Join if you can’t beat them? Why did Binance hastily get involved in the L2 battle?

Why did Binance jump into the L2 competition instead of trying to win it?Author: Haotian, Blockchain Researcher Source: Twitter@tmel0211

Foreword

Unexpectedly, as Polygon announced its layer 2, @BNBCHAIN, another heavyweight contender in layer 1 to kill Ethereum, also announced its entry into the L2 race. So, what is the necessity of BNBChain’s L2 layout? What does BNBChain, which is already performance-oriented, want by pursuing extreme performance in L2? Why did Binance hastily get involved in the L2 battle? With some questions and analysis, let’s explore it together.

- BNB Chain has launched the opBNB testnet, a Layer 2 network based on the OP Stack.

- South Korean professor tracking Do Kwon’s funds: Signs of Terra’s collapse were present in early 2019

- Who are the winners in the EVM innovation wave?

BNB Chain did not roll up the Ethereum series L2 like Polygon, but based on the BNBChain mainnet to do L2, the logic makes more sense. The problem is that BNBChain, which is already performance-oriented and low-cost, has not reached the L1 performance limit. In fact, BNBChain’s L2 is entirely a strategic intent, on the one hand, to meet the demand for competition at the same level as BNBChain and Ethereum; on the other hand, to facilitate seamless “migration” channels for other L2 developers.

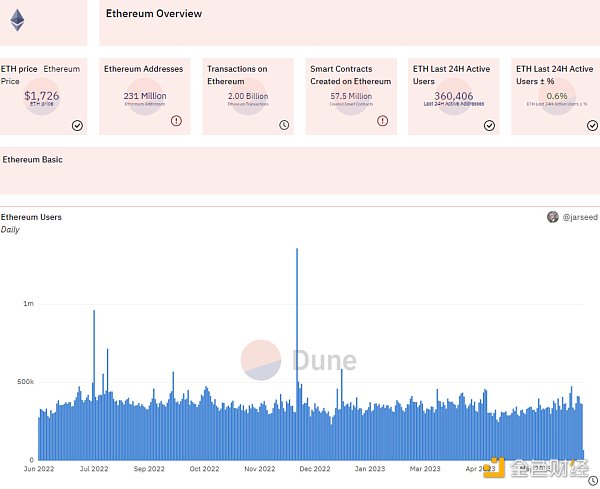

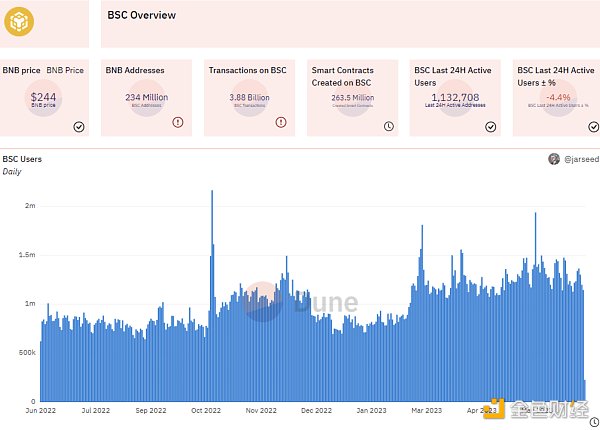

Everyone’s intuition is that the crypto ecosystem is centered around Ethereum, but @cz_binance, who holds more than 60% of the liquidity, may be laughing. Let’s take a look at the data of Dune 6.18. BNBChain has a daily activity of 1.14 million and txs of 3.8 billion, while compared with ETH, the daily activity is 360,000 and txs is 2 billion. Based on Binance’s huge user activity, coupled with the extended gameplay of LaunchBlockingd, BNBChain already has its huge ecosystem, and it cannot be “rolled” away.

Choosing Optimism as the L2 solution is entirely based on the perspective of EVM compatibility, ecological integration, and cross-ecological “migration”. This means that excellent developers on Ethereum L2 can seamlessly connect with BNBChain. This is exactly the same as its L1 mainnet’s high-precision replication of the main chain Ethereum EVM. Obviously, intercepting the developer community and applying zero-friction invisibility to developers have long been the best way for BNBChain to rapidly grow its ecosystem.

From the perspective of asset transfer and other transaction dimensions, BNBChain’s performance is superior at present. And in the current situation where all L2 is rolling up zk, BNBChain’s zk github stopped updating last year. In this background, there is only one reason to launch L2: BNBChain needs to focus on social and game applications with higher throughput requirements, faster frequencies, and lower fee requirements. Will games, social, and other areas become the growth points of BNBChain?

Moreover, Binance’s main CEX has been targeted by regulators such as the SEC, so Binance’s determination to make a move into DEX is urgent. This time, the opBNB infrastructure will be greatly developed, relying on Binance’s liquidity siphon effect, which is bound to attract a large number of projects. However, this may only exacerbate the overall scarcity of native projects and over-shanzhaiization. Nonetheless, it may also spark competition with Ethereum on the same plane, and the BNBChain mainnet narrative is almost successful.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Attention drawn to Ethscriptions, an Ethereum NFT protocol that competes with Ordinals, with over 30,000 minted in just a few days since launch.

- Comprehensive Review of the Polygon zkEVM Ecosystem: Slow but Steady

- Exploring the Effectiveness of Layer2 Airdrops: A Case Study of Optimism and Arbitrum

- Cracking the interoperability trust problem: how will Web3 and cross-chain bridges ultimately evolve?

- Analyze the three main characteristics of the Cosmos LSM module: what are the positive implications?

- Blockchain detective ZachXBT sued by “Big Brother Ma Ji”: Received donations of over one million US dollars, supported by CZ and Justin Sun

- Sei Network: The fastest Layer1 public chain on Cosmos designed for trading?