Platform currency war: the secret behind the value of OKB, HT, etc. |

The destruction of HT and OKB caused the platform token to rise again. What is the value of destruction?

On February 10, OKEX announced the destruction of all outstanding 700 million OKBs, valued at approximately RMB 20 billion. In response, Huobi immediately issued a monthly destruction announcement, which destroyed a total of 147 million HTs worth about 5 billion yuan.

Source: Weibo

- Slump ignites panic, BTC will test $ 8,000 intensity

- Viewpoint 丨 Can the value of Bitcoin cover the environmental costs of mining?

- Ethereum Blockchain Application: Are Enterprises Moving from Private Networks to Public Networks?

As the head exchange, the token destruction of OKEx and Huobi immediately triggered a follow-up wave in the blockchain industry. ZB, FCoin, MX and other exchanges immediately announced the destruction of the token.

After the announcement, almost all the platform tokens that announced the destruction plan ushered in a wave of rise. As the leader of the destruction wave in February, OKB reached a 25% increase within 24 hours, breaking the 5USDT mark. , The largest increase even exceeded 50%; the maximum increase of HT, also exceeded 20%.

It can be seen that the platform token uses the method of periodic repurchase and destruction, mainly to ensure economic deflation.

Let's take a look at what destruction methods exist for tokens? What reference value and significance does it have?

The mainstream method of token destruction

(1) Enter the token into the black hole address

The destruction of a token is not a physical destruction of the token, but a process of permanently removing it from the circulation market, that is, permanently freezing it. At present, the most mainstream way to destroy a token is to enter the token into a black hole address. The so-called black hole addresses refer to addresses where the private key is lost or cannot be confirmed. Due to the lack of a private key, tokens entering these addresses can no longer be offered to re-join the market, and these addresses are like black holes "only in and out". Due to various reasons such as the loss of the private key or deliberately, such black hole addresses exist on most public chains currently on the market. An example of an address.

The black hole address is currently the most commonly used method of destroying platform tokens, and it is also the current solution adopted by Huobi and OKEx when destroying tokens. For example, the OKB destruction this time, according to the announcement of the OKEx platform, its destruction address is 0xff1ee8604f9ec9c3bb292633bb939321ae861b30.

Source: OKEX

(2) Use smart contracts to destroy the token and store the destruction on the chain

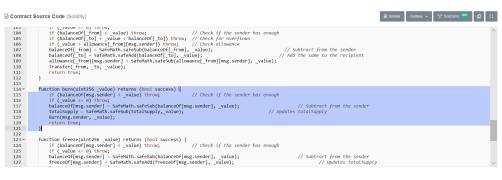

Compared to OKEx and Huobi, Binance tends to use smart contract destruction when destroying tokens. In smart contracts, you can choose to use a specific token destruction function to perform token destruction. When the function is executed, as long as the judgment conditions in the function are met, a certain number of tokens will automatically disappear forever.

Destroy function in BNB smart contract, source: Etherscan

The destruction function of BNB is written in the contract. When the destruction function in the contract is executed, a certain amount of BNB will be permanently removed from the circulation market. All BNB destruction will be recorded in the Ethernet blockchain browser, and anyone can find them in the Coin Burn incident.

(3) Burning Proof Consensus (PoB) proves hashrate by destroying tokens

Proof of Burn (PoB) is a relatively new and current blockchain consensus. The core idea is to prove the user node's investment in the network by destroying the token, and then obtain "mining" and confirm the transaction. s right. Proof of combustion is currently considered as one of the future alternatives to proof of equity.

There are multiple implementation mechanisms for the combustion proof consensus. The combustion proof consensus in Slimcoin mining is a typical case. If Slimcoin miners want to mine, they need to destroy the Slimcoin originally held by the miners as fuel. The more they are destroyed, the greater the possibility of mining new data blocks.

In practice, not only this token can become a "fuel", for example, XCP uses mining Bitcoin as fuel for mining. Because a part of the tokens were destroyed as "fuel", the combustion proved that this mechanism played a role in limiting the total amount of tokens circulating in the market by destroying the tokens.

The main role of platform token destruction

(1) It is a method to raise prices under the limitation of its limited use scenarios

Deflation is the bottom logic for crypto assets to keep their prices constantly rising. Whether it is the mainstream crypto asset halving mechanism or the destruction of platform tokens, the fundamental purpose is to ensure the deflation of the platform token itself. However, compared with mainstream crypto assets, the use scenarios of platform tokens are limited. Taking the leading platform token BNB as an example, the main control of BNB is on-chain transactions on Binance platform. Including deductions and rewards. However, the use environment of the platform token itself is very limited. Even if BNB has been implemented in the ecology of more than 180 projects, its use environment is still very limited compared with mainstream Tokens.

Source: bitool.cn

At present, crypto asset trading platforms have their own core, use platform tokens to open up and downstream, and build a vision of an integrated community. However, the establishment and prosperity of the entire community is a very long and arduous process. Although the long-term development of the platform can drive the effective increase of the price of the token in the long run, for ordinary investors holding tokens, it is extremely risky. High crypto asset market, long-term control of platform tokens is an overly risky investment decision. In addition, compared with the completely decentralized mainstream crypto assets, the trading platform faces more severe challenges of supervision and security risks. Therefore, in order to stimulate the rise of the price of the platform token, from the side, it is supplemented by the stability and prosperity of the platform itself. The method of destroying the token directly changed the market supply and demand relationship to raise its price, and it became an inevitable method.

(2) The destruction of the platform token does not mean an inevitable price rise, investors need to carefully evaluate the risk

The destruction of platform tokens changes market supply and demand, but this rise cannot necessarily make investors benefit from it. Take HT as an example. After Huobi announced that immediately after OKEx announced the destruction of 150 million HTs, the price of HT rose rapidly on the day of the announcement. The price rose by more than 20% in 24 hours. The peak price broke through the $ 5 mark, but then quickly dropped. The increase was only 2%. Since then, it has made up for 2 consecutive days, almost giving up all the gains brought about by the destruction.

Many retail investors suffered heavy losses in the pursuit of this wave of good news. At a price of more than $ 5, HT's trading volume exceeded 5 million, and the transaction value exceeded 200 million, almost all of which came from retail's pursuit of heights. Many retail investors who suffered heavy losses in the fall of HT blame HT's mouse warehouse.

In a sense, retail investors complain that HT ’s mouse warehouse is not groundless. According to AlCoin, after HT issued a destruction announcement, a total of 134 large orders were placed, of which 2.62 million HT large orders were placed.

The platform side has never completely shaken off the rumors of manipulating the price of tokens in the trading of platform tokens, and the means include Zhuangzhuangpan, mouse warehouse or insider trading, etc. As the platform token itself has a small plate and is easy to manipulate, retail investors need to carefully evaluate the possible fluctuation of the Token price under the good news when investing in the platform token.

(3) The value of the platform token is still determined by the value of the platform itself

In the wave of token destruction in February, some platforms have maintained a wait-and-see attitude.

For example, Johnny Lyu, the co-founder of the kubi platform, clearly stated that he would not follow up on this destruction wave. The form is far greater than the actual meaning. We are more concerned about enhancing the intrinsic value of the token, such as deducting fees from KCS and obtaining VIP qualifications, and expanding applications in travel, lending, gaming, and social scenes, much more than planning. Some destruction events make more sense. "

The value of the platform token lies in the integration of the platform itself for the upstream and downstream of the entire industry and the construction of the entire community. This is already a recognized standard in the blockchain community.

From this point of view, the destruction of tokens has indeed a positive meaning for the community's ecologically complete head platform to boost the price of Tokens.

But for some small platforms, because the platform itself has no development potential, the platform token cannot find application scenarios and it is difficult to flow in the secondary market. Then under this premise, "destruction" itself becomes a gimmick.

Conclusion

From this we can see that the proper and planned destruction of the token is a side reflection of the benign operation for the platform. Although the destruction of tokens is generally good news for Tokens, because the platform itself has a huge impact on the price of tokens, it is still necessary for investors, as ordinary investors, to invest cautiously in the face of the "token destruction" news.

In the long run, the price fluctuations of platform tokens still depend on the platform's credit, redemption ability, operating ability, anti-risk ability and profitability, and community building.

References

(1) Aziz, Guide to Coin Burning: What it coin burn and how does it work ?, http://masterthecrypto.com/coin-burning-what-is-coin-burn/

(2) DeepFlow, platform currency deflation trap: OKEx channeled new money, Huobi built a mouse warehouse, http://finance.sina.com.cn/blockchain/roll/2020-03-03/doc-iimxyqvz7472596.shtml

(3) blocks rhythm, destruction and halved: uncover the real logic behind rising, https: //www.baidu.com/link url = 7mPrAq2ZrLxPjgqF_LQMNtNXgwQO14ne08V_wVNET4Mh2W7Utragv21svhBcePXaWFFZMvV3z1R7lnFsb8y3A_ & wd = & eqid = 8aaa8e430005c038000000055e64da9b?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin plummeted early in the morning, where is the data for the outsole?

- National financial scam? Venezuela's government takes the lead in cutting leek oil coins

- Babbitt column 丨 Why does the blockchain wave trigger a new round of business change?

- In addition to "halving", you need to pay attention to these Bitcoin technologies in 2020

- Bitcoin welcomes new technology update, Core developers teach you how to verify the client

- Bitcoin's Secret History: Why is CSW being mocked by the group?

- The two founders talk about Ethereum: expansion is the number one priority, and more enterprises will use Ethereum in the future