Can the Circle, which has its core business centered on stablecoins, withdraw its divestiture business, can "bet" this time?

Wen | Editing by Zhou Wenyi | Bi Tongtong Source | PANews

After six years of business, the unicorn Circle reached the fork and made strategic adjustments again.

On December 17, the official Circle blog announced the sale of the Circle Trade OTC business to Kraken, and stated that the company will focus on the stablecoin business in 2020. This time, Circle cancelled its support for its social payment application Circle Pay, suspended its Circle Research project, and split its exchange Poloniex, and made another "cut meat" adjustment to its business.

- Dry goods | Pure coins, points, stocks, three simple token valuation models

- Has the golden age of the alliance chain arrived?

- Trust crisis for charity projects, but only blockchain can solve it?

In addition to the business sector, the Circle team has also been "slimmed". Among them, Circle co-founder Sean Neville will withdraw from the co-CEO position and only participate in the board of directors as an independent director. Also withdrawing from the team were Chief Financial Officer Naeem Ishaq and Chief Legal Counsel Gus Coldebella.

In response to the streamlining of its business and the adjustment of its personnel organization, Circle officially attributed it to focusing on the development of stablecoin business. According to the official statement, in the next phase, in 2020, Circle will reduce the complexity of its business, focus the company's strategy on the stablecoin market, and establish a set of services around the USDC pegged to the US dollar. Global payment, escrow, and stablecoin wallet APIs, providing low-risk, high-efficiency infrastructure services to businesses and developers worldwide.

o1

Blockchain Unicorn Circle Attack History

Since its establishment in 2013, Circle has mainly provided Bitcoin storage and legal currency exchange services. Circle has entered the "Blockchain Unicorn Club" and has been developing smoothly, and has been favored by many well-known institutions including Goldman Sachs and Baidu. According to PANews statistics, Circle has raised a total of $ 246 million so far.

At the beginning of 2013, Circle received a US $ 9 million Series A financing led by General Catalyst, which also reached the highest ever financing amount of a cryptocurrency company at the time. In March 2014, Circle was led by Breyer Capital, and General Catalyst followed in a round B funding of $ 17 million. In April 2015, Circle received a $ 50 million Series C financing led by Goldman Sachs Group and Accel Partners.

At the end of 2015, Circle undertook a social transformation of its bitcoin application Circle Pay. At the time, Circle Pay was similar to WeChat Pay, which could support Bitcoin trading and transfer transactions. In 2016, Circle opened the doors of the European Union and China, successively enclosing a lot of funds and users. At that time, the Circle, which was flourishing at the time, had a transaction value of more than US $ 1 billion in 2016, and the number of users had exceeded 1000%.

Since 2016, Circle has begun to expand the Chinese market, trying to divide the payment business from Tencent and Alibaba. In June of the same year, Circle received a USD 60 million round D investment and completed the construction of a business team in China. This round of financing was led by IDG Capital. Baidu, Breyer Capital, General Catalyst, CICC, Everbright Investment, Wanxiang Group and CreditEase also participated in the co-investment, with a valuation of approximately $ 480 million. (Related reading: Exclusive Dialogue | Trade Secrets of Blockchain Unicorn Circle )

Circle is well received by investors, and its compliance license may be an important bargaining chip. In September 2015, Circle obtained the first digital currency license BitLicense issued by the New York State Department of Financial Services, which means that Circle can now provide digital currency services with a license in New York State. Currently has payment licenses in the United States, the United Kingdom and the European Union, and BitLicense in New York State. It is the company with the largest number of global licenses in the crypto asset industry.

With the dual blessing of funds and licenses, Circle suddenly became a dazzling star in the crypto field and was once favored as the "American version of Alipay".

However, its bitcoin payment business encountered a bottleneck. On December 7, 2016, it announced that it would “abandon the bitcoin business”, but still use bitcoin ’s underlying blockchain technology and launch a platform called “Spark”, which can achieve zero Fees and zero exchange rate foreign exchange transfers.

It was also this year that Circle turned its focus to the cryptocurrency market and successively launched various products. These include the Bitcoin transfer business in iMessage supporting Apple's IOS 10 and Circle Invest, a mobile application for personal crypto assets investment.

In October 2017, Circle officially launched "Circle Trade", which is also the first business it has established and launched in Asia to provide institutions with large digital currency transactions.

In February 2018, Circle acquired Poloniex, then one of the world's largest digital currency exchanges, for $ 400 million. Despite mixed reviews, this acquisition is an important step for Circle to win the fat meat of cryptocurrencies. The acquisition of Poloniex means that Circle will expand the over-the-counter trading of crypto assets to the market, in addition to greatly increasing its ability to attract gold, it can also greatly expand the size and types of users.

In May 2018, Circle completed a US $ 110 million round E financing led by mining giant Bitmain. After this round of financing, its valuation soared to US $ 3 billion.

Then, in the second half of 2018, Circle and Coinbase launched a USD-based stablecoin based on Centre, USDC, a stablecoin anchored to USD and USDC, a platform applicable to USDC deposits and conversion of legal currencies, to test stablecoins. Through Centre, Circle has gradually worked on cross-chain and cross-digital asset conversion.

On October 5, the same year, Circle acquired the equity crowdfunding investment company SeedInvest to help startups issue digital assets.

o2

How can Circle rebirth after its divestment?

If it is said that the development of Circle before 2018 can be described as smooth sailing, the Circle entering 2019 has been particularly bumpy.

In March of this year, Circle laid off about 30 people in its finance department, accounting for about 10% of its total workforce. Its off-site business was also affected by brain drain, including its former OTC director Ryan Salame. Circle attributes this to the challenging regulatory environment in the United States.

In the first half of 2019, Circle's core business exchange Poloniex was also volatile. Due to constant regulatory turmoil, in May 2019, Poloniex was forced to delist 9 cryptocurrencies, and in October, 6 cryptocurrencies were delisted again, losing a lot of profits. Circle CEO Jeremy Allaire has publicly expressed his dissatisfaction with US regulators several times.

The passive situation evolved into layers of divestitures in the second half of this year.

Since June of this year, Circle has begun to "slim down" and was forced to use its sword to cut off the past. In the same month, Circle announced that starting from July 8, the Circle Pay service will gradually remove support for user payments and charges, and eventually completely cancel all support for Circle Pay on September 30.

On September 25, Circle published an article on its official website stating that it would suspend the Circle Research project.

In October 2019, Bermuda became the first government to accept USDC as a payment for taxes and other government services. Earlier in July, Circle announced that Poloniex had obtained a Bermuda digital asset business license. In the same month, the Poloniex team and leadership were separated from Circle, and a new independent international company, Poloni Digital Assets Ltd, was established, and Poloniex's main business gradually turned to Bermuda. With the support of Asian Investment Group, the spin-off can achieve huge benefits.

On December 17, Circle sold its OTC desk Circle Trade to the exchange Kraken. Another media report said that since this summer, Circle has been looking for buyers for its OTC platform. Circle's OTC platform traded $ 24 billion in 2018.

Faced with the situation of turning over the sea, the Circle chose to preserve its stablecoin sector, cut off its wrist and cut off Bitcoin payments and other businesses, and streamline the team. Aiming at business streamlining and deployment of personnel organization, Circle believes that this move will simplify its complicated business layout and team composition, which is effective in specializing in the stablecoin market.

o3

Aiming at stablecoins, can USDC work?

According to the official statement, starting in 2020, Circle will support global payment, escrow and stablecoin wallet APIs, providing low-risk, high-efficiency infrastructure services for global enterprises and developers.

For targeting stablecoins, there is already a clue. Since the hearing of “Reviewing the regulatory framework of digital currencies and blockchains” in July, Circle CEO Jeremy Allaire has realized that the current regulatory environment in the United States is unclear and it is difficult for cryptocurrencies to escape the regulatory constraints, while stablecoins are legal tender and The intermediate bridge of cryptocurrency will be a key cornerstone of the future digital economy.

Jeremy Allaire has publicly stated that Circle will mainly issue a single fiat stablecoin, and its long-term goal is to establish a global digital currency, supported by the main fiat currency and bitcoin, and making it a global transaction, business And the most attractive currency.

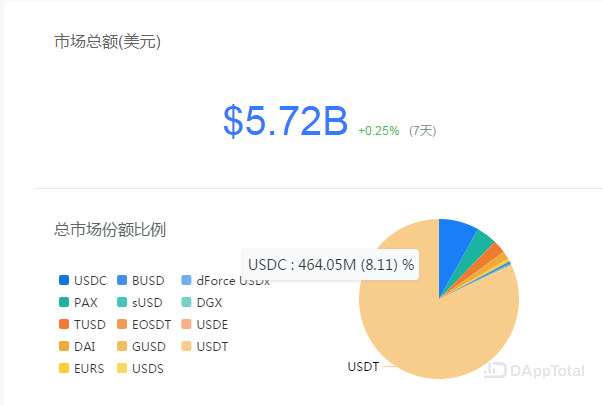

According to DAppTotal.com data, as of December 18, the total USDC stablecoin market was US $ 46.405 billion, with a market share of 8.11%, ranking second. Since late October, its supply has increased by about 81%. However, the market share of the first USDT reached more than 80% of the total market, which basically dominated the market, and the market Matthew effect was significant. USDT's trading volume in 2017 reached 107 billion U.S. dollars, and in 2018 it broke the trillion dollar mark.

Undoubtedly, stablecoins have long been established as the cornerstone of the crypto ecosystem. They have outstanding advantages in terms of cross-border payment settlement and fiat currency agency, but their relative risk factors are particularly high. USDC wants to sail on the sail of the stablecoin, but still needs to borrow a wind from the regulator.

But dare to bet the stablecoin with the potential of breaking the boat, Circle does hold an important weight-regulatory compliance. Circle has done a lot of work on regulatory compliance, in addition to winning the first digital currency government license in New York State and the United Kingdom; the company built its own internal legal compliance team to actively cooperate with the regulators in anti-fraud and KYC. In terms of regulatory compliance, this is exactly the weakness of the stablecoin leader USDT. Circle's CMO Marieke Flament once said frankly to PANews, "In the field of blockchain, sustainable development is service regulation." With the increasingly fierce competition in the stablecoin market and the crypto industry gradually moving towards orderly compliance, it is in compliance with regulations. The stablecoin will become a trend.

The Defi field is also an important application market for USDC. PANews previously pointed out in the article "Status of Ethereum DeFi Lending: Maker Becomes a" Central Bank "User's Financial Demand Strong" . Of the total, USDC has become the second largest borrowing asset with a proportion of 20%, and has borrowed the most among all fiat stablecoins. Pan Chao, the head of the Maker Dao Chinese community, analyzed to PANews that this is related to the Circle and Coinbase behind it. "The issuers of USDC Circle and Coinbase have the usual US dollar exchange channels, regulatory advantages, credit guarantee and 100% reserve. Others Stable currencies, such as USDT, are more risky, people are not willing to hold them for long periods of time, and the US dollar channel is not smooth. At present, the main users of DeFi are still US dollar holders. "

Whether the second-ranked USDC can surpass the USDT in one fell swoop, or whether Circle can rebuild its glory in the stablecoin business is unknown.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Cryptocurrencies behind Africa's economic "crash" have become a new battleground

- Can smartphone + hardware wallet save HTC?

- Ethereum welcomes hard fork upgrade again, Reddit community supports block rewards reduced to 1 ETH

- The road to low-defense DeFi: how to achieve it? Let's take a look at these four options

- DeFi's windfall, ConsenSys researchers find that DeFi is driving Ethereum decentralization

- Nine developments, based on the performance of Lightning Network in a year, can you submit satisfactory answers?

- Industry Blockchain Weekly News 丨 Leaders in many places support the blockchain, the party secretary of Shanghai