Amazon’s participation and the skyrocketing value of AI company Anthropic become FTX’s biggest hope of repaying the debt?

Will Amazon's participation and the soaring value of Anthropic, an AI company, be FTX's best chance to repay its debt?Author: ASXN

Translation: Azuma, Odaily Planet Daily

On September 25th, artificial intelligence company Anthropic announced that it will receive a maximum investment of 4 billion US dollars from Amazon. Considering that FTX had invested 500 million US dollars as the lead investor in Anthropic’s Series B financing, many FTX creditors see this equity investment as their greatest hope of recovering their principal.

The following is a specific analysis by BoutiqueDigital Asset analyst ASXN on the current value and potential appreciation of this equity investment.

- LianGuai Daily | Li Xiaolai responds to the Mixin incident; Hong Kong Securities and Futures Commission releases multiple lists of virtual asset trading platforms.

- Interview with Former President of Polygon Labs Games will be a key factor in driving the mainstream adoption of cryptocurrencies

- Interpreting Namada A Modular Privacy Solution Serving the Multi-Chain Ecosystem

FTX and its affiliates have been very active in the venture capital field, with data showing that they have invested billions of dollars in more than 130 companies.

Among FTX’s hundreds of investments, the most noteworthy one is undoubtedly the lead investment in Anthropic’s Series B financing, in which FTX invested as much as 500 million US dollars. As Anthropic continues to stir up the primary market, its soaring valuation naturally brings new expectations to FTX creditors.

First, here is some basic information about Anthropic. It is an artificial intelligence company founded by former OpenAI employees and has developed an artificial intelligence chat application called Claude, which is now widely regarded as OpenAI’s biggest competitor.

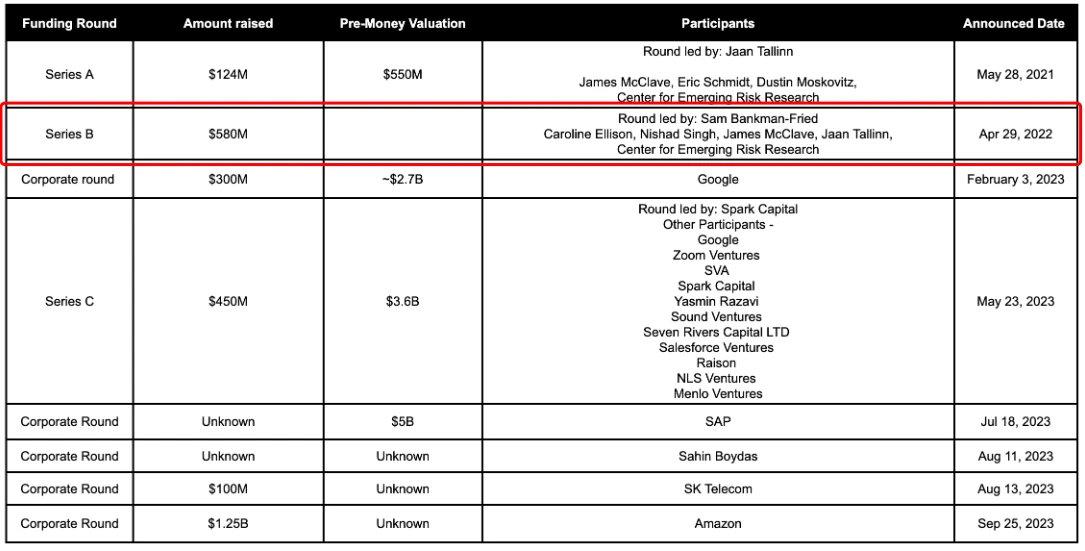

Since its establishment, Anthropic has raised billions of dollars in venture capital through multiple rounds of financing.

In April 2022, Anthropic completed a Series B financing of $580 million, of which FTX accounted for a total investment of $500 million, including the lead investment by SBF himself, as well as the participation of FTX’s co-chief engineer Nishad Singh and former Alameda CEO Caroline Ellison.

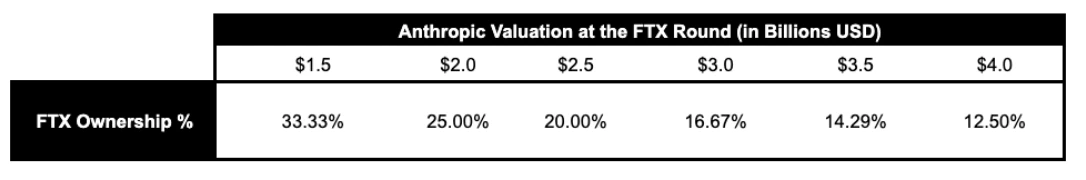

However, the valuation of this round of financing was not disclosed, so we cannot obtain the specific transaction price and shareholding ratio of FTX. However, we can speculate on this based on the subsequent Series C financing.

In May 2023, SLianGuairk Capital led the $580 million Series C financing of Anthropic. TechCrunch reported that the valuation of this round of financing was approximately $4.1 billion. Considering that the AI concept has not shown any signs of decline during this period, it also means that the valuation during the Series B financing is unlikely to exceed $4.1 billion.

Therefore, it can be inferred that FTX’s shareholding ratio in Anthropic is likely to exceed 10%. Based on different valuation figures, we estimate that FTX’s shareholding ratio should be between 12.5% and 33.33%.

Another proof of FTX’s shareholding ratio is Google’s investment in Anthropic. In February 2023, Google invested $300 million in Anthropic, and media such as TheVerge reported that this transaction resulted in Anthropic owning 10% of the shares.

Since FTX entered earlier and contributed more, its shareholding ratio should be higher than Google’s.

Turning to the latest development, Anthropic has recently received a huge amount of additional funding from Amazon. According to public interviews with both parties by TechCrunch, this investment will be immediately implemented with $1.25 billion, and the total subsequent investment is expected to reach $4 billion.

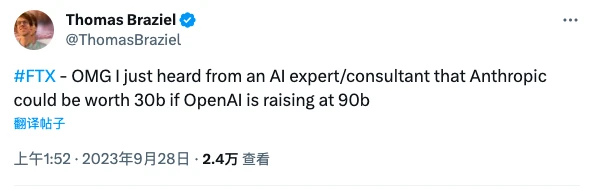

Although the valuation of this round of financing has not been disclosed, the capital market has made relevant speculations based on another event at the same time.

On September 27, The Wall Street Journal reported that another AI giant, OpenAI, is negotiating share sales with potential investors with a valuation of $90 billion. Combining the competition between OpenAI and Anthropic, there are rumors that the latest valuation of Anthropic in the funding market has reached $30 billion.

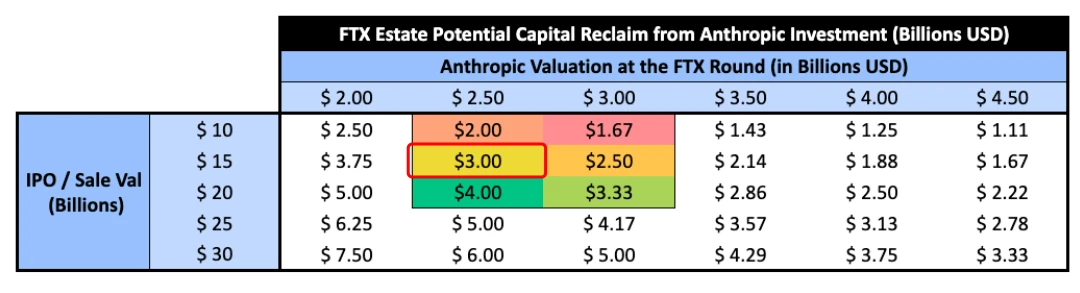

We take a more conservative calculation method, assuming that when FTX contributed, Anthropic’s valuation was $2.5 billion, and the current valuation is $15 billion. FTX’s shareholding ratio is 20% (all three data are taken as the median value), and the corresponding equity value has reached $3 billion.

Now, let’s address FTX’s debt issue itself.

At the time of FTX’s bankruptcy application, its asset gap was about $9 billion, and the data submitted by FTX in May indicated that “about $7 billion in liquidity has been recovered so far,” leaving a hole of $2 billion. If we don’t consider liquidity issues (including the real liquidity of FTX’s assets and the restrictions on the realization of Anthropic’s equity), it seems that the equity value of Anthropic is enough to cover it…

Perhaps there are still other non-transparent issues in between, but in any case, for the creditors who have been deeply affected by the FTX incident, the increase in the valuation of Anthropic is definitely an extremely positive change, bringing greater expectations for the victims who are still suffering from the long wait.

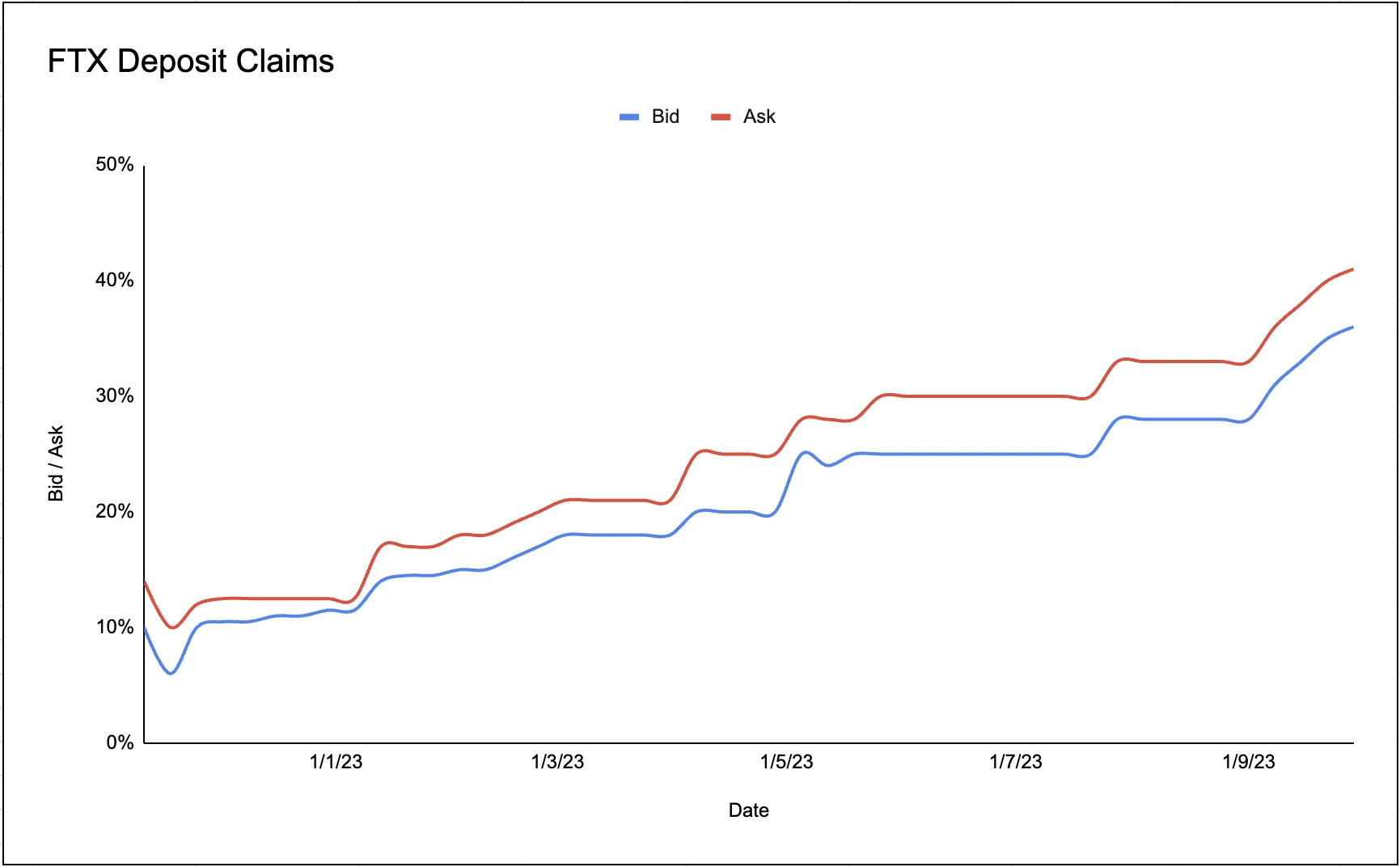

This is also reflected in the secondary market of FTX’s debt claims. The current expected payout rate has risen to 35%-40%, reaching a new high since the collapse of FTX.

Finally, the editor wants to insert an old news.

In June of this year, insiders revealed that the investment bank Perella Weinberg, responsible for handling the bankruptcy case of FTX, had been considering selling the equity of Anthropic held by FTX. For this reason, it has conducted several months of investigations on potential bidders, but ultimately chose to give up.

Now, this decision may change the fate of FTX and thousands of creditors.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- RWA Potential Exploration The Next Large-Scale Application Track after Stablecoins?

- UBI Development History The Combination of Utopia and Fantasy

- Wall Street Journal Binance Empire on the Verge of Collapse

- A Shenzhen University alumnus who graduated just a year ago donated 50 million yuan to his alma mater, and his first bucket of gold may have come from cryptocurrency.

- Binance He Yi’s Open Letter Perseverance and a Light Boat Will Cross Ten Thousand Mountains

- Andre Cronje The Lone Ranger’s Network Odyssey

- Popular Token Simple Rating CRV Achieves the Best Performance, OP Only Has Speculative Value