innovates in mainstream lending mechanisms, making significant changes in liquidity, earning methods, and many other aspects. On the other hand, Hover is deployed on the promising emerging Kava ecosystem and backed by Cosmos, which will be more conducive to capturing users and funds, and further reducing the suction effect brought by leading lending protocols. In addition, based on the Cosmos system, Hover is also expected to promote seamless interoperability among various DeFi platforms, create unprecedented user opportunities, and cultivate a vibrant decentralized financial ecosystem. Hover’s development prospects are also highly regarded by the industry.

Hover’s Lending System

Hover is a non-custodial on-chain lending protocol, currently deployed on Kava and backed by the Cosmos ecosystem. Similar to “traditional” on-chain lending protocols, Hover has built an overcollateralized lending system that serves users on both sides of the lending process. For users who hold assets and seek passive income, they can deposit their assets into Hover’s lending pool as lenders. Most of the protocol income generated from borrowing fees will serve as interest income for lenders’ collateral deposited in the pool. By building corresponding mechanisms to enhance the yield of collateral, Hover aims to incentivize users to deposit funds and help the protocol obtain lending liquidity.

For borrowers, they need to pledge the assets they hold as collateral and borrow assets in an overcollateralized manner based on the collateralization ratio. For example, by pledging $2000 worth of ETH, borrowers can borrow 1400 USDT stablecoins from Hover’s lending pool at a collateralization ratio of 0.7. Borrowers can continue to profit by adopting strategies based on Hover. For example, investors with good market control can increase leverage through loop borrowing to achieve multiplied returns.

In certain special cases, Hover may liquidate borrowers. Hover uses a measure called the Health Factor to inform depositors of the status of their overcollateralized positions. When the Health Factor approaches 1, it indicates that the loan value is approaching the liquidation threshold. If the Health Factor drops below 1, the position faces liquidation risk – the process of selling collateral on the open market to repay the excess value of the borrower’s loan. Borrowers can deposit more collateral or repay enough loans to maintain a safe ratio and prevent collateral from being liquidated. Hover’s lending, deposit, and liquidation activities will be automatically executed by smart contracts, and the price fairness will be ensured through price feeding by oracles.

In addition, Hover will extract a portion of each loan repayment for protocol operation and reserve assets, and distribute them according to the Reserve Factor (RF) specified in the Hover reward program.

Hover’s other features mainly include the Jump Interest Rate Model, Token Loan Ceiling Mechanism, and Collateral System.

● Jump Interest Rate Model

Lending protocols themselves require sufficient funds in the lending pool. Hover adopts the industry-standard “Jump Interest Rate Model” mechanism. When the liquidity in the pool is relatively abundant, Hover will provide a relatively moderate interest rate that is advantageous for both lenders and borrowers. This interest rate will vary with the change of funds in the pool, and a simple trend is that the interest rate will increase when liquidity decreases.

When more than 80% of the funds in a specific funding market are borrowed, the mechanism of jump interest rates will be triggered, which means that both the deposit interest rate for depositors and the borrowing interest rate for borrowers will increase significantly. In this case, depositors will have the incentive to deposit in order to earn higher interest income, while borrowers will be more inclined to repay their loans to reduce the high repayment interest. This promotes the balance of the ecosystem.

Such mechanisms that have “spontaneity” typically have a good effect in balancing on-chain protocols. For example, in the AMM protocol, arbitrageurs can maintain the stability of the protocol’s price by balancing the price difference, helping the price return to a reasonable range. The jump interest rate model can also be seen as a “soft” guarantee for Hover to maintain the stability of fund pool liquidity, and Hover’s interest rate model is more flexible.

Of course, in addition to the “jump interest rate model” mechanism, Hover has also built a “hard” guarantee mechanism called the “token lending limit mechanism” to prevent extreme situations and attacks from causing impact.

● Token Lending Limit Mechanism

In addition to the jump interest rate model, Hover has set a maximum limit for borrowable tokens for each asset market, regardless of the amount of tokens deposited. This borrowing limit is based on parameters within the ecosystem, including the liquidity of decentralized exchanges and the amount of bridged assets.

Based on comprehensive considerations, when the borrowing amount in a pool reaches the maximum limit, Hover will restrict borrowers from borrowing funds from it until the funds in the pool are restored and can operate normally again. In fact, attacks on lending protocols do occur, and even pools with no restrictions can be “emptied” by attackers. Usually, such extreme events occur within a very short time period, and developers and operators of relevant projects may not have enough time to react. Therefore, the pre-construction of such preventive mechanisms lays the foundation for Hover to deal with emergencies, establish security mechanisms, and provide users with long-term high-quality trading services.

● Three-Token Model-based Economic System

Hover has set up an economic system based on a three-token model, including HOV, esHOV, and xHOV. Users can pledge HOV assets to obtain esHOV tokens, participate in optional KYC processes to further convert esHOV into xHOV, and also participate in the Hover Rewards Program.

Similar to the current mainstream veToken governance system, both esHOV and xHOV assets are non-transferable and can only be traded or transferred after the HOV pledge is released. If users want to cancel their pledge, they can trigger the redemption and specify the redemption period to convert their esHOV and xHOV back to HOV. Redemption usually takes 90 to 180 days, and in this case, users will receive HOV in a 1:1 ratio. Users who choose to redeem within 15 days must destroy 50% of the redemption tokens as a penalty for early redemption. Users who decide to cancel their pledge between 15 and 180 days will pay a linearly decreasing penalty, and the destroyed tokens will be permanently eliminated from the circulating supply.

So, ignoring the functional role of tokens, esHOV and xHOV, especially the redemption period of up to 180 days, will further reduce the market liquidity of HOV assets. The punishment mechanism will further promote the absolute deflation of HOV assets.

In order to further encourage HOV holders to participate in staking, Hover has launched a new staking plan. Staking users will be able to obtain corresponding staking benefits. After staking the HOV assets to obtain esHOV, users will receive loan rebates (providing fee rebates when obtaining loans from the Hover market) and liquidation rebates (providing fee rebates when a borrower’s position is liquidated) income. Once Hover transitions to DAO, esHOV holders will be able to vote on market parameters and innovations.

When users further stake esHOV to obtain xHOV, they will enjoy the Hover reward program. Stakers must pass the third-party KYC check by Quadrata to qualify. Quadrata is a GDPR-compliant digital identity service that performs checks to ensure that only personnel from approved countries/regions can access the Hover reward program. Hover cannot access or collect any personally identifiable information (PII). After completing Quadrata’s quick onboarding process, users will receive a Soulbound NFT, and the Hover smart contract will query this NFT to determine eligibility to use the platform.

In the Hover reward program, 33% of the protocol’s revenue is allocated to xHOV stakers who pass the KYC check. This program will be launched through the public sale proceeds of 10% and the ecosystem allocation of 0.75% to ensure stable returns at least in the first year.

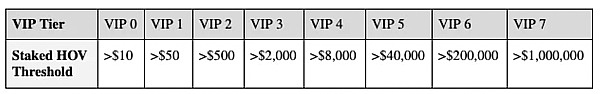

In addition, users holding esHOV and xHOV will receive HOV VIP levels, which will provide users with many benefits, including rebates on protocol fees for lending and liquidation. Different levels will also include access to token-gated group chats, early access to new features, and more, to ensure the longest-term, consistent users get the best experience of Hover products.

HOV will permeate throughout the development of the Hover ecosystem, further promoting more users to join the Hover ecosystem as sticky users and participate in the early development of the ecosystem. The series of staking systems will also help stabilize and deflate the price of HOV assets in the long term, providing continuous promotion for the long-term development of the Hover ecosystem.

Deployed on Kava, backed by the Cosmos ecosystem

Kava is a Layer1 built on the Cosmos Layer0 system, backed by the Cosmos ecosystem. Developers can use Kava’s security, cross-chain bridge, and adapted Chainlink oracle to quickly create new cross-chain DeFi applications and deploy them to Kava’s global user base. With technologies such as Tendermint’s Proof of Stake (PoS) consensus mechanism, the Kava network can achieve the ability to quickly confirm blocks within 6 seconds in a globally distributed ledger.

On May 18th this year, Kava launched a new mainnet called Kava13, which is based on Kava EVM 2.0. The network stability and performance of Kava13 have been continuously improved. At the same time, the new Kava ecosystem has introduced a new developer incentive program, attracting a large number of high-quality developers to participate in early construction. Therefore, for Hover, it can obtain native support from Kava that other underlying protocols cannot provide. As the most innovative lending protocol currently, Hover is expected to further help Kava improve its lending system and play a certain promoting and nourishing role in the long-term development of the Kava DeFi ecosystem.

In addition, Cosmos, as the most well-known Layer0 system currently, has established an ecosystem based on a set of modular, highly adaptable, and interactive tools. Developers can build chains with low threshold based on their infrastructure, and chains built with modular components based on their toolset can achieve communication between homogeneous and heterogeneous chains through their communication components such as IBC and Peg Zone. In addition to Kava, currently well-known projects such as Sei Network, Canto, IRIS Network, Secret Network, Evmos, and Juno are all built on Cosmos, and well-known projects such as dYdX also expressed that they will develop application chains based on Cosmos SDK. The Cosmos ecosystem is also evolving in a new narrative direction, such as the Noble project is helping Cosmos develop towards the direction of RWA (real-world asset tokenization).

The continuous growth of the Cosmos system is also bringing new opportunities to Hover. Based on its high interoperability, it will facilitate Hover to capture users and build a foundation from the Cosmos ecosystem, and is expected to help Hover evolve into a new form of lending paradigm (exploring new directions such as RWA). This is also an inherent advantage of Hover in addition to its own design.

Currently, the Hover protocol has been released in multiple languages in order to provide services to global users more widely from a market perspective. At the same time, it has cooperated with Rome Blockchain Labs (RBL) and Ledger Works to jointly promote the long-term development of the Hover ecosystem.

Although the top protocols in the DeFi lending track have strong network effects, there are still great opportunities for emerging lending protocols. Hover is a trailblazer in the DeFi lending track. In addition to innovating in its own mechanisms (lending model, governance system) to gain intrinsic motivation, it also gains extrinsic motivation from the increasingly prosperous Kava and Cosmos ecosystems. This also makes Hover have considerable development prospects and is worth long-term attention.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of co-processor solutions and their alternative solutions What use cases can be unlocked?

- Beyond Engineering Cryptographic Aesthetics

- MetaMask’s growth engine is losing momentum, and generalized user applications are becoming the new center of ‘entry’.

- LayerZero Security Prospects and Ecological Opportunities Capture

- Hainan issues a red-headed document to cut off NFT digital collectibles.

- It is not surprising that OpenAI is making chips, what is surprising is if OpenAI does not make chips.

- Vitalik proposed a decentralized solution to the Ethereum staking protocol.