Regulatory intervention creates a “bottom” for the market. How will Wall Street’s entry during the chaos affect the industry?

Will Wall Street's entrance during market chaos impact the industry, considering regulatory intervention sets a market "bottom"?Author: BlockingBitpushNews Mary Liu

As the SEC takes regulatory action against top crypto exchanges such as Binance and Coinbase, and the crypto market stagnates, several Wall Street giants have unexpectedly announced their foray into the cryptocurrency space, with BlackRock sparking a wave of Bitcoin exchange-traded fund (ETF) applications for spot trading, and institutions such as Fidelity supporting the launch of the EDX Markets (EDX) exchange in the United States. The institutional narrative is back, sparking a new round of debate about the future of the cryptocurrency market. Why have these financial institutions suddenly changed their stance on cryptocurrencies? What impact will this have on the industry? Could this trigger a new cryptocurrency bull market?

TradFi finds a “good opportunity” to enter the market

At first glance, the move by institutions seems counterintuitive, as the SEC’s increasingly aggressive regulatory crackdown has left the crypto industry in a state of uncertainty, with legal action now threatening the business of top exchanges. However, Wall Street’s entry into the crypto market is more of a “strategic move” than a gamble, driven by a variety of factors.

- Understanding the working principle of LSDFi’s flagship project Lybra Finance and its V2

- So far, those who predicted a recession in the US economy in 2023 were all wrong.

- Details analysis of Azuki Elementals Sale, is manual opening of images bringing higher premium space?

Firstly, the growing demand for digital assets cannot be ignored. Cryptocurrencies were once seen as the patent of tech enthusiasts, but are now firmly established in mainstream consciousness. Bitcoin in particular has attracted a new generation of investors seeking non-traditional asset classes, and spot Bitcoin ETFs will provide investors with a way to obtain Bitcoin exposure without directly dealing with the asset.

ARK Invest founder and CEO, and prominent crypto supporter, Catherine Wood sees Wall Street’s move as a strategic response to the burgeoning market demand. She told Bloomberg that more and more retail and institutional investors are attracted to the high potential returns of the crypto space. “By offering a Bitcoin ETF, the traditional institutions are building a bridge to allow these investors to enter the cryptocurrency space without barriers,” Wood said.

Secondly, competing through differentiated products. Despite volatility, cryptocurrencies still show considerable profit potential, which is attractive to institutions offering these products and their clients. By offering Bitcoin ETFs, these institutions can diversify their products and help them stand out in a competitive market.

While the US is currently conducting strict regulatory scrutiny of cryptocurrency exchanges, many in the financial industry interpret it as a sign of future clearer and stricter regulatory measures. Wall Street may be betting on the future of cryptocurrency, in which there are sound regulatory frameworks to reduce non-compliance risks and provide investors with greater security.

Mike Novogratz, CEO of Galaxy Digital, said in a tweet that institutions are preparing to take full advantage of the potential disruption: “Given recent legal action against cryptocurrency exchanges, traditional finance sees an opportunity to carve out a space for itself in the cryptocurrency market.” He added that investors may see Bitcoin ETFs offered by familiar big brands as a safer choice than cryptocurrency exchanges that are struggling to register.

According to public records, the Securities and Exchange Commission (SEC) approved 575 BlackRock ETFs, with only one ETF rejected in October 2014, when the company sought permission to create actively managed ETFs without having to disclose holdings every day. Bloomberg’s senior ETF analyst Eric Balchunas recently tweeted that this is “another reason why the scale is so big and they’re not kidding”.

In fact, Wall Street’s testing of the cryptocurrency business began long ago, with centralized cryptocurrency financial firms and some early adopters of traditional companies, including Bank of New York, Fidelity Bank, Bank of America, Mastercard, BlockingyBlockingl, and JPMorgan, all of which have been active in this area. Andreas Antonopoulos, a well-known Bitcoin advocate, believes that BlackRock’s entry is a key point. He wrote in a blog post: “This marks a milestone moment in the relationship between traditional finance and cryptocurrency. Wall Street’s participation enhances the legitimacy of cryptocurrency and recognizes the inevitable evolution of global finance.”

The timing is most important. With the SEC’s crackdown on cryptocurrency exchanges, a vacuum may appear in the cryptocurrency market, and traditional financial institutions see it as the best time to fill that vacuum. If exchanges such as Binance and Coinbase face significant regulatory obstacles, investors may flock to Bitcoin ETFs as a safer alternative to direct cryptocurrency investments.

Hivemind founder and managing partner Matt Zhang told MarketWatch: “If large asset management companies like BlackRock are taking such measures in the midst of tightening cryptocurrency regulation, it suggests they may have done enough due diligence to know that ETFs have a good chance of gaining regulatory approval.”

What is the impact on native participants in crypto?

As Binance and Coinbase come under pressure, the involvement of traditional financial institutions such as BlackRock in the cryptocurrency industry could have a number of effects. On the one hand, it can bring more legitimacy and stability to the industry, attract more mainstream investors, and potentially gain recognition from more regulatory agencies. On the other hand, it could intensify competition among existing cryptocurrency companies, potentially driving consolidation or even driving out smaller companies. Gordon Grant, Managing Director of Sales and Trading at Genesis Trading, released data showing that “dozens” of top clients increased their investment in Bitcoin after BlackRock submitted its filing.

The worst-case scenario is that the cryptocurrency industry may be taken over by TradeFi giants, and the SEC forcing Binance to withdraw from the US market will be the last straw for the industry. After that, the launch of BlackRock’s spot Bitcoin ETF will almost be the only relatively simple way for people to invest in BTC, eliminating many technical complexities as well as regulatory and tax uncertainties. Eventually, BlackRock and other companies that obtain SEC approval to launch spot Bitcoin ETFs will own BTC. This includes WisdomTree, Invesco, and Valkyrie Investments. Therefore, the large capital in the United States will actually become a mandatory intermediary between investors and Bitcoin, making it easier for US authorities to control the largest decentralized digital asset (Bitcoin) and a considerable portion of the US dollar.

However, the characteristic of the cryptocurrency industry is innovation and disruption, usually led by start-ups and independent developers. Therefore, new and existing cryptocurrency companies must find ways to effectively compete with traditional institutions. The future of the cryptocurrency industry may be influenced by a variety of complex factors, including technological developments, regulatory changes, market trends, and the actions of various stakeholders.

Will there be a cryptocurrency bull market?

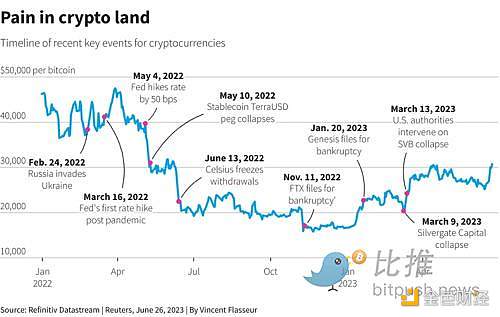

Bitcoin rose by more than 15% last week, breaking $30,000 for the first time since April and enjoying its best week since March. The industry has suffered from a loss of investor confidence and regulatory scrutiny following a series of high-profile cryptocurrency company collapses in 2022. BlackRock’s application is seen as a sign of Wall Street turning to bitcoin, and many observers speculate that this could ignite a new bull market in the cryptocurrency space. The participation of major financial institutions provides a degree of legitimacy and credibility to cryptocurrencies, which may attract a new wave of investors. Increased liquidity may drive demand and consequently push up the prices of these digital assets.

However, analysts warn that economic pressures could hinder hopes of sustained recovery. Bitcoin’s gains slowed over the weekend, with the trading price at $30,405 on Monday.

CoinShares chief strategy officer Meltem Demirors warns of the unpredictability of the cryptocurrency market. “While Wall Street’s involvement signals a positive shift, it may not necessarily protect the market from potential volatility. Cryptocurrencies, by their very nature, thrive on volatility and unpredictability.”

Bitcoin miner BTCM’s chief economist Youwei Yang says, “Sticky inflation and concerns about economic recession remain long-term risks that we must be cautious about.”

Usman Ahmad, CEO of Hong Kong cryptocurrency company BC Technology, says, “Uncertainty surrounding the activity of the US Securities and Exchange Commission (SEC) has led to weak price movements, and BlackRock’s ‘support’ feels a little different. Nonetheless, further challenges may be faced as interest rates continue to rise.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of the Derivative DEX Track: Will it Dominate the Next Bull Market?

- How did Binance Labs grow into a $9 billion scale and become the most resourceful crypto venture capital institution?

- BAYC Holder’s Story: How I Became a Diamond Hand?

- Radpie: Upcoming launch of RDNT’s “Convex”

- How to Trust AI: What Ideas Does Zero-Knowledge Machine Learning (ZKML) Offer?

- Founder of Aave: “DeFi frontend applications” such as payments will drive widespread adoption of Web3

- Will Perp DEX lead the next bull market? Comparative analysis of the fee structure, indicators, and growth potential of six protocols.