"The Secret History of Bitcoin": Who is the super-large Bitcoin mining pool with a computing power that approached 51%?

Source: Hash Pie

Author: LucyCheng

In the previous story, we talked about a sudden hard fork event called "51% attack rehearsal" by some people; this time we want to talk about the super large bit that really makes the community feel the threat of 51% attack. Coin mining pool-Ghash.io.

Nowadays when it comes to large bitcoin mining pools, everyone may think of BTC.com and its ant mining pools acquired by Bitmain, or the oldest fish ponds in China; but in fact they have retired four years ago. Ghash.io is the most dominant mining pool in Bitcoin history.

- Babbitt launches | Swedish central bank pilots "e-Krona", what are the characteristics of the world's first retail CBDC?

- Digital Currency Research Institute of the People's Bank of China: Development and Management of Blockchain Technology

- Opinion: Ethereum is promoting crypto market recovery

Screenshot from: http://ghash.io/Official website

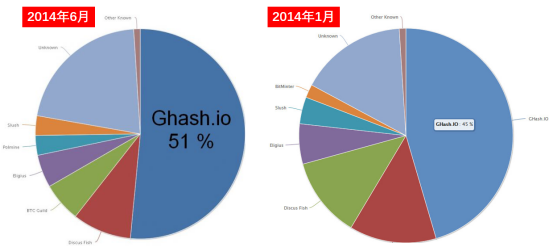

Relying on the superior mining pool cost and the support of the parent company CEX.io, Ghash.io has long occupied the top of the entire network computing power from 2013 to 2014. At its peak, June 13, 2014, the computing power accounted for nearly 51%. , Is about to reach the legendary level that can destroy Bitcoin. As we all know, the 51% attack has always been regarded as a sharp sword hanging above the crypto community, and within three years of Ghash.io being put into operation, there have been two panic events that have a computing power ratio that can shock the community.

On January 9, 2014, the share of Ghash.io's Bitcoin network computing power climbed to about 42%, which caused a strong response from the community. Under pressure from public opinion, Ghash.io released and implemented measures to reduce computing power in a timely manner to reduce its computing power share to less than 38% within 24 hours before it could calm down public anger. In order to appease miners and speculators, Ghash.io issued a statement saying that they have developed a solution to ensure that their computing power will never exceed 51%. They will also suspend the acceptance of new independent miners while adding permission. Existing users participate in functions of other mining pools.

Screenshot from: Blockchain.info

Unfortunately, the solution mentioned by Ghash.io didn't seem to work. After more than five months, the mining pool's share of the Bitcoin network's computing power again reached 51%, and it quickly triggered a sharp drop in the price of Bitcoin. In the end, under the initiative of external miners and its partner Russian mining company Bitfury to withdraw some computing power, Ghash.io's computing power ratio fell to about 31% in four days. "This is the early geek circle. Everyone respects decentralization. When they may violate the principle of decentralization, they will make decisions spontaneously." Yuchi, the founder of Yuchi, said with emotion.

After the Ghash.io incident, the community's proposal on P2P mining pools was re-raised, and discussions to prevent the phenomenon of mining pools' centralization have received more and more attention. Of course, some optimists believe that the concentration of computing power in the mining pool is not a problem. Because the mining pool is rational, their 51% attack is equivalent to destroying the trust base of Bitcoin, which is different from killing a chicken that will produce golden eggs. Moreover, the actual attack does not necessarily need to reach 51%. Having more than 30% of the computing power can pose a threat to the Bitcoin network, and having more than 40% of the computing power has a great chance to overcome six deep-confirmed blocks.

There are some interesting inferences behind this discussion for the development of the community. Conspiracy theorists believe that Ghash.io can actually manipulate the market through this behavior. They let the computing power close to 51%, use the market panic to suppress the price, buy cheap bitcoins, and then resolve the crisis by automatically mobilizing the computing power. Finally, they will sell the bitcoin after the price has risen, thus making a profit. This is logically possible, but whether it is credible or not is a matter of opinion.

Retrospective: (18 ) What happened to the Bitcoin hard fork panic?

Next notice: (20) Any bold guesses about who is Satoshi Nakamoto?

A collection of bitcoin story series you don't know, will be continuously updated, so stay tuned …

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Insight into central bank patents: digital currency generation, circulation, and recovery solutions have taken shape

- Analysis of Bitcoin's price trend with Elliott wave theory: we are in a rising stage

- Russia will ban the use of cryptocurrencies as a means of payment

- Analysis: Risks and Opportunities for Dual Currency Contracts (quanto)

- Anniversary of the planning of the Greater Bay Area: Guangdong, Hong Kong and Macau have become a treasure trove of blockchain development

- Morgan Stanley acquires crypto-friendly brokerage firm E * Trade for $ 13 billion

- Views | Oscar nominations have repeatedly been criticized, blockchain may change the status quo