Maker multi-collateral Dai migration is coming to an end, and DeFi financial competition will become the main battlefield in the future?

In the latest DeFi Industry Report 2019 published by DAppTotal, it focused on a comprehensive review of MakerDAO's data performance over the past year.

From the report, we can see that in the past year, MakerDAO has firmly occupied the leading position in the DeFi lending platform, but it is still far from being at ease, and still faces the threat of competition from other DeFi products. In 2019, in addition to MakerDAO, the entire industry has shown diversified and extended development, and a series of financial innovation models such as Compound, dYdX, Uniswap, Synthetix, and instaDApp have appeared.

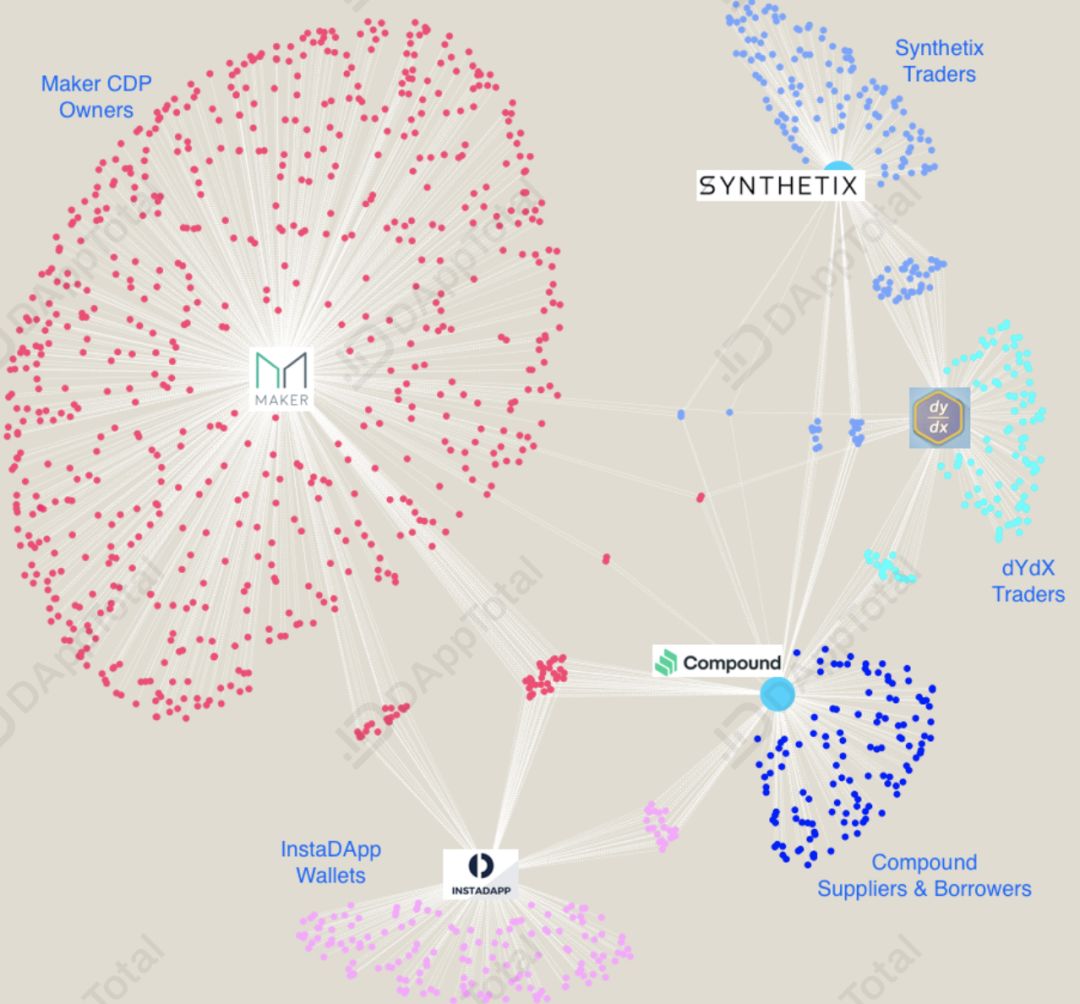

As we all know, due to the open and transparent nature of blockchain technology, DeFi products have strong composability characteristics. DAI borrowed from MakerDAO can be stored in Compound and then loaned for dYdX transactions. As shown in Figure 1, we also analyzed the user portrait (CDP) of multiple DeFi products and found that there is a large degree of overlap between users on different platforms.

- Tracking patients, alleviating the shortage of masks, deploying supplies … Can the blockchain become a magic weapon to fight the epidemic?

- ECB President Lagarde: Hopes to assess whether central bank digital currencies can serve the public and support ECB goals

- Will Bitcoin's death spiral stomp really happen?

(Figure 1 User overlap between DeFi platforms)

This means that the DeFi platforms may seem to complement each other functionally, but the competition is actually stalemate.

For example, when Maker ’s loan interest rate remained at a high level of 20.5% last year, there was a time when users deposited Dai into products such as Compound and dYdX to earn interest. During that time, Maker ’s demand for deposits and loans declined, and Compound and Both dYdX's platform user volume and hedging volume have increased significantly.

It should be said that Maker is the central role of the central bank, and each interest rate adjustment will have a direct impact on the market environment of other commercial banks such as Compound and dYdX. But there is one thing for sure, the current overall audience of the DeFi industry is still small, and Maker must not want to see the situation where fertilizer and water flow into outsiders' fields.

To this end, on November 18 last year, MakerDAO launched the Multi Mortgage Dai (MCD) in order to change this situation, as shown in:

2. Maker launched multi-mortgage assets, decentralized exchange Oasis Trade, etc., to further improve its product derivative business to block the outflow of Dai.

According to data from DAppTotal on February 10, the total supply of Dai as of now is 115 million, and the total supply of Sai is 22.59 million. Since the multi-collateral Dai went online, Sai has transferred a total of 103 million to Dai.

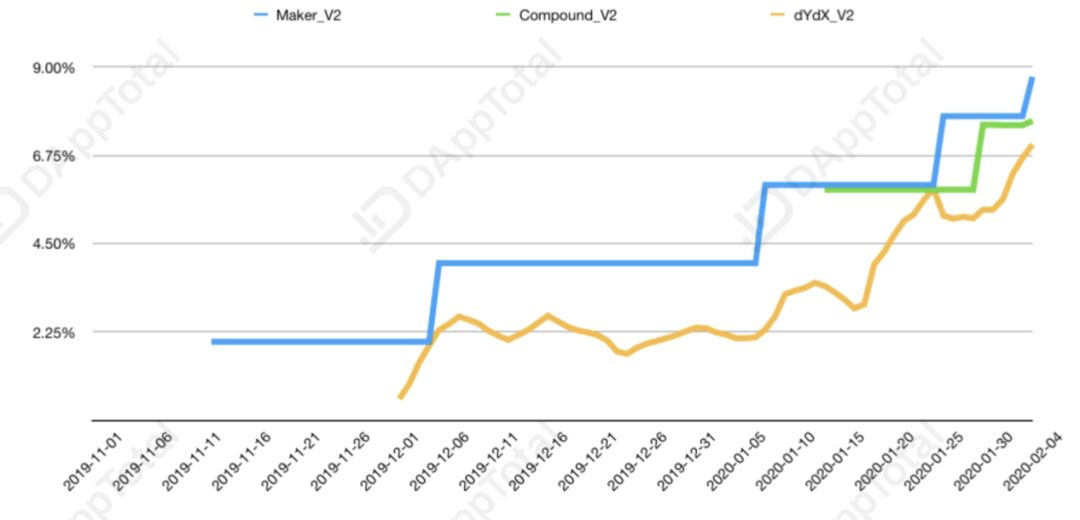

From the data point of view, Maker has been trying to do the migration of Sai like Dai since the launch of multi-collateral Dai, which is nearing completion. During this period, the economic adjustment method of raising Dai's deposit and borrowing rates has been used to guide users to transfer. At present, the transfer of Sai to Dai has basically been announced.

So, what impact will the completion of Sai have on the overall DeFI market? Especially products like Compound and dYdX.

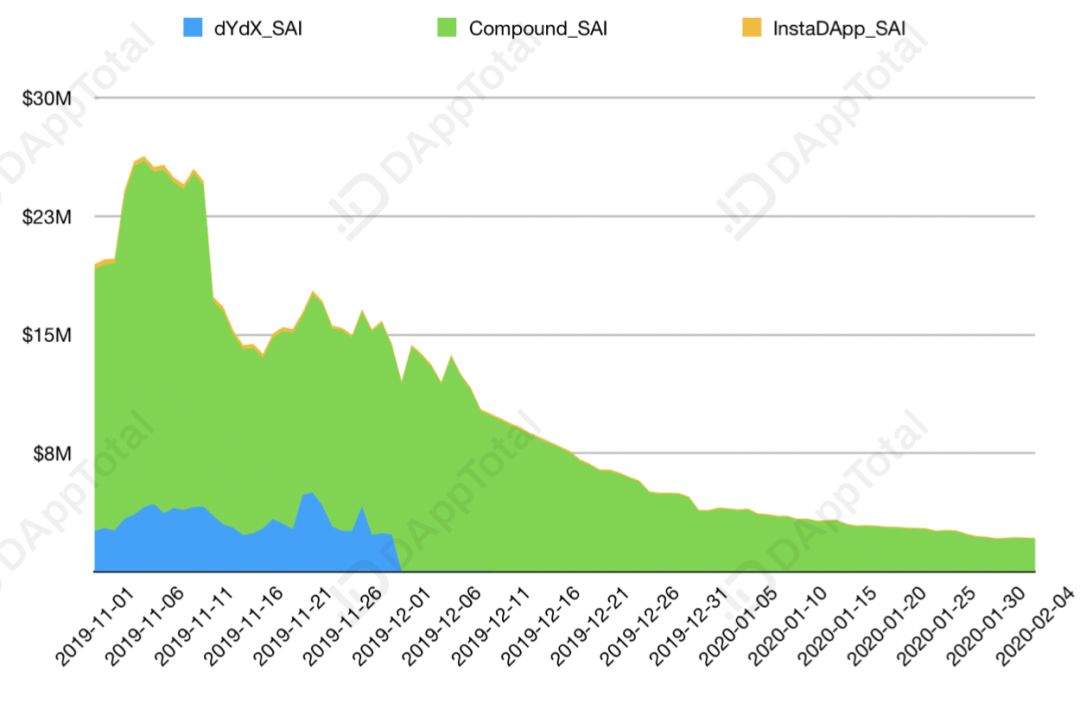

(Figure 2 Sai lockup situation of each DeFi platform)

As shown in Figure 2, since the beginning of November last year, before Maker officially launched multi-mortgage Dai, the number of Sai originally locked in the Compound and dYdX platforms began to decrease sharply. Taking Compound as an example, on November 05, Sai's lock-up volume was 22.06 million, and on February 04, three months later, Sai's lock-up volume was only 2.07 million, a reduction of 90.61%. dYdX is even more obvious, with a maximum of 4.27 million Sai being almost cleared.

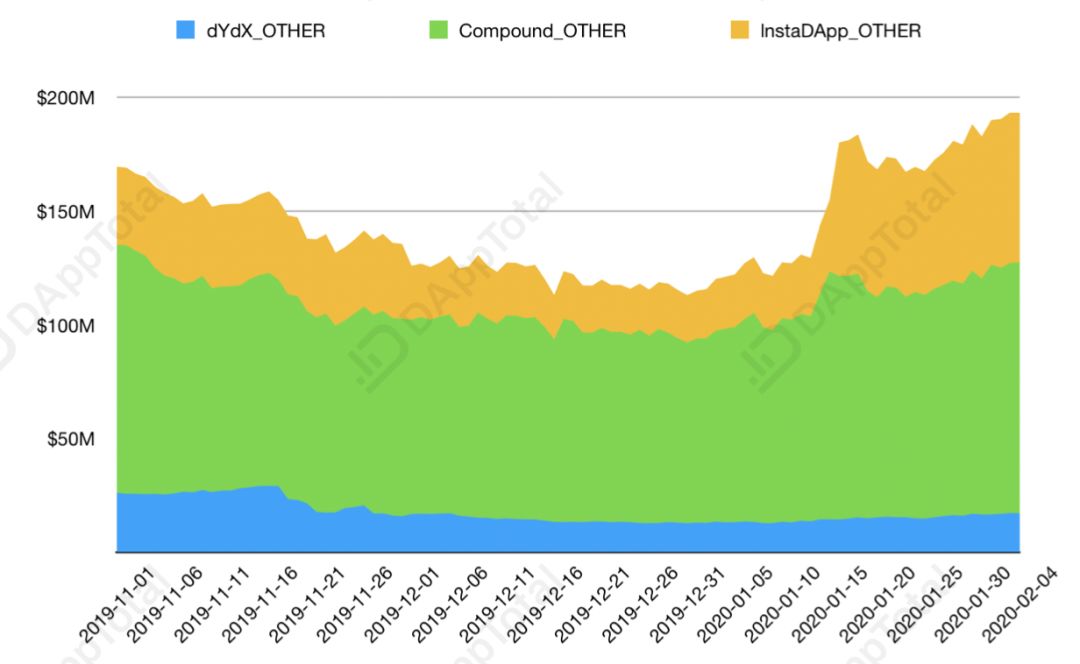

However, platforms such as Compound and dYdX are asset pools with many mortgage assets, such as ETH, USDC, REC, ZRX, etc. Take Compound data as an example. Of the total locked positions of USD 125 million on November 01, Sai accounted for USD 16.57 million. The majority of the locked positions were mainly ETH. As shown in Figure 3 below, Sai ’s large withdrawal will have a short-term impact on his platform's hedging, but from the perspective of the actual hedging data trend, the impact will not be too great.

(Figure 3 Locking of other assets on each DeFi platform)

So what's the real impact?

1) Free circulation in the DeFi market is blocked in the short term

Previously, DAppTotal wrote an analysis article stating that "demand far exceeds the total amount issued, and Dai becomes the king of DeFi lending platform circulation." It mentioned that Dai's greatest value is to promote interoperability between DeFi platforms. Previously, Maker did not have a deposit interest rate on the market, and users who chose to generate Dai on mortgage assets would choose to pay interest on platforms such as Compound and dYdX. Now Maker has also launched a deposit interest rate, and it is not necessary for Dai to flow out.

2) DeFi Finance will become the main battlefield of future competition

Originally, the user audience of Maker was mainly to meet the redemption requirements of miners without selling coins, and the application scenarios were relatively narrow. After Maker launches the DSR deposit interest rate, it will lead the market to nurture even greater financial demand. You know, as the main competitor, Compound's main business direction has always been to earn interest on deposits. This is a maker slow. But the addition of Maker will make the DeFi wealth management market more attractive. In the foreseeable future, competition in interest rates on deposits between different DeFi platforms around financial management needs will be inevitable. As shown in Figure 4 below, the deposit interest rates between Maker, Compound, and dYdX platforms will affect each other under market adjustment.

(Figure 4 Changes in the deposit rate of DeFi platforms)

Originally, the DeFi platform was only a niche market, and its application scenarios were very limited. Under the agitation of DeFi financial management requirements, it is bound to directly drive the growth of the overall market deposit and loan demand. In fact, in the past 3 months, the amount of ETH held by major platforms has shown an increasing trend.

Overall, the existence of Maker multi-collateral Dai will obviously completely rewrite the competitive landscape of the DeFi market. In the short term, it will bring some competitive pressure to platforms such as Compound and dYdX, but in the long term, it will intensify the competitive format of the DeFi market, and the maturity of the DeFi financial market will bring the DeFi industry into the next fast track .

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Fed Chairman: China has not officially started creating digital dollars, China's new crown virus could hurt global economy

- Interpretation: mask industry chain and blockchain anti-epidemic

- Singapore Digital Bank Application Guide: Eligibility Criteria, Compliance Criteria, Inspection Criteria, and Operation Planning

- Google Cloud announces joining Hedera Hashgraph Management Board and will run a network node

- Bitcoin returns strong to five digits, but US government loses $ 1.7 billion

- Electricity is 2 cents, and the policy is gradually opening up. Is Central Asia becoming a "mining paradise" for Bitcoin miners?

- Digital gold, scarcity, and Bitcoin halving