Crypto derivatives exchange FTX seeks $ 15 million in funding

This article from at The Block , the original author: Yogita Khatri

Odaily Planet Daily Translator | Yu Shunsui

Summary:

- Cryptocurrency derivatives exchange FTX CEO Sam Bankman-Fried confirmed that the exchange is seeking to raise $ 15 million in equity financing at a valuation of $ 1 billion.

- In addition, the exchange's development plan includes expanding its product line and hiring more employees.

A person familiar with the matter told The Block that the cryptocurrency derivatives exchange FTX is conducting a round of equity financing at a valuation of $ 1 billion.

FTX CEO Sam Bankman-Fried confirmed this progress, telling The Block that the exchange aims to raise $ 15 million in Series B at this valuation. He added that "depending on speed and interest," the company could raise as much as $ 30 million.

- Graphic dismantling: Where did FCoin assets go? Is there a problem with the funding chain in 2018?

- Cryptocurrency Essence Series: The Rise and Development of the Mining Industry

- Forbes: Bitcoin's rebound this year is more sustainable than 2019

According to Bankman-Fried, FTX was launched in May 2019 and plans to sell 1.5% to 3% equity.

FTX raised $ 8 million from investors last August , including Proof of Capital and Consensus Labs. According to Bankman-Fried, the company sold its token FTT in its last funding round.

According to CoinGecko data , the current price of FTT is about $ 2.65, with a market value of more than $ 75 million.

After this round of $ 8 million in token financing, FTX received "tens of millions of dollars" from Binance in a round of equity financing last December .

When asked why investors prefer equity over FTT tokens, Bankman-Fried said: "FTT has more short-term liquidity, and equity has a greater ultimate economic benefit in the company."

increase rapidly?

Hong Kong, China-based FTX began operations in early 2019 and appears to be growing rapidly.

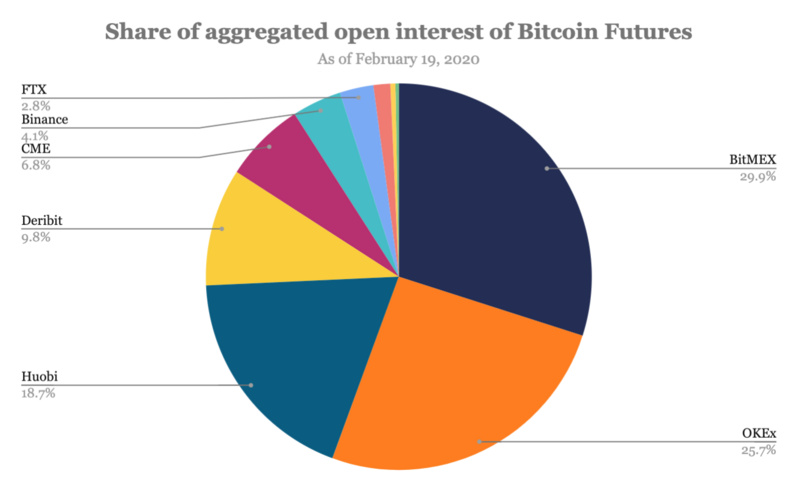

According to Skew's data, FTX currently ranks seventh in terms of open contracts (ie, the value of open derivative contracts that have not yet been settled). FTX's current open positions are approximately $ 132 million, which accounts for approximately 10% of the crypto derivatives giant BitMEX.

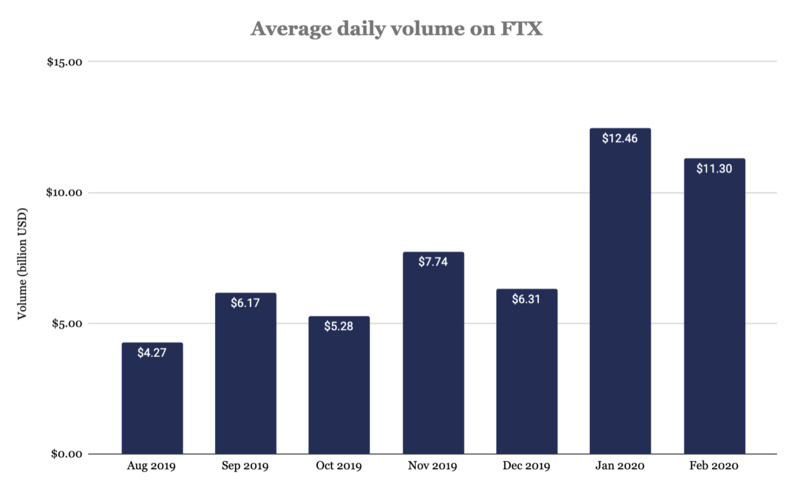

According to Skew's data, in terms of transaction volume, FTX has an average of $ 11 billion worth of crypto derivatives transactions per trading day.

Image source: Skew, The Block Research

Looking ahead, FTX has a "significant" expansion plan, Bankman-Fried told The Block, including the growth of its product line and more market expansion.

He said, "We want to expand more fully into the field of tokenized products and transactions, and at the same time expand to many markets, including important regions in East Asia, Southeast Asia and Eastern Europe."

He also said that in terms of team expansion, FTX hopes to double the number of employees from the current 35 or so to about 70 in the next year.

Earlier on the Scoop podcast , Bankman-Fried told The Block that the exchange was shifting its focus from adding new futures products to products such as options.

He said at the time, "I do think that, to a considerable extent, futures are now trading at a much higher volume, and I don't think options will soon exceed that level, which is why we launched futures first, and we spent It took about 9 months to get into the options space. But in the options space, there are far fewer real competitors … I think there is still a lot of innovation in options. "

Bankman-Fried also said that FTX is also studying the Volatility Index (VIX) to track the price fluctuations of Bitcoin.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- MakerDao urgent vote to prevent governance attacks, this crisis may be related to the life and death of DeFi

- "The Secret History of Bitcoin": Who is the super-large Bitcoin mining pool with a computing power that approached 51%?

- Babbitt launches | Swedish central bank pilots "e-Krona", what are the characteristics of the world's first retail CBDC?

- Digital Currency Research Institute of the People's Bank of China: Development and Management of Blockchain Technology

- Opinion: Ethereum is promoting crypto market recovery

- Insight into central bank patents: digital currency generation, circulation, and recovery solutions have taken shape

- Analysis of Bitcoin's price trend with Elliott wave theory: we are in a rising stage