Opinion: Ethereum is promoting crypto market recovery

Author: Eric Elliott

Compilation: Share Finance Neo

Source: Shared Finance

Ethereum is the main driver of the recent recovery of the crypto market, far exceeding Bitcoin.

- Insight into central bank patents: digital currency generation, circulation, and recovery solutions have taken shape

- Analysis of Bitcoin's price trend with Elliott wave theory: we are in a rising stage

- Russia will ban the use of cryptocurrencies as a means of payment

mainly include:

ETH month-on-month increase of 61%

BTC increased 14% month-on-month, why is there such a difference

The price of ETH has been suppressed by fear

As the solution to the problem is found, these concerns are dissipating.

Layer 2 scalability is being addressed

Usability and onboarding issues are being addressed.

DeFi has exceeded the $ 1 billion lock-in milestone.

There are already over a million dapp users.

The trillion-dollar market opportunity will soon be released on Ethereum.

At the time of writing this article, after reaching a peak of about $ 10,400 last week, Bitcoin is up 14% from the previous quarter. Obviously, this market sentiment is related to halving Bitcoin, and it is this risk aversion that has triggered a $ 10,000 tug-of-war between longs and shorts.

Equally impressive is that Etheruem is currently up 61% from last month. You can check the difference between the price of ETH and the price of BTC in the last 30 days. If they grow at the same rate, this line is flat:

The price of ETH relative to BTC, January 18-February 18, 2020

Let's take a closer look at why Ethereum may lead to a recovery in the crypto market:

In December 2017, people were optimistic about the possibility of blockchain applications, and the first blockchain game to get the hype from mainstream media was Cryptokitties.

Unfortunately, it is not newsworthy because it is so popular, but because it is so popular that the Ethereum network cannot handle it.

The price of Ethereum has been under pressure for the past two and a half years, as people have speculated that something else might replace it. Around July 2018, shortly after EOS released its mainnet, the price of ETH dropped significantly. In November 2018, due to the BTC computing power battle, the price of BTC plummeted, and the decline in ETH even exceeded that of BTC. Obviously, compared with the daily active users and other network values, this really depressed the price of ETH.

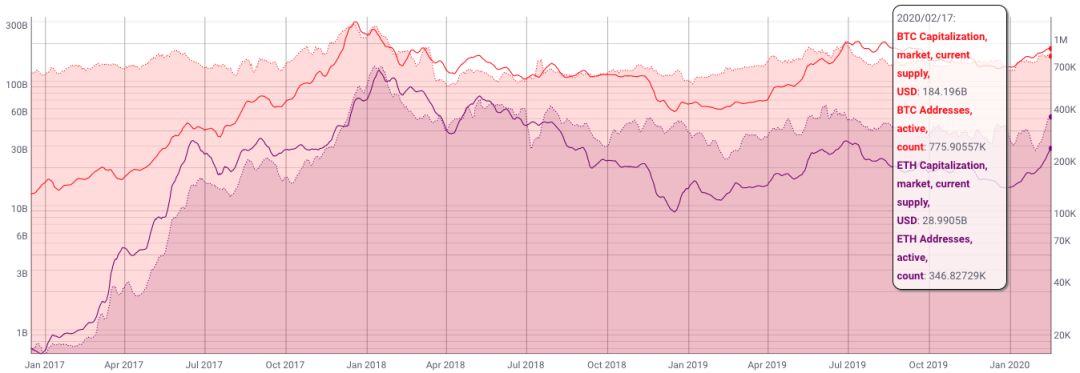

Market value by valid address. Red: BTC, purple: ETH

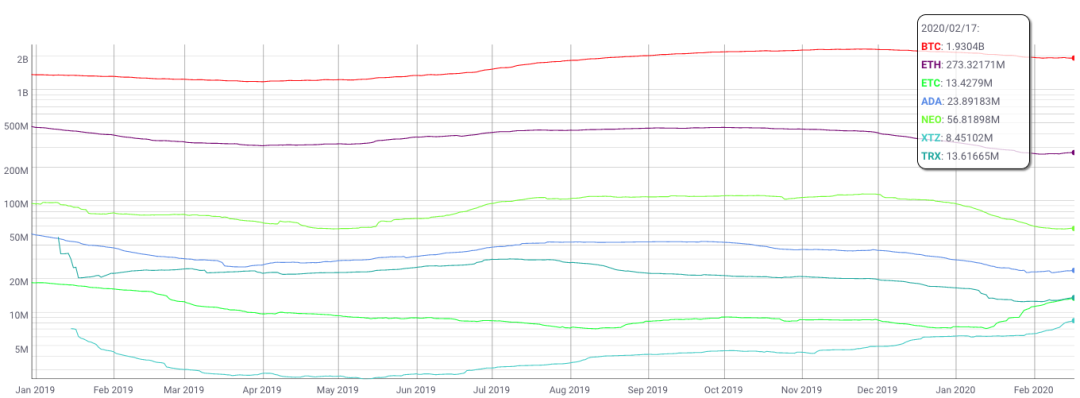

At the same time, throughout the process, Ethereum gained more momentum among developers and solved its scalability and usability issues. In fact, Ethereum is the only smart contract platform that is widely used. You can see this from the transaction volume, which is still mainly driven by speculation in all other smart contract platforms:

Dapp platform transaction volume. Includes BTC for reference (Data source: Coinmetrics)

EOS is not intentionally excluded from the above chart. EOS on Coinmetrics cannot get this data. The EOS network has usability issues due to operating spam attacks that cause denial of service (DoS) conditions on the network. In fact, holders of EOS and other easy-to-play networks may be using spam transactions to improve the ranking on the indicator graph in order to artificially increase the value of the token.

"Operation" indicators on the blockchain are easily deceived and cannot be compared on the blockchain.

Last fall, EOS proved that it has many of the same scaling issues as Ethereum. The network stopped working, and ongoing governance issues affected its technical capabilities. EOS is Ethereum's number one competitor, but it suddenly disappeared in the water.

While competing platforms strive to attract and retain users, Ethereum has also broken through two major obstacles:

The Layer 2 scaling solution launches a live main network, allowing new dapps like Audius to scale to tens of thousands of active users (previously, all Ethereum applications combined only managed about 10,000 daily active users).

Audius brings mainstream musicians and fans willing to follow them. It's just getting started, but one day it could compete with Spotify as a fairer and more reliable streaming payment option and as a way for fans to make money by organizing and sharing playlists.

Etherum's availability is strongly supported by Fortmatic, which removes some major obstacles, including authentication, commands, password login, and key management. To use Fortmatic securely, users don't even need to know that they are using a blockchain or private key. They can pay with a credit card and log in with a username, password, email, phone number, and 2FA (2-factor authentication).

Fortmatic is now integrated with most popular applications in the ecosystem, and it can even improve the usability and security of traditional applications, whether or not they use Ethereum.

There are already over a million dapp users

The first dapp with more than one million has been launched (two of them are on Theta network, not Ethereum, but Ethereum is the de facto dapp platform):

DLive (on Theta) has over 5 million users

Theta.tv (on Theta) has over 5 million users

Brave browser's income / tips feature is provided by Ethereum. 10 million + users

The improved UX breakthroughs I mentioned above have only recently been released, and application developers have not had enough time to complete the integration. Over time, we may see millions of dapps users appear.

DeFi

At the same time that this happened, DeFi continued to explode, recently breaking the $ 1 billion locked milestone.

So, how much can ETH rise after the price has rebounded so much?

Let's take a look at the basis of network value. First, with daily active users, taking the relative network value of Bitcoin as a reference, Ethereum's current number of active addresses is expected to be about $ 76 billion, and its current market value is $ 23 billion.

Therefore, if we assume that Bitcoin is halved, the pricing and value ratio should be the same: Ethereum's value may increase by 260% from the current level in terms of active users, and the value of ETH has risen in the past 30 days 60%.

From the perspective of transaction volume, based on historical data, both Bitcoin and Ethereum are overvalued.

This indicator seems to indicate that investor speculation may be driving the current value of the two networks, but if we include this indicator into the comparable value of Bitcoin, we can predict that the value of Ethereum will reach about $ 46 billion The upper limit is 156% higher than the current value.

If we proceed with caution, I think Ethereum may grow another 50%-100% in the coming weeks or months. I also think that few people will establish such a link, and we will see some ups and downs as traders look prematurely at the top short and try to get bank profits in the process of rising.

But one thing I'm pretty sure about: Ethereum has built a very competitive moat in the dapp ecosystem. In order to attract developers, competitive networks need to provide 10 times the performance, I do not mean 10 times the L1 expansion speed. I mean better combination of original smart contracts on the mainnet.

This article does not predict that Ethereum will defeat Bitcoin one day (although it is possible). Even if Ethereum defeats Bitcoin on the payment and transaction network, the Bitcoin network may continue to provide an essential and valuable service to the entire value internet as proof of working security and settlement layers: Ethereum dapps are likely Will continue to take advantage of this service.

I don't believe Ethereum 2.0 technology can replace Bitcoin as a security protocol layer, and Ethereum dapps may need to rely on Bitcoin for additional security because we are expanding the representativeness of large debt pools, real estate and composites, which are already worth Reached trillions of dollars.

Imagine that both Bitcoin and Ethereum operate as complementary protocols under the trillions of dollars of the Internet.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis: Risks and Opportunities for Dual Currency Contracts (quanto)

- Anniversary of the planning of the Greater Bay Area: Guangdong, Hong Kong and Macau have become a treasure trove of blockchain development

- Morgan Stanley acquires crypto-friendly brokerage firm E * Trade for $ 13 billion

- Views | Oscar nominations have repeatedly been criticized, blockchain may change the status quo

- Blockchain war "epidemic" is on its way, 20 applications have landed

- Becoming the first crab-eating country, Sweden begins testing e-krona, a digital currency of the central bank based on blockchain

- Lightning Loan: New DeFi Project Gameplay, How to Attack MakerDao for $ 700 Million