The future of blockchain is in China

Blockchain's future lies in China.Author: Lawyer Liu Honglin

01 Is there potential in blockchain?

This is an article that I have been dragging in my stomach for a long time.

Friends often ask me, why did Lawyer Man Kun choose blockchain as the industry to focus on? Isn’t it prohibited in China? Can you provide legal services in a prohibited industry? Is there really potential?

- Vice President of WeBank Qianhai Possibilities of Public Consortium Chain 2.0

- Highlights of the ‘2023 Shanghai Blockchain International Week’ (continuously updated)

- Full text of Xiao Feng’s speech at the opening ceremony of the 2023 Global Blockchain Summit The next three years are a crucial moment for large-scale application.

To be honest, it is precisely because many peers and friends in the blockchain industry hold such views that we have even more potential.

The earth may be flat, but there are still some hills.

As an emerging thing, blockchain technology has only been around for 14 years, and its development has been full of ups and downs, not only in China but also globally. Since its birth, China’s regulation of blockchain has always been progressing positively, although this positive progress is achieved by constantly drawing up negative lists.

I often repeat the three negative lists of blockchain development in China to my friends:

-

It is not allowed to engage in illegal fundraising and pyramid schemes under the guise of virtual currency

-

It is not allowed to operate virtual currency exchanges in China or target Chinese citizens

-

It is not allowed to engage in virtual currency mining in China

In addition to the above three points, there is no problem with conducting blockchain-related business in China.

Many people have a narrow understanding of blockchain and only associate it with virtual currency. They think that China’s denial of virtual currency is also a denial of blockchain. However, virtual currency is just a scenario in the early development of blockchain technology. China’s restrictions and denials of virtual currency in China are parallel to the encouragement and development of blockchain technology. This is an important premise for understanding blockchain entrepreneurship in China. There are many places related to the broad concept of blockchain where one can start a business. Compared with the application scenarios and value of blockchain in the commercial society, China’s three negative lists for virtual currency can be considered insignificant.

If a blockchain entrepreneur is not doing well and doesn’t make money, and then blames mainland China for not welcoming blockchain and not allowing them to issue coins and raise funds, that would be a bit ridiculous.

Zhao Benshan has a classic scene in the TV show “Country Love”, where the foolish son complains to his father that he can never succeed because the overall environment is not good.

Uncle Benshan comforts him by saying: If you don’t have the ability, just admit it. Don’t always blame the environment. How come wherever you go, the environment is never good? You are the one who ruins the environment!

02 What will the next decade look like?

The so-called “look at ten years, work for one year.”

A few days ago, when I was having tea with Mao Jiehao, a lawyer from the Mankun team, I casually mentioned that I have been thinking about a question recently: What will the blockchain industry be like in 10 years? More importantly, what will the blockchain industry in China be like?

I have a few bold speculations, which are very irresponsible:

1. By 2023, major institutions and hot projects in the industry may have all failed, including certain security companies and certain Ethereum-like projects, just like Yinghaiwei in Beijing in 1995.

2. Bitcoin will either become a conventional target for alternative asset allocation, with a slow price increase to over $100,000 (not investment advice!), or it will completely go to zero.

3. Stablecoins will become the preferred choice for cross-border trade and remittances. Mainstream social media and financial institutions will gradually launch their own stablecoin systems. The global currency war in the Web 3.0 era will continue to be played out between China and the United States.

4. Security tokens have matured, but the path is not for tokens to become securities, but for securities to become tokens. Mainstream securities exchanges, including the Hong Kong and A-share markets, will choose to use blockchain as the underlying technology. There will be a proliferation of RWA-backed tokenized debts.

5. Both the East and the West will launch regulatory sandboxes for encrypted financial centers, allowing blockchain startups to issue tokens for fundraising/bond issuance through a registration-based system. However, the fundraising amount and investors will be limited, and participation in subscription and trading will be limited to compliant funds or compliant investors.

6. Utility tokens will become standard for the majority of Web 3.0 applications, just like wallets and points in the Web 2.0 era. Utility tokens do not have the function of fundraising, but are only used for user incentives and network data circulation. The circulation of utility tokens across projects and chains will become a trend, whether initiated by the government or third-party commercial institutions.

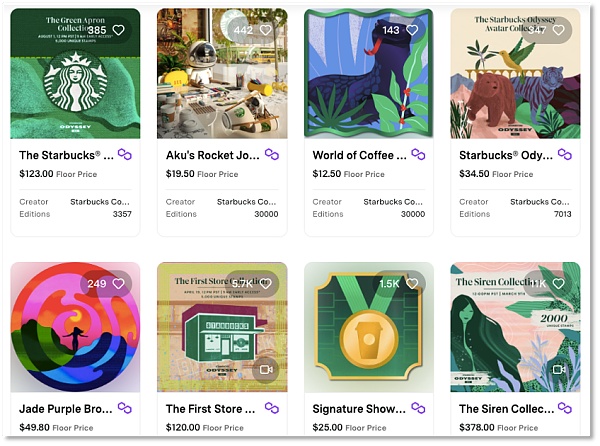

7. NFTs will become standard for online socializing, online gaming, and e-commerce, no longer emphasizing NFTs as a means to promote tangible assets. Digital goods that are invisible but tangible will become a normal presence in everyday consumption.

8. More importantly, these speculations are highly likely to occur in China.

03 The Future of Blockchain in China

In the process of communicating with many Chinese blockchain entrepreneurs, I discovered that many inexperienced blockchain entrepreneurs have a bad habit of “looking up” to overseas project parties and entrepreneurs.

Some even came up with a hierarchy of disdain in the blockchain world: roughly, blockchain project parties and practitioners in the European and American markets look down on those in Southeast Asia, Hong Kong, and Singapore, and entrepreneurs and practitioners in Southeast Asia, Hong Kong, and Singapore look down on those in mainland China.

Do you want to ask your friends who despise the blockchain why they feel superior? They often can’t give a clear answer. This phenomenon is indeed a bit puzzling. Adding a “1” after the number behind “Web” is enough to scorn the predecessors in the industry. Mistaking the dividends of the era as their own ability is a bad habit. It really has nothing to do with Web.

In the early stages of the development of an emerging technology, the focus should not be on despising the blockchain and engaging in internal strife, but on finding ways to truly solve social problems, identify real business application scenarios, create business value, and earn money by serving customers or users based on their abilities. It is meaningless to compete in creating technical concepts or managing market value late at night.

Talk is cheap, action is valuable. Entrepreneurship in Web3 requires aiming for the stars, but what is more important is to stay grounded. Don’t just focus on China’s land and indulge in empty narratives about overseas market concepts. This is also why I have always advised Chinese entrepreneurs not to pay too much attention to RWA and DAO. To be honest, as a Web3.0 blockchain entrepreneur, being able to be in the Chinese market is already extremely lucky.

This judgment is based on my personal experience as a former Web2.0 entrepreneur:

1. China has accumulated globally leading internet infrastructure in the Web2.0 era, including both hardware and software, as well as O2O. The internet industry’s upstream and downstream supply chain is well-established, and the Chinese government has clearly tasted the benefits of the Web2.0 era. China, as the global leader in the first gradient of the internet, will definitely not give up its position easily.

2. China has the world’s best internet product managers and operators. Whether it’s due to hard work or internal competition, it is undeniable that China has an absolute lead in terms of the quantity of outstanding internet talents in various dimensions such as product design, user experience, traffic acquisition, and business monetization. Despite the fact that many money-making projects in the market are represented by European and American faces, at least half of the personnel behind them are Chinese. The blockchain world cannot be without Shenzhen and Hangzhou, just like the West cannot be without Jerusalem.

3. China has a population of 1.4 billion, and the user base of mobile internet alone reaches 1.2 billion. Such a unified large market is the envy of internet projects from other countries and regions. Moreover, this unified large market is protected by an invisible wall. Don’t let blockchain entrepreneurship become a barrier. Chinese entrepreneurs want to go abroad, and foreign entrepreneurs want to enter.

Therefore, Chinese entrepreneurs should not feel inferior, nor should they underestimate themselves. They should not always talk about how the stone from another mountain can be used to polish jade. We must understand that in the early days of the previous generation of the internet, it was C2C (Copy2China) to some extent, but the later story of China’s internet going global is even more convincing.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Google Cloud Executive Web3 is for solving business problems, not for speculating token prices.

- Community First Building Sustainable Power for Web3 Growth

- Popular Science What is the stateless that Vitalik has frequently mentioned in recent speeches? What does it mean for the decentralization of Ethereum?

- An Overview of Mainstream Cryptocurrency Exchange Account Password Leakage Data and Security Mechanism Analysis

- Blockchain Game of ERC-6551 Use Case

- Exclusive Interview with Web3Brand How do AI and Web3 achieve mutual development in the wave of technological advancement?

- a16z Zero-knowledge proofs are just a magic trick