Chen Bin, General Manager of Wanxiang Blockchain Trusted Digitalization of Assets is the Passport for the Integration of the Real Economy into the Digital Economy.

Chen Bin, General Manager of Wanxiang Blockchain, believes that trusted digitalization of assets is the key to integrating the real economy with the digital economy.On September 19, 2023, the “2023 Shanghai Blockchain International Week · 9th Global Blockchain Summit” opened in Shanghai. Mr. Chen Bin, General Manager of Wanxiang Blockchain, gave a speech titled “Asset Trust Digitalization is the Passport for the Integration of the Real Economy into the Digital Economy”.

For more information, please click: “Highlights of the 2023 Shanghai Blockchain International Week (Continuously Updated)”

LianGuai provided live coverage of the conference. The following is a summary of the speech.

- Commitments will be recorded on the chain Awakening Long-termism

- The future of blockchain is in China

- Vice President of WeBank Qianhai Possibilities of Public Consortium Chain 2.0

Respected guests and colleagues, good morning everyone!

I am Chen Bin from Wanxiang Blockchain. Today, I bring you the theme “Asset Trust Digitalization is the Passport for the Integration of the Real Economy into the Digital Economy”. There is no doubt that the digital economy, as an important engine for global development, has become a global consensus. There are two dimensions to understanding the development of the digital economy:

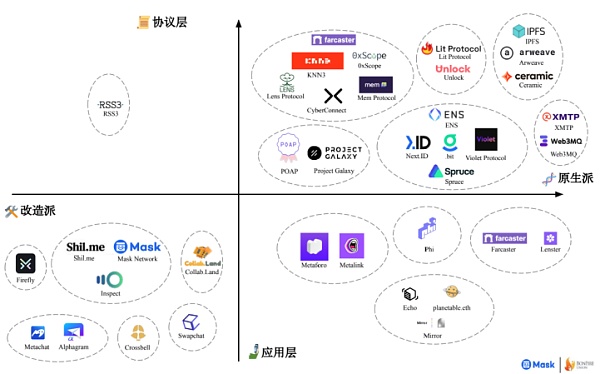

The first dimension is to consider it from the perspective of economic laws and economic paradigms. We believe that Web3.0 is an ideal economic paradigm for the digital economy. Web3.0 includes two important features:

First, decentralization emphasizes fairness, data sovereignty, and the sharing of rights among stakeholders.

Second, Tokenization in Web3.0 emphasizes the efficiency of asset circulation, with fairness and efficiency being the two key aspects. When we tokenize all assets and use smart contracts in the new network, the efficiency of economic circulation is higher. This is the first level, looking at the paradigm of the digital economy from the perspective of Web3.0.

The second dimension is to look at it from the perspective of digital assets, which can be divided into native assets and mirrored assets. The development of the digital economy cannot be separated from the large-scale development of digital assets. What are native assets? In traditional fields, digital games are a very traditional form of native digital economy. In addition, there are traditional economies. Only when traditional economies enter the integration with the digital economy on a large scale can there be significant development. For example, industries like e-commerce and O2O are typical cases of the integration of large-scale physical economies into the digital economy in the traditional Internet. Only the development of these industries can drive the development of the digital economy.

Just like the current discussions on the digital economy and digital assets, everyone talks about Crypto and encrypted assets. If all encrypted assets are purely native assets, the scale of this industry may not be very large. There must be a large-scale entry of traditional economies and physical economies into this field, transforming them into digital economies and digital assets, in order to become a new engine of economic growth. In the real economy, there are important characteristics of regularized operation that conform to traditional rules. We can see that the development of the real economy is determined by the changes and influences of the four aspects: the supply-demand relationship, productivity improvement, short-term debt cycle, and long-term debt cycle.

In the digital economy era, there will be new operating rules called “smart economy”. The foundation of the smart economy is a set of economic operating models within Web3. Of course, when we talk about new economic operating models, many guests have mentioned the impact of AIGC on the new economic model in the past few days. Professor Yang Xiaohu just expressed his concern that discussing many things about the real economy may be very boring and make everyone feel uninterested.

Quoting a lyric from rock singer Cui Jian, “My ideal is there, my body is here.” Of course, many of us who play in Web3 are young people and don’t listen to Cui Jian’s songs very often, but this lyric can very well illustrate the current development status of the industry. If one day we want to expand the proportion of the digital economy and develop the Web3.0 industry on a large scale, a significant sign is that the real economy and real assets need to enter the crypto field and the digital economy on a large scale. The integration of the digital economy and the real economy is a great future. That’s why I am discussing this topic today.

When we talk about the development of digital assets, many people think of crypto and tokens. However, in Web3, as discussed today, many topics such as DePIN and RWA have been mentioned. It can be seen that when real economy assets are integrated into the digital economy, not all assets are suitable for digitization or tokenization. This raises a question: what kind of assets are suitable for digitization and tokenization?

If we want to develop a new economic operating model in Web3.0, asset tokenization is a prerequisite. However, not all assets are suitable for tokenization. In the public chain field, many people are also exploring how to tokenize traditional economy and traditional assets. In the consortium chain field, in addition to the problems encountered in the public chain field, there will be policy and regulatory issues, determining what can and cannot be done.

In light of this, we propose a viewpoint that this road may be a long one because the ideal is there, but the body is still here. We still have a long way to go to integrate the real economy on a large scale into the development of Web3.0 and the digital economy. There may be a Web2.5 state in between.

Trustworthy digitization of traditional economic assets is a necessary step before tokenization. What does it mean to have trustworthy digitization of assets? This brings up the concept of digital twins and trustworthy digital twins.

Previously, when people mentioned digital twins, they would think of 3D engine rendering and simulating the real world. This technology is not unfamiliar, especially in Web3.0. Traditional games like “The Sims” are essentially a type of digital twin. In the early days of the internet, Web1.0, there was a famous saying, “On the internet, nobody knows you’re a dog.” This means that when we create digital twins, we must consider what a trustworthy digital twin is, ensuring that all assets twinned into the cyberspace are trustworthy and not just simple simulations. This will bring many new, different values in terms of technology, scenarios, and business applications.

Talking about the trust digitalization of assets, there are mainly two categories of assets:

(1) Financial assets, with a global scale of approximately 250 trillion.

(2) Non-financial assets, physical/biological assets and real estate, with a global scale of 350 trillion, compared to only 1 trillion US dollars of global encrypted assets. This represents a huge space for traditional assets to enter the world of crypto and digital economy.

Asset trust digitalization must consider three dimensions:

1. Physical dimension, from the perspective of physical and non-financial assets, is there physical trust, such as whether inventory is there and what its condition is. Transaction trust, whether the transactions of financial assets and supply chain are real and trustworthy.

2. Ownership trust, whether the ownership of assets is yours. In traditional means, there are property rights certificates and ownership certificates. How to map traditional centralized accounting methods into a trustworthy digital environment.

3. Value trust, when we map assets into cyberspace and turn them into digital assets, in addition to ownership and physical trust, value trust is very important because value is constantly changing. We need to use large-scale data analysis techniques, even AI technologies, to determine the credibility of the assets we own and hold in terms of their value in the real world. These are the three dimensions of asset trust digitalization that we are talking about.

Many key technologies will be used, not just the rendering, 3D engine, and Unity technology mentioned earlier, but also include identity management, data security, real-time monitoring and reliable collaboration, access control, traceability auditing, etc. Lin Yao also mentioned IoT technology today, how to make assets trusted and put their status on the chain, accepted by multiple parties. These are very important technical paths in asset trust digitalization that we are talking about.

Let’s share a few cases of how asset trust digitalization empowers the integration of the real economy and the digital economy.

Just mentioned, blockchain technology is widely used in this field. Before tokenization, asset trust digitalization is in the state of Web2.5 and has a lot of financing potential, realizing the value of digital finance.

Case 1: Trustworthy circulation of supply chain assets.

In traditional supply chain finance, accounts payable generated based on the credit of core enterprises, once electronic bills are used, in the value network formed by blockchain, they can be infinitely split and circulated, and finally realize the financing value of these bills, empowering small and medium-sized suppliers and enterprises in the supply chain to solve the problems of difficult financing and high financing costs.

Case 2: Trustworthy operation of battery assets.

For example, there are currently a large number of energy storage and new energy charging station equipment, which encounter significant pain points in the traditional economic field, especially in the distributed energy storage and charging station operation links. The important feature is that the operation is centralized, but asset investment is distributed. This brings difficulties in management and there will definitely be multiple parties involved in heavy assets, such as asset investors, operators, and users. How to build trust among these parties, solve financing problems, operational problems, and incentive problems. Through the trustworthy module of blockchain and IoT technology, the real-time operation status of batteries and charging stations can be put on the chain, allowing multiple parties to share data. This can realize the financing potential of charging stations and energy storage networks, which is also a very important application scenario.

Case Three: Trustworthy Pledge of Oil Storage Assets.

This method can be applied to inventory assets. Traditionally, financial institutions may prefer real estate or credit financing based on the creditworthiness of the subject, which is what we usually refer to as the traditional financial field based on the creditworthiness of physical objects and subjects. However, the creditworthiness of physical objects is more biased towards real estate, which is traditional finance. When we deal with movable assets (inventory), a series of financial fraud issues such as unclear owners and multiple pledges have occurred in the steel industry and bulk oil storage and trading sectors in the past. This has caused many financial institutions to be reluctant to touch these types of movable assets.

By using technologies such as trustworthy supervision of movable assets, IoT technology, blockchain technology, and big data technology, including the previously mentioned trustworthy value, trustworthy ownership, and trustworthy physicality, can be fully demonstrated in this field. It allows inventory assets that were previously unable to be used for mortgage financing to become eligible for mortgage financing, which is a very valuable digital financial application.

Case Four: Trustworthy Supervision of Biological Assets.

In the past, there was a saying, “Wealth does not include anything with fur.”

When we go to Inner Mongolia, Qinghai, and the pastoral areas of Tibet, many farmers and herdsmen have a large amount of productive assets, and the value of biological assets is very high, but their financing ability is very poor. For example, in the beef industry, when we attach a blockchain ear tag to each head of cattle, which contains a communication module, and transmit the real-time status of each head of cattle to the backend webpage, each individual cow becomes an NFT, and financing eligibility can be achieved based on NFTs.

This is a very interesting case. We usually consider agriculture and animal husbandry as very traditional industries, which are primary industries. When we attach blockchain ear tags to each head of cattle in the beef industry, and when each head of cattle becomes an NFT and a digital asset, traditional industries and traditional primary industries become digital economic industries. This is a very meaningful and typical case in the digitization of trustworthy assets and the integration of the real economy into the digital economy.

Of course, as we mentioned earlier, the digitization of trustworthy assets is currently still in the stage of Web2.5, solving the problem of financing eligibility in traditional finance. Of course, this is a necessary stage. In the future, with the advent of Web3.0, especially the tokenization of tangible assets, transitioning into a value network in blockchain and Web3.0, and becoming a new economic model of economic sharing among stakeholders, we may still have a long way to go. In the process, we need to explore step by step, whether it is in the category of asset products, the way to digitize assets in a trustworthy manner, or how to generate practical value in the economy after achieving the digitization of trustworthy assets, and solving the real difficulties encountered in the industry. If we can solve these problems, there will be corresponding value.

The emergence of new technologies can truly promote the development of the entire industry only after they have created real value in practical industries.

Finally, let’s review the overall perspective:

We all believe that Web3.0 could be an ideal economic paradigm for operating in the digital economy. When it has a new value and runs the model of capitalist interests in the new economy, it is necessary to bring the large-scale real economy into this field in order to promote the development of the entire industry.

We are gradually integrating with various industries in China, digitizing assets from various industries to solve industry problems. In the future, we will tokenize assets and realize the updated economic value in the Web3 network. We will spare no effort in this regard, hoping to make a greater contribution to the entire society and economy.

This concludes my presentation today. Thank you, everyone!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Highlights of the ‘2023 Shanghai Blockchain International Week’ (continuously updated)

- Full text of Xiao Feng’s speech at the opening ceremony of the 2023 Global Blockchain Summit The next three years are a crucial moment for large-scale application.

- Google Cloud Executive Web3 is for solving business problems, not for speculating token prices.

- Community First Building Sustainable Power for Web3 Growth

- Popular Science What is the stateless that Vitalik has frequently mentioned in recent speeches? What does it mean for the decentralization of Ethereum?

- An Overview of Mainstream Cryptocurrency Exchange Account Password Leakage Data and Security Mechanism Analysis

- Blockchain Game of ERC-6551 Use Case