Application of liquidity in PoS: Examples of Berachain, Tenet, and Mangate

Liquidity in PoS examples: Berachain, Tenet, and Mangate.Author: Jiang Haibo

Projects such as Berachain, Tenet, and Mangate hope to improve the PoS mechanism to make liquidity more sustainable, increase network security, and improve the utilization of funds.

The PoS mechanism protects the security of the public chain, but also occupies a large amount of funds, resulting in low utilization of these funds. DeFi is also often criticized for its lack of liquidity loyalty, and projects are prone to entering a death spiral. How can these two be combined to allow liquidity to participate in protecting the security of the public chain while obtaining returns? Berachain, Tenet, Mangate and other projects have made attempts in this regard.

Berachain: Liquidity Proof and Third-Generation Token Model

Berachain is an EVM-compatible chain built using the Cosmos SDK. It adopts a unique “liquidity proof” consensus mechanism and a third-generation token model. Berachain hopes to incentivize the ecosystem in a more sustainable way. The liquidity proof consensus promotes the synchronous growth of Berachain’s liquidity, asset utilization rate, and market value.

- Inventory of 11 Celebrity Cryptocurrency Scammers: Jake Blockingul, Floyd Mayweather, John Wall…

- Application of Liquidity in PoS: Examples from Berachain, Tenet, and Mangate

- Interpretation of How to Earn Profits with PENDLE

The three types of tokens in Berachain are the native stablecoin $HONEY, the gas token $BERA, and the governance token $BGT. The reason for separating the gas token and the governance token is to avoid the voting power of frequent users in the network decreasing over time.

Users deposit various assets into the consensus system of Berachain to obtain the right to participate in the consensus and share transaction fees, protocol fees and block rewards $BERA. The deposited assets will be used to provide liquidity with newly minted stablecoin $HONEY in the AMM. The collateral for minting $HONEY is the assets deposited by users. If the loss occurs due to impermanent loss in the AMM, the amount of assets that users can finally redeem may also decrease. In addition to being used to pay gas fees, $BERA can also be staked to obtain governance token $BGT, which is the only channel for producing $BGT.

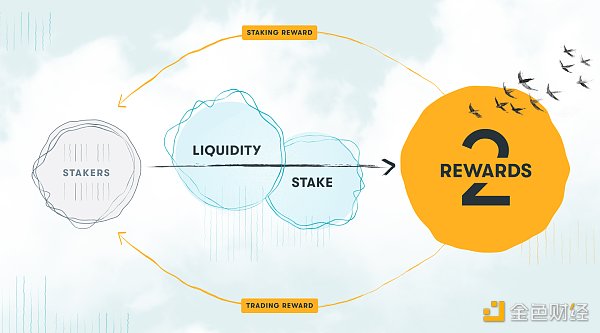

Staking $BGT can get a share of the protocol income, such as transaction fees in the AMM. So, the flywheel of Berachain might be like this.

-

Users stake assets to obtain $BERA block rewards, and the staked assets and $HONEY form a trading pair in the AMM;

-

The more assets staked, the better the liquidity of the protocol, and the more it can attract trading volume;

-

The more trading volume, the more protocol income is generated, and the higher the demand for $BGT;

-

Since $BGT can only be produced by staking $BERA, the demand for $BGT leads to an increase in the demand for $BERA;

-

Incentivize users to stake more assets to obtain $BERA.

Currently, the Berachain mainnet has not yet launched, so its specific performance is still pending for the project’s launch. In April of this year, the project received investments from Polychain Capital, Hack VC, OKX Ventures, and others with a valuation of $420 million.

Tenet: Diversified Proof of Stake and Liquidity Staking

Tenet is also an EVM-compatible chain built on the Cosmos SDK, which introduces a new proof-of-stake framework called Diversified Proof of Stake (DiPoS), which improves security compared to the traditional PoS model.

Security events related to governance attacks can occur in decentralized applications, which correspond to network attacks in Layer 1 blockchains. Diversified Proof of Stake allows users who hold a basket of assets to participate as validators in network consensus, eliminating the risk of the network being controlled by a user who holds a large amount of a single asset (the native token of the public chain).

Tenet’s consensus can approve assets other than the native token to participate in network security, such as ETH, ATOM, BNB, MATIC, ADA, and DOT. As the number of asset types increases, network attackers need to have a significant share of these mainstream cryptocurrencies to complete the attack, and therefore benefit from the joint security brought by these assets.

In order to help users earn profits while maintaining network security, Tenet also accepts protocols such as Lido and RocketPool, as well as liquidity staking derivatives cast by institutions such as Binance and Coinbase. At the same time, Tenet provides its own internal infrastructure to help assets such as ETH and ATOM complete liquidity staking. Since Tenet cares more about network security, it can make its liquidity staking service more attractive by not charging a 10% management fee like the Lido protocol.

Through this cross-chain staking method, Tenet hopes to create a multi-party mutually beneficial cooperative relationship, where other chains can increase security through more staking, users have more profit opportunities, and Tenet itself benefits from the security enhancement brought by diversified proof-of-stake.

Currently, Tenet has launched the mainnet beta version, and its native token $TENET has also been listed on exchanges such as Bybit and Kucoin recently. In the Tenet system, there are also native stablecoins and DEX.

Mangate Finance: A DEX application chain using liquidity proof

Mangate is a decentralized exchange in the Polkadot ecosystem, and won the 68th parallel chain slot auction of Kusama.

Mangate believes that PoS locks up a large amount of assets, which leads to a reduction in available funds in DeFi, while the efficiency of staked funds is low. Therefore, it introduces a liquidity proof mechanism, using LP tokens as staking assets to release staked liquidity, thereby improving capital efficiency.

Mangate is also a case of a DEX application chain. Compared with traditional DEX, it has some advantages: there is no gas fee in transactions, but a transaction fee of 0.3% needs to be paid; it prevents MEV at the consensus level; and it adopts a liquidity proof mechanism. Staking LP tokens can simultaneously obtain block rewards and transaction fee income from providing liquidity.

After the upgrade in June this year, Mangate enabled single-coin staking of the native token $MGX in liquidity proof, which expanded the usage of $MGX and strengthened the security of the network.

Mangate has issued its native token $MGX on Kusama, but there are fewer users on Kusama. The project is still being updated and plans to build a new ZK Rollup on Ethereum’s Layer 2.

Summary

In the above solutions, Berachain hopes that liquidity can be more sustainable and form a flywheel between liquidity and token demand; Tenet hopes to increase its network security by using other PoS tokens; and Mangate uses LP tokens as staking assets to release staked liquidity.

These improved PoS solutions can increase capital efficiency, while obtaining transaction fee rewards from DEX and other blockchain block rewards, increasing the use cases of PoS assets. However, the recent popular LSD and LSDFi are also competing in this field, which allows PoS assets to obtain additional income in DeFi activities while maintaining network security, obtaining staking rewards, and maintaining asset liquidity.

In addition, these improved solutions allow more types of assets to participate in blockchain consensus. When the project grows, it can indeed attract more valuable assets to improve network security because of supporting more types of assets. However, if a death spiral occurs, in a traditional PoS chain, to attack the network, one must hold the native token of the public chain. In solutions such as Tenet, holders of mainstream coins may also be able to attack the network, which has pros and cons.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introducing two new NFTs launched this week: Ether and Azuki Elementals.

- The Ethereum team has tentatively scheduled the launch of a new testnet called Holešky on September 15th to replace Goerli.

- How does Curio integrate the ECS game engine into OP Stack?

- FTX’s new CEO: FTX has been lying to banks about its mixed funds issue

- Regulatory intervention creates a “bottom” for the market. How will Wall Street’s entry during the chaos affect the industry?

- Understanding the working principle of LSDFi’s flagship project Lybra Finance and its V2

- So far, those who predicted a recession in the US economy in 2023 were all wrong.