BRICS: Prelude to Overthrow the US Dollar Hegemony

The BRICS member states discussed the “Building a unified payment system and digital currency between the five countries” at the recent annual summit of BRICS leaders. "Golden Brick Coin" Sword refers to overthrowing US dollar hegemony?

- A few things you must know before Maker MCD goes live

- Kay Uncle commented: Have you lost money in the currency circle? Look for it to get back

- Interview with cryptographer Wang Xiaoyun: cracking the hash function algorithm, she insisted on 10 years

text

Kirill Dmitriev, head of the Russian sovereign wealth fund “Russian Direct Investment Fund”, said that the major members of the BRICS countries expressed support for this idea. He pointed out that the development of a unified payment system will prevent BRICS from being exposed to the risks of global payment infrastructure while strengthening mutual economic cooperation.

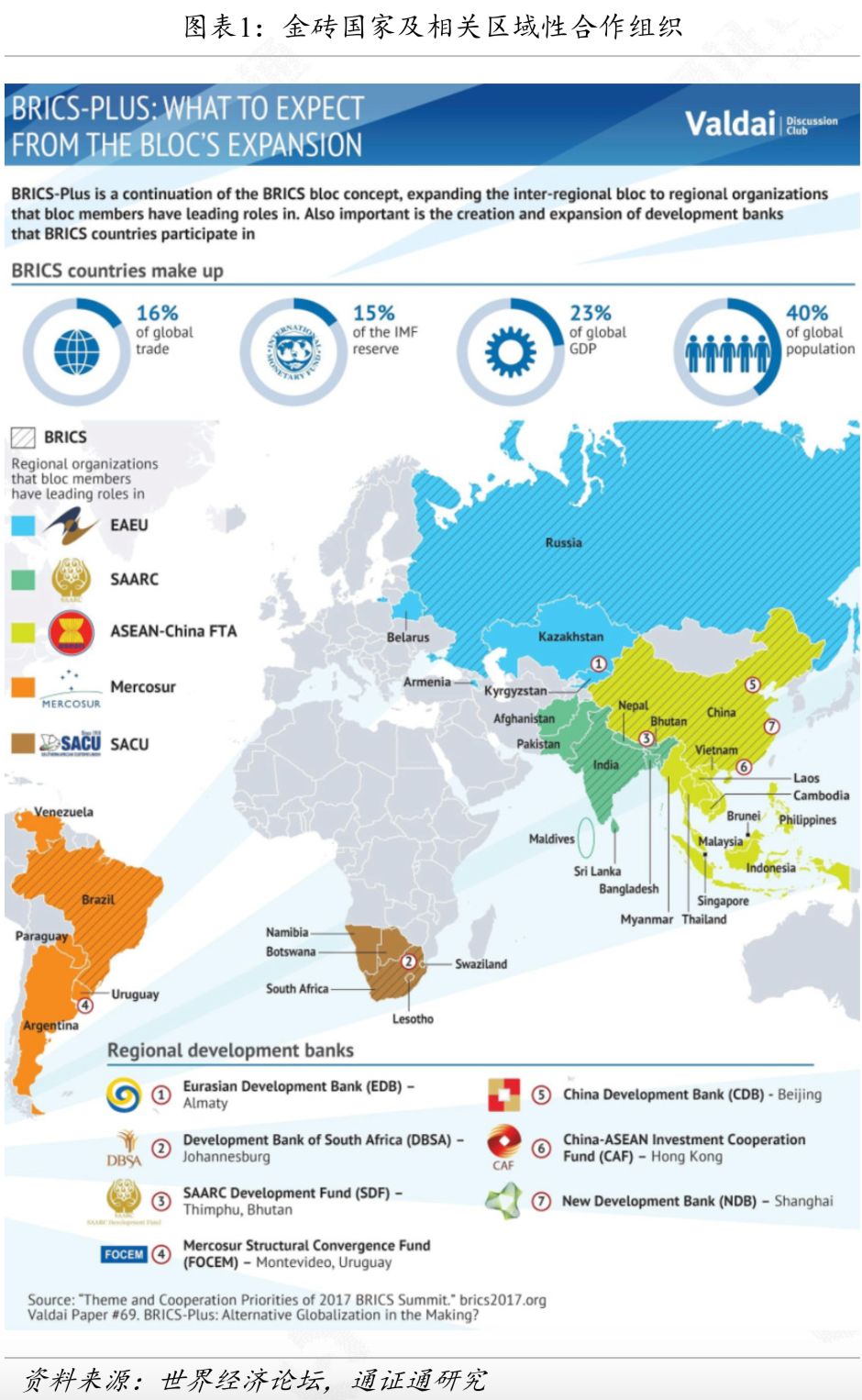

The main cooperation methods among the BRICS countries include: integration of trade and investment, construction of regional development banks and currency reserves, construction of payment systems between countries/five countries, establishment of regional alliances, and cooperation with international organizations.

Integration of trade and investment. At the annual summit of BRICS leaders, China proposed that "protectionism and bullying countercurrents will have an impact on international trade and add downward pressure on the global economy." The BRICS countries can continue to deepen cooperation through free trade zones and preferential trade agreements.

Construction of a regional development bank. Although the BRICS countries have made certain achievements in economic development, they still have certain disadvantages in terms of finance. Development Banks are important supporters of infrastructure development in developing countries and need to continuously strengthen their hard power and asset reserves.

Building a payment system between the five countries. The BRICS countries need to develop their own monetary payment and settlement systems in bilateral/multilateral trade and reduce their dependence on developed countries' currencies.

Develop regional alliances . The BRICS countries are each important economies on their own continents, and they can form regional economic alliances centering on themselves, such as China's “One Belt, One Road” plan. As a representative of emerging economies, the BRICS can play a greater role in the international arena.

But the most important investment and payment system is monopolized by Western economies led by the United States. In the field of traditional financial cross-border payment and settlement, SWIFT (Global Interbank Financial and Telecommunications Association) has a monopoly position. The trade settlement between countries is almost inseparable from SWIFT. SWIFT has the ability to sanction an economy and sever its foreign trade. For example, Iran's foreign exchange settlement and commodity trading are currently being restricted by SWIFT. SWIFT is like a pair of invisible hands, holding the throat of the fate of developing countries.

1.2 BRICS: The break of the dollar hegemony?

Blockchain technology has become a powerful alternative to traditional inter-bank cross-border payment channels by virtue of its decentralized trust, efficient transaction settlement, and unchangeable account history. Founded in 1973, SWIFT has a series of problems such as low efficiency, long remittance time, and high friction costs. It is a product of the last era. On the other hand, the US dollar, which is the main settlement and reserve currency of international trade, has achieved economic hegemony by controlling the SWIFT system. An economy that does not comply with the wishes and interests of the United States may be subject to SWIFT sanctions, resulting in its inability to conduct international trade.

The establishment of a unified payment network in the BRICS countries is of great significance to financial stability. Dmitriev said that the investment between the BRICS countries accounts for more than 20% of the total global investment. A payment system that can guarantee the settlement and investment stability between BRICS countries is very important and can stimulate the use of member countries. Payment is made in the national currency to ensure sustainable investment among member countries.

Trade between BRICS countries is gradually de-dollarization. In the past five years, the share of the US dollar in foreign trade settlement has dropped from 92% to 50%. Russian Deputy Finance Minister Korechev said in November 2019 that the Russian central bank is adjusting its international reserve structure. The Russian Ministry of Finance plans to reduce the proportion of the US dollar in the National Welfare Fund by 2020, and consider adding RMB reserves. According to data from the Bank of Russia, as of October 2019, 13.4% of the Russian central bank's international reserve assets were located in China, and China became the foreign country with the most concentrated international reserve assets of the Russian central bank.

“Golden Bricks” has a relatively complete infrastructure. The RMB cross-border payment system (CIPS) is eroding the share of the SWIFT system in the international settlement business. According to the statistics of the central bank, there are currently 25 RMB clearing institutions in the world. The CIPS business covers 165 countries and regions. In the first three quarters of 2019, the cross-border payment of RMB exceeded 14 trillion, a year-on-year increase of 20%.

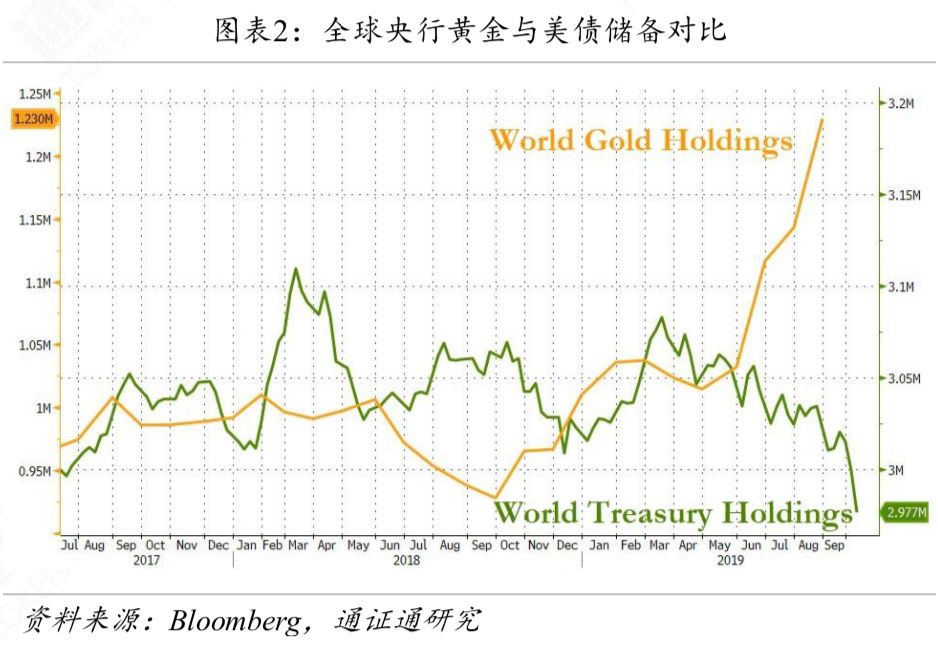

“Golden Bricks” is not only a breakthrough in SWIFT monopoly, but also a “breaker of dollar hegemony”. Judging from the attitude of the United States toward Libra, US legislators have neglected the positive factors such as blockchain technology and the efficiency gains that CBDC (central bank digital currency) may bring, and magnified some of the shortcomings of Libra. Libra's basket of currency reserves has shaken the dollar's position as a global reserve currency, but the US does not want the current dollar hegemony to be challenged. However, blockchain technology has inherent advantages over SWIFT and other wire transfer payment systems. In the long run, SWIFT's market share will inevitably be replaced by more regional digital payment systems, and the monopoly position will cease to exist. If the United States lags behind other economies in the world in CBDC competition, dollar hegemony will be weakened. According to statistics, the global central bank has reduced its holdings of US debt for half a year. At this point in time, the BRICS countries launched their own payment and settlement system, which is undoubtedly another heavy blow to the US dollar system.

The development of blockchain technology and the emergence of CBDC will reduce the influence of the dollar. After China indicated that it will vigorously develop blockchain technology, it is speculated that the People's Bank of China will launch the world's first central bank digital currency, while central banks such as Europe, Japan and Iran have plans to launch central bank CBDC. The Bank of England Governor has also urged recently. Global central banks should work together to create a multi-polar reserve currency system.

In the past few decades, whether it is the IMF, the World Bank or SWIFT, the foundation and voice of global finance are in the hands of Western economies. The total voting share of the IMF BRICS countries is less than 15%, and with the partners of the BRICS countries, the voting share has only increased by 1-2%. The BRICS League lacks the right to speak on the key decisions of the International Monetary Fund.

Although financial globalization and multi-polarization of the monetary system are still a difficult goal to achieve, the establishment of a payment system between BRICS countries can challenge the current situation. Payment tools based on blockchain technology can efficiently utilize resources within the BRICS countries, make resource transfer allocation more effective, reduce dependence on the US dollar system, and improve the financial independence of BRICS countries and the right to speak in the international economy. It will also become an important complement to the global financial system, making the global economy based on a more diversified and stable foundation.

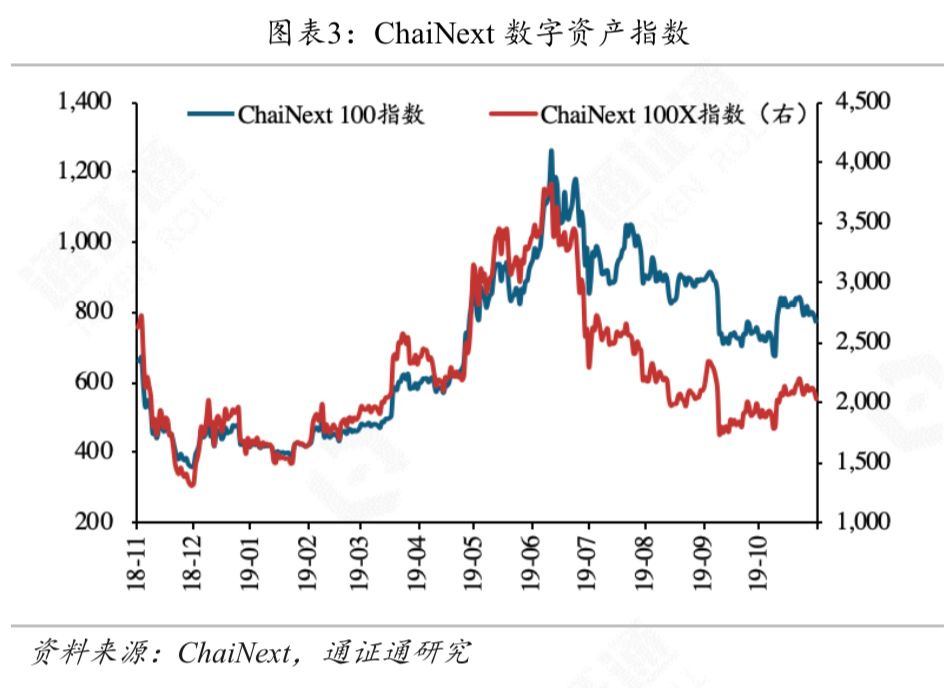

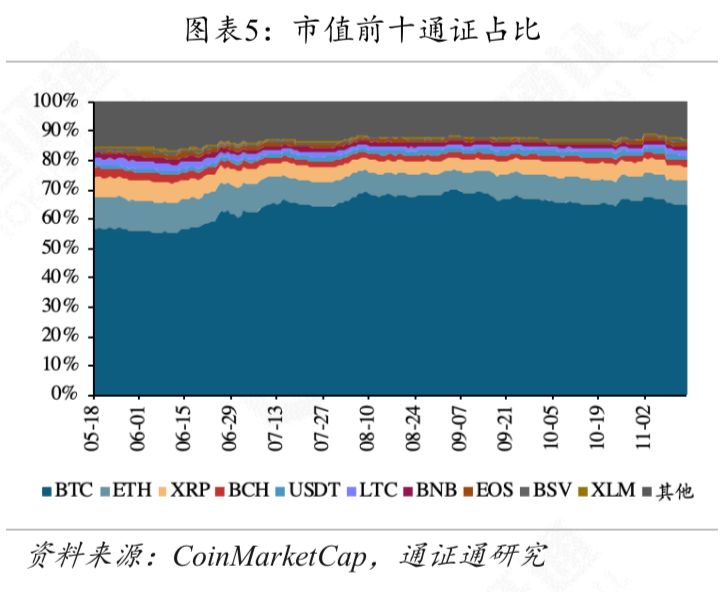

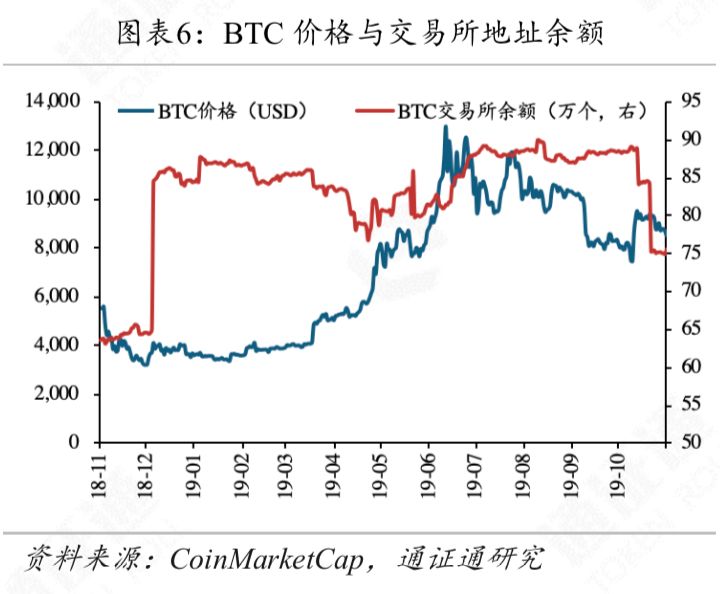

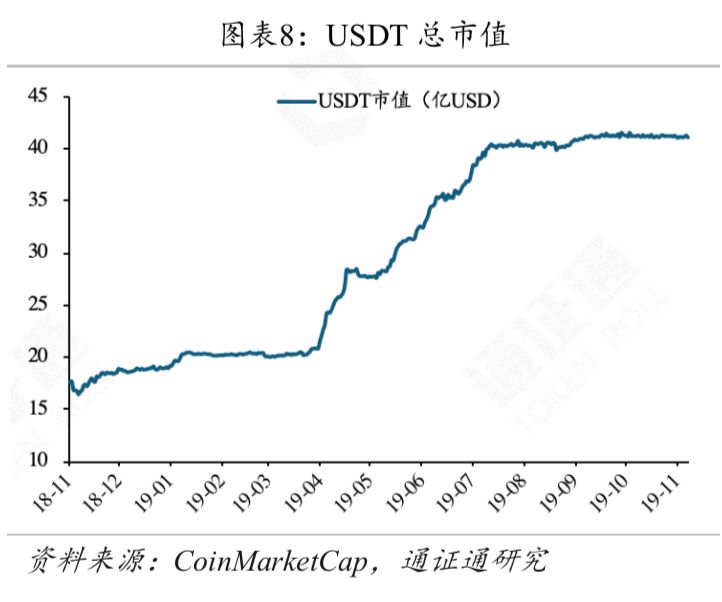

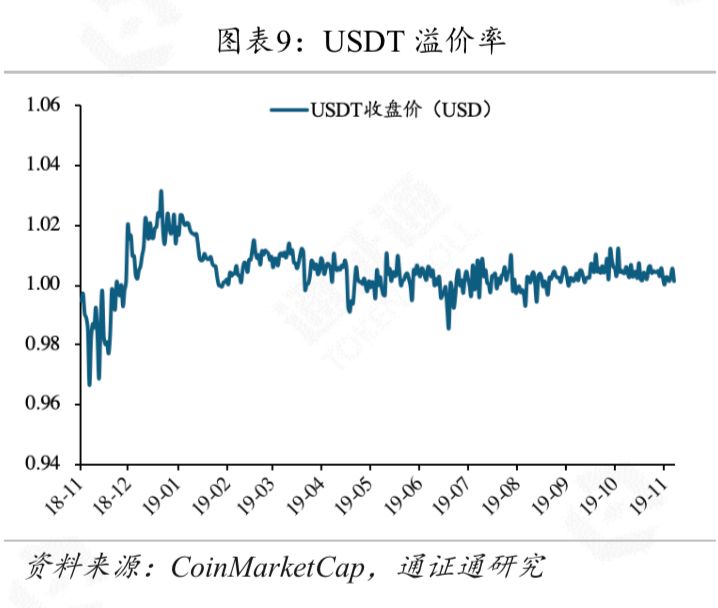

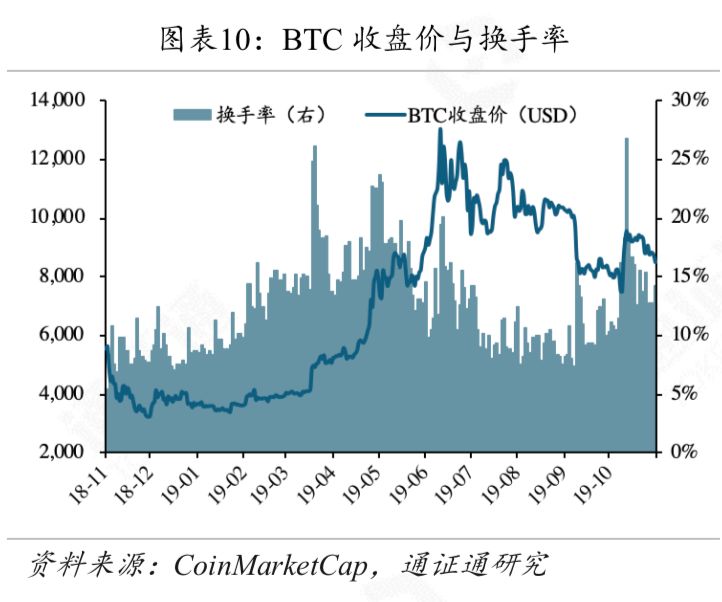

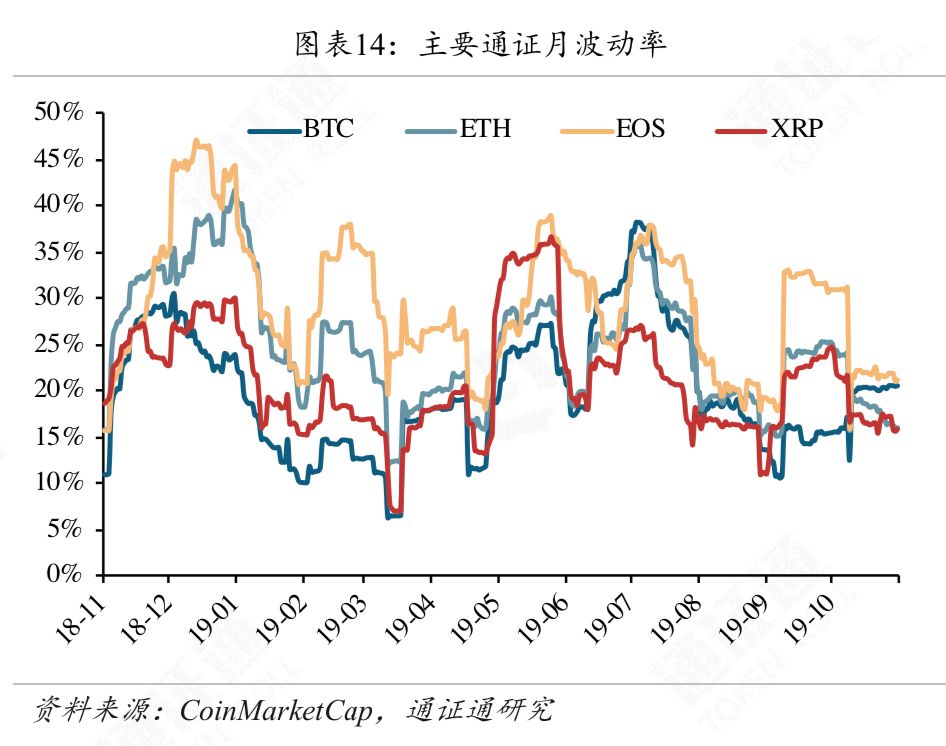

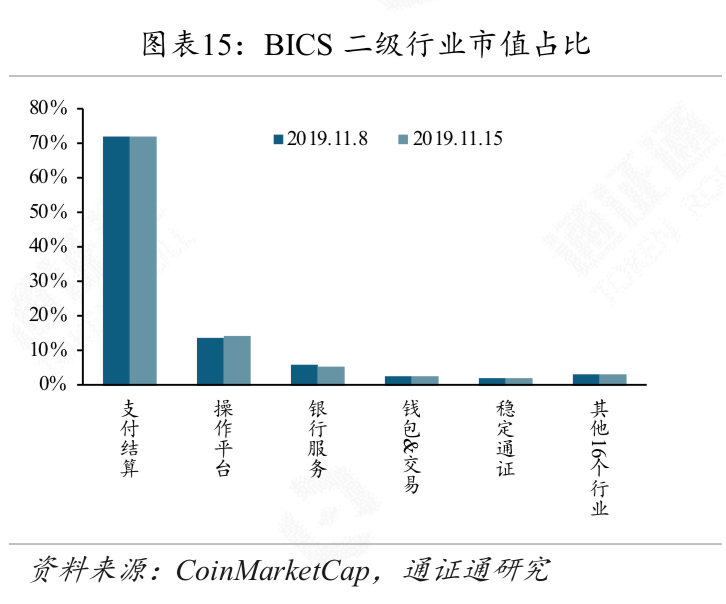

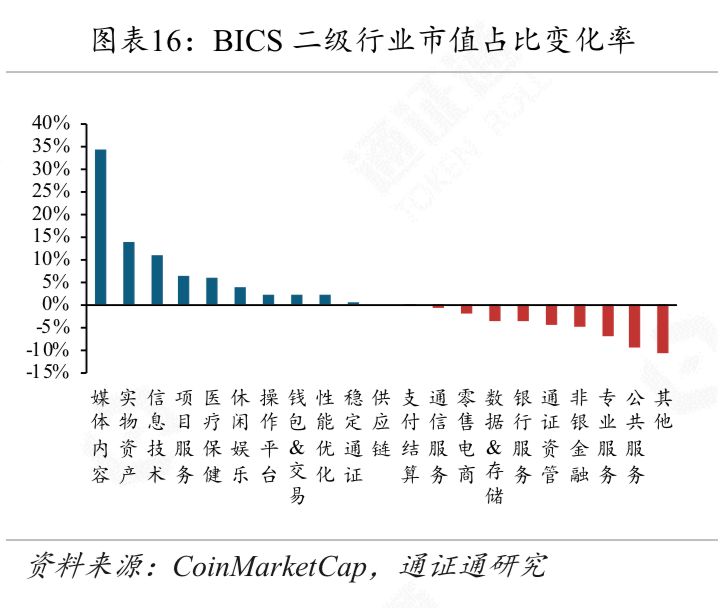

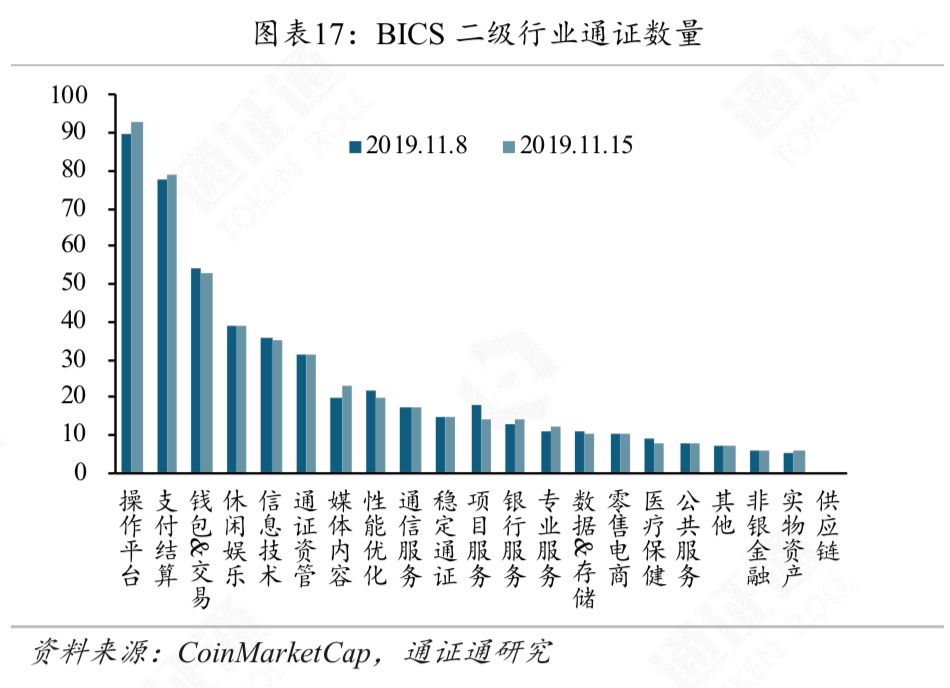

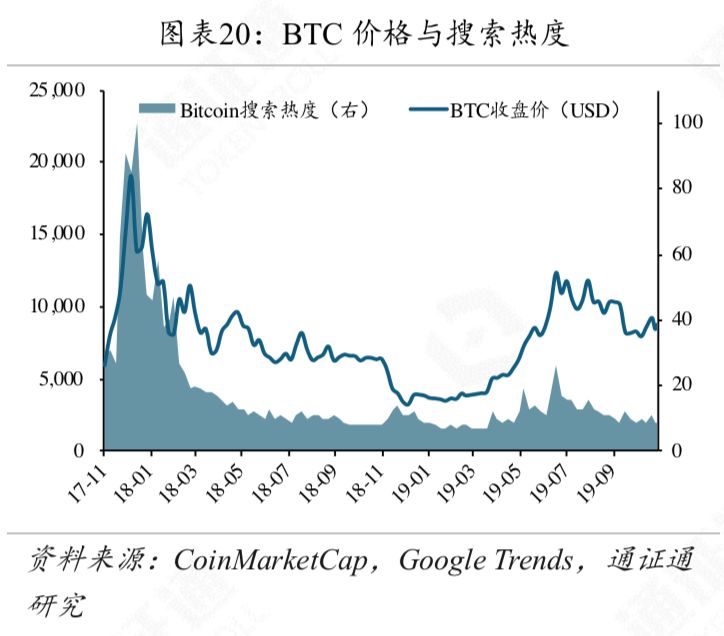

This week, the ChaiNext Digital Asset 100 Index closed at 768.22 points, down 2.98%. ChaiNext's digital asset 100X (no BTC) index closed at 2035.17 points, down 1.78%. The main circulation certificate is slightly stronger than the BTC.

The total market value of digital certificates this week was 236.28 billion US dollars, down 6.37 billion US dollars from last week, a drop of about 2.6%.

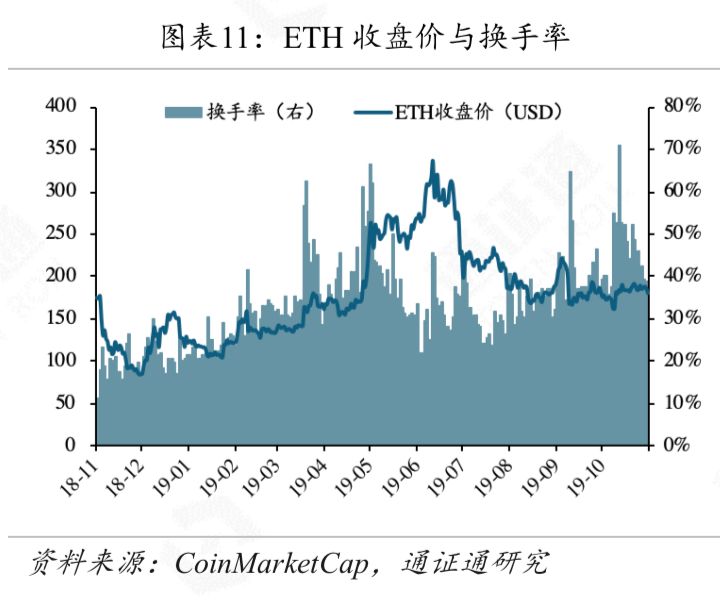

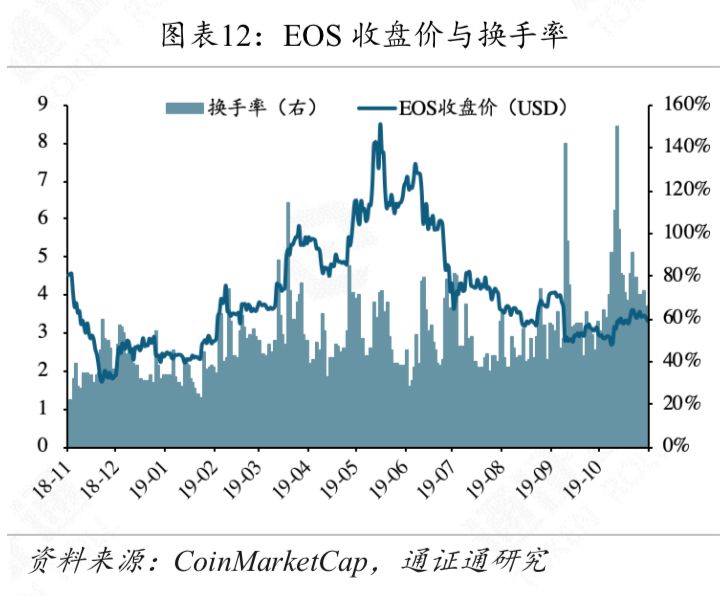

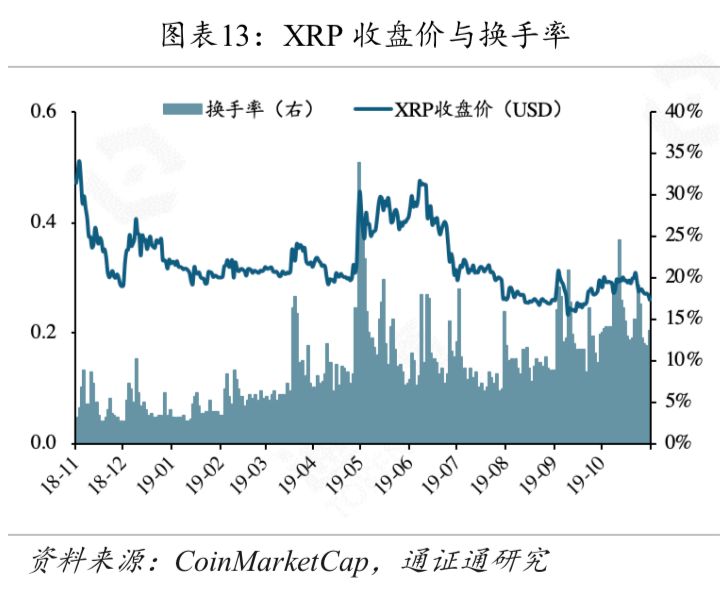

The average daily volume of digital passes this week was 68.48 billion US dollars, down 15.5% from last week. The average daily turnover rate was 28.1%, down 3.9% from last week. This week, the market continued to fall, the rebound was weak, and the trading volume was severely reduced.

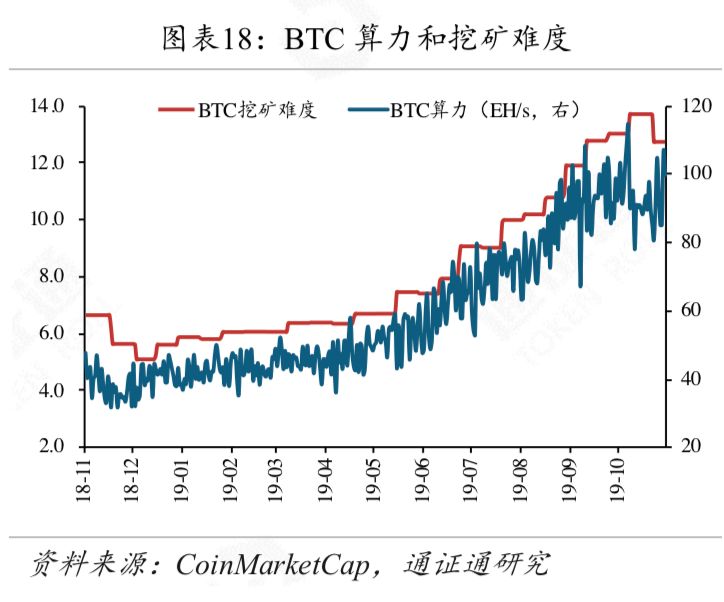

The low position of BTC can be gradually added. In the long run, the quality pass has a large imagination, and it is still in the early stage of the bull market. The callback is a rare opportunity to increase the position. Investors can do a good job of asset allocation based on their own situation.

Several sources confirmed to The Block that BTC mining machine manufacturer Jia Nan Zhizhi will ring the bell on Nasdaq on November 21. According to documents submitted by Jia Nan Zhizhi to the SEC, Jia Nan hopes to raise 0.9-110 million US dollars through IPO, which has shrunk by 75% from the previously announced US$400 million. However, it is still unclear the price range of its stock listing.

According to sources, Bitcoin has secretly submitted a prospectus to the SEC in late October, and plans to complete the listing in early 2020, raising at most $500 million, and the sponsor is Deutsche Bank. Bitcoin declined to comment on this news.

4.2 Bakkt will provide BTC hosting services to institutional clients

Golden Finance reported that Bakkt, a digital asset platform of the Intercontinental Exchange of the United States, announced on Monday that it will provide institutional customers with the Bitcoin hosting service "Bakkt Warehouse". Pantera Capital, Galaxy Digital and Tagomi have signed up to become the initial customers of the “Bakkt Warehouse”, and other “large enterprises” are expected to join in the next few weeks. This means that the New York Financial Services Department has granted the company an additional trust license.

4.3 BRICS discusses the possibility of issuing an encryption certificate for a unified payment system

Cointelegraph quoted Russian media RBC as saying that the BRICS countries (Brazil, Russia, India, China, South Africa) discussed the possibility of issuing a new cryptocurrency for the unified payment system at the recent BRICS Forum. Dmitriev, Director General of the Russian Direct Investment Fund (RDIF), pointed out that the BRICS payment system can stimulate domestic currency settlement services and ensure settlement and investment stability among member states.

4.4 Shanghai Mujin Remediation Office takes the lead in launching a rectification campaign for the virtual currency exchanges within the jurisdiction

澎湃News learned that under the leadership of the Shanghai Mutual Rehabilitation Office, the Municipal Financial Stability Joint Office and the Shanghai Headquarters of the People's Bank of China jointly issued the “Notice on Launching the Renovation of Virtual Currency Trading Places” to launch a virtual currency exchange within the jurisdiction. Rehabilitation. According to the notice, in the near future, with the promotion and promotion of blockchain technology, virtual currency speculation has shown signs of rising. In order to prevent the resurgence of resurgence, according to the relevant arrangements of the National Mutual Renovation Office, the district rectification offices are required to sort out the three virtual currency-related activities within the jurisdiction. And completed the work before November 22nd.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Anxious USDT, catching up with rookies, where is the stable currency road?

- The four fates facing Bitcoin, the survey shows that nearly 80% of people are optimistic about their long-term development

- Regulators, lottery players become chain nodes, blockchain makes the lottery industry self-certified

- BTC's volatility is low, and the market is changing

- Babbitt column | Application of blockchain in digital art

- Featured | Chris Burniske: BTC goes to gold, ETH goes to currency; every bitcoin bull market starts with miners surrendering

- Interpretation of the new regulations of the National Development and Reform Commission: Is virtual currency mining allowed or restricted to the restricted or eliminated category?