Analysis: Risks and Opportunities for Dual Currency Contracts (quanto)

Author: Su Zhu

Translation: Zoe Zhou

Source: Crypto Valley A dual currency contract (quanto) is a derivative in which the underlying asset is denominated in one asset (such as ETH), but the derivative instrument is settled in another asset (such as BTC). BTC dual currency derivatives were first launched by the derivatives exchange ICBIT as early as 2013 (now closed).

BitMEX is the world's most active digital currency derivative exchange, and only uses BTC to settle all margin collateral. In August 2018, it launched a popular digital currency dual currency derivative in the form of ETHUSD dual currency permanent swap and early this month XRPUSD dual currency.

- Anniversary of the planning of the Greater Bay Area: Guangdong, Hong Kong and Macau have become a treasure trove of blockchain development

- Morgan Stanley acquires crypto-friendly brokerage firm E * Trade for $ 13 billion

- Views | Oscar nominations have repeatedly been criticized, blockchain may change the status quo

Today, we will analyze how this derivative works and what risks users should be aware of. Whether from the perspective of financial engineering, or from the perspective of actual transactions, the inherent non-linearity of dual currency derivatives is very attractive to users.

principle

A permanent swap contract, also known as a "swap contract" in the traditional market, is a derivative similar to a traditional futures contract, except that it has no expiration or settlement date. It mimics the margin-based spot market and uses a financing interest rate mechanism, which is a series of regular payments between buyers and sellers of a permanent contract to make the transaction price consistent with the base reference price.

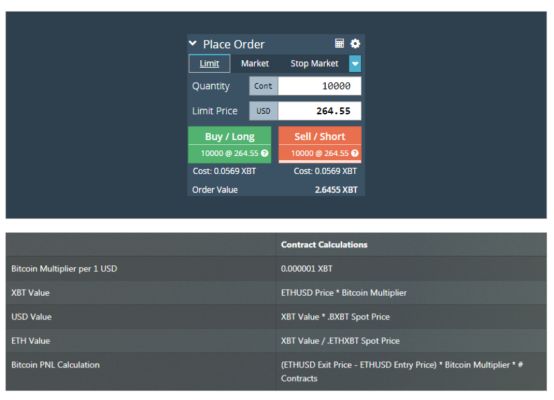

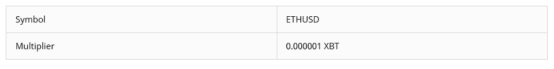

BitMEX offers permanent swap contracts for BTC, Ethereum (ETH) and Ripple (XRP). As BitMEX only accepts BTC as collateral, ETH and XRP products are dual currency permanent swaps. The BTC multiplier for ETHUSD dual currency derivatives is fixed at 0.000001 BTC. This allows traders to go long or short the ETHUSD exchange rate without touching ETH or USD. Investors will use BTC as margin and get or lose BTC when the ETH / USD exchange rate changes.

Example: The value for 10,000 contracts is 10000 * 0.000001 * 264.55 BTC = 2.6455 BTC.

Data source: Ethereum Series (ETH) Guide

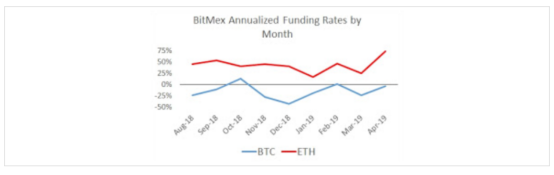

Looking at the historical financing rates of XBTUSD and ETHUSD, it seems that we can see that there is an arbitrage behavior between the perpetual swap financing rate of ETHUSD and the perpetual swap financing rate of XBTUSD. Can you short ETH at a 50% annual yield, long BTC at a 0% annual yield, and long ETHBTC futures at a 5% annual yield, and get huge returns?

As we can see, the fair financing interest rate for dual currency swaps may be much higher than normal swaps because the risk itself changes when the price changes. This is called dual currency adjustment, or covariance, but this article will avoid mathematical calculations and focus on intuition.

Nikkei dual currency futures

The most famous dual currency derivative in the traditional market is the Chicago Mercantile Exchange's Nikkei 225 index futures. The Nikkei 225 Index (NKY) is the most commonly traded stock index product on the Japanese stock market. Its futures are traded on three exchanges at the same time: Osaka Stock Exchange (OSE), Singapore Exchange (SGX), and Chicago Commodity Futures (CME). In Osaka and Singapore, they trade mainly in Japanese yen margin, while in Chicago, they trade mainly in US dollar margin. The OSE multiplier is 1,000 yen, the SGX multiplier is 500 yen, and the CME multiplier is $ 5.

For macroeconomic reasons, the correlation between USD / JPY and NKY is usually positive:

- The yen is a safe-haven currency, and it rises when the stock market falls.

- As the yen weakens, the global competitiveness of Japanese exporters and the Japanese stock market will increase.

We see that the price of dual currency futures has always been higher than the price of yen-based futures. Why?

The most intuitive way to understand this is to imagine that you are shorting dual currencies and longing normal futures at the same time. If the Nikkei goes up by 50%, your dual currency futures will lose money and normal futures will gain money. If USD / JPY goes up by 25% at the same time, it means that your dual currency loss is greater than your normal futures gain. Therefore, you need to get some premium from the market to bear such risk.

Or, you can imagine the opposite situation: you short the dual currency futures again, and long the normal futures. USD / JPY is up 25%; now the economic risk of you shorting dual currency futures is much higher than the economic risk of long regular futures, because the value of 5 yen per percentage point is higher than before. To rebalance the Nikkei or risk to make it flat, you must buy more Nikkei futures. If the Nikkei soars in an instant, you will eventually buy at a high price. If USD / JPY bounces back to its original level, as does the Nikkei, then you will have to hedge through Delta.

In order to maintain Delta neutrality, the process of continuously rejecting the scaling delta is not a problem, but an inherent characteristic of dual currency risks.

ETH dual currency

Data source: BambooClub

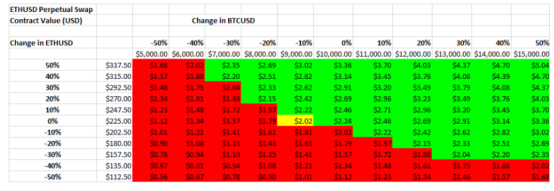

Going back to the ETH dual currency itself, we see an example similar to the previous Nikkei index. When the BTC / USD decline scenario occurs, the value of the US dollar will also decline significantly, and vice versa. This is because the nominal value of the ETHUSD swap contract depends on the BTC / USD price:

When the price of BTC rises, because the value of the multiplier is in US dollars, the dual currency's own expenditures will also rise. Therefore, given the high correlation achieved, shorting a dual currency futures position always poses a huge risk to every trader.

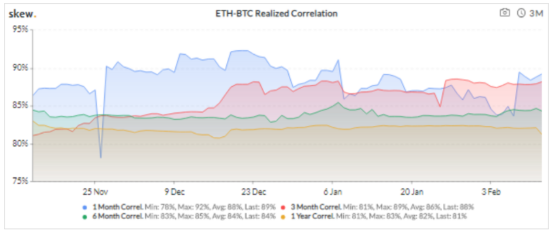

Over the past year, the correlation between ETH / USD and BTC / USD has exceeded 80% and there is no sign of disappearing. Therefore, shorting dual currency futures means amplifying losses when prices rise and minimizing gains when prices fall.

How much is it worth? The theoretical formula for dual currency adjustment is also called covariance:

Covariance (ETHUSD, BTCUSD) = Correlation (BTCUSD, ETHUSD) * Volatility (BTCUSD) * Volatility (ETHUSD)

Inserting some reasonable value 85% * 80% * 80% can get 54.4%. Now, people are beginning to understand why the market is willing to pay us "exorbitantly" for this position.

Risk of immediate bankruptcy

Dual currency swaps actually expose traders to immediate and unpredictable bankruptcy risks. Suppose a trader is short 1 ETH at a price of 200, and BTC / USD is 10,000, and considers his clearing price to be 300. If ETH / USD rises to 250 and BTC / USD rises to 12500 at the same time, he will find that he has been liquidated because the size of his position has been liquidated as the price of BTC has risen.

Traders can use dual currencies to observe covariance. If they believe that the correlation will weaken in the next few days and the market will generally remain stable, they may want to short the dual currencies to gain returns. Conversely, if they think that BTC and ETH will rebound soon, then they may be long on dual currencies and happy to pay for dual currency adjustments.

The essential

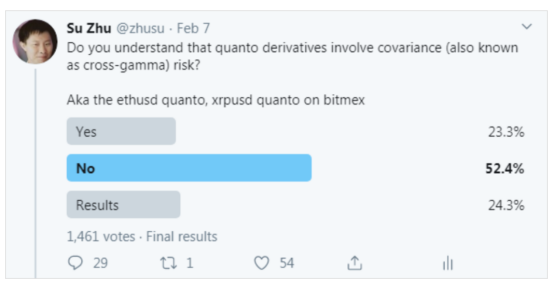

Dual currency derivatives are not new products in the financial market, but may be new to most digital currency traders. BitMEX provides dual currency permanent swap contracts, allowing traders to easily access new assets, but also forcing investors to pay attention to the future trend of ETH and XRP and the covariance between each asset and the underlying BTC.

If the results of this test can explain anything, it is that traders may not be aware of the risks they actually need to take when trading these novel derivatives. If they want to trade ETH / USD and XRP / USD without dealing with dual currency risks, they'd better trade on an exchange that can deposit the domestic currency of their trading currency: for example, ETH to ETH / USD, XRP exchange XRP / USD.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain war "epidemic" is on its way, 20 applications have landed

- Becoming the first crab-eating country, Sweden begins testing e-krona, a digital currency of the central bank based on blockchain

- Lightning Loan: New DeFi Project Gameplay, How to Attack MakerDao for $ 700 Million

- Rational understanding and perceptual practice of blockchain: How to correctly understand blockchain and choose the correct technological development route?

- The court acquiesced that Gram tokens are securities? Telegram's fight against regulation is coming to an end

- Benefits escalate again! Babbitt Industry Orientation Starts Knowledge Officer Program

- The plunge was caused by Binance shorting after losing coins? Let the data on the chain tell you the truth