Compared with Bitcoin, will Ethereum be more risky in the past six months?

Original: Yahoo! Finance

Original author: Omkar Godbole

Translator: Moni

Source: Odaily Planet Daily

- Hedge funds short Zcash and XRP to hear what they say

- 22 halving coins detonated 2020: ferocious little coins, taking you to heaven and hell

- The most profitable cryptocurrency field is lending

If you look at the pricing of rights in the last few cycles, in the next six months, we may see that Ethereum faces greater volatility-at least compared to Bitcoin.

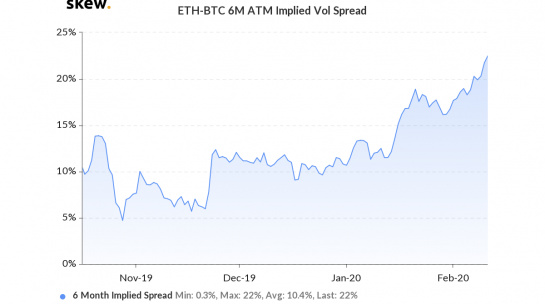

Crypto derivative analysis company Skew noted that the difference between the implied volatility of six-month parity options on Ethereum (ETH) and Bitcoin (BTC) has risen to a maximum of 22 percentage points. In fact, the recent significant surge in the implied volatility difference in ETH-BTC's six-month parity options illustrates one thing: investors expect Ethereum to fluctuate significantly over the next 180 days, meaning that the price of Ethereum will increase more than Bitcoin, but at the same time the decline will also be greater than Bitcoin.

The implied volatility of ETH-BTC parity options bottomed in October 2019, when the indicator number was only 4.7%, but it has been on an upward trend ever since. "Interesting" is that in the past three and a half months, Ethereum's increase has been higher than Bitcoin, which is also the basis for the rise in the implied volatility spread indicator of parity options.

In the last two months of 2019, Bitcoin has fallen by 21% and Ethereum has fallen by almost 30%. But when the time comes to 2020, the situation is completely different: Bitcoin's yield so far this year is 37%, but Ethereum's yield during the same period has reached a staggering 73%.

Implied volatility is an assessment indicator of the market's expectations of the future risk of assets. It substitutes the market's option or warrant trading price into the theoretical price model of the warrant, the Black-Scholes model, and the volatility value derived from it. As the option pricing model (such as the BS model) gives a quantitative relationship between the option price and five basic parameters (underlying stock price, strike price, interest rate, expiration time, and volatility), as long as the first four basic parameters and The actual market price of an option is substituted into the pricing formula as a known quantity, and the only unknown quantity can be solved from it. Its size is the implied volatility.

The implied volatility will have a positive correlation effect on the option price. The higher the volatility (uncertainty), the greater the hedging demand for call options (calls) and put options (puts). However, it should be noted that the implied volatility is not an indicator to evaluate the development direction of the market. In layman's terms, you cannot judge whether the market will develop in a bull market or a bear market through this indicator. You can only use it to determine what may occur. Large increase or decrease trend. However, because traders often associate increased volatility with a bear market, for most investors, implied volatility is more of a "risk" indicator.

Compared to Bitcoin, Ethereum is relatively less dangerous than before

If we analyze the distribution data of historical volatility, we will find that the fluctuation of Ethereum is indeed larger recently. But in recent months, compared to Bitcoin, Ethereum's asset risk does not seem to be as great as expected.

The two indicators, Realized volatility and Historical volatility, reflect the standard deviation from the average price of the underlying asset and are usually expressed as a percentage. The higher the historical volatility of an asset, the greater its risk.

In the week of February 3, the six-month actual volatility difference in ETH-BTC increased by 13 percentage points, reaching the highest level since July 13, 2019. In early December 2019, the indicator number was as low as nearly 2.3 percentage points, but it has now risen sharply, which indicates that compared to Bitcoin, the inherent risk of Ethereum has increased.

If we analyze historical volatility data, we will find that the average historical volatility of Ethereum over the past three years is 29 percentage points, which is much higher than the recently observed level. This also seems to indicate that although the recent "risk" is higher than Bitcoin, but If time is lengthened, Ethereum will relatively reduce its risk to a level close to Bitcoin.

Volatility and mean regression

According to the mean regression theory, over time, any indicator will eventually return to its historical average.

If this is the case, then implied volatility and historical volatility are also applicable to this theory. This seems to mean that because the difference between current and historical volatility is much lower than its average 29-point volatility, this indicator may "return" to the historical average in the next six months, which is 29 Percentage points.

In short, Ethereum may be more volatile than Bitcoin in the near future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of Cryptocurrency Market Regulation: Status, Demands, and Challenges

- Chief Economist of CBEX: Bitcoin lacks correlation with mainstream assets and can be included in investment portfolios

- If you halve, you will appreciate. Half a bitcoin is more valuable?

- Founder of Wikipedia who was forced into a hot spot: BSV is impossible in this life

- EU launches public consultation on crypto asset supervision, final plan to be released in Q3

- The State Council's earliest document to establish a "whistleblower" also mentioned the use of blockchain

- Dr. Xiao Feng first authored in 2020: Blockchain and Global Public Affairs Governance