Hong Kong Treasury Bureau’s Chen Haolian The development of Web3.0 should not undermine the stability of the financial system.

Chen Haolian from the Hong Kong Treasury Bureau emphasizes the importance of maintaining financial system stability while developing Web3.0.Source: 21st Century Economic Report

On August 3rd, the “Realizing Digital Assets – Exploring Compliance and Future Prospects in Asia” seminar, jointly organized by Southern Finance Media Group and HashKey Exchange, was held in Hong Kong.

At the seminar, Chen Haolian, Deputy Director of the Financial Services and Treasury Bureau of Hong Kong, delivered a keynote speech on the theme of “Opportunities and Challenges for Hong Kong to Build an International Virtual Asset Center.”

Chen Haolian stated, “Web3.0 represents an important transformation in the development of the Internet. It uses blockchain technology and has the characteristics of transparency, efficiency, decentralization, and platform elimination. Web3.0 plays a very important role in digital economy and financial technology innovation.”

- Recent Amendments to Cryptocurrency-related Legislation in the US Congress

- All you need to know | China AIGC Entrepreneurship Legal regulation and policy summary (July 2023)

- Google’s major policy update Can Web3 attract a large number of Android users?

Currently, Hong Kong is actively building an international virtual asset center. Chen Haolian believes that Hong Kong has clear advantages in this regard, including being an international financial center with world-class financial infrastructure, legal system, and regulatory framework that is aligned with major international markets.

Chen Haolian said that Hong Kong is actively seizing the development of Web3.0 and using it as an important entry point for financial innovation practices. For example, “we are committed to promoting the sustainable development of various financial services on the entire virtual asset value chain, including virtual asset issuance, tokenization, trading and payment platforms, financial and asset management, as well as custody, etc.”

Earlier this year, several cryptocurrency exchanges experienced crises one after another, causing market shock. In response, Chen Haolian stated that the Hong Kong SAR Government has conducted research on these cases and summarized the experience. “We believe that the problem lies in the fact that they operated without proper regulation and management. However, the underlying blockchain technology is the focus of developing virtual assets and is a technology that we must embrace.”

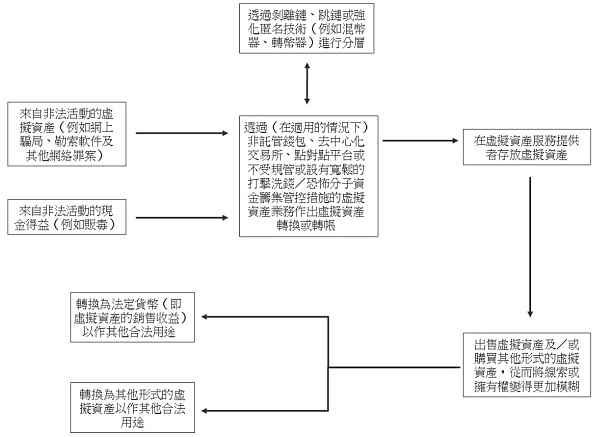

Based on this, Chen Haolian believes that Hong Kong should seize the opportunity to promote the development of Web3.0 in Hong Kong, but the premise is to protect investors and not allow it to be used for illegal purposes such as money laundering or harm the stability of the financial system. He introduced that Hong Kong, under the regulatory approach of “same business, same risks, same rules,” allows Web3.0 to develop sustainably and responsibly within an appropriate regulatory framework, serving the real economy and citizens.

In June of this year, the Hong Kong SAR Government announced the establishment of a third-generation Internet development task force, which is chaired by the Financial Secretary and consists of 15 non-official members from the relevant industry, as well as representatives from relevant government officials and financial regulatory agencies.

Chen Haolian emphasized that the goals and policy directions of the Hong Kong SAR Government are very clear, “which is to provide appropriate regulation to the market while unleashing the potential of Web3.0 and related technologies to improve the efficiency and transparency of finance and trade in clearing, settlement, and payment processes.”

In February of this year, the Hong Kong Special Administrative Region Government announced the successful issuance of HKD 800 million tokenized green bonds under the government’s Green Bond Program, becoming one of the world’s first government-issued tokenized green bonds.

Chen Haolian said, “We expect that more and more traditional financial instruments will be tokenized. Since such tokens have similar terms, characteristics, and risks as traditional securities, the Securities and Futures Commission will issue a circular to update the policies on the issuance of security tokens.”

Regarding the digital Hong Kong Dollar, the SAR government is preparing for the possible launch of retail-level central bank digital currency through a three-track approach. “The Hong Kong Monetary Authority will closely cooperate with different stakeholders to conduct a series of experiments to explore the application scenarios and related implementation and design issues of the digital Hong Kong Dollar,” said Chen Haolian.

It is worth mentioning that in the field of central bank digital currencies, the SAR government attaches great importance to strengthening its connection with the Mainland. For example, the People’s Bank of China Digital Currency Research Institute and the Hong Kong Monetary Authority conducted the second phase of technical testing for cross-border payments using digital RMB last year, and introduced more Hong Kong banks to participate and enhance the value of digital RMB wallets through “Faster Payment System”.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Must-read in the Evening | Key Policy Elements for Cryptocurrency Assets

- SEC New Regulation Listed Cryptocurrency Companies Must Disclose Significant Cybersecurity Incidents

- The U.S. House Financial Services Committee passes the U.S. Stablecoin Regulation Bill.

- LianGu Air Paradigm What principles should be followed in formulating stablecoin policies?

- Latest Proposal from Both Parties in the United States DeFi and Crypto ATMs Also Need AML and KYC

- Global NFT Tax Regulation Policies Overview, Comparison, and Outlook

- “Responsible Financial Innovation Act” to be submitted. What’s new about the new bill?