Understanding the working principle of LSDFi’s flagship project Lybra Finance and its V2

Understanding LSDFi's Lybra Finance and V2 working principle.LSD ecological background

With the successful upgrade of Ethereum Shanghai, which has turned the Ethereum network from POW to POS, users can pledge 32 ETH as a validation node, and users can withdraw pledged assets. As a result, LSD continues to grow. Because pledging ETH reduces asset liquidity for users, LSDfi was born. LSDfi refers to a DeFi protocol built on liquidity collateral derivatives (LSD). By providing additional opportunities to generate revenue, the LSDfi protocol allows LSD holders to put their assets to use and maximize profits. Thanks to the adoption of liquidity collateral, the total value locked (TVL) in the LSDfi protocol has increased rapidly over the past few months.

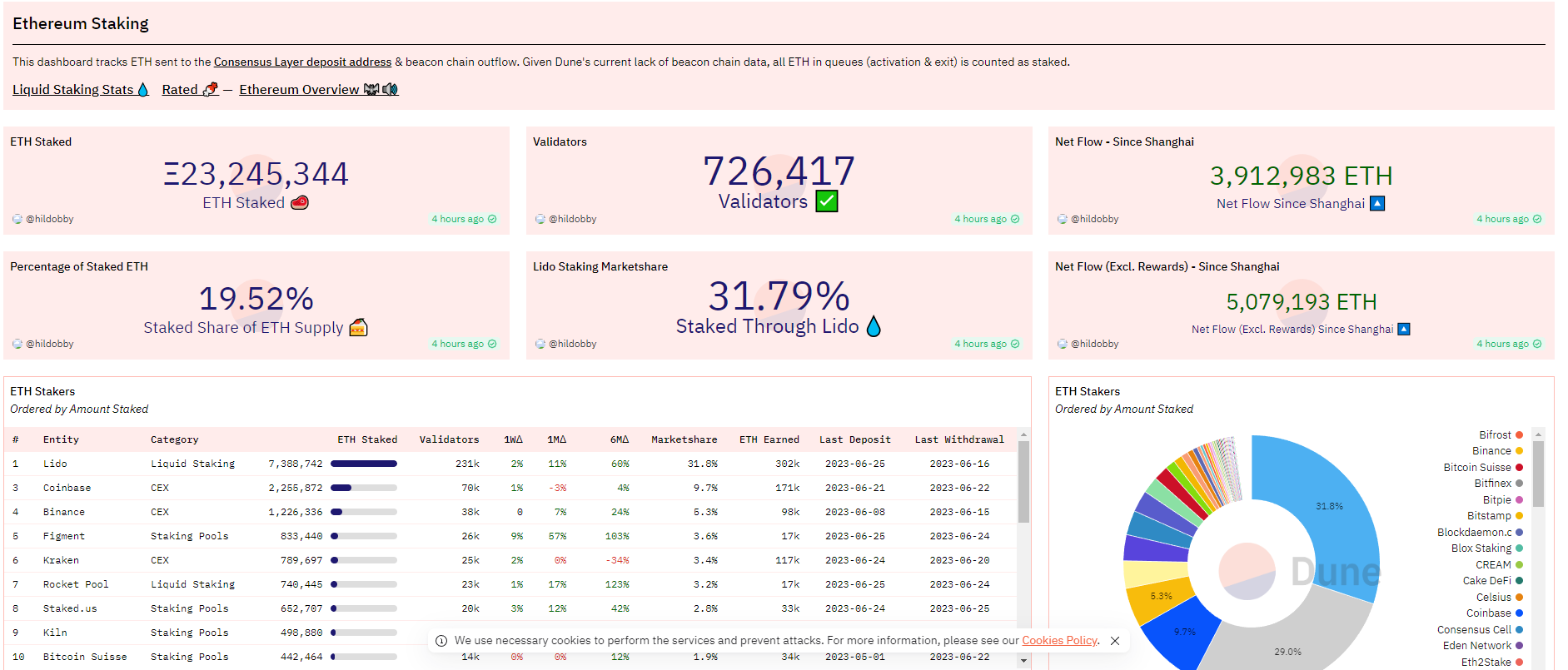

From the chart, we can see that the total amount of ETH pledged has reached 23,245,344, which is close to 20% of its total supply. The driving factors for LSDfi’s growth include the growth of pledged ETH and the current low penetration rate of LSDfi. The TVL in the LSDfi protocol currently accounts for less than 3% of the entire potential market.

- So far, those who predicted a recession in the US economy in 2023 were all wrong.

- Details analysis of Azuki Elementals Sale, is manual opening of images bringing higher premium space?

- Overview of the Derivative DEX Track: Will it Dominate the Next Bull Market?

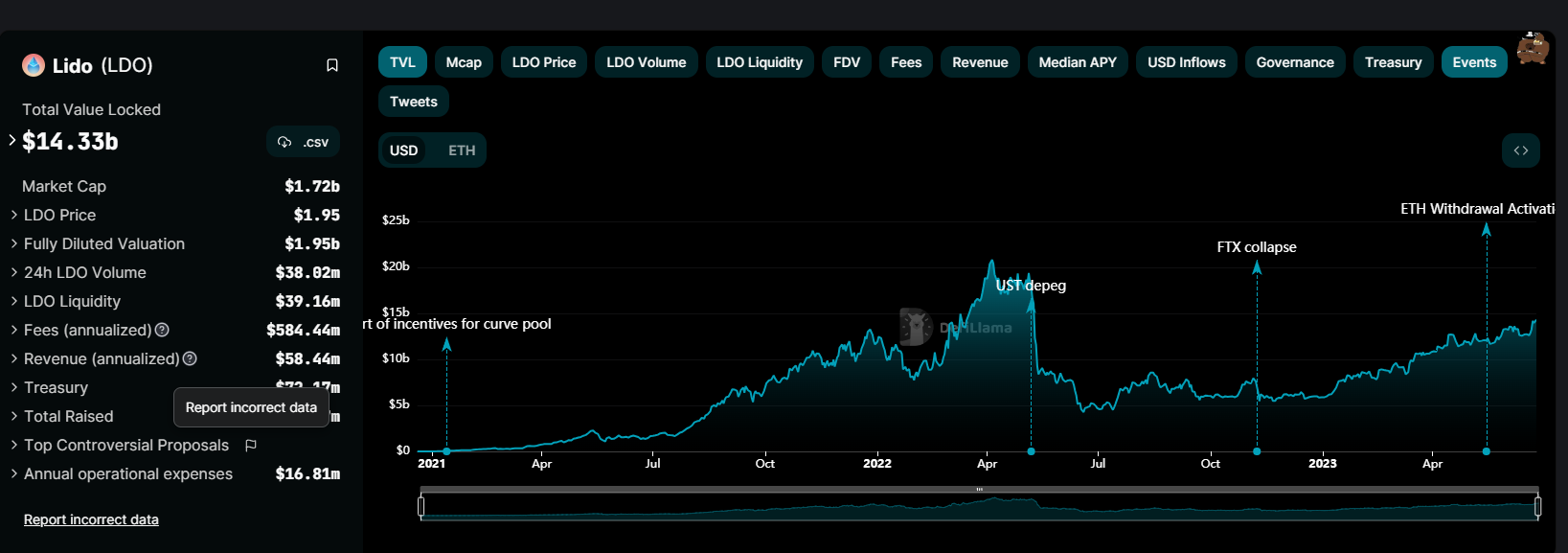

LIDO is the leader in LSD, with a pledge ratio of 31%. LIDO’s TVL has also been steadily rising and has surpassed last year’s peak in May. Currently, about 8M ETH is pledged in the LIDO protocol.

So much ETH being pledged in the protocol is bound to reduce ETH’s liquidity, and users’ returns are relatively single. Therefore, the purpose of LSDfi is to maximize the returns on users’ pledges. It is equivalent to depositing money in a bank and then using the deposit slip to pledge it to a third-party lending company to continue lending assets, and then continuing to deposit the borrowed assets into the bank, and so on. Because it is all over-collateralized, there is also a safety line here, and the possibility of being liquidated increases when it exceeds this line.

What is Lybra Finance?

Lybra Finance, as a DeFi protocol, promotes the casting of eUSD by allowing users to borrow with their deposited ETH and stETH. eUSD is a stablecoin collateralized by ETH assets. One notable feature of the Lybra protocol is that users can earn stable periodic income by holding the cast (borrowed) eUSD, and the power of eUSD comes from the LSD (liquidity collateral derivatives) income generated by depositing ETH and stETH. In other words, when users deposit ETH or stETH and cast eUSD, they will receive about 5% stable income from stETH, which is converted into eUSD through the protocol and distributed to them. eUSD is an interest-bearing, over-collateralized stablecoin that ensures safety and stability.

Lybra’s working principle

Step 1: Deposit ETH/stETH as collateral;

Step 2: Mint eUSD;

Step 3: Hold eUSD to earn interest, with an APY of around 7.2%.

What sets Lybra apart from other LSD protocols?

1. Most loans are over-collateralized, meaning that you may only be able to borrow 50-60% of your principal, but with Lybra, you can borrow 70-80% of your principal;

2. Lybra’s pure collateral yield may be slightly lower than other LSDs, but the eUSD it mints is a stablecoin, and holding eUSD can earn interest;

3. Lybra allows users to deposit ETH as collateral and mint eUSD without any loan fees or interest. Users can use the minted eUSD to buy more ETH, effectively using leverage to go long on ETH at zero cost. This strategy may be advantageous in a bull market as it allows users to potentially increase returns while maintaining an ETH exposure.

After a surge that took LBR’s price to $4.1, it has since retraced to around $1.4. With the Cancun upgrade in the second half of the year and Lybra V2 on the horizon, we can keep an eye on LBR’s movements.

What are the highlights of Lybra V2?

While Lybra V1 primarily focused on the use of Lido’s stETH, Lybra V2 will expand to include other LSD/LSTs across the spectrum as collateral. This includes Rocket Pool’s rETH, WBETH, wstETH, etc. V2 will see a wide range of options to put eUSD/OFT-peUSD to work, including DEXs, perps, lending protocols, and more.

Summary

The Cancun upgrade in the second half of the year is a relatively certain event, and LSD is expected to see another wave of growth. The LSDfi field is also in its early stages, so we can pay more attention to the relevant track.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How did Binance Labs grow into a $9 billion scale and become the most resourceful crypto venture capital institution?

- BAYC Holder’s Story: How I Became a Diamond Hand?

- Radpie: Upcoming launch of RDNT’s “Convex”

- How to Trust AI: What Ideas Does Zero-Knowledge Machine Learning (ZKML) Offer?

- Founder of Aave: “DeFi frontend applications” such as payments will drive widespread adoption of Web3

- Will Perp DEX lead the next bull market? Comparative analysis of the fee structure, indicators, and growth potential of six protocols.

- Gemini: Customers affected by Voyager’s bankruptcy can file claims through opening an account on Gemini