Bitcoin plummeted early in the morning, where is the data for the outsole?

——The bull market grows in pessimism, grows in doubt, matures in optimism, and dies in excitement (John Templeton)

1,

Yesterday was a good day. Bitcoin, with a younger brother, kept going up, and it kept rising from 8680 to $ 9,187.

- National financial scam? Venezuela's government takes the lead in cutting leek oil coins

- Babbitt column 丨 Why does the blockchain wave trigger a new round of business change?

- In addition to "halving", you need to pay attention to these Bitcoin technologies in 2020

However, as has been mentioned many times before, the rising market under halving expectations has become the bookmaker's harvesting game: as soon as it rises, many troops will be exploded, and all technical indicators will become furnishings.

Yesterday, the technical indicators of BTC and ETH stood on the 30th and 60th lines, respectively. It seems to be revealing naked: Everyone is seated, and I want to continue to rise.

But the dealer never let us down. Look at last night's data:

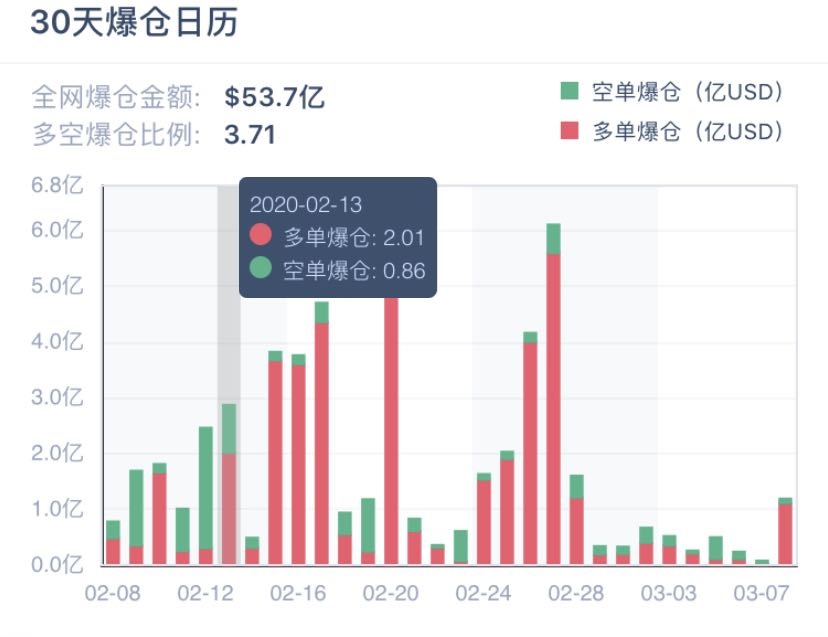

Shuangsong was the explosion of multiple troops. The largest single order reached 38 million yuan. How many times has it been in a month? Take a look at the picture below. The red ones are all multi-arms that have been out of stock …

At a glance, you can even say the last sentence "Kaidu will die." An Air Force like Pangan Superman dared to short hundreds of millions of funds and then made hundreds of BTC.

Why are so many troops cut so badly? I think the contract has a great relationship. Although the contract has been a tool for a long time, in the past, the number of users was small, the price of bitcoin was not high, and the difficulty of manipulating the spot was relatively small. But to this day, bitcoin price High, the difficulty of manipulating the spot has also increased, and the role of contracts has begun to become greater.

The dealer doesn't care what economic crisis is, just keep harvesting.

2,

One of my concerns is, how much will this fall? Look at the picture:

Looking at the chart above, the last round of 8400 and 8700 rose twice, with many buying orders (see the lower green pillar). In other words, to fall below 8700, two waves of retail investors need to feel fear, but the current wave of decline is more the profit retreat after the rise of 8700-the people who chase the rise yesterday, in the crash In order to avoid losses, keep selling chips and that's it.

What is the current market sentiment, look at the picture below:

The larger this number, the more the market

The larger the number, the more greedy the market is. Emotions are now more fearful. In fact, fear is already the current normal state of the market. Starting from a high of 65 on February 13, the market has been growing in fear. What day is February 13? Take a look at the following figure:

That was the beginning of the halving boom. Before the first mainstream mining coin ETC was halved, this day was the first large multi-order liquidation. From this day, multiple orders were exploded into the normal state, which can verify that "multi-order must die" Enchantment.

That was the beginning of the halving boom. Before the first mainstream mining coin ETC was halved, this day was the first large multi-order liquidation. From this day, multiple orders were exploded into the normal state, which can verify that "multi-order must die" Enchantment.

3.

If there is no big negative news, the 8700's position is difficult to break. So from the point of view of the spot, this is a good position.

In fact, all the short positions have little effect on the spot. The purchase of bitcoin for $ 8,400 and the purchase of $ 9,100 is not much different. After all, the holding time of the spot is calculated in units of years.

As an ordinary investor, we must pay attention to the distinction between the operation ideas of the spot and the contract. The spot is to hold, and the only thing to consider is whether it can always be held.

The "BTC sniper" of the veteran Tunbian Party said, "For so many years, I have seen people holding big pie, all of them have spare money, and they have people who have a house and a car to solve their basic living needs. Those who professed to be "I have faith, and boiled rice in a big bowl of water," turned out to be a gambler, and the big cake was lost. "

I firmly believe that the bull market has arrived, and the big economic situation has a greater impact than all bookmakers. In front of the trend, the operating idea of the spot is definitely to buy or not to sell.

According to the latest news, the U.S. epidemic has exploded and two participants have been confirmed infected at a high-level meeting of 18,000 people in the United States on March 1-3. Unfortunately, Secretary of State Pompeo and U.S. Vice President Pence both attended the meeting, along with nearly two-thirds of U.S. congressmen. After the meeting, they also visited the office of the Congress with great interest, and everyone enjoyed the exchange.

At such a meeting, none of them wore a mask … Remember the senior Iranian officials who had been sweating at the meeting? He was diagnosed the next day. Therefore, the logic of the previous article is continued. When the economic crisis is inevitable, safe-haven assets are more important than everything else, and gold and bitcoin will become two different asset choices: stable and risky.

4.

From the perspective of the contract, although the position of price 8700 is difficult to break through, it is judged based on the purchase price of retail investors and the psychology of futures buyers. In fact, there are still many factors that can affect the currency price, especially the following two:

The first is to be alert to India's favourable situation and becoming a bearish one. India's digital currency trading ban is lifted. This is the final ruling of the Supreme Law. It will take less than a month to take effect. Once it takes effect, it is of course great. After all, a huge market second only to China has great power. .

But in less than a month, the Indian government and the Reserve Bank of India will propose a reconsideration-I think the reconsideration is inevitable, after all, the national conditions of India have made it difficult to accept the popularity of Bitcoin transactions.

But whether this reconsideration can overturn the previous verdict depends on whether power is greater than law or law is greater than power in India. Judging from my little knowledge of the Indian government, I am not optimistic.

Therefore, in terms of contract operations, it is still timely to make a profit. Once the Indian ban was reopened after reconsideration, there was no problem.

The second is the continuous transfer of PT wallets. The Plustoken fund disk project, with a maximum of 200,000 BTC accumulated, officially ran out in the second half of last year.

According to CoinHolmes data, at 09:27 on March 5th, the funds on PlusToken's running funds at 15pyB7 and 1Gc91z began to change. Two transfers totaled more than 13,000 BTC to new addresses starting at 15Z1sT and 1CkuKa.

Although these Bitcoins will be frozen when they are directly exchanged, there are still many ways to keep Bitcoins from being tracked, such as Bitcoin mixers, decentralized lending protocols, and so on.

This kind of scam gang generally leads a life of insecurity, there is no reason to continue holding the currency, and it will definitely want to cash in batches.

5.

Playing contracts is short-term, and the short-term trading win rate of 60% is already great. In short-term trading, technical analysis can only be a supplement. It would be miserable if technical analysis was taken as the Bible.

The currency circle KOL Xiaoxia has a very interesting comment on the K-line analysis. Share it:

I find that leek is really easy to have personal worship for those who understand technology, but I have seen from many years of experience that technology is of reference significance to shocked cities. It is useful to do short-term. Knowing technology is better than not. The technical operation will be much better, but I think the commonly used Bollinger line is enough, and it is not difficult to operate the upper and lower rails, but this kind of short-term timeline extension, you find that the winning rate will not be higher than 50% Too much, so it's no different from guessing the size. The important thing is to stop the loss in time by judging the mistake and get more profit to control the profit and loss ratio.

If you want to survive in the long-term in the future, you have to major in internal skills. Your trading mentality, position management, and judgment of fundamentals cannot be limited to the short-term. In the short-term, you ca n’t make much money. Big market, but this unilateral market is technically useless, and it will often trick you out of the car and set you on a bigger market, such as the US stock market, Bitcoin 30,000 to 140,000 market. The market has long wiped out knowing technology.

Technical analysis is like lottery analysis. There is no regular thing. You must spend a lot of analysis to make a lot of analysis, it seems that it has a reference meaning for the next issue of buying lottery tickets.

Each wave of market is different. It is necessary to grasp the internal logic and analyze the K-line purely by technology. It is like looking at the leopard in a tube, watching the flowers, and drawing the K-line in a dazzling manner. , How to say, I think there is no threshold, even like metaphysics, too obsessed with this thing, will only get farther and farther from the Holy Grail.

Therefore, it is very strange to understand the K-line but not to be obsessed with it. It is strange to draw various complicated diagrams to infer the next trend. However, in any case, the truth comes out of practice. I believe that as long as we continue to study and learn, we can always form our own trading system.

I always like to do difficult things, because the more challenging things, the more valuable they are.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin welcomes new technology update, Core developers teach you how to verify the client

- Bitcoin's Secret History: Why is CSW being mocked by the group?

- The two founders talk about Ethereum: expansion is the number one priority, and more enterprises will use Ethereum in the future

- The company system enters the dusk token economy and the future is expected

- Agricultural blockchain company GrainChain secures $ 8.2 million in Series A funding, and Overstock provides $ 5 million in support

- Babbitt Column Deng Jianpeng: Lessons from the FCoin Thunderstorm on the Exchange

- Ethereum is up 5% in the day, and all the outbreaks have already erupted. It is time to take the next step.