Crypto market soars, how to deal with the "black swan"?

Editor's Note: The original title was "This Black Swan Is Not Another Black Swan"

Foreword: Cryptocurrency markets often skyrocket, and if you need to explain afterwards, you can always find the reason. For example, this weekend's slump can find the following possible reasons: the global outbreak of the new crown virus caused pessimism on the economic outlook, oil producers failed to negotiate, crude oil plummeted, Bitcoin's commodity attributes plummeted, and miners sold bitcoin. In line with the characteristics of the bear market, the change of the Plustoken address … are these black swans in the crypto market? Black swans are extremely rare events that are unpredictable and have serious consequences. According to this definition, the sharp rise and fall of the crypto market is not really a real black swan, but only a small black swan. If it is an investor in the crypto market, in such a highly volatile high-risk market, how to deal with these recurring small "black swans", and how to deal with the really possible big "black swans"? It is worth every investor's in-depth thinking and preparation. Lou Kerner, author of this article, is translated by "LoJJ" of the "Blue Fox Notes" community.

The term "black swan" was coined by Nassim Nicholas Taleb, a former Wall Street quantitative trader. After the 2008 financial crisis, the term black swan was widely used.

- Babbitt Column | Why Coins Rise and Fall Together?

- BCH with inner taste! It is said that it is the original Bitcoin? !!

- How should the Blockchain Foundation and DAO be designed? Learn from Centennial Experience of the American Foundation

According to the investigation, the Black Swan incident was defined as:

Black swans are unpredictable events that go beyond the expected range of normal conditions and can have serious consequences. The black swan incident is characterized by being extremely rare and influential, and it is stupid to try to predict them with a summary of various failed cases.

In my opinion, the black swan events are typically characterized by "… characterized by their extreme scarcity …". Let's take a look at some "black swans".

New crown virus: Sequoia's 2020 Black Swan

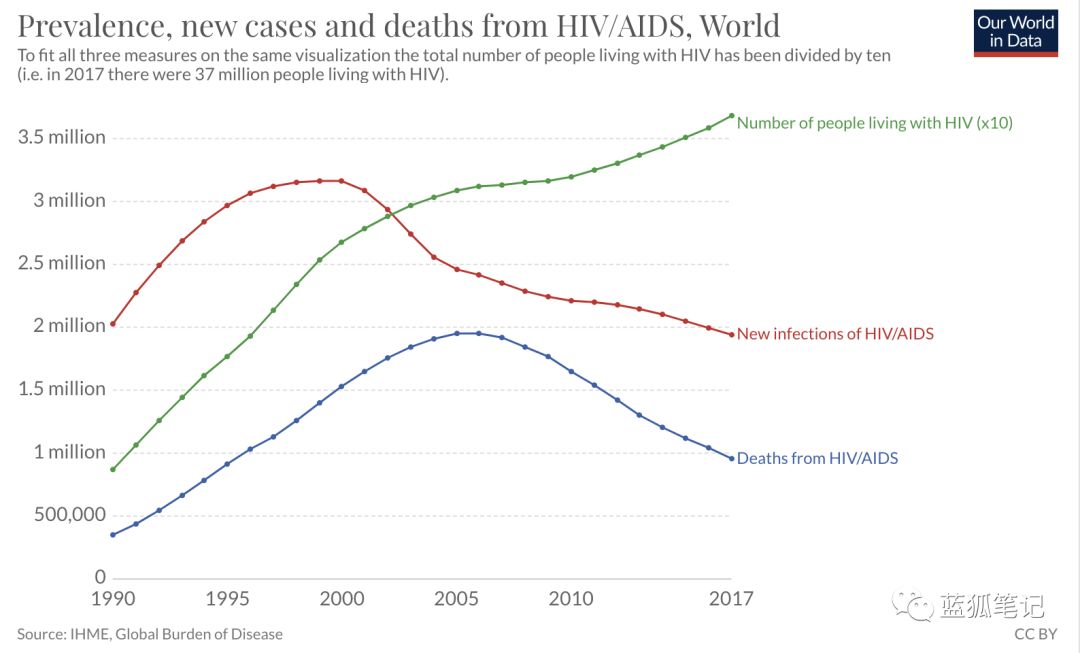

In this widespread warning, the new crown virus is considered a black swan. is it? Okay, this is an epidemic. So, is the epidemic a black swan? Is the epidemic "….. characterized by its extreme scarcity …"? So you might ask, when was the last big epidemic? The previous epidemic of the new crown virus occurred in 2017, which killed 954,000 people. This is HIV / AIDS.

On August 8, 2014, the World Health Organization announced the Ebola virus outbreak as a public health emergency of international concern. From 2013 to 2016, more than 1,100 people were killed by the Ebola virus.

"Hong Kong flu" was first detected in Hong Kong in early 1968 and spread to the United States later that year. In 1968/1969, approximately one million people were killed worldwide, including 34,000 deaths in the United States.

In 1967, the World Health Organization estimated that about 15 million people were infected with smallpox, and about 2 million people lost their lives that year.

You can still write down now. However, epidemics are not rare black swans. They keep happening.

Black Swan in Investment

Back to the "Investment Encyclopedia", in my opinion, they are very casual:

"Economic downturns or crashes, such as Black Monday, the stock market crash of 1987, or the Internet bubble of 2000, are relatively modelable."-So they are not black swans.

"… But the attacks of September 11 were very rare. And who would have expected the collapse of Enron? As for Bernie Madoff, everyone may be able to argue.-The first two are black The Swan incident, and the last one may be. "(Blue Fox Note: The Madoff incident refers to the largest" Ponzi scheme "in history. Madoff is a Wall Street legend and former chairman of the Nasdaq market. In his Ponzi scheme, the CCP Customers scammed up to $ 50 billion. This incident was completely unexpected and unpredictable)

To be more explicit, there is an article on "Data-Driven Investors" entitled "Nine Black Swan Incidents That Changed the Financial World":

These are the nine black swan incidents in 20 years. This statement is contradictory. Because you can't have 9 "extremely rare" events in 20 years.

Why do we call it a black swan?

We call them black swans because we cannot predict them.

I know the definition of "rare" is open. A simple statement like "three times a week" can also be interpreted as "almost never" or "constantly".

Calling the 2008 mortgage crisis the "black swan" has lifted the CEOs of all insolvent banks out of trouble. What can they do? Staged again and again.

Most of what we call the black swan is always happening. Therefore, we should be prepared. Because in the definition of "investment encyclopedia", the real part of what we call the "black swan" is: "… their impact is serious."

——

Risk Warning: All articles of Blue Fox Notes can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market analysis: After the dive, the more critical for BTC is this resistance line

- Why South Korea's top crypto exchanges delisted cryptocurrencies on a large scale

- "Year Spring Red Packet Rain"-Barkis Network Public Chain (BKS) Million Red Packets Coming Soon

- Oil price avalanche! Bitcoin plunges $ 800, or will the black swan continue?

- Bitcoin suffers from the "siege of siege", and there are several incidents outside the collapse of the international market that are preventing Bitcoin from return

- Platform currency war: the secret behind the value of OKB, HT, etc. |

- Slump ignites panic, BTC will test $ 8,000 intensity